The crypto market sentiment has entered an extreme greed phase!

The Fear and Greed Index soared to 90 this week, officially reaching a state of extreme greed.

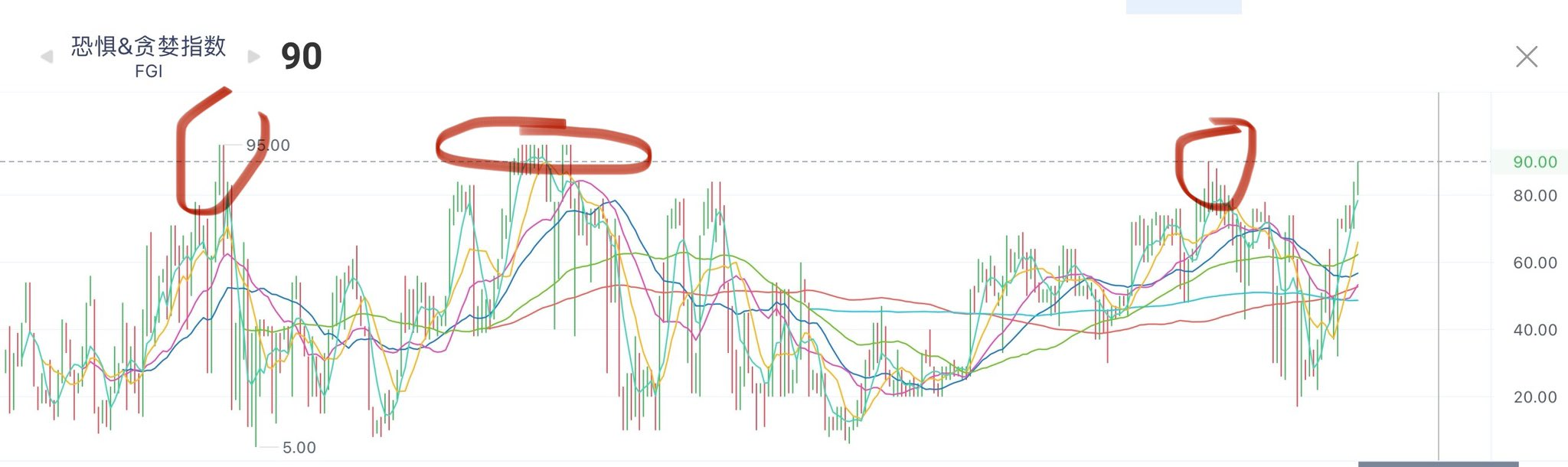

Looking back over the past few years, there have been three instances where the index touched 90 or even higher:

At the end of June 2019, from the end of October 2020 to early February 2021, and at the beginning of March 2024. The first and third instances both surged to 90 and then quickly turned downward, with the market reversing rapidly.

Only from October 2020 to the first quarter of 2021 did the Fear and Greed Index remain in the extreme greed state above 90 for more than ten weeks, peaking at 95.

The logic here is: Bear to bull market oscillations make extreme greed unsustainable. However, during the peak of a bull market, extreme greed can persist for a long time until the sentiment is completely exhausted. Which previous instance will this one resemble?

Bitcoin's performance is very healthy; don't always think about corrections when the trend is coming. The daily level has just started, meaning that if it doesn't surge past 100k, the market has no desire for a correction. It is expected to soon push past 100k.

Some altcoins have also seen significant gains in the past few days, with Om leading the entire Rwa sector to take off, and on the public chain level, Hbar and Xtz have also experienced substantial increases.

In a bull market, everything rises; the question is how much.

When will the long-standing second place, Ethereum, rise?

When Bitcoin was at 40k, ETH was at 3000; when Bitcoin was at 60k, ETH was still at 3000. Now that Bitcoin is at 90k, ETH is still at 3000. Fans often message me asking why I don't talk about ETH. With it in such a poor state, what is there to discuss? The last round of strength for ETH was due to the massive demand for ETH in both ICOs and DeFi, which drove it from a low of around 80 in 2018 to nearly 5000 in the last round, but what does ETH have this time?

It was hard to get an ETF, but everyone rushed to Bitcoin, and with SOL lurking nearby, I previously mentioned that if I had to choose, at least for now, I would choose SOL.

So what about the second place? Here are some personal views:

With the ETF opening up staking, although the yield is not high, it is still a significant temptation for big finance. Moreover, as the yield on old U.S. bonds continues to decline, ETH staking will become increasingly attractive.

Another aspect is waiting for the capital to flow back into Ethereum, waiting for its rebound, but these are all future matters. The main upward wave is likely in the later stages; for those currently holding, waiting can be torturous. As for what to do now, we don't need to be overly concerned; at least for now, there are still many better options in this round.

Although we currently see no sufficient reasons for it to rise, there is still hope for the future!

Bull markets are divided into different stages, and it is very difficult for ordinary retail investors to capture the benefits of every stage:

For example, last year's inscription market, the AI DEPIN RWA market at the beginning of the year, the subsequent Sol Ton Sui market, and the Pump Meme market that ran throughout the entire bull market, up to the recent nationwide PVP market. I believe most people can only seize one or two opportunities.

While this may lead to rapid wealth expansion, the entire bull market process is long, and there will be various pitfalls waiting for you along the way.

For instance, over the weekend, Dexx was taken down, and many friends' PVP gains vanished in an instant. In the last round of Fb's segmented mining market, many people gambled all the money they earned from inscriptions and runes into Fb, only to be harvested. However, the BN mining pool added Fb to BTC mining rewards, directly reviving Fb and doubling it in an instant.

The logic of this round's market is very chaotic. If you follow path dependence and still use rational and data-driven thinking to discover valuable projects, you will likely end up with a bunch of worthless VC coins, while the seemingly ridiculous Meme coins, many of which look like scams and insult intelligence, such as the cult coin leader Spx, can yield hundredfold returns.

When you can accept that their methods are reasonable, you will truly understand how to play this bull market. In summary, just follow the trend!

Cherish this month's market; this is what we call the Q4 market, and I believe everyone has witnessed it.

That's all for this article. If you liked it, please give a follow and a thumbs up~

To seize the next wave of bull market opportunities in the crypto industry, you need to have a quality circle, where everyone can come together for support and maintain insight. If you are alone, looking around and finding no one, it is actually very difficult to persist in this industry.

If you want to band together for support or have questions, feel free to join us—WeChat Official Account: You Bi Zhi Qing Nian

Thank you for reading! If you liked it, please give a thumbs up and follow us. See you next time!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。