Original | Odaily Planet Daily (@OdailyChina)

The Bitcoin ecosystem was once considered one of the most promising ecosystems in this bull market, with a total market value expected to reach the hundred billion dollar level.

However, since the end of the inscription craze from late 2023 to early 2024, the Bitcoin ecosystem has slowly entered a bear market, with a sharp decline in new users and funds. Although subsequent projects like Rune, the 5-character BRC-20 token pizza, the Fractal ecosystem, and CAT-20 have provided some lifelines to the Bitcoin ecosystem and garnered attention, their scale has never matched the initial frenzy of inscriptions across the network.

On one hand, Bitcoin prices continue to rise and set new highs, with $100,000 seemingly within reach; on the other hand, the gradual prosperity of the Solana ecosystem and other ecosystems (such as Base, Sui, etc.). When will the bull market wind blow to the Bitcoin ecosystem? Odaily Planet Daily will outline some clues in this article regarding the potential resurgence of the Bitcoin ecosystem.

Support from Major Exchanges for Bitcoin Ecosystem Development

For the ecosystem, support from major centralized exchanges is crucial, as it means significant traffic, new funds, and potential development resources. Recently, users have focused on which Solana memes Binance will list, but in reality, Binance has also been supporting the development of the Bitcoin ecosystem.

During the last inscription bull market, Binance actively listed BRC-20 token ORDI, SATS spot trading, and RATS contract trading. Subsequently, other excellent asset protocols emerged in the Bitcoin ecosystem, such as Rune, Atomical, and CAT-20, all of which are expected to receive support from Binance.

Especially yesterday (November 18), Binance Pool announced its support for Fractal Bitcoin (FB) joint mining, and the token FB briefly rose over 80% after the announcement. Although Binance noted in the announcement that "the launch of Fractal Bitcoin (FB) mining services on Binance Pool does not guarantee that the token will be listed on Binance.com," this is still a positive signal for the struggling Bitcoin ecosystem and Fractal.

In addition to Binance, OKX has also been supporting the development of the Bitcoin ecosystem. Whether it’s BRC-20, Atomical, Runes, or the recent Fractal and CAT20 ecosystems, OKX Wallet has been continuously updated to enhance user experience within the Bitcoin ecosystem. Besides UniSat, OKX Wallet has also become one of the most used wallets in the Bitcoin ecosystem.

Since November, OKX's Chinese official Twitter has frequently mentioned the Bitcoin ecosystem. On November 11, when Bitcoin set a new historical high, OKX posted about the "BTC ecosystem also thriving," with images covering all tracks and protocols of the Bitcoin ecosystem.

On November 12, OKX's Chinese official Twitter again posted about the Bitcoin ecosystem, featuring images of BRC-20, Runes, CAT-20, and Fractal, which are among the most discussed and passionate sectors within the Bitcoin ecosystem community.

According to OKX's latest announcement, it will officially launch DOGUSDT perpetual contracts and open trading at 2:00 PM (UTC+8) on November 19, 2024. (Odaily Note: DOG is a fully open-source, community-driven meme coin based on the Bitcoin rune standard.)

Rune Surpasses BRC-20 to Become the Top Asset Protocol in the BTC Ecosystem

Previously, the Bitcoin ecosystem was still in its early exploratory stage, with developers actively conducting various experiments on the Bitcoin network, leading to the emergence of various asset protocols. Actively exploring the possibilities of the Bitcoin ecosystem is a good thing, but it also has "side effects," as existing asset protocols tend to operate independently, dispersing community consensus and funds within the Bitcoin ecosystem, which is not conducive to forming a collective force.

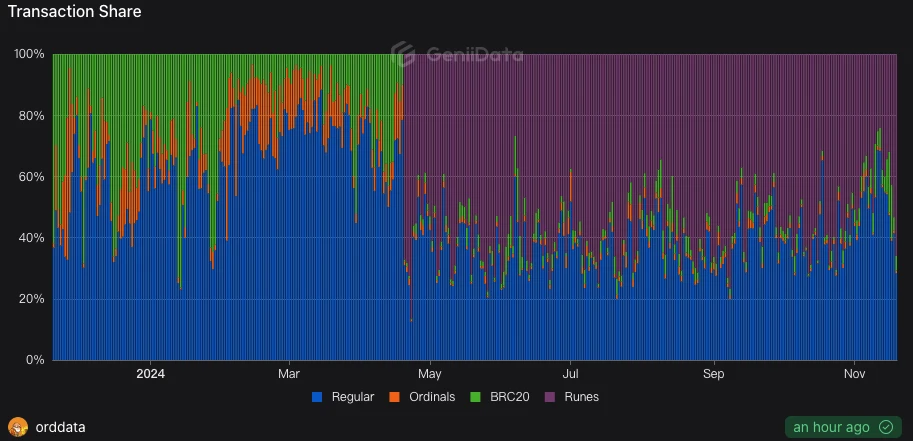

However, this situation is beginning to change, as Rune is becoming the largest consensus for asset issuance protocols in the Bitcoin ecosystem, even surpassing the "big brother" BRC-20. From the data, since the official release of the Rune protocol in April this year, Rune trading has consistently accounted for over 50% of the Bitcoin chain's trading volume, followed by regular Bitcoin transfer transactions or other asset protocol transactions (some asset protocol transactions are not recognized), while the trading share of BRC-20 and Ordinals has shrunk to less than 10%.

Data source: https://geniidata.com/user/orddata/bitcoin-protocols-analysis

Compared to other asset protocols, Rune currently has the best community activity and profitability effect in the Bitcoin ecosystem.

As the ecosystem's heat fades and asset prices decline, many communities within the Bitcoin ecosystem have gradually "declined." However, in Rune, communities such as DOG•GO•TO•THE•MOON, PUPS•WORLD•PEACE, BILLION·DOLLAR·CAT, and RSIC·GENESIS·RUNE remain active, continuously giving rise to other quality communities like MEMENTO·MORI and GIZMO•IMAGINARY•KITTEN.

Although there are instances of PVP and "gas arbitrage," Rune remains the asset protocol in the Bitcoin ecosystem that continues to generate hotspots and has some profitable effects. The AI meme craze in the Solana ecosystem naturally drives the heat of other ecosystem AI memes. Among the many asset protocols in the Bitcoin ecosystem, only Rune has captured this heat and brought about a wealth effect, with the current market cap of the leading Rune AI project, CYPHER•GENESIS, surpassing $30 million. (Recommended reading: November 15 and November 18 Odaily editorial team's complete record of meme operations)

Last night, the new Rune MILO•THE•MILLIONAIRE•GATOR completed its etching, and I personally tested minting a set (25 pieces) at a cost of about 60 USDT. Due to the connection between the project's deployer and the largest IP puppet in the Bitcoin ecosystem, the market price of a set on Magic Eden has already risen to around 118 USDT today.

Although in terms of market cap, the current total market cap of Rune is $1.91 billion, still less than BRC-20's over $3 billion total market cap, as the Bitcoin ecosystem gradually warms up, the total market cap of Rune is also climbing, and surpassing BRC-20 is just a matter of time.

Data source: Geniidata

Today, OKX announced the launch of DOG•GO•TO•THE•MOON, which also represents the recognition of Rune by major exchanges. If one had to guess which Bitcoin ecosystem asset could be listed on Binance first, the leading assets within Rune would likely have the highest probability.

Of course, there are also other very high-quality asset protocols and ecosystem sectors in this round of the Bitcoin ecosystem, such as the Lightning Network, Fractal, CAT20, and the Bitcoin staking and re-staking narrative led by Babylon. However, at this stage, the ecosystem should focus on uniting efforts to bring the Bitcoin ecosystem back to the center stage. Only in this way can other quality assets and narratives attract more attention.

Waiting for the Wind

Once the decision to buy is made, everything else is left to time.

The first bull market in the Bitcoin ecosystem occurred from June to July 2023, when the small images of Ordinals and the new asset issuance method represented by BRC-20 attracted attention;

The second Bitcoin ecosystem bull market occurred six months later, from November 2023 to February 2024, when some BRC-20 tokens were listed on major exchanges and the inscription gameplay was replicated across all chains, leading to many overnight wealth stories, similar to the current meme trend;

The third small bull market in the Bitcoin ecosystem occurred in April 2024 when the Rune protocol was officially launched, lasting about a month.

Based on past experience, the cycle of bull and bear markets in the Bitcoin ecosystem is 3 to 6 months. Now, it has been half a year since the last bull market, and although there have been some hot projects in the ecosystem that attracted short-term attention, a large-scale effect has not yet formed. At the end of June this year, Odaily Planet Daily published an article analyzing that the Bitcoin ecosystem bull market might be approaching (Related reading: What will be the antidote to bring the Bitcoin ecosystem out of the low period?) and now, several months have passed, and we still believe that the wind will come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。