Year-to-date, the total inflow of funds has reached $33.5 billion.

Source: cryptoslate

Translation: Blockchain Knight

Last week, digital asset investment products saw an inflow of $2.2 billion. This reflects a broader market uptrend driven by Trump's victory in the U.S. presidential election.

A few days ago, the inflow of funds in the digital asset market peaked at $3 billion, bringing the total assets under management (AUM) to a historic high of $138 billion.

During this period, BTC's record price performance prompted an outflow of approximately $866 million, resulting in a net inflow of $2.2 billion.

According to CoinShares data, since the interest rate cuts in September, the total inflow of funds has reached $11.7 billion. Year-to-date, the total inflow of funds has reached $33.5 billion.

CoinShares research director James Butterfill explained, "The recent surge in activity seems to stem from two reasons: first, the loose monetary policy, and second, the Republican Party's significant victory in the recent U.S. elections."

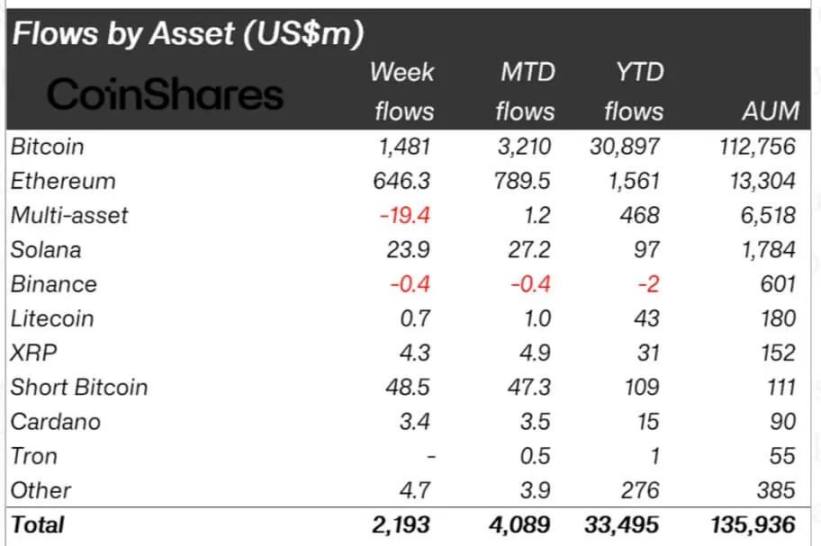

BTC's dominance remains strong, with inflows amounting to $1.48 billion.

The substantial inflow of funds is related to the outstanding performance of U.S. spot exchange-traded fund (ETF) products, which continue to attract significant attention from retail and institutional traders.

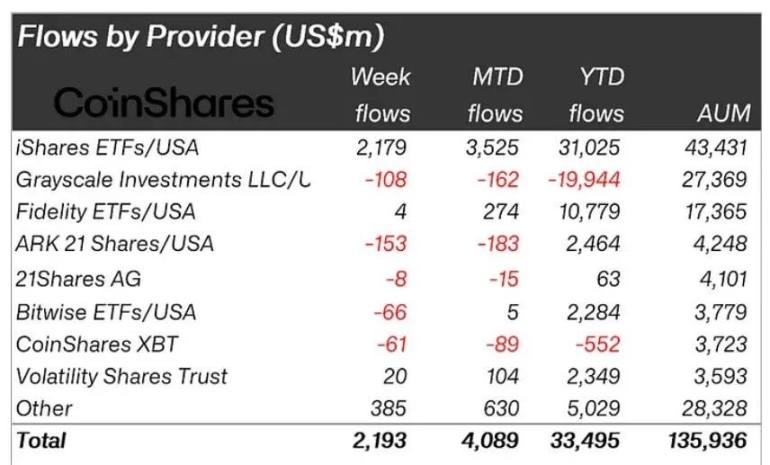

According to CoinShares data, BlackRock's IBIT and Fidelity's FBTC saw inflows of $2.1 billion and $4 million, respectively.

On the other hand, the Ark 21 Shares fund experienced an outflow of $153 million, surpassing Grayscale's outflow, which was $108 million this week.

Meanwhile, BTC's record price performance breaking the $90,000 mark attracted bearish traders, who invested $49 million to short BTC products.

Additionally, the bullish market sentiment seems to have also influenced interest in Ethereum, which attracted a significant inflow of $646 million (equivalent to 5% of its assets under management).

Butterfill linked this inflow of funds to the election results and the proposed Beam Chain network upgrade.

Other assets, including Solana, XRP, and Cardano, saw smaller inflows of $24 million, $4.3 million, and $3.4 million, respectively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。