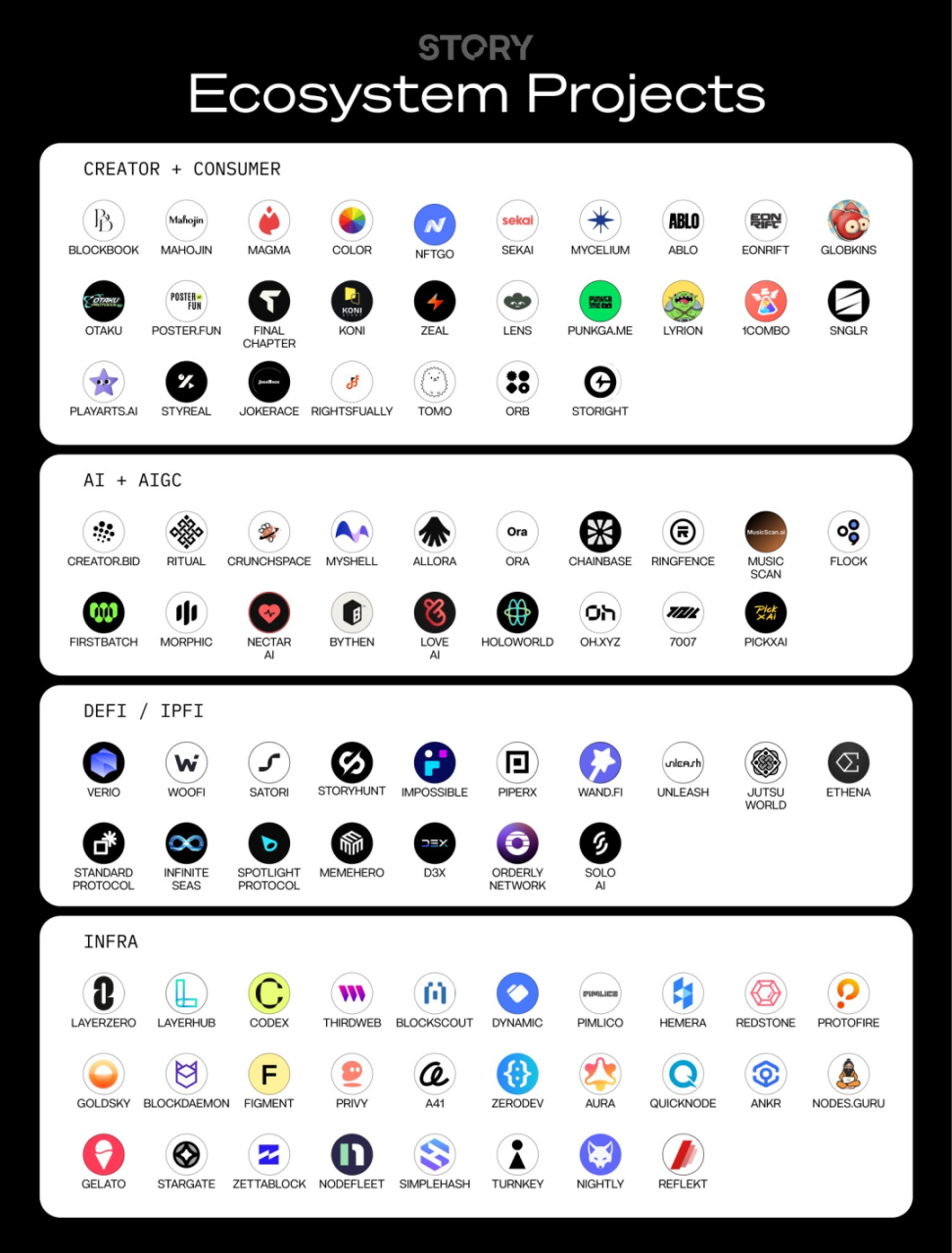

Last week, Story Protocol announced the launch of its final testnet, Odyssey. Nearly 100 ecosystem partners are building killer applications on Odyssey. As the last testnet before the official launch, what changes is Story Protocol about to bring to the IP industry with its massive $140 million funding?

Written by: IOSG Ventures

Introduction

Last week, Story Protocol announced the launch of its final testnet, Odyssey. Nearly 100 ecosystem partners are building killer applications on Odyssey. As the last testnet before the official launch, let's take a closer look at the changes that Story Protocol is about to bring to the IP industry with its $140 million funding.

1. Current State of the IP Industry

Since the enactment of the Digital Millennium Copyright Act in 1998, the United States has addressed issues such as copyright infringement on the internet and digital platforms, focusing on preventing the illegal copying and distribution of copyrighted works. Since then, the global retail revenue of the intellectual property industry has expanded to $356 billion by 2024, generating $44 billion in royalties for IP owners.

To better understand the landscape of intellectual property, we need to familiarize ourselves with the key participants here:

Supply Side:

- IP Owners: Grant licenses for their content in exchange for royalties (licensing out)

- IP Creators: Obtain these licenses and leverage brand recognition to attract customers (licensing in)

Demand Side:

- IP Distribution Platforms: For example, gaming companies that provide value-added services to end buyers using IP.

Intermediaries:

- Intellectual Property Professional Services: Consulting and law firms that facilitate smooth transactions between IP owners and IP creators, as well as between IP creators and IP distribution platforms.

2. Pain Points in the IP Industry

Despite progress, the current IP industry is far from perfect. Today, nearly 80% of total IP licensing sales are completed through intermediaries, such as the consulting and law firms mentioned above.

2.1 Friction in IP Licensing

Due to the numerous intermediaries between supply and demand, independent IP creators often lack the time and resources to hire legal and consulting professionals. The manual management tasks of recording intellectual property contracts using Microsoft and Google tools (spreadsheets, documents, etc.) further delay and complicate the entire licensing process.

This makes secondary independent derivative creators reluctant to pay licensing fees to IP owners through official channels, preferring instead to infringe. Traditionally, for IP licensing transactions between two large companies, a custodial account must be used as an intermediary. Both parties' lawyers must review and sign the contract before the transaction can proceed. Relying on custodial accounts is highly inefficient, and this process could be fully automated using smart contracts.

2.2 IP Distribution Platforms Hinder Innovation in Intellectual Property

Web 2 distribution platforms often hold too much power in IP transaction negotiations, especially when it comes to independent IP owners, as these platforms can precisely control the exposure and traffic of each IP.

As noted by Story Protocol founder SY Lee, content companies often lack network effects, forcing them to rely on large content production and marketing budgets to survive. This overwhelming negotiating power makes it difficult for smaller IPs to be profitable, often leading to their failure before launch. Even large IP studios hesitate to develop new IPs, choosing instead to focus on expanding existing ones.

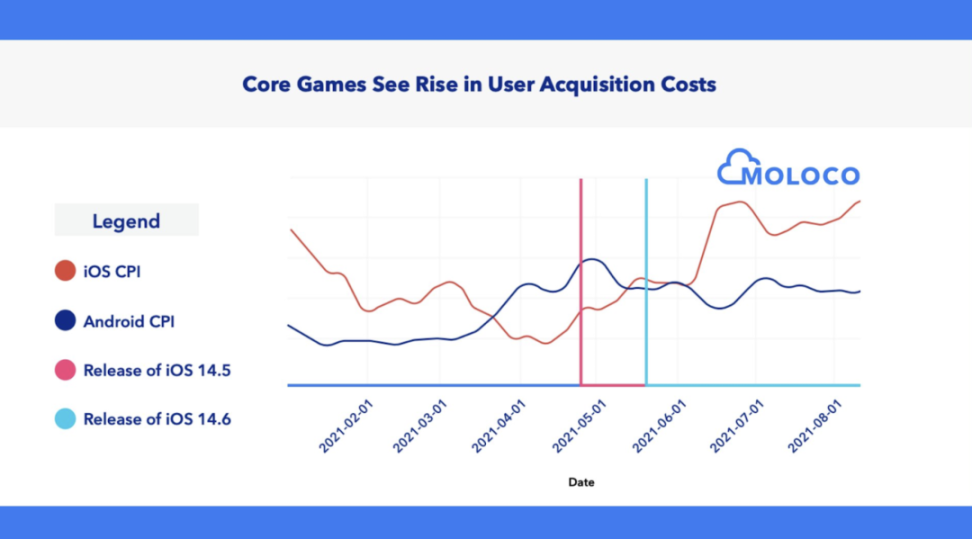

For example, Moloco reported that after Apple banned targeted advertising to mobile consumers, the cost per install skyrocketed, leading many mobile applications to fade away. To combat the pricing power of Web 2 platforms, independent IP owners and creators need an effective way to fight back.

Source: Moloco

The most promising solution is to help small independent IPs evolve into networks. Transforming intellectual property into a network of fans and creators can help break these monopolistic structures and bring more value to IP owners.

Source: Story Protocol founder SY Lee

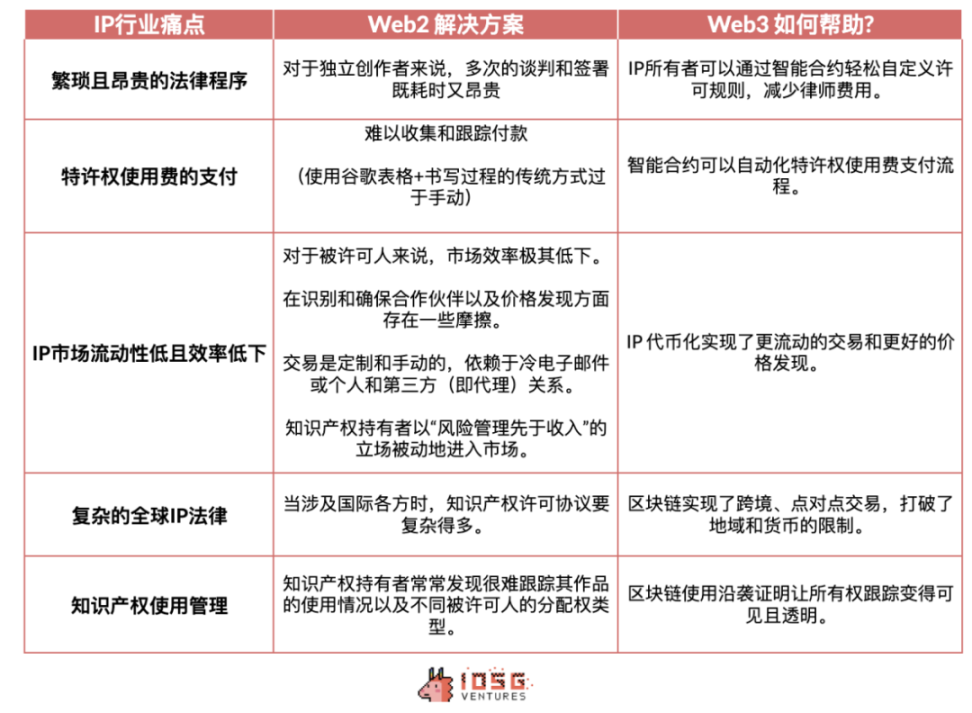

Of course, the issues in the IP industry go far beyond this. Below are the challenges faced by the traditional IP industry and why we believe Web 3 can help address these issues.

3. Opportunities in Web3

The IP industry faces significant inefficiencies and transparency issues, and Web 3 offers potential solutions. But haven't NFTs and related protocols already addressed these issues?

3.1 Are NFTs Enough?

It is undeniable that the emergence of NFTs (i.e., ERC-721 tokens) has introduced a permanent identifier for ownership of specific metadata such as verifiable text, images, and videos, effectively representing IP on the chain!

However, these NFTs are relatively static, as their metadata is fixed once minted. To address this limitation, dynamic NFTs (dNFTs) have been introduced, providing greater flexibility by encoding predefined conditions in smart contracts to allow for automatic metadata updates triggered by on-chain or off-chain events.

Another important issue surrounding NFTs is liquidity and royalties, which is a widely explored area in NFT financialization. Sudoswap addresses liquidity challenges through an AMM model, achieving automatic price discovery and adjustment. This resolves liquidity issues in traditional markets like OpenSea, where sellers often wait for buyers to match prices.

Blur further improves the NFT trading experience by reducing market fees to 0% and aggregating listings from various markets, allowing users to easily compare prices and liquidity across platforms. Additionally, Blur has launched Blend, a lending protocol that enables users to borrow without selling their NFTs.

Despite the increased liquidity from AMM models and market aggregation, certain NFTs, especially rare or niche ones, may still face liquidity issues in funding pools. To address affordability and liquidity issues, Floor Protocol attempts to break down NFTs into micro-tokens called μ-Tokens, making them easier to use. NFT royalties remain a contentious issue, with past disputes between Blur and OpenSea. Magic Eden has taken a clear stance, imposing royalties on all ERC-721C series listed on its platform.

As NFTs continue to evolve, the building blocks for blockchain innovation in the intellectual property field seem to be in place, but one key component is still missing: the ability to support the programmability of creator derivatives.

3.2 What is the Programmability of Derivatives?

IP owners need IP creators to create derivatives to maintain the visibility of their IP and extend its lifespan. The more creators involved, the greater the long-term benefits for the IP. This creates a dilemma that requires better solutions to effectively manage and execute licensing agreements.

However, derivative works of IP often involve complex parent-child relationships that are difficult to handle. Current NFT protocols struggle to track the connections between each version created on-chain and effectively implement customized royalty structures or licensing agreements.

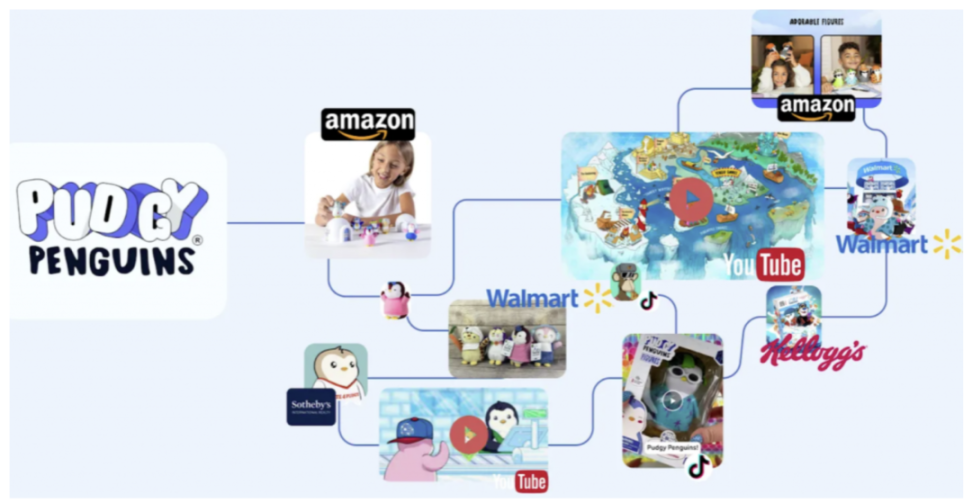

When Luca Netz, CEO of Pudgy Penguins, sold over 20,000 toys on Amazon in just two days, the cumbersome process of signing partial licenses with individual NFT holders added extra time and legal costs.

Source: TinTinLand

Programmability of derivatives essentially refers to supporting IP owners and derivative creators in more efficient IP licensing and version control.

A simple analogy is Git and GitHub. At the core of GitHub is Git, which tracks every modification made to files. This version control system allows you to track and revert to any point in the version history.

So why is this programmable layer so important for IP creation and ownership?

The creation and ownership of intellectual property are key elements in both Web 2 and Web 3 ecosystems. In the context of Web 2, the importance of intellectual property is evident with the rise of AI-generated content (AIGC) and user-generated content (UGC). Similarly, in Web 3, the relevance of IP ownership is emphasized by the popularity of meme coins. Examples like $BRETT, $APU, $PEPE, and $PEPE2.0, which stem from the PEPE-themed Boy Club, showcase the significance of derivatives in this space. These meme coins exhibit significant trading volumes, but the original creator, Matt Furie, finds it challenging to capture the economic value generated by these derivative assets.

For instance, while $PEPE and $PEPE2.0 are viewed as different tokens by the market, $PEPE2.0 is essentially a derivative asset of $PEPE, distinguished only by a color change. This situation highlights the limitations of the current IP management framework in Web 3. Utilizing Story Protocol's IP tracking capabilities, the original holder of $PEPE should capture the value creation of their IP.

In such a new mechanism, either a portion of the Pepe-themed derivative tokens could be airdropped to IP owners, or a portion of transaction fees could be directly given to IP owners, allowing the original creator of the Pepe-themed IP, Matt Furie, to benefit economically.

Clearly, a more effective solution is needed to manage the relationships between IP asset derivatives, providing greater programmability, which is precisely the solution that Story Protocol is actively developing.

4. Story Protocol

The main innovation of Story Protocol lies in its ability to provide IP owners with a comprehensive and open solution to manage their IP assets. This includes features such as verification, authorization, traceability, and automatic profit distribution and claims, all with enhanced programmability. Story Protocol has built an EVM-compatible L1 blockchain using Cosmos-SDK, allowing IP owners to easily register their intellectual property as IP assets on L1.

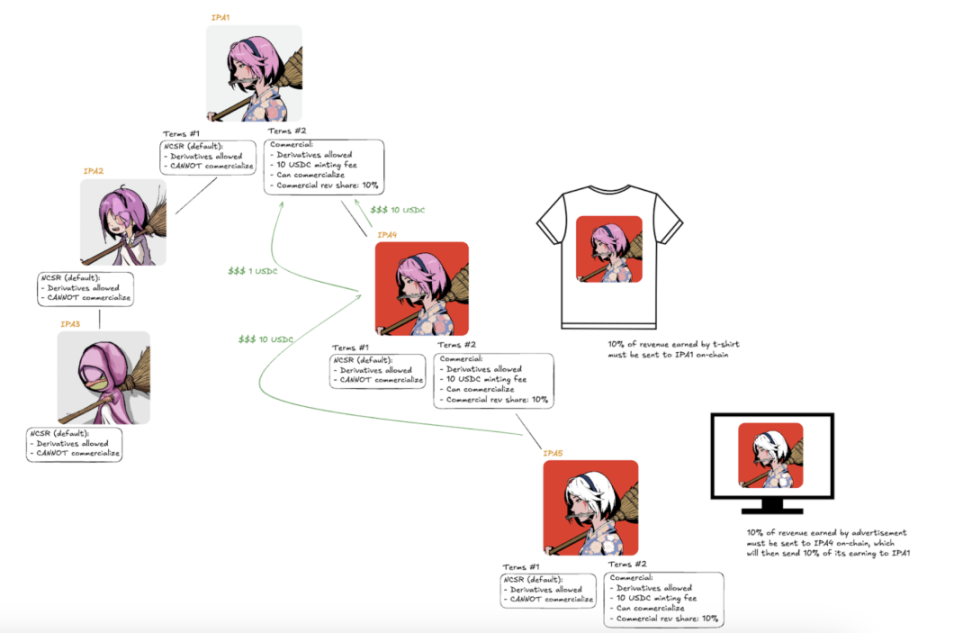

Story Protocol records the multi-level parent-child relationships between various IP assets, where each asset can be a Web 3 native NFT or an on-chain proof NFT of real-world IP, such as Donald Duck. In bringing real-world IP onto the chain, Story Protocol has also developed a code-based contract template called Programmable IP License (PIL). Through PIL, IP owners can map off-chain licensing terms onto the blockchain by attaching the PIL to their IP assets.

The Programmable IP License (PIL) embodies the principle of "code is law" in the blockchain space and offers three predefined templates:

- Non-Commercial Social Remixing: This template allows users to freely use, share, and remix the original IP in social contexts, explicitly prohibiting any commercial use.

- Commercial Use: This template allows users to purchase the rights to use the original IP at a preset price but prohibits the resale of the original IP or its use for creating and selling commercial derivatives.

- Commercial Remix: This template allows for commercial use rights and permits resale and derivative development based on the commercial use template, allowing for secondary creations and commercial use of derivatives.

An IP asset can have multiple different PILs, and in addition to the three preset templates, users can customize their own usage terms. These terms are open and transparent to all participants. Other creators can view these terms, and if they agree, they can obtain a license with just one click and immediately start creating derivative works.

When derivative works generate revenue, smart contracts automatically distribute royalties between the original IP creator and the derivative work creator based on the preset terms of the original IP. This process is efficient and transparent, requiring no third-party intervention, ensuring that profits are fairly and timely distributed to all participants. In addition to openness, licensing, and royalty distribution, Story Protocol also includes a dispute module specifically for rights verification. This module allows IP owners to report derivative creators in cases of intellectual property infringement. Currently, Story Protocol's legal team acts as arbitrators, but this may be handed over to third-party legal teams for arbitration in the future.

In the example above, we can see how Azuki IP NFT allows both IP owners and derivative creators to gain their respective commercialization revenue through the process of derivative creation and profit distribution.

4.1 From Lack of Liquidity to Liquidity

Story Protocol acts as a new intermediary, replacing traditional intermediaries such as costly and cumbersome legal and consulting services. This innovation significantly lowers the entry barrier for IP licensing while ensuring that derivative and remix works are controllable and traceable, ultimately protecting the originality of IP owners and derivative creators.

However, some may express concerns about market non-uniformity. The customization of IP is virtually limitless, and when excessive customization occurs, it can lead to potential liquidity issues in financial markets. How can this problem be addressed? What automated matching solutions can be implemented to meet the diverse preferences of demand-side participants?

Addressing market liquidity issues is a key factor that distinguishes Story Protocol from competitors like Spaceport.

Through the licensing module and royalty module, all users of Story Protocol (including IP owners and derivative creators) primarily trade two types of tokens: License Tokens and Royalty Tokens.

- License Tokens (ERC-721): These tokens grant the rights to use intellectual property or create derivatives of intellectual property. They can be minted by paying a fee or purchased on the secondary market. When a license token is destroyed, the holder accepts the licensing terms of the intellectual property, allowing them to start creating derivative works. This system transforms the rights to create derivatives of intellectual property into tradable assets, providing new revenue opportunities for creators.

- Royalty Tokens (ERC-20 tokens, supply of 1B): These tokens represent a portion of the revenue generated from intellectual property. Revenue comes from three sources: fees for minting license tokens, IP usage income, and revenue sharing between the original IP and its derivatives. Royalty tokens allow holders to claim a portion of this income, making future revenue streams from intellectual property more liquid and available for creators and investors.

License tokens transform the rights to create derivatives of intellectual property into tradable liquid assets, providing creators with diversified income sources. Meanwhile, royalty tokens, as asset-backed securities, can tokenize future cash flows, enhancing liquidity for intellectual property asset owners and investors. This process reflects the benefits of asset securitization, allowing the revenue rights of intellectual property assets to be traded like financial assets. Additionally, buying or selling IP usage fee tokens reflects investors' optimistic or pessimistic sentiments about the future income of the IP.

Story Protocol stands out due to its L1 architecture. By registering all IP assets on a single L1, it ensures unified processing of these assets and prevents liquidity fragmentation. For example, meme coins can be viewed as a form of intellectual property asset. Although meme coins are typically ERC-20 tokens, if converted to ERC-721, they would essentially represent meme NFTs.

IP assets deployed on different blockchains (e.g., $MOODENG) are often treated as different tokens, even if they represent the same underlying asset. This leads to liquidity competition between the same tokens on different chains, reducing their overall value. Story Protocol's L1 structure addresses this issue by consolidating liquidity in one place, preventing asset value from being diluted across multiple blockchains.

Furthermore, Story Protocol's royalty payment and licensing modules help control the creation of derivative memecoins in a copycat manner, such as $NEIRO, $Neiro, and $NEIROETH. By introducing royalties, the cost of launching new meme coin derivatives increases, thereby preventing excessive and unsustainable proliferation of these tokens.

4. IP + Web 3.0: A Promising Future

All of this sounds very exciting, and in fact, we can clearly imagine how the traditional IP industry will be massively disrupted by blockchain.

Especially with the advent of the AIGC era. AIGC represents a revolutionary shift in the way creative works are produced, utilizing advanced AI algorithms to automatically generate text, images, audio, and video, blurring the lines between human creativity and machine-generated output.

However, copyright issues in the Gen AI field remain unresolved. Traditional intellectual property law allows IP owners to decide how to use their works, including creating new derivative works based on the original. But for content generated by Gen AI, there is no clear legal framework for copyright confirmation.

One unresolved situation is whether these AI-generated works should be considered unauthorized derivatives or entirely new intellectual property. This is an urgent issue that requires further clarification and improvement in copyright law.

Today, Gen AI has generated a large amount of content based on existing IP. For protocols like Story, it is crucial to help establish IP ownership within AIGC and address the challenges of traceability, liquidity, and royalty distribution for these AIGC IPs.

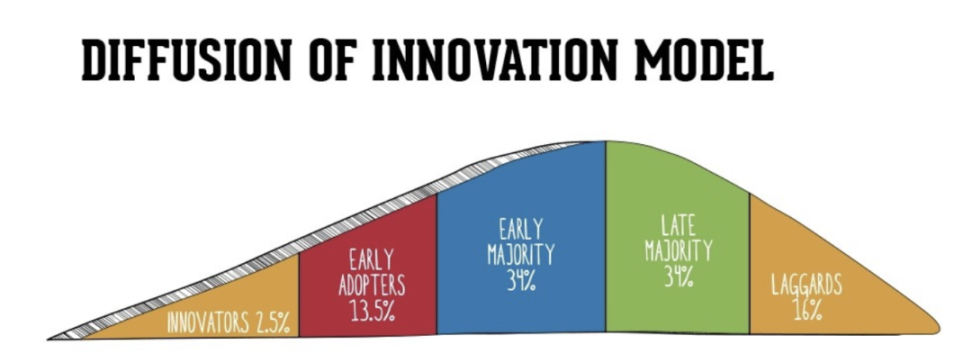

Clearly, we still need to remain calm. A very obvious fact is that Web 3 is still in its developmental stage, as described in the innovation diffusion model, transitioning from early adopters to early majority.

Source: Everett Rogers' Theory of Innovation Diffusion

However, we believe that over time, this situation will naturally improve, and the reasons are clear. According to the recent a16z cryptocurrency status report, there are approximately 617 million cryptocurrency holders, with active addresses and usage reaching all-time highs. We believe that with the mass adoption of Web3, combined with the advancements of Story Protocol itself, the IP era will move in an ideal direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。