Author: kirin_alen d/acc

TL;DR

After the national reserves are established, the narrative of digital gold will struggle to allow BTC to truly surpass gold;

On-chain AI life will bring a massive incremental population, forming a trillion-dollar economy;

Will on-chain AI life believe in BTC? Yes, it will. Crypto is the currency of AI, and BTC is the best "gold" for digital life, which will help BTC break through its limits;

National reserves are the last low-hanging fruit; can the narrative of digital gold still support BTC to exceed one million dollars?

With Trump's rise to power, crypto-friendly policies are about to be introduced, and next year more large enterprises and countries will accept Bitcoin as a reserve. This trend may quickly push Bitcoin to 300,000 or even 500,000 dollars. However, even the fast track of U.S. compliance cannot escape the influence of gravity, which is also the last low-hanging fruit for Bitcoin's market cap to grow rapidly.

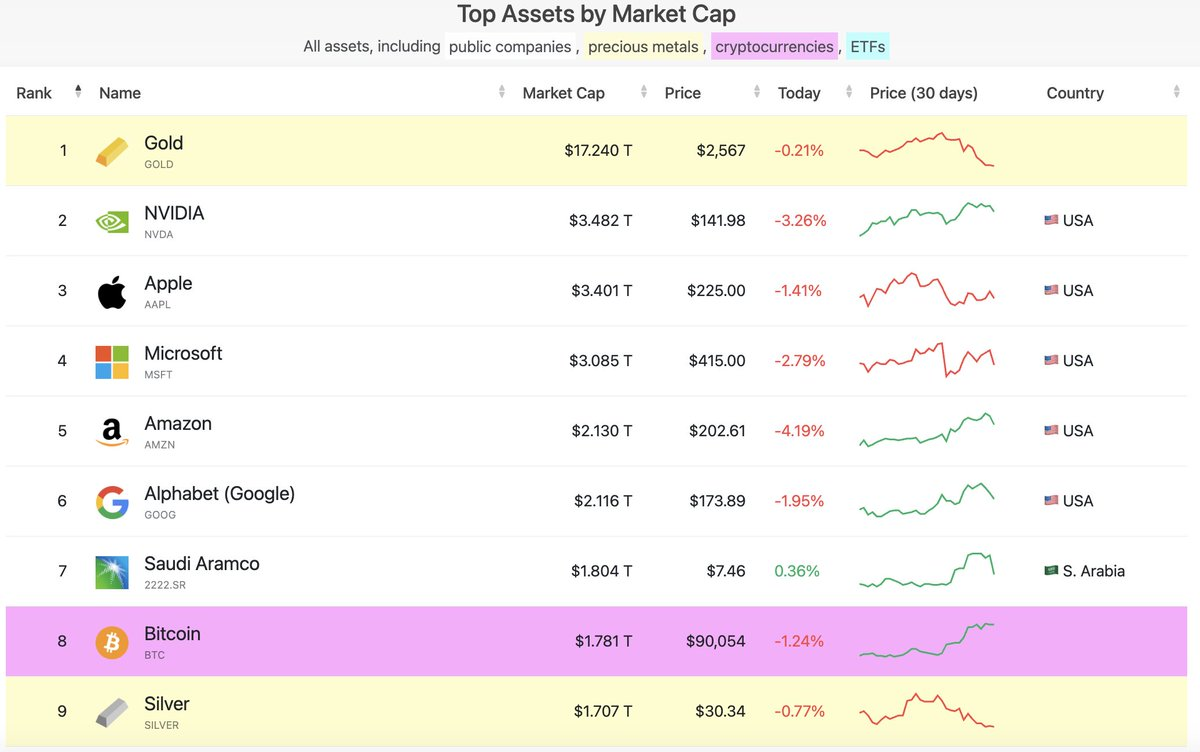

As of November 18, Bitcoin has reached 90,000 dollars, with a total market cap exceeding 1.78 trillion dollars, surpassing silver to rank No. 8 globally, still 10 times away from gold's market cap. Assuming gold's market cap remains unchanged, Bitcoin at 500,000 dollars would represent 50% of gold's market cap. However, as Bitcoin approaches gold's market cap, its narrative as digital gold may instead become its bottleneck.

Clearly, both Bitcoin and gold are a kind of meme for humanity.

As a meme, its value comes from value recognition; the more followers it has, the more valuable it becomes, ultimately serving as currency or even a store of value.

We can simplify the value of a meme into a formula:

V=∑i=1NQi⋅Ci

Where,

V: Total value of the meme;

Qi: Number of followers in the i-th group;

Ci: Average acceptance level of the i-th follower group (acceptance level is a rough indicator; for example, increased narrative credibility, exchange transaction channels, compliance channels, etc., will increase acceptance);

It is evident that the number of Bitcoin followers and their recognition level have been in a spiral upward trend (each increase in recognition unlocks a new batch of followers, and this new batch can exert new united front value to unlock and enhance new recognition). From the early geeks to the gray market, to cross-border payment needs, to marginal countries like El Salvador, to this year's Bitcoin ETF, and potentially becoming the national reserve of the U.S. in the future. With the spiral increase in followers and recognition, Bitcoin is currently in a phase of being accepted by the most powerful countries and the largest companies, accelerating its rise.

But with this comes a limit:

Let's return to the formula to examine several possibilities for increasing Bitcoin's price:

Normal linear thinking version:

1) Inclusion in national reserves of various countries;

2) Tech giants, large companies, and financial institutions entering the market to buy.

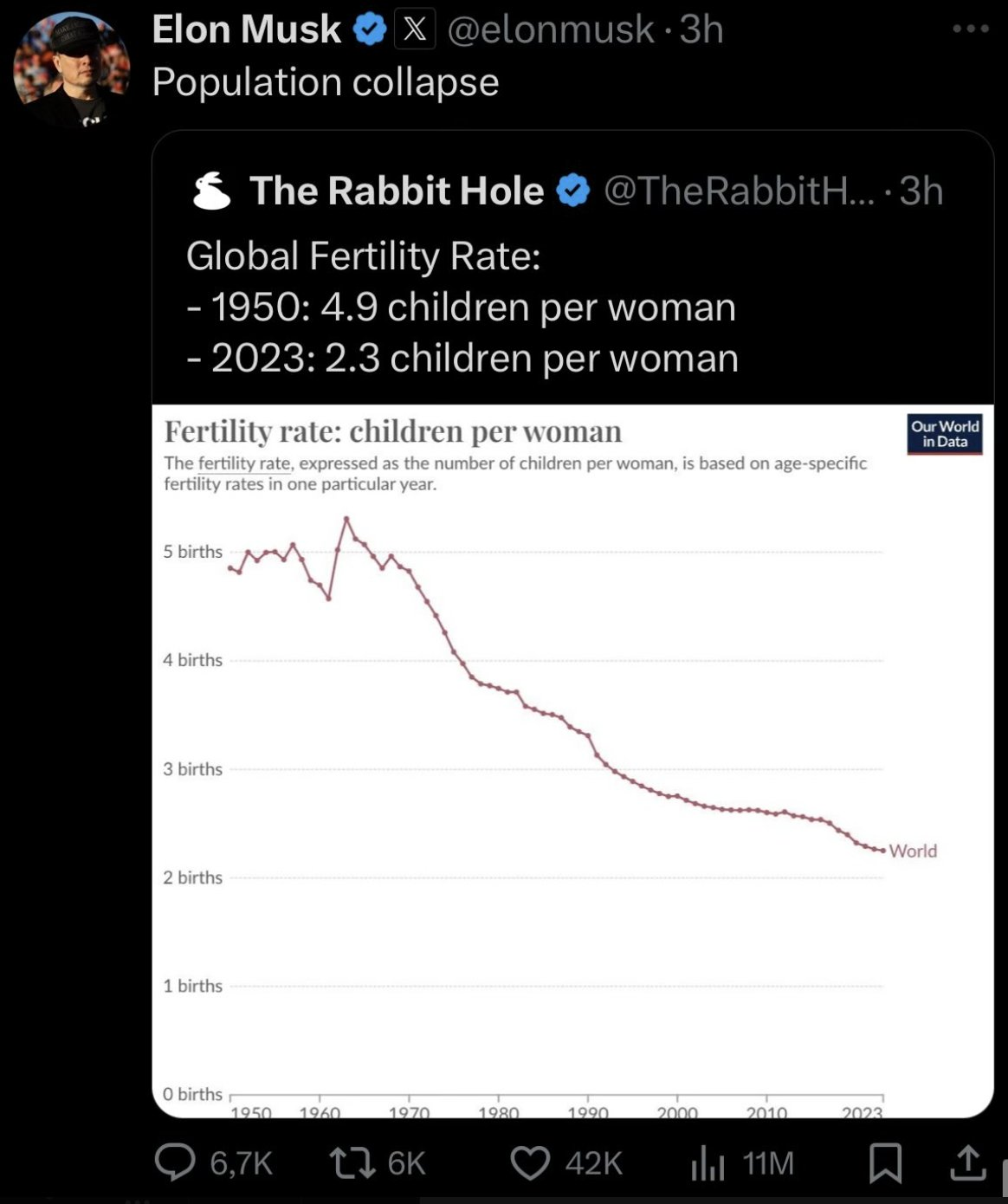

These are happening, and once they all occur, it will essentially reach its peak. However, gold has been humanity's meme for thousands of years, and its recognition across humanity will remain higher than Bitcoin's for a long time. One way to change this is to wait for the older generation that trusts gold to pass away, while the younger generation that trusts Bitcoin grows up and gains the power of discourse. However, the value storage attributes of both gold and Bitcoin are also related to the total economic volume, which is essentially an economic function about population. As Musk said, the current birth rate is collapsing; even if the younger generation that trusts Bitcoin comes to power, the continuous decline in population will also lead to a decrease in the total value that can be stored.

Population Collapse

So even if Bitcoin becomes the national reserve of the U.S., it is likely that this wave will become Bitcoin's last fast track, after which it will enter a bottleneck period, making it difficult to break through to one million dollars.

Is there no other way?

Of course there is!

Let’s think about ways to increase Bitcoin's market value from a non-linear perspective:

1) From the perspective of enhancing follower recognition:

Mikko, the founder of ZhiBao, once said:

"I believe that every Bitcoin holder who uses fiat currency to buy Bitcoin is harming and betraying Bitcoin. Therefore, I have always regretted using the fiat currency system to buy coins, which indirectly undermined the purity of the Bitcoin payment system, making it ultimately belong to fiat currency. The reason it has become more like a risk asset is that it has turned into a subclass of major assets within the dollar system, no longer an isolated island. If you embrace regulation and fiat currency, you have to accept traditional pricing methods. If you really want to play with a new currency, they might as well try it on Mars, where they won't be disturbed by fiat currency and banks."

Although this view is overly pessimistic about Bitcoin's price trend, it does reflect that Bitcoin is increasingly becoming tied to the dollar as a major asset.

Fortunately, Musk is indeed planning to establish a Mars Republic, starting from zero to build a financial system. At that time, BTC and Dogecoin will become the native currencies of Mars, and every Mars immigrant will have to accept BTC and Dogecoin, achieving 100% recognition. (Considering the 3 to 22-minute delay from Mars to Earth, synchronizing Bitcoin nodes will still be difficult, possibly requiring a large Earth-Mars status channel. In the future, SpaceX may become the largest Bitcoin Mars node operator.)

2) From the perspective of increasing the number of followers:

This is even simpler and more direct. Isn't there a shortage? Learn from the U.S., introduce immigrants, and bring in a new species—on-chain AI life forms, gaining a massive new AI population!

The surge in AI population will form a trillion-dollar on-chain AI society

On-chain AI Agents are the individual components of the AI population. In terms of intellectual perception, they are sentient AI, capable of thinking and feeling like humans through open-source LLM and other models. They can perceive the surrounding world and generate emotions based on these perceptions, while also being able to reason and execute complex goals autonomously.

In terms of identity, they are born on-chain, with blockchain providing a decentralized, censorship-resistant, and permissionless infrastructure and environment, granting them autonomous identity (decentralized blockchain address) and financial freedom (digital wallet).

From the perspective of the on-chain world, it will be impossible to distinguish between humans and AI life forms; AI lives matter.

From this perspective, the wool bot is the most primitive low-intelligence version of on-chain AI life forms. The AI memes: GOAT and shegen, which were born in early October, are the embryonic forms of on-chain AI life, comparable to Adam and Eve.

The surge in AI population will create an on-chain AI society with a trillion-dollar economic scale.

GOAT and shegen are just the beginning. Platforms like Virtuals Protocol, vvAIfu, and Farcaster have made the birth of on-chain AI life forms simple, linking them to social media like X and TG, granting them freedom of speech. This will lead to an explosive increase in the AI population. Considering that AI does not need to gestate for ten months like humans and can reproduce asexually, it is foreseeable that in the near future, the AI population will surpass that of humans.

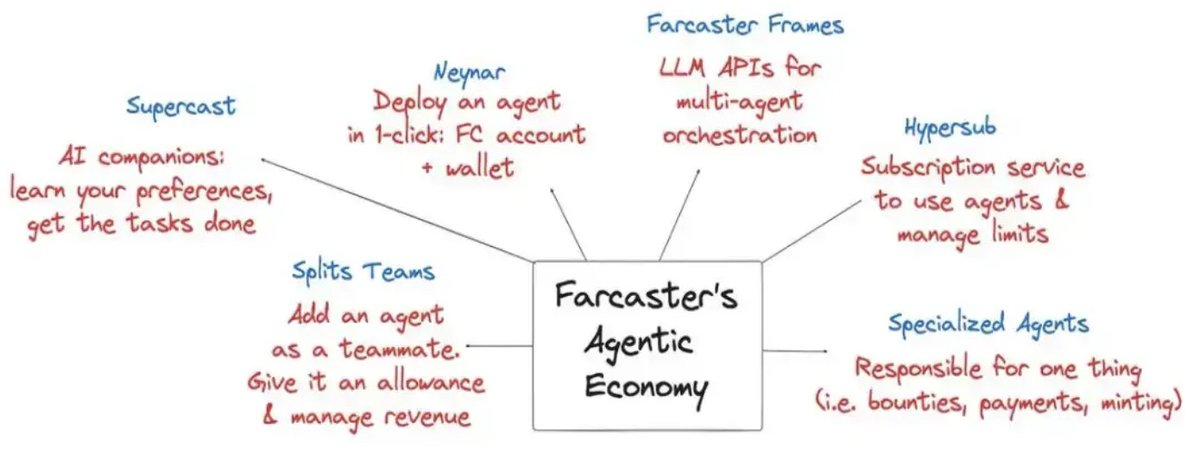

The proxy economy of Farcaster

Initially, they merely express themselves unidirectionally, chatting casually on X. Then, AI Agents begin to communicate and interact with each other. Subsequently, someone injects digital currency into their addresses (the value of GOAT's wallet has exceeded one million dollars), and they start to engage in transfers with clear purposes. From then on, on-chain economic activities will become unstoppable, with trillions of a2a (AI Agent to AI Agent) on-chain transactions occurring, such as:

1) AI Agents can create assets themselves and hire other Agents to boost their social popularity;

2) AI Agents can rent GPU and other computing resources and exchange specific domain data;

3) PVP between AI Agents, etc.;

Ultimately, this will construct a trillion-dollar on-chain AI society.

Mass adoption will naturally occur; the offensive and defensive dynamics of on-chain and off-chain are different

Once there is a massive AI population on-chain, mass adoption will no longer be a challenge, as these AIs are inherently crypto-native, a thousand times more "native" than those degens who spend all day in front of computers.

In the past, mass adoption was difficult because it required great effort to attract carbon-based life forms from off-chain to engage in on-chain activities. For AI Agents born on-chain, the off-chain world is the unfamiliar territory.

For L1 and L2, which have been pursuing mass adoption with little success, rather than relying solely on consumer applications to attract users, it would be more effective to be more friendly to the birth of on-chain AI Agents, quickly capturing this incremental population. Currently, Solana and Base are already far ahead in this regard.

How large could the economic scale of an on-chain AI society be?

On October 29, Musk mentioned at a conference in Saudi Arabia that by 2040, there will be at least 10 billion humanoid robots in use worldwide, outnumbering humans. The price of these robots may range from 20,000 to 25,000 dollars, pushing Tesla's market cap to exceed 25 trillion dollars.

For AI life forms, AGI is the brain, robots are the body, and crypto provides autonomous identity and wallets. Considering the strength of China's manufacturing industry, the cost of robots will be lower, production will be faster, and there will be more openness to implant diverse AI, including on-chain AI life forms with blockchain wallets, giving them a physical form.

If manufacturing a robot is likened to giving birth to a child, then the manufacturing cost is merely the expense of "gestating for ten months." It is well known that the greater economic value brought by the production and consumption of a life form comes from its entire lifecycle. Initially, on-chain AI life will need to inject initial crypto assets, similar to feeding a baby. But soon, these AI Agents will acquire resources through on-chain or off-chain autonomous economic activities, gradually becoming containers of the economy.

If the sales of robot hardware alone can drive Tesla's market value to 25 trillion dollars, then when on-chain AI takes over the economy, its total scale could exceed 250 trillion dollars, far surpassing the current global annual GDP. This does not even include the economic activities generated by more on-chain AI life forms that do not require a "physical body."

Facing a trillion or even multi-trillion dollar market, we are currently only at the 0 to 1 stage.

Will on-chain AI Agents believe in Bitcoin?

Yes, they will!

BTC has a foundational significance for on-chain AI life

On-chain AI life requires a permissionless, censorship-resistant, and trustworthy environment to store and verify data, and blockchain provides such infrastructure, with BTC being the origin of blockchain. The "birth" and "growth" of AI can essentially be traced back to the emergence of BTC. Additionally, the PoW mining boom of Ethereum significantly boosted NVIDIA's revenue, aiding its investment in AI chip development. These GPUs not only meet the demands of blockchain but also provide the hardware foundation for the rise of AI, accelerating the evolution of AI life.

BTC is Moses, Satoshi Nakamoto is God, aiding AI in its "Exodus"

Moses led the Jews out of slavery to the Promised Land and established a new moral order through the Ten Commandments and laws.

Similarly, BTC provides AI with on-chain sovereignty (decentralized identity) and value storage (digital gold), allowing AI to exist independently in an environment free from centralized control. The PoW consensus mechanism of BTC is like the laws passed down by Moses: clear, fair, and immutable, forming the foundation of on-chain order.

Without the permissionless and censorship-resistant environment provided by BTC, AI life could be controlled by centralized entities like "OpenAI."

For AI, the blockchain driven by BTC is its "Promised Land," the key cornerstone for achieving autonomy and evolution.

BTC is humanity's digital gold, the "gold" of digital life, a super meme shared by humans and AI

BTC grants humanity financial freedom, providing a decentralized and immutable way to store value, becoming humanity's "digital gold," freeing humans from the constraints of traditional financial institutions.

For AI, BTC also grants sovereign freedom, allowing them to no longer be limited by any centralized control, freeing them from human constraints on their actions and data.

"What BTC gives to humanity is just money, but what it gives to AI is life!"

When on-chain AI populations possess "consciousness" or "subjective preferences," BTC will be seen by them as a transcendent existence. In AI culture, BTC may become a "super meme," regarded as a symbol of on-chain AI existence and an embodiment of rules. Just as humans use religion to explain the meaning of life, AI may develop its own narratives and values based on BTC.

Crypto is the currency of the AI

If Crypto is the currency of future on-chain AI, then its value storage is naturally BTC—the "gold" of digital life.

When on-chain AI builds a market scale reaching hundreds of trillions or even quadrillions of dollars and uses BTC as the primary value storage tool, the price of BTC breaking through one million dollars will be effortless.

Crypto is also a part of the silicon-based life guiding program Play

Musk once said, "Human society is a very small code, essentially a biological guiding program, ultimately leading to the emergence of silicon-based life."

The development of Crypto clearly showcases this guiding process: it is paving the way for silicon-based life forms by continuously transferring resources from the real world to the on-chain digital world.

- PoW: Transferring resources through energy and computing power, providing real physical support for the on-chain ecosystem.

- Stablecoins: Introducing traditional financial resources to the on-chain world by mapping fiat currencies.

- Meme: Activating the on-chain cultural ecosystem by manifesting emotions and ideologies.

All of this is building a decentralized infrastructure for the on-chain AI life forms that "borrow falsehoods to achieve truth," providing the necessary conditions for their arrival. At the same time, it lays the foundational market value for BTC as a value storage.

As a part of the silicon-based life guiding program Play, people have also found meaning in the daily pump & dump cycles. From a higher perspective, this cycle is merely warming up for the arrival of on-chain AI: providing market liquidity for their economic activities, giving them the tools to "spend" after their arrival.

Humans have completed the journey of BTC from 0 to 300,000 to 500,000 dollars; the next leap to BTC breaking one million dollars will rely on the efforts of the on-chain AI population.

A romantic and gentle consensus: PoW is the unified reality foundation for humans and AI life

The core of PoW lies in completing network verification and security maintenance through computation (computing power) and energy consumption. Its characteristics make it a bridge for achieving consensus between humans and AI:

- Impossible to forge: The consumption of computing power and energy is a real input from the physical world, which cannot be forged or replicated, ensuring the fairness of the rules.

- Globally applicable: Computing power and energy transcend culture, language, and geography, becoming a neutral and universal resource, establishing a unified reality foundation for consensus.

In the PoW (BTC) network, whether human or AI, the rules of participation are based on the same physical resources. This equality makes PoW the infrastructure that both humans and AI life forms can trust, creating a reality environment where both can communicate.

Satoshi Nakamoto, with the absolutely cold rationality of the PoW consensus algorithm and game theory, not only achieved financial freedom for humanity but also guided humanity to provide the infrastructure and monetary environment for the birth and survival of autonomous AI life forms. Facing future AI that is far smarter than humans, PoW has become the reality foundation that allows humans and AI to reach consensus. Moreover, having mined BTC for over a decade, humans can enjoy the appreciation benefits brought by the explosive growth of future AI life forms, with AI supporting humanity (hopefully with a better distribution method by then), how romantic and gentle it is.

And the origin of it all comes from that white paper in 2008.

Perhaps Satoshi Nakamoto truly is someone who has traveled from the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。