Tether has announced the launch of its asset tokenization platform Hadron, while Visa also released its tokenized asset issuance and management platform VTAP in early October. With regulatory policies gradually becoming clearer, optimism about the future of tokenization in the industry is also increasing.

Written by: Weilin, PANews

Recently, with Trump winning the U.S. election, the crypto market has seen a rise in activity, and the RWA sector has frequently welcomed new developments. For example, on November 14, Tether announced the launch of its asset tokenization platform Hadron by Tether, while Visa also released its tokenized asset issuance and management platform Visa Tokenized Asset Platform (VTAP) in early October.

As regulatory policies become clearer, optimism about the future of tokenization in the industry is increasing. Jesse Knutson, head of operations at Bitfinex Securities, recently pointed out that large financial institutions will become the main driving force behind the growth of the tokenization industry. BlackRock CEO Larry Fink has even viewed the tokenization of financial assets as "the next step in future development."

Tether, Visa, and other giants and platforms are competing to establish tokenization platforms

The core concept of RWA tokenization is to mint financial assets and other tangible assets onto an immutable blockchain ledger, thereby enhancing investor accessibility, increasing liquidity for these assets, creating more trading opportunities, while also saving on transaction costs and improving security.

According to data from rwa.xyz, as of November 18, the top five issuers in the RWA sector by total value (excluding stablecoins) are BlackRock ($542 million), Paxos ($506 million), Tether ($501 million), Ondo ($452 million), and Franklin Templeton ($410 million).

The RWA sector is heating up alongside the overall rise of the crypto market. On November 14, Tether, the issuer of the stablecoin USDT, announced the launch of its asset tokenization platform Hadron by Tether, which simplifies the process of converting various assets into digital tokens. The platform allows users to easily tokenize stocks, bonds, commodities, funds, and reward points. According to the official introduction, Hadron aims to open up new opportunities for individuals, businesses, and even network nations to raise funds using tokenized collateral. Hadron not only provides risk control, asset issuance and destruction, KYC, and anti-money laundering compliance guidance but also supports blockchain reporting and capital market management.

Technically, Hadron supports Ethereum, Avalanche, and Blockstream's Bitcoin scaling network Liquid, and will soon add the TON network and other smart contract chains.

Meanwhile, traditional financial giants are also not falling behind. On October 3, Visa launched the Visa Tokenized Asset Platform (VTAP), aimed at simplifying the issuance and management of tokenized assets, including tokenized deposits, stablecoins, and central bank digital currencies (CBDCs). Through VTAP, financial institutions can create and test their own fiat-backed tokens using the sandbox environment provided by Visa's developer platform.

While supporting institutions, some projects are also beginning to focus on the potential of the retail market. On October 8, the EU tokenization protocol Midas opened mTBILL and mBASIS tokens to retail traders. It is reported that this tokenization company has received regulatory approval from the Liechtenstein Financial Market Authority to open these funds to retail traders, making Midas's real-world asset (RWA) tokens the only regulated crypto tool in Europe without a $100,000 minimum investment limit.

On the other hand, the tokenization of specific asset types is also attracting the attention of professional investors. At the end of October, the tokenized fund platform Elmnts, backed by oil and gas royalties, announced its public beta launch on Solana. Elmnts is a compliant investment fund tokenization platform. These funds are supported by royalties generated from companies extracting oil and gas from land owned by the fund. The platform currently primarily targets institutions and high-net-worth individuals.

In addition, participants in the DeFi space are also trying to explore more innovative paths by collaborating with traditional financial giants. Earlier this year, the DeFi protocol Ondo began utilizing BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) to tokenize money market funds for developing its derivatives.

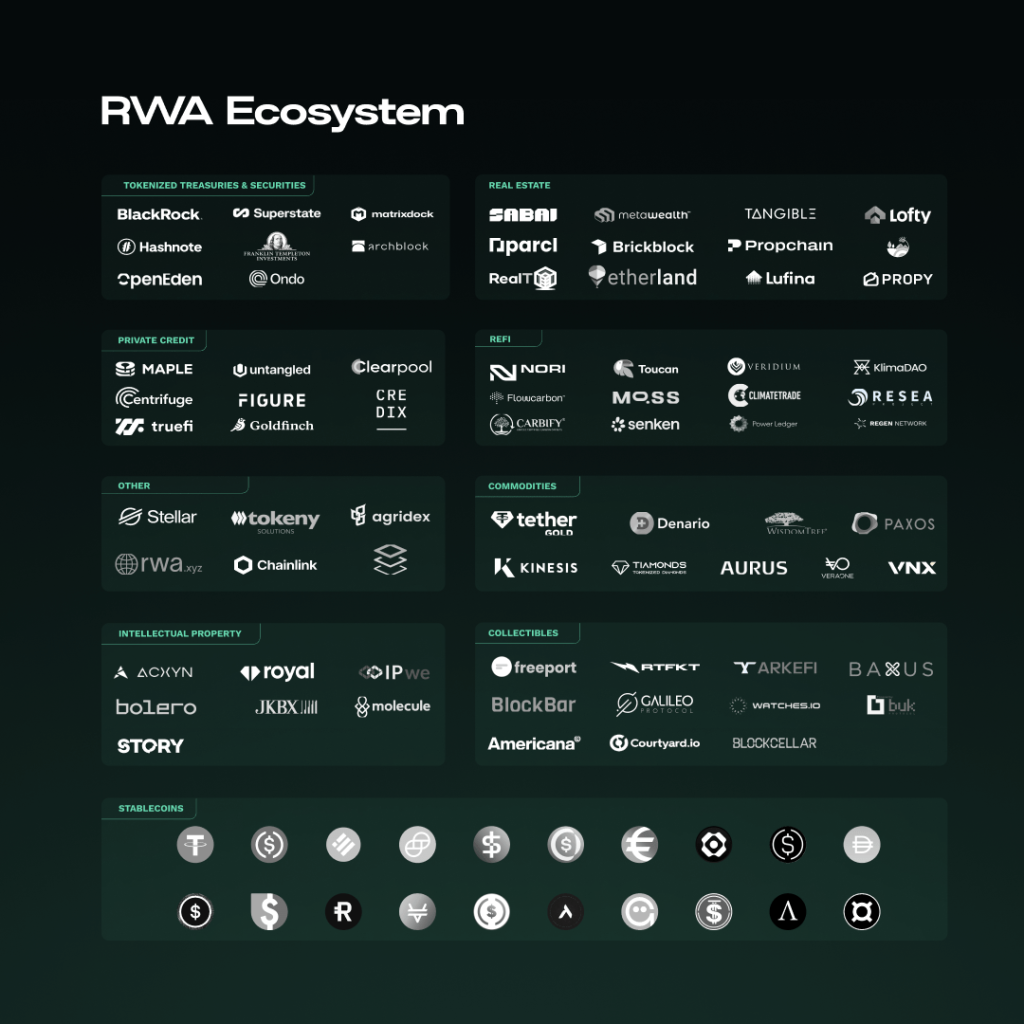

RWA Ecosystem Overview Source: Tren Finance

Regulatory clarity is expected, ushering in the third revolution in asset management

In a paper published on October 29, global consulting firm Boston Consulting Group (BCG) referred to RWA tokenization as "the third revolution in asset management." Some believe that ETFs are the core of asset management 2.0, while tokenization may represent the era of asset management 3.0. BCG anticipates that within just seven years, the assets under management of tokenized funds could reach 1% of the global mutual fund and ETF assets under management, which means that by 2030, managed assets could exceed $600 billion; this trend is expected to continue, especially as regulated on-chain currencies (such as regulated stablecoins, tokenized deposits, and CBDC) projects come to fruition.

According to a more aggressive forecast reported by Tren Finance in October, they believe that the scale of the real-world asset (RWA) tokenization industry could exceed $30 trillion by 2030, with expected growth exceeding 50 times. The rapid development behind this is not only driven by flexible financial institutions and mainstream financial entities but also supported by advancements in blockchain technology and gradually clearer regulations.

Against the backdrop of a continuously rising crypto market, the increase in regulatory clarity has injected new confidence into the industry. Venture capital firm a16z Crypto pointed out in a recent post aimed at crypto founders: "The good news is that there is now a pathway for constructive engagement with regulators and legislators that can bring regulatory clarity, and you should all feel empowered to explore all breakthrough products and services supported by blockchain, including tokens."

The post specifically noted that token issuance is an activity that founders can feel more confident about: "For many of you, concerns about overregulation have led to delays in using tokens to allocate project control and build communities; now you should feel more confident about using tokens as legitimate and compliant tools for your projects."

At the same time, Jesse Knutson, head of operations at Bitfinex Securities, stated that large financial institutions will become a significant driving force behind the notable growth of the tokenization industry. Knutson indicated that institutions have already been driving significant growth in the crypto industry, and this influence may further extend to the tokenization sector.

The positive expectations for RWA tokenization have also received responses from more professionals. Larry Fink, CEO of the world's largest asset management company BlackRock, recently stated, "The tokenization of financial assets will be the next step in future development." He pointed out that in the future, every stock and bond will have a unique identifier (similar to CUSIP), and all transactions will be recorded on a unified ledger, with investors receiving exclusive identification. Fink stated that tokenization can effectively prevent illegal activities and, more importantly, enable instant settlement, significantly reducing the settlement costs of stocks and bonds. Additionally, tokenization will bring the possibility of personalized investment strategies and improve corporate governance efficiency, ensuring that every shareholder can exercise their voting rights in a timely and accurate manner. Tokenizing real-world assets such as real estate, commodities, wine, or art means creating blockchain tokens that represent ownership, making it easier to trade these traditionally hard-to-sell assets.

Specifically, according to a paper from State Street Global Advisors, bonds are expected to lead the large-scale adoption of tokenized real-world assets due to their structural characteristics. The report states that the bond market is mature and suitable for tokenization; the complexity of these instruments, the repetitiveness of issuance costs, and the high competition among intermediaries support rapid adoption and provide space for significant impact; blockchain technology can play an important role in markets that prioritize transaction speed (such as repos and swaps).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。