How far is BTC from $100,000?

Written by: CMed

Since Trump was elected President of the United States, the biggest narrative in cryptocurrency has changed. Many people say that Trump's presidency has ushered in the era of "crypto gold," and cryptocurrencies may no longer be heavily regulated by the SEC for being considered "securities." The U.S. stock market has also shown extreme "Trump trading" market sentiment, with Tesla and the Trump Media Group experiencing significant surges.

BTC has also resonated with the U.S. stock market, showing even better performance. During this time, it broke away from a six-month-long consolidation phase and initiated a strong upward trend, consecutively breaking through the $80,000 and $90,000 thresholds, with almost no "pullbacks" during this period. Interestingly, many whales who shorted the market have faced liquidation, witnessing $80 million and $20 million in short liquidations in the futures market.

However, no feast lasts forever. As the "Trump trading" sentiment cools, the U.S. stock market has seen a significant pullback, with the Nasdaq index closing in the red for five consecutive trading days. Initially, BTC was able to rise independently of the U.S. stock market, but on November 14 and 15, it also experienced slight declines. Currently, it seems to have found support at the EMA20 on the 4-hour chart and has rebounded, remaining above $90,000.

Most altcoins have seen significant increases since Trump's election, with gains of 20-30%. However, for many, the path to "breaking even" seems long, especially after BTC has opened up upward space. Is there still an opportunity for altcoins? Is it still suitable to continue going long on BTC? Let's take a look at the thoughts of traders in the market.

Technical Analysis Group

@biupa

OTHERS.D has been in a downward channel for the past 49 days, while DXY has been in an upward channel, showing a strong negative correlation. This explains why altcoins are only rising with BTC but experiencing deeper pullbacks. Both the dollar and Bitcoin are in a policy bull market, and the ones suffering are the altcoins. Recently, there has been too much focus on internal data from the crypto space, neglecting the impact of macro factors. A reasonable prediction is that a reversal in DXY is needed to bring about a rebound in OTHERS.D.

For BTC, on the morning of the 15th, a negative premium on Coinbase was observed for the first time during the last hour of the U.S. market close. In the following hours, there was no negative premium, which may be an isolated incident but is worth noting. As U.S. buying pressure weakens, the upward space for BTC is limited in the short term. Personally, I believe the probability of touching $100,000 before the end of the year is low.

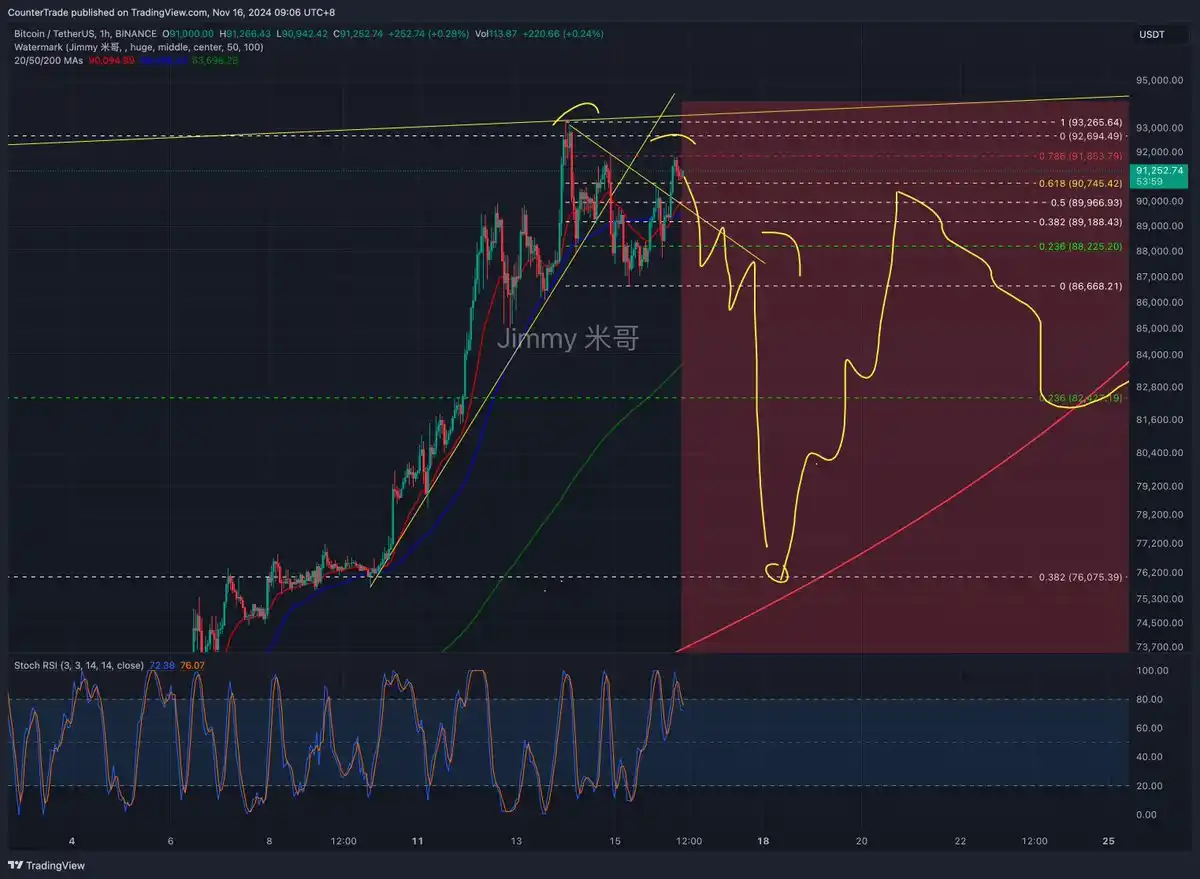

@Cryptos_Laowai

@Cryptos_Laowai believes that a true bull market will only begin after Trump is officially elected President of the United States and implements genuinely favorable measures for crypto, likely after 2025. It is very possible that we are still just at a temporary peak of a small bull market, and there will not be a widespread altcoin season. After breaking the current upward trend line, it is currently viewed as a standard second inducement pattern, expecting a significant drop, with a target short position at $76,000 to fill the CME gap next week.

@CryptoPainter_X

Currently, BTC has four possible trends, and the quantitative strategy still holds a long position at $69,000. The structure remains bullish, but the following four trends are possible:

- Price continues above $90,000 (maintaining a consolidating upward trend);

- Price remains below $90,000 (confirming a range-bound consolidation);

- Price breaks below $85,000, leading to a bottom reversal (maintaining range-bound consolidation + long opportunities);

- Price confirms a break below $85,000 and fails to reclaim, considering potential extreme pullbacks to fill the CME gap;

If BTC performs weaker than the fourth scenario, consider the possibility of the bull market ending.

@roger73005305

Today, I will continue analyzing the overall market and altcoin trends.

Soon, you will see the miraculous phenomenon of BTC falling while altcoins rise.

First, let's analyze the market from December 2021 to February, which is similar to our current situation leading up to the Lunar New Year in February.

At the end of December 2021, the market began to consolidate until February, and typically, when the market is consolidating or declining, altcoins should plummet. However, this was not the case because BTC had already risen significantly, and altcoin sentiment was just beginning to rise. BTC's market share reached its peak and then started to decline, leading to the beginning of altcoin season. Thus, we saw quality altcoins like BNB and SOL slowly start to rise. It was not wise to take profits or reduce positions at this time because they hadn't really increased; there was no talk of taking profits or reducing positions.

Therefore, my view is to continue to accumulate quality altcoins that haven't risen yet. For those that have surged several times, at the very least, one should break even. For the cautious, it may be wise to sell everything and switch to those that haven't increased.

Data Analysis Group:

@Maoshu_CN

As of this week, the market sentiment following Trump's victory has completed two weeks. Through market data, we can clearly see that sentiment is gradually weakening. Next week, we need to focus on whether the market can continue the expectations and independent trends following Trump's victory.

Of course, in the future, if the overall expectations are good and funds continue to flow into the market, this will undoubtedly be a positive sign for the market's future, providing some assurance against price declines, especially for BTC. If there is a significant drop due to short-term negative factors, I believe it may trigger a lot of funds to buy the dip.

If next week does not continue the short-term expectations of Trump's victory, we should prepare for a pullback, referring to market analysis.

Comparing with Thursday's data, the overall market capitalization has decreased, with #BTC and #ETH market caps primarily decreasing, while altcoin market caps have increased. Based on the proportion, market risk appetite is gradually improving, but currently, #altcoins are still overly reliant on the meme sector.

Overall trading volume has weakened, and as the weekend approaches, activity has decreased. However, if we compare this year's Saturday market data, the current trading volume activity is still at a peak, whether for BTC, ETH, or altcoins, as well as the activity of USDT/USDC funds.

Funds continue to flow significantly into the market, with the current market liquidity at $186 billion, a substantial increase compared to Thursday.

@Murphychen888

According to the indicators:

- The red line is currently close to a short-term high. If it goes up further, it will create a "divergence." Based on past experience, the greater the divergence, the larger the pullback.

- It is also observed that a small pullback may occur in the next 10 days. The current red line is at 2.52, with the pullback range around 2.35, corresponding to the current BTC price of about $82,000 (this calculated price will increase over time).

- After this period, around mid-December, it is expected to return to an upward trend, but based on current data, it is uncertain whether it will significantly exceed previous values.

For me personally, since my holding cost is low, I will ignore this short-term fluctuation. If the holding cost is high, one needs to prepare a trading plan.

Options Market Data:

Thomas Erdösi, head of CF Benchmarks products, stated that market data shows traders seem to be aggressively buying Bitcoin call options with a $100,000 strike price. The 30-day constant expiration 25 delta deviation has now surpassed the 5 vol threshold, approaching the highest level since the beginning of the year, indicating a much greater demand for upside exposure.

Additionally, the demand for call options with strike prices exceeding $100,000 is also surging, as evidenced by the rising implied volatility of these options.

Macro Analysis Group:

@Maoshu_CN

Inflation data is generally neutral, neither favorable nor unfavorable, fully in line with market expectations. Overall, inflation remains under control, but a short-term rebound in inflation may also raise market concerns about future inflation.

In the U.S. stock market, the trend is relatively cautious, especially as the S&P forms effective turnover around the 6000-point mark, which is actually a good sign for the U.S. stock market.

For Crypto and BTC, the current sentiment is overly optimistic; as long as there is no negative news, it is considered positive. This is the current state of enthusiasm in the Crypto space.

The inflation data has once again sparked discussions about a rate cut in December, and the current CME rates indicate an 82.5% high probability of a 25 basis point cut in December.

Moreover, regarding the current U.S. economic sentiment, the CPI data rebounded but did not exceed expectations, aligning with the Federal Reserve's expectations mentioned in Powell's speech last week. Therefore, short-term CPI data will not affect the Fed's decision-making. Additionally, Trump's potential as the next U.S. president, who has a proactive attitude towards significant rate cuts, may also indirectly influence the Fed's upcoming actions.

Moreover, the market has slowly begun to accept the expectation that inflation may rise in the future, so the short-term inflation pressure is no longer seen as a significant negative sentiment.

In Powell's last speech, he mentioned a key point: the Federal Reserve is seeking the correct neutral interest rate to adjust policies around that rate. Currently, the neutral interest rate may be higher than market expectations, and this could be an important topic for the Federal Reserve moving forward.

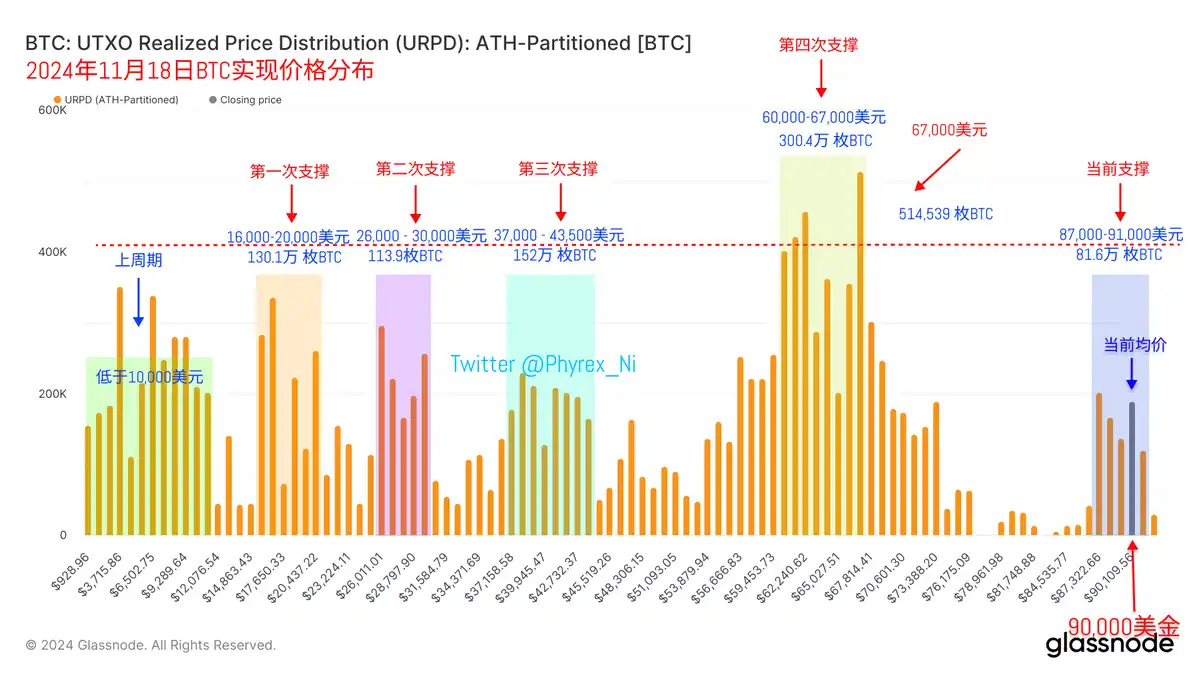

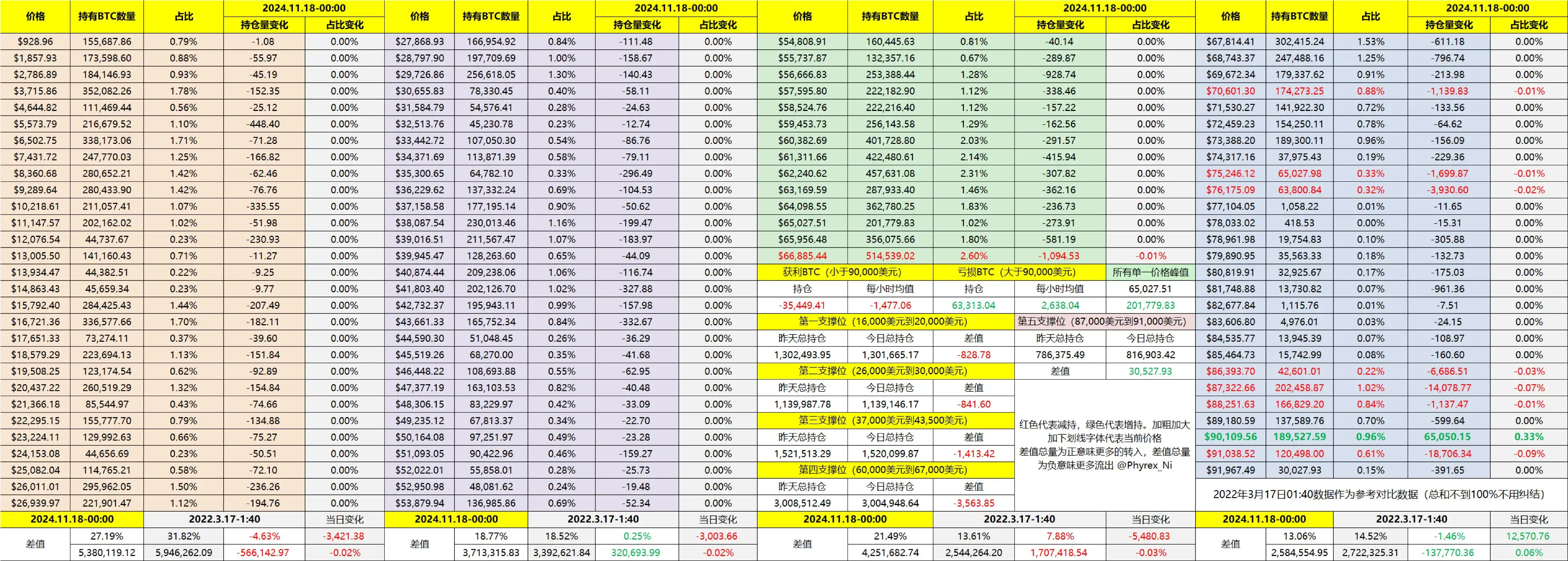

@Phyrex_Ni

From the current data, it seems that the FOMO sentiment among American investors has likely cooled down. We can temporarily see fluctuations between $87,000 and $91,000. Whether this position can form a new bottom is still uncertain, but historically, there has never been a gap in BTC prices. However, from the URPD data, it is evident that the open interest at $77,000, $78,000, and $82,500 is almost nonexistent. This kind of gap has appeared before but was later "filled."

From last week's ETF data, we can also see a significant decrease in buying power for both BTC and ETH, with BTC experiencing substantial selling yesterday. This indicates that the FOMO sentiment during the election phase may have ended, and the next step should be to rebuild the bottom.

I want to emphasize that this is not a bearish view; it is simply a preparation for a potential pullback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。