Key Indicators (November 11, 4 PM - November 18, 4 PM Hong Kong Time)

BTC/USD price increased by 13.0% (from 81.2k to 91.75k USD), while ETH/USD price decreased by 0.3% (from 3.14k to 3.13k USD).

BTC/USD year-end (December) ATM volatility increased by 5.2 points (from 51.8 to 57.0), and December 25d skew increased by 2.7 points (from 3.2 to 5.9).

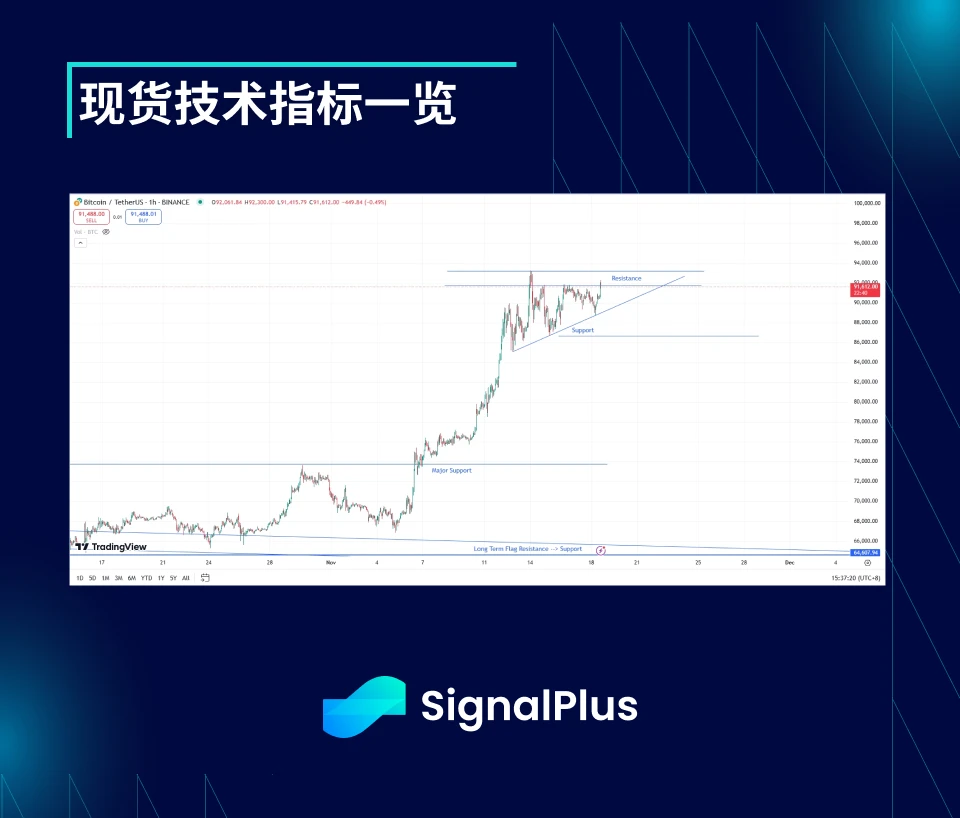

Spot Technical Indicators Overview

In the past week, the market began to accelerate upward, with any initial signs of being overbought ultimately replaced by strong momentum. The market likely accumulated a significant amount of Gamma around the 90k level, as it faced multiple rejections at this point before attempting to break upward and eventually reaching 93.25k USD. Currently, the 91.75k-93.5k USD range will be our top resistance level.

Referring to the above chart, the first support level is a diagonal support slightly below the current price level, which will continue to exert pressure guiding the market to test price highs. If the price fully breaks down below this support level, we will find good support again around 85k-86.25k USD. However, further down, we expect to see a wave of fierce position liquidations.

The daily and hourly volatility ranges have begun to show signs of contraction. If the coin price cannot break through 93.5k USD, we expect to see a reduction in actual volatility. We still maintain a long-term bullish view and reasonably predict a target of 105k-115k USD for the first quarter of next year. However, during this period, we expect the market to gradually stabilize and take a slight breather over the next six months. If we see stronger evidence supporting the contraction of the volatility range in the next week or two (at least in the short term), this view will be confirmed and begin to exert pressure on Gamma positions.

Market Themes

This week, the "Trump trade" continues to be in full swing. The US dollar continues to rise against other fiat currencies, while US Treasury yields are also climbing. Cryptocurrencies have once again shown performance that is completely unrelated to the dollar. Bitcoin surged above 90k USD, while other altcoins also experienced astonishing gains. The US stock market had a good week and saw a sharp decline in the VIX index, followed by a slight correction over the weekend. However, this is merely a minor correction within the current bull market trend.

Everyone's focus is now on Trump's cabinet selections, with attention in the cryptocurrency space on the upcoming announcement of the Treasury Secretary appointment. Scott Bessenet initially appeared to be the most promising candidate, but Elon Musk expressed support for Howard Lutnick over the weekend. Both can be considered pro-cryptocurrency candidates, although Lutnick is more so. However, it seems that the final selection is still far from being finalized, as Kevin Warsh and Mark Rowan have also been added to the candidate list in the past 24 hours.

It appears that there is still ongoing buying demand after MSTR announced the purchase of over 27,000 bitcoins before and after the election. The company's stock price continues to trade at peak levels, with a net asset premium of 2.5 times the spot price of bitcoin. The BTC/USD price has received good support during each pullback. Even with ETF fund outflows from ARKB and BITB on Thursday and Friday, the coin price still managed to regain the 90k USD level over the weekend.

ATM Implied Volatility

After a strong breakout above the 80k-82k USD resistance level last Monday evening, the price surged upward, and the implied volatility levels sharply increased across the board. As the market reached 93k USD, high-frequency actual volatility was pushed to the 60s, and then the price oscillated violently back to the 87k-93k USD range.

The price volatility arrived earlier than the market expected, while the rapidly rising actual volatility led to a quick inversion of the volatility term structure. The ATM implied volatility for November 29 rose from a low of 47-48 ten days ago to a high of 65. The volatility levels further out on the curve were also dragged higher in a time-weighted manner.

There is a structural argument that volatility will gradually weaken under the new situation. If Trump successfully pushes for regulation of cryptocurrencies, a wave of funds will flow in and ultimately support the coin price, further weakening volatility. Moreover, the current price level has largely taken these factors into account. Although the price is still fluctuating significantly, actual volatility has not exceeded the 60s, while the implied volatility for the day of expiration continues to hover between the low 50s and high 60s (the average level this year is 45-50). However, at present, bullish momentum has stimulated demand for the price range of 100k-150k from the end of this year to the end of January next year, while also providing support for implied volatility.

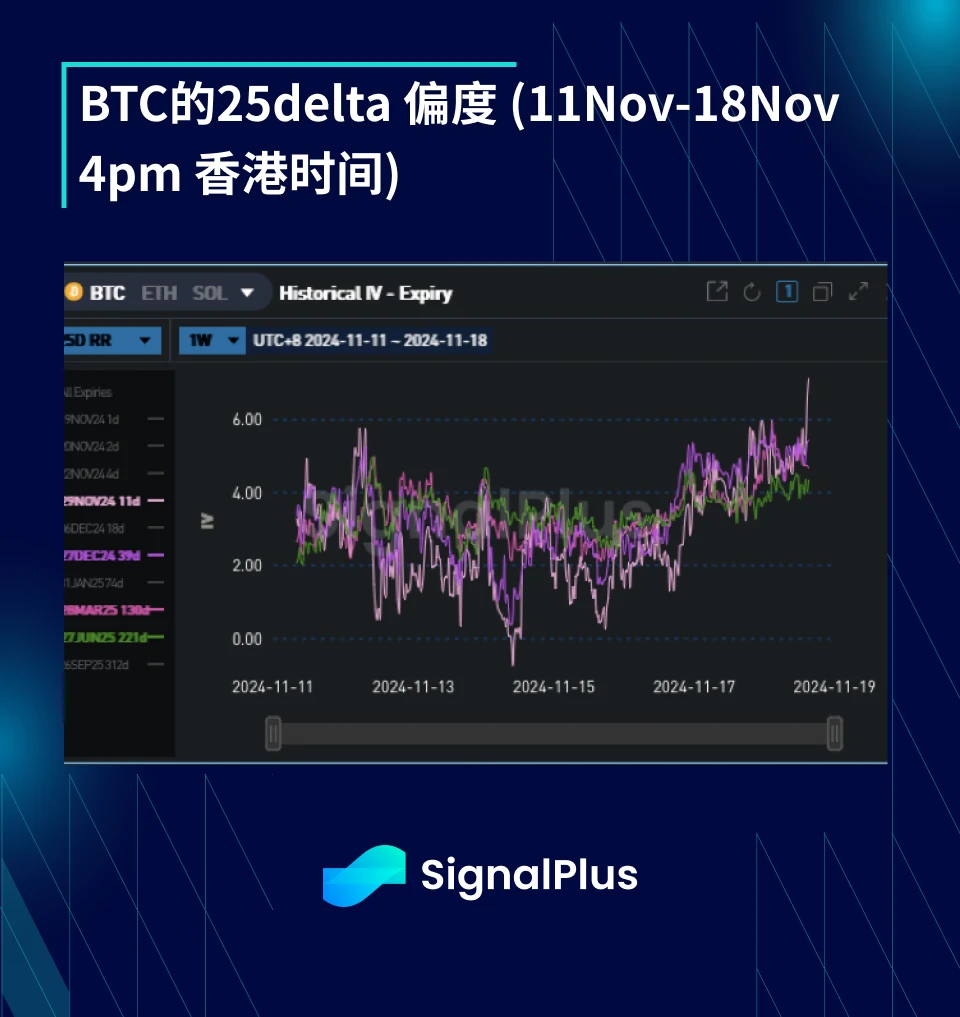

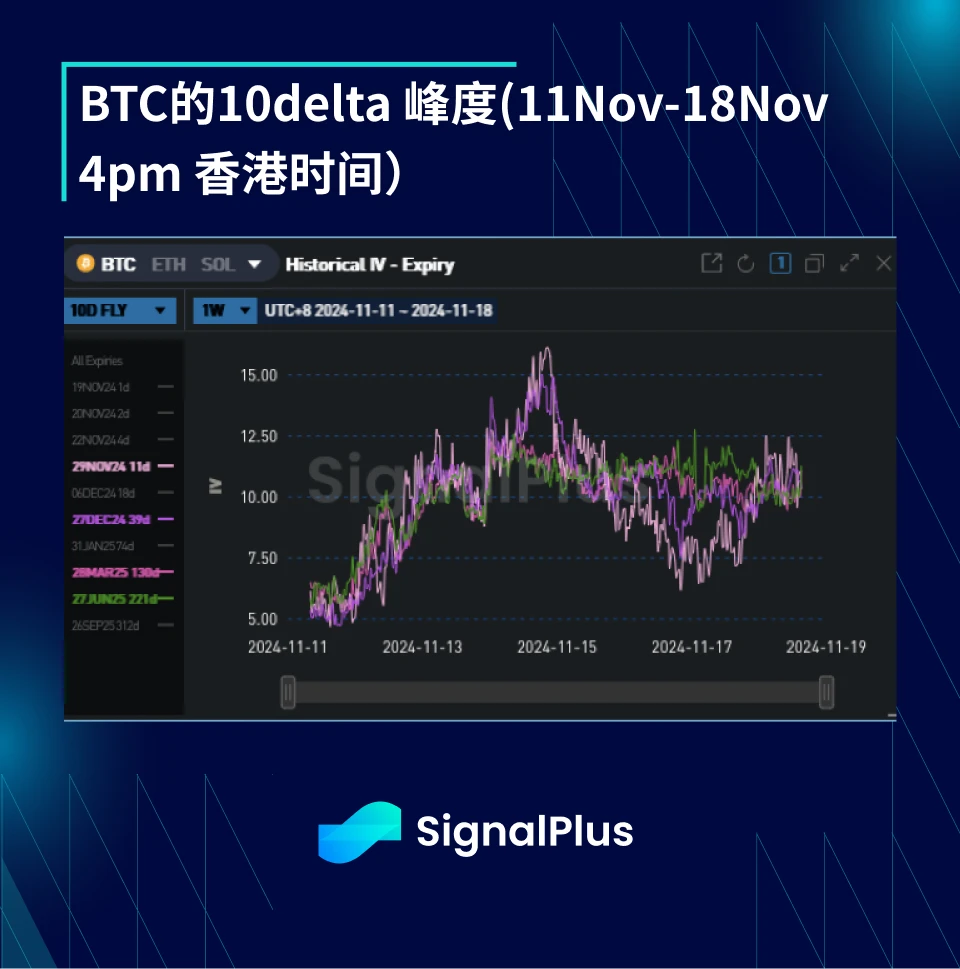

Skew/Kurtosis

This week, skew continued to rise (mainly on the bullish side), primarily due to the market's anticipation of further upward breakthroughs in coin prices. Implied volatility continues to show a positive correlation with coin prices. When the price drops to the 87-88k range, implied volatility is compressed across the entire curve, but whenever the price attempts to break upward again in the 91.5k-93.5k USD range, sellers quickly retreat. Additionally, the closing of in-the-money call spreads and rollovers also drove the increase in skew.

As actual volatility rapidly increased, kurtosis also significantly rose. This week saw an increase in demand for the upside wing, especially above 100k USD. The market also observed some demand for the downside wing in the short term, mainly used to protect spot or margin positions.

Wishing everyone good luck in the coming week!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。