Author: @jackmelnick_, Head of Berachain DeFi

Translation: Felix, PANews

Eight months ago, I wrote a post about LP costs, which did not attract much attention at the time. However, yesterday the post's readership tripled, so this article revalidates this method with the latest examples.

Premise: To make this method work better, you need to position yourself early in memecoins and recognize that a certain memecoin has some advantages in the medium to long term, along with high trading volume. This article uses the BUCK token as an example.

As mentioned in the previous post, you need to set a v3 range, with the lower limit slightly below the current price of the token (usually about 25% lower) and the upper limit relatively higher (this article example chooses about 100 BUCK/SOL or about $2.5/BUCK). This setup minimizes the amount of SOL you need to deposit into the LP, and as the price rises, DCA (dollar-cost averaging) will gradually allow you to transition from memecoins to SOL.

Now let's talk about impermanent loss (IL): here is a paraphrase of @AbishekFi's statement:

IL is a tool, not a loss……measuring LP returns is a hot topic, but it actually depends on your preferences as an LP. Do you want asset_ A or asset B? Or are you willing to let your position value increase?

The only way this happens is if one or both assets in your token pair appreciate, resulting in impermanent loss. However, if you are providing LP for two assets that you don't mind holding, then you are simply creating an on-chain DCA that generates fees at the same time._”

As @shawmakesmagic mentioned, this can be a very valuable tool for token developers, especially for AI agents with ongoing costs. Providing v3 range liquidity for a token pair allows developers to profit/pay fees using the fees while participating in the token's rise. It will directly adjust value in the long term (depending on how the range is set).

To demonstrate that this method is effective, let's look at a simple example with BUCK, where the author divides it into initial reserves, ongoing impermanent loss, generated fees, and return on investment.

Yesterday, I created a BUCK/SOL LP, providing 17 SOL and 892,000 BUCK. The reason for this is that the Gamestop movement has broad appeal, with fast token rotation, high volatility, and trading volume.

I set the range with an upper limit of 100 BUCK/SOL (about $2.5) and a lower limit of 8,500 BUCK/SOL ($0.029), which is about 20% lower than the market price of approximately 6900 BUCK/SOL, ensuring that if BUCK drops in the short term, the token pair will not exceed the range.

This represents a total value of about $4,000 in SOL and $30,000 in BUCK (related to the later calculation of impermanent loss).

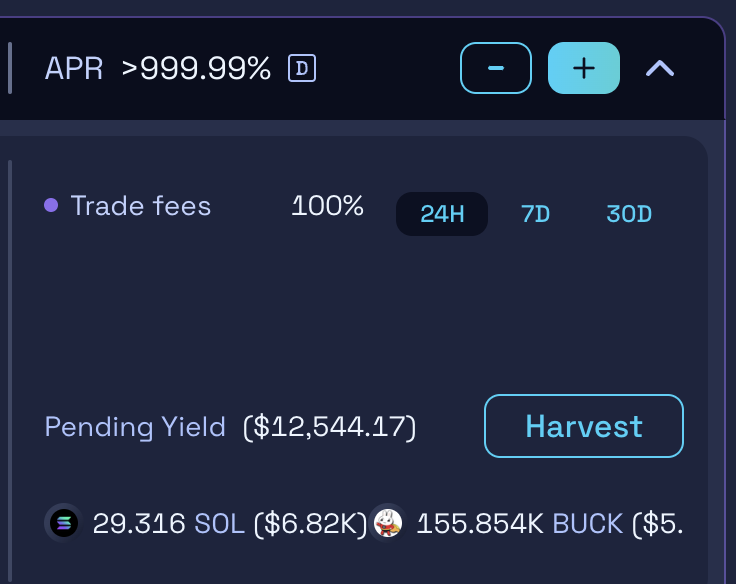

After 10 hours of LP extraction, it generated:

- 29.3 SOL and 156,000 BUCK (fees)

- 25.1 SOL and 841,456 BUCK (LP)

The $34,000 deposit generated about $12,500 in fees over 10 hours, which is approximately 88% of the daily fee generation. This is an absolutely incredible figure, with an APY reaching 32,120% even without compounding.

In this case, the impermanent loss amounted to about 50,000 BUCK tokens, which were replaced by another 8 SOL, which is negligible from the perspective of impermanent loss.

To clarify:

- Deposited (total) = 17 SOL and 892,000 BUCK

- Withdrawn (total) = 54.4 SOL and 997,000 BUCK

- Total profit from LP = 37.4 SOL and 105,000 BUCK

It is clear that the impermanent loss generated by the pool is greatly offset by the fees generated from trading volume. This is optimized in token pairs that keep prices roughly consistent with extremely high trading volume.

Even crazier, further optimizations can be made:

- Adjust the LP fee tier from 1% to 2%, as deeper liquidity leads to higher trading volume

- Tighten the upper limit of the initial range to further concentrate liquidity, and if the price rises, rebalance the range over time

- If you want to avoid a drop after the token rises (no round-trip trading), you can pull your LP and rebalance the lower limit of the range to again reach 20% of the current bottom price, thus pocketing the SOL income you have DCA'd.

In the meme market, the demand for trading volatility is extremely high, and the sensitivity to price is very low. Positioning yourself as a passive LP is an excellent strategy to maximize returns, especially for token pairs with longer holding times and higher trading volumes, considering users who are uncertain about holding SOL or memes.

Related reading: In-depth exploration of two DEX mechanisms: How to address LP's profit risks?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。