Original Author: Matt Crosby

Original Compilation: Luffy, ForesightNews

As Bitcoin enters a price discovery mode once again, participants in the crypto market are curious: Has retail FOMO begun? Will we see the same influx of retail investors as we did in the previous bull market cycle? We will examine the current state of the Bitcoin market and the potential near-term outlook using active addresses, historical cycles, and various market indicators.

Rising Retail Interest

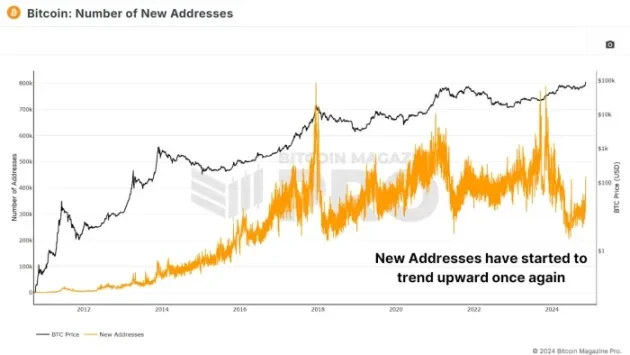

One of the most direct signs of rising retail interest is the number of newly created Bitcoin addresses. Historically, a sharp increase in new addresses often marks the beginning of a bull market as new retail investors flood into the market. However, in recent months, the growth of new addresses has not been as rapid as expected. Last year, we saw about 791,000 new Bitcoin addresses created in a single day, indicating strong retail interest. In contrast, although the current number of new addresses has seen a slight increase, we are still hovering at lower levels.

Figure 1: The number of new addresses on the Bitcoin network has started to rise

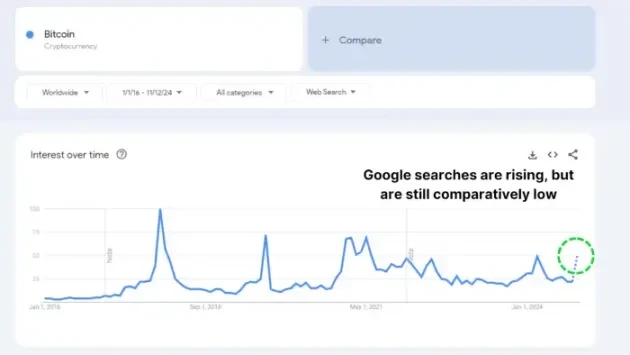

Google Trends also reflects this interest. Although the search volume for "Bitcoin" has been increasing over the past month, it is still far below the peaks of 2021 and 2017. Retail investors seem to be showing new curiosity, but it has not yet reached the frenzied excitement of FOMO.

Figure 2: The search volume for "Bitcoin" on Google is also rising, but remains relatively low

Changes in Holders

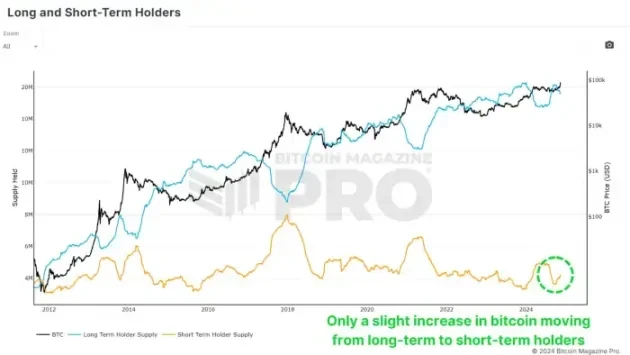

We are witnessing a shift of Bitcoin from long-term holders to newer short-term holders. This change in supply may suggest the beginning of a new market phase, where experienced holders are taking profits and selling to newer market participants. However, the total amount of Bitcoin being transferred remains relatively low, indicating that long-term holders have not yet begun to sell off their Bitcoin in large quantities.

Figure 3: The number of Bitcoins changing hands to new holders has only slightly increased

Historically, during the last bull market from 2020 to 2021, we saw a significant flow of funds from long-term holders to new investors, which drove the subsequent price increase. Currently, this transfer is not evident, as long-term holders choose to continue holding their Bitcoin despite the price rise. This reluctance to sell indicates that holders are confident in the potential for further increases.

Spot-Driven Rally

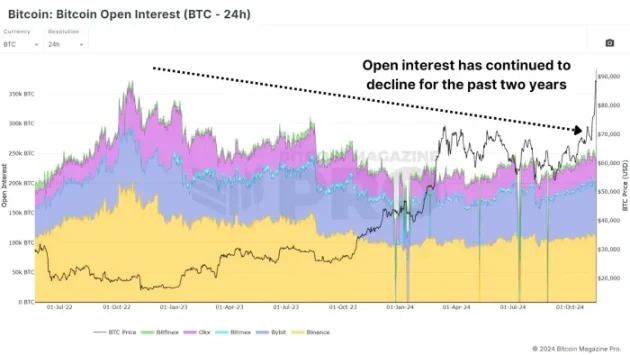

A key aspect of Bitcoin's latest rally is that it is spot-driven, contrasting sharply with previous bull markets that relied on leveraged positions. The open interest in Bitcoin derivatives has only seen a slight increase, in stark contrast to previous peaks. For example, prior to the FTX collapse in 2022, open interest was quite substantial. A spot-driven market tends to be more stable and resilient, as there are fewer investors facing the risk of forced liquidation.

Figure 4: Open interest has been declining over the long term, with only a slight recent increase

Whales are Accumulating

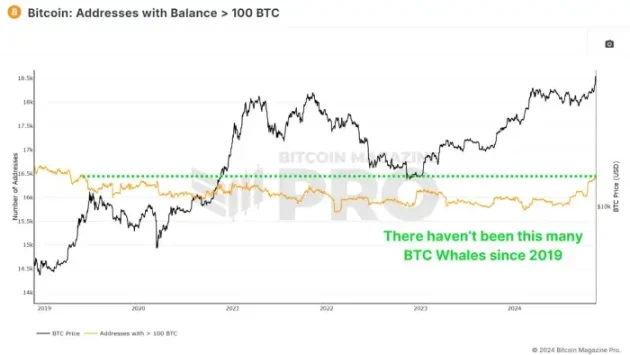

Interestingly, while the number of retail addresses has not significantly increased, the number of "whale" addresses holding over 100 BTC has been steadily rising. In recent weeks, wallets holding large amounts of BTC have increased by tens of thousands of Bitcoins, worth billions of dollars. This indicates that even as Bitcoin reaches historical highs, whale investors remain confident in the current price levels.

Figure 5: The number of addresses holding at least 100 BTC has reached its highest level since 2019

In previous bull market cycles, we saw whales exit or reduce their holdings near market peaks, but this time we have not observed such behavior. The accumulation by experienced holders is a strong bullish signal, as it reflects confidence in the market's long-term potential.

Conclusion

While Bitcoin's rise to historical highs has rekindled interest, we have yet to see signs of retail FOMO. This suggests that we may only be at the beginning stages of this bull market. Long-term holders remain confident, whales are accumulating Bitcoin, and leverage remains moderate, all indicating a healthy market with potential for continued upward movement.

As we continue into the bull market cycle, the market structure suggests that there may still be a larger-scale retail-driven surge ahead. At that time, Bitcoin could be pushed to new heights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。