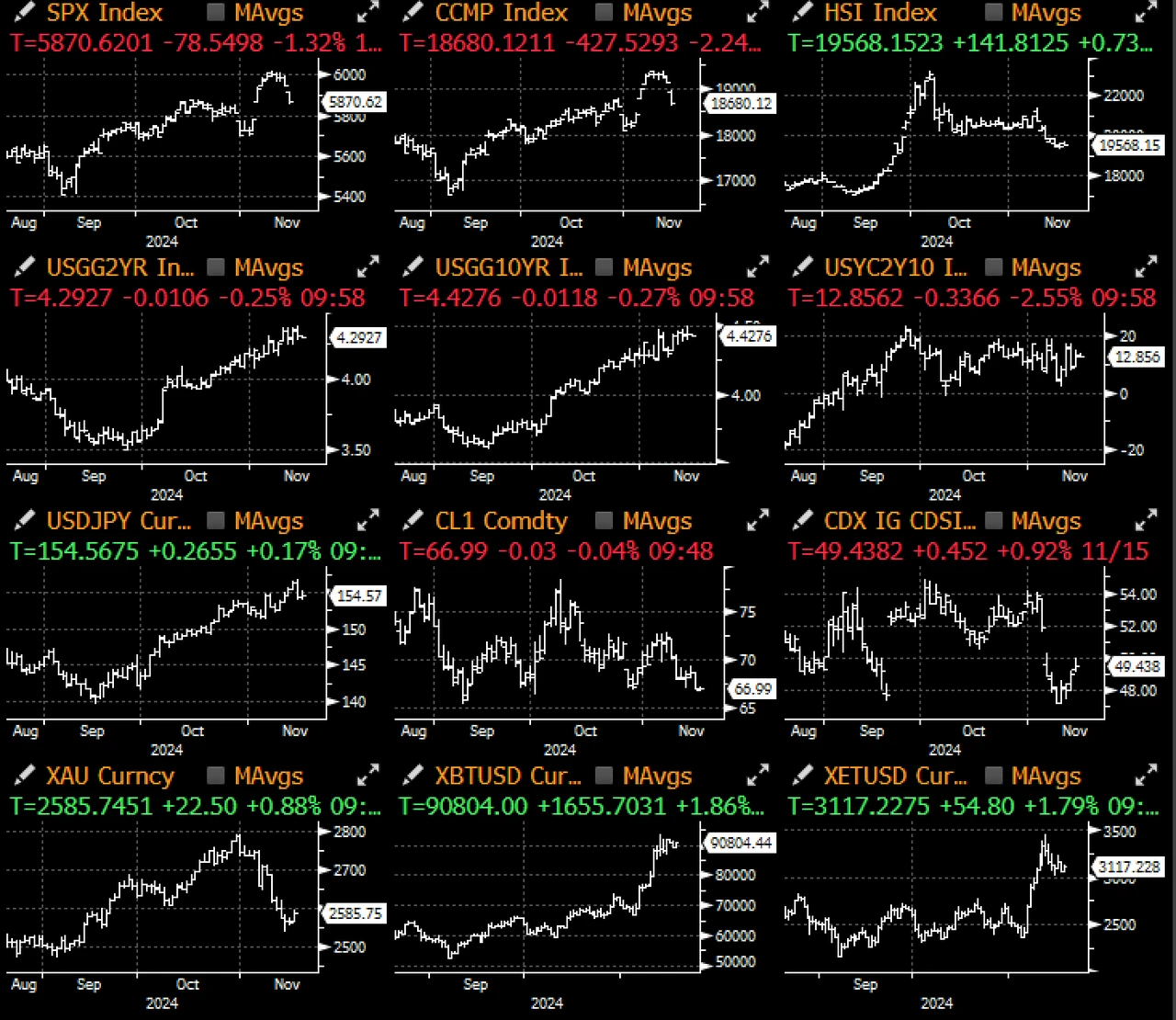

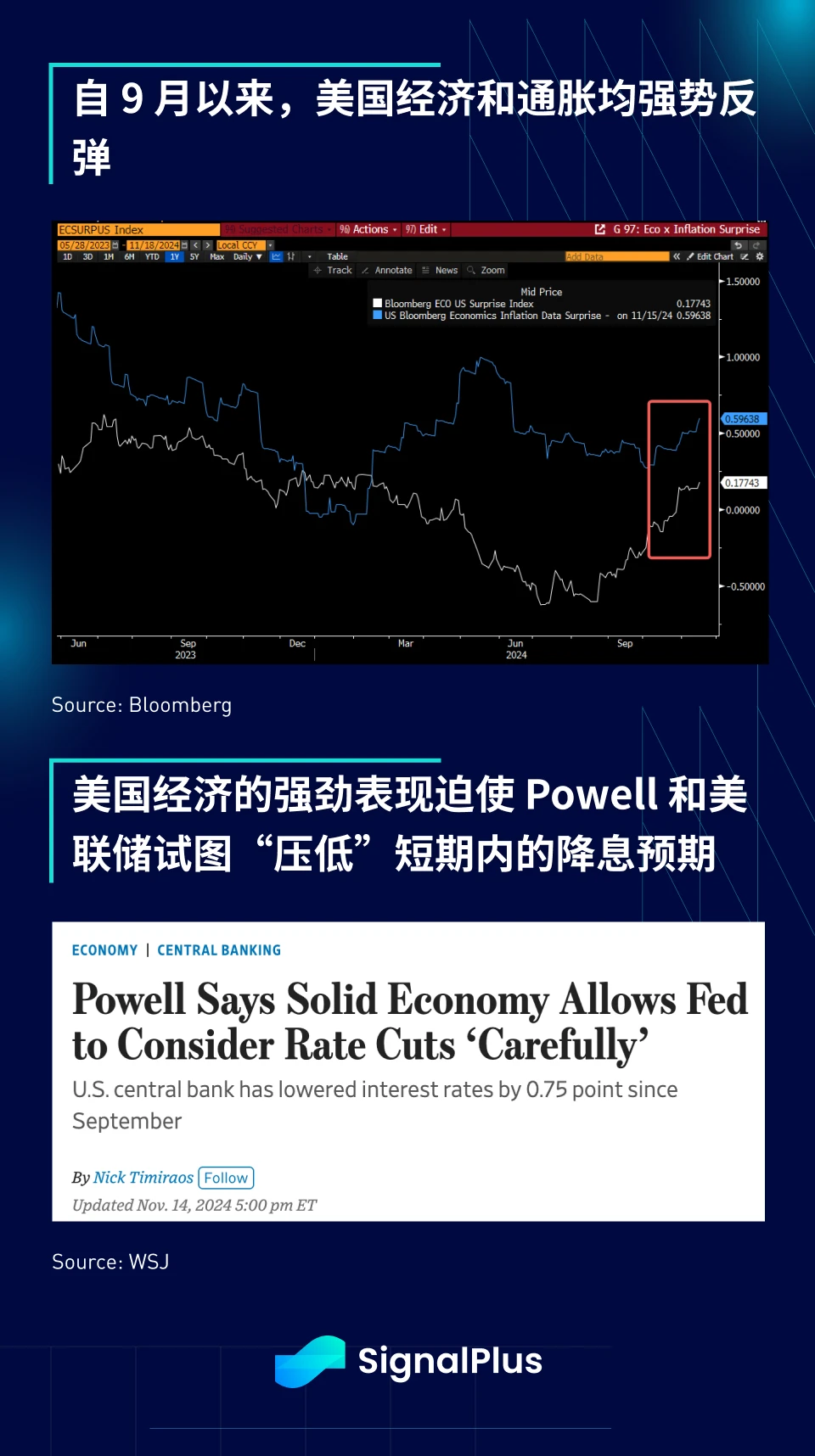

Bullish positions are at extreme levels, coupled with market concerns over rising yields (the 10-year nominal yield is about 4.45%, and the real yield is >2.15%), the U.S. stock market has retraced some of its recent gains (last Friday SPX -1.3%, Nasdaq -2.3%). Additionally, Chairman Powell indicated in his remarks last week that given the strong economic conditions, the Federal Reserve is considering slowing the pace of interest rate cuts, leading to a decline in the market's pricing of a December rate cut from nearly 2 basis points at the September peak to just 61%.

"The current economic situation has not signaled any urgent need for rate cuts," Powell said during a talk in Dallas on Thursday. "The strong performance of the current economy allows us to make decisions more cautiously." -- Jerome Powell

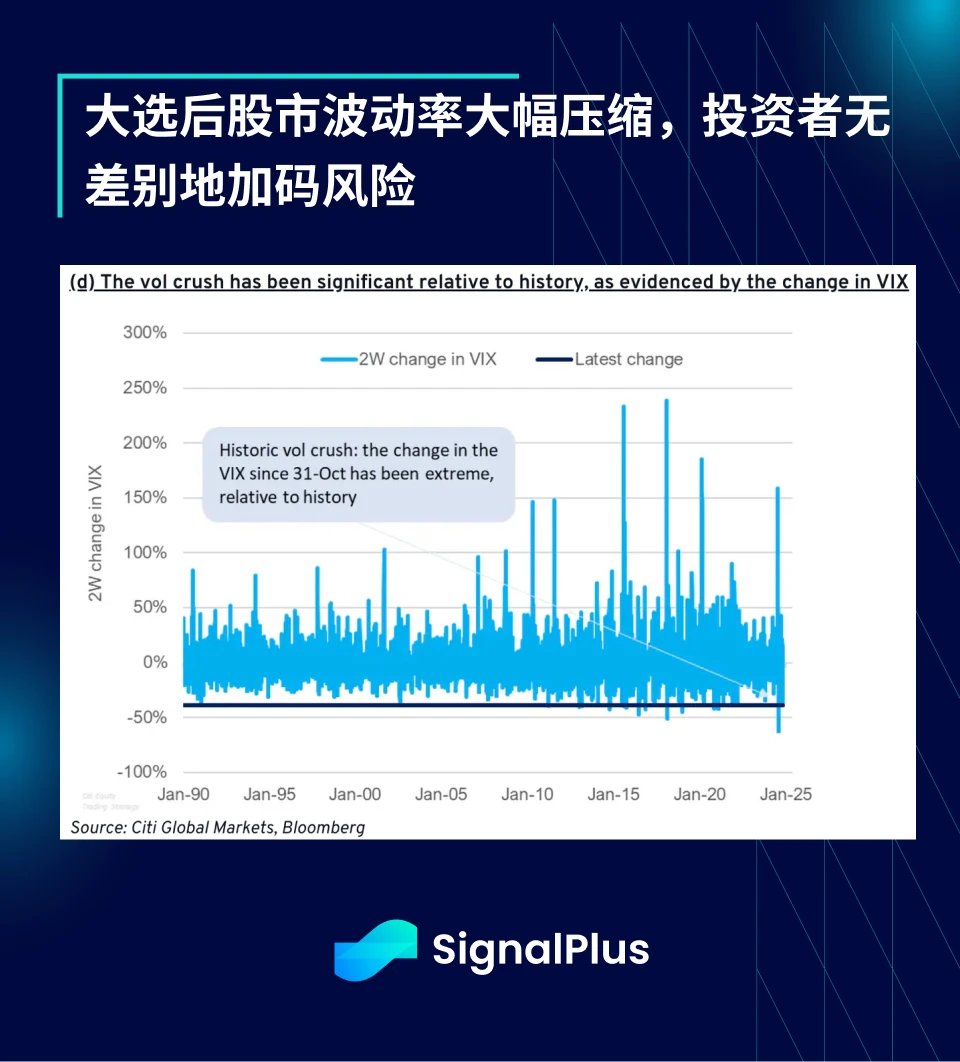

Before last Friday's significant market sell-off, the stock market volatility index (VIX) had dropped from 23 to 14 after the election, plummeting nearly 40% in two weeks. Although market movements have become increasingly rapid, as seen in the rebounds in both the stock market and cryptocurrencies (memecoins), we believe that the "easy part" of trading is over, and the market will face more volatility and challenges ahead.

President Biden and Trump have explicitly committed to a smooth transition of power, and the market's focus has now shifted from the election to policy. The market is closely watching the upcoming cabinet appointments, with several key positions already clarified, particularly leaning hawkish on trade and national security. One of the remaining key positions is Secretary of the Treasury, with current frontrunners being Scott Bessent (a long-term investor and partner of Soros) and Howard Lutnick (CEO of Cantor Fitzgerald).

Bessent is seen as a "safe choice" with extensive experience in capital markets, while Lutnick's company is one of the custodians of Tether, thus attracting particular attention from the cryptocurrency community. Regardless of who enters the cabinet, both candidates are viewed as "supportive of cryptocurrencies," providing the cryptocurrency industry with an opportunity to continue receiving political support and promoting Bitcoin as a reserve asset in the long term.

In terms of policy, while the market is excited about the various measures Trump is expected to introduce, not all policies will have the same impact, and even with the Republican control of Congress, implementing policies will still require addressing many details.

Currently, we are in a relatively easy phase, with the market rebounding purely out of hope and expectations. Investors are optimistic about the positive impact of stimulus plans while temporarily overlooking the negative effects of tightening tariffs and immigration policies. Essentially, this is an ideal scenario that satisfies both sides, leading to a significant rise in risk assets.

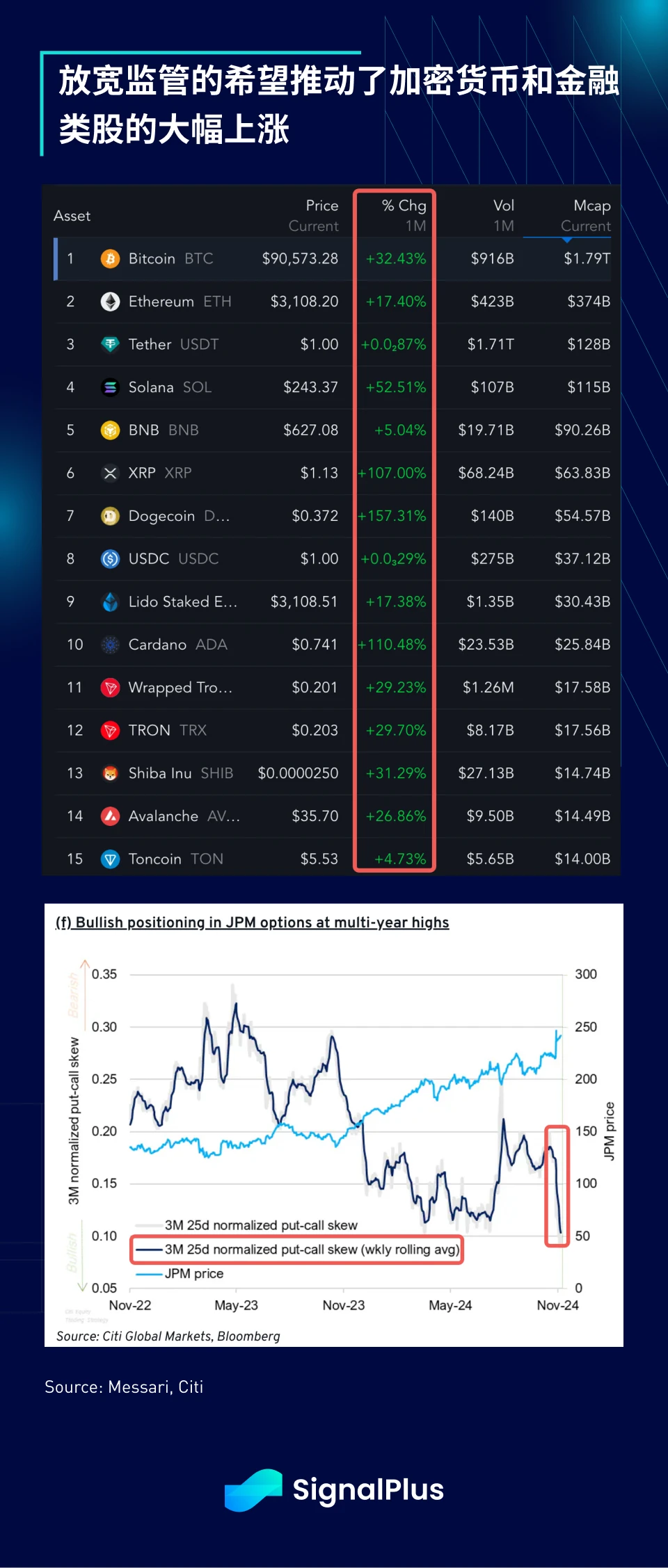

The next actions the incoming president is most likely to take will be to relax regulations, which can be directly implemented through executive orders, such as various energy projects and withdrawing from the Paris Climate Agreement. Essentially, the relaxation of regulations for banks and cryptocurrencies also falls into this category, although the latter may take some time and require more regulatory clarity to support the current bull market.

Next are the more controversial issues of immigration and tariffs. In terms of immigration policy, strengthening border control and mass deportations will face severe challenges from the media and courts, but the Trump administration may push these as core campaign policies. These measures could lead to a reduction in labor supply, especially in blue-collar jobs, further exacerbating inflation and making the Federal Reserve's job more difficult in the second half of 2025.

Regarding tariffs, the market expects significant news as early as the first quarter, with Trump likely targeting China based on his previous term's experience. Broader tariff measures against Europe and other trading partners may require Congressional support and could necessitate Trump proposing reconciliation as motivation, potentially delaying until the second quarter, with the negative impact of rising costs on inflation expected to become apparent in the second half of 2025.

Finally, given the soaring U.S. debt balance and the newly established "DOGE" department's focus on government efficiency and cost reduction, large-scale fiscal spending plans will be the most challenging measures for the Trump administration to implement. Any tax cuts and spending plans will need to be negotiated with the Treasury and Congress, and the market is expected to ultimately feel disappointed in this regard.

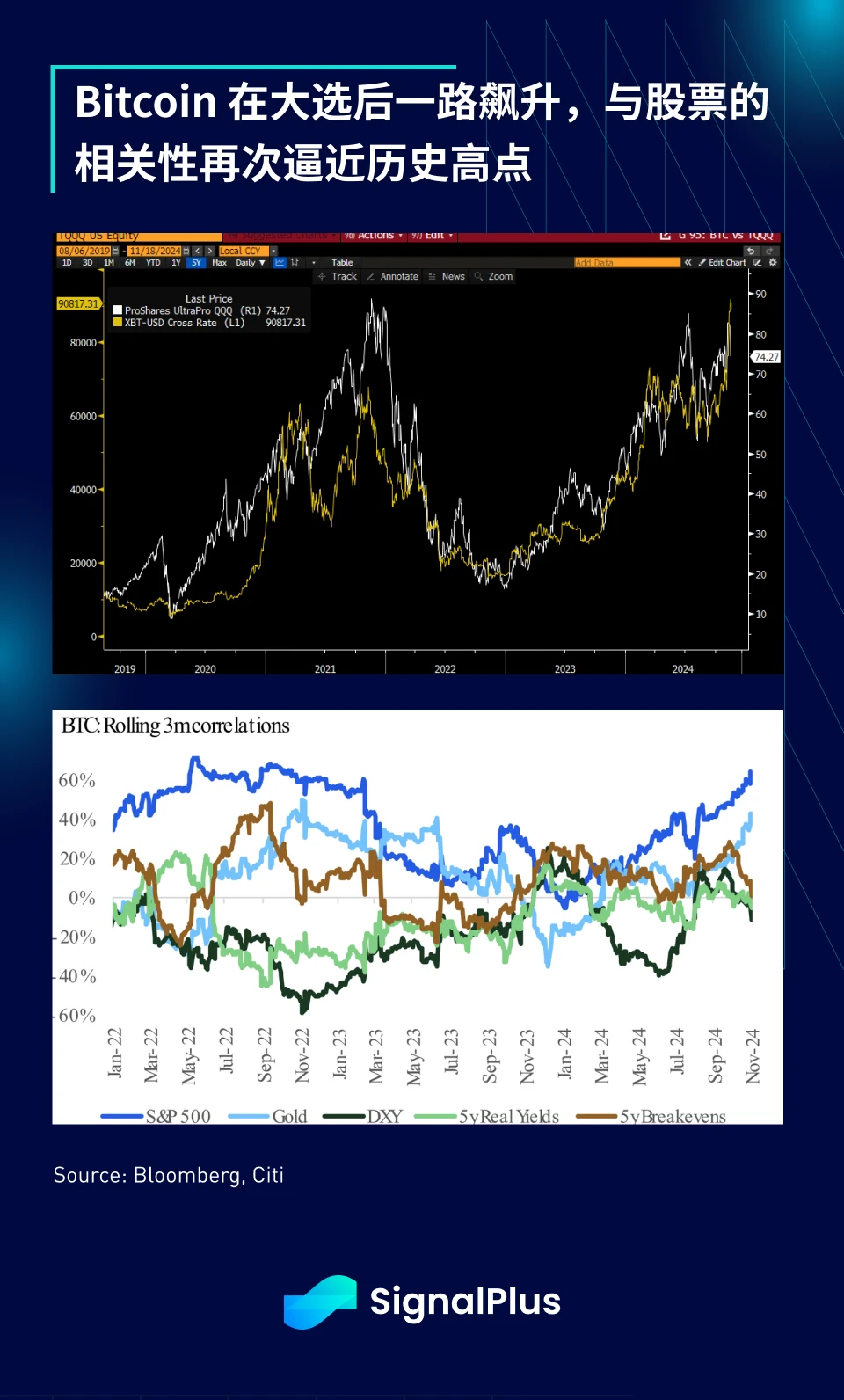

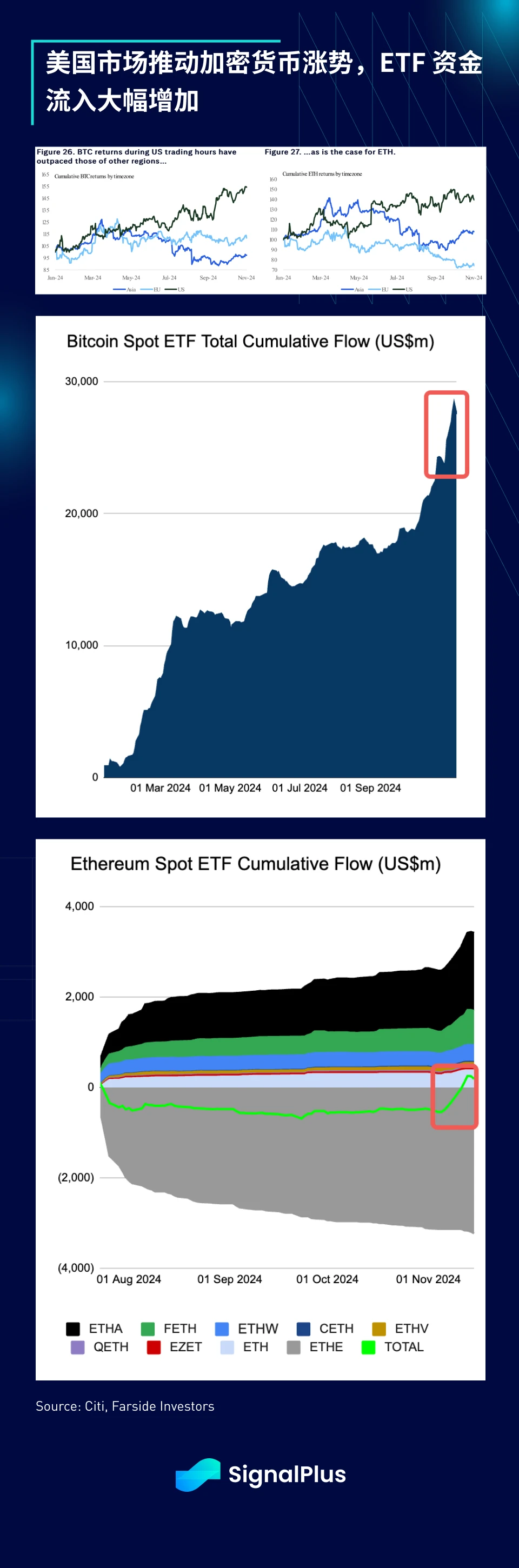

Since Trump's election, cryptocurrencies have been the hottest asset class, with BTC breaking through $90,000, even outpacing the leveraged Nasdaq index. The surge in BTC is primarily driven by U.S. trading hours, with mainstream participation continuously increasing, and significant capital inflows into spot ETFs, with $1.7 billion flowing into BTC ETFs last week and $500 million into ETH ETFs.

Another positive sign of mainstream participation is the continued growth in the market capitalization of stablecoins, which has surpassed $160 billion, nearing the historical high of 2022. Stablecoins are an important indicator of mainstream participation, as nearly all on-chain activities begin with converting fiat currency into stablecoins. Additionally, the supply of stablecoins has roughly grown in sync with M2. If the U.S. government returns to a net expansionary monetary supply policy, it would be a good sign for the market in the long run.

Overall, we believe that the "easy" part of the market rebound has ended, and the next phase will be more challenging, with prices likely to be more volatile and potential pullbacks. Furthermore, although the memecoin frenzy has revived and ETH shows some signs of life, BTC's dominance continues to rise unidirectionally, similar to the dominance of large-cap stocks in the SPX index, which is not particularly ideal for the current cryptocurrency ecosystem. Regardless, as market sentiment reaches a highly euphoric level, we will closely monitor the potential for a peak pullback in the market in the short term. Please ensure proper risk management and remain vigilant for more volatility in the future!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat: SignalPlus123), Telegram group, and Discord community to interact and exchange ideas with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。