The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens.

Yesterday, the overall trend continued to maintain a rebound and growth. Basically, the market has been like this for the past two days. After chatting with most coin friends, I found that everyone still finds it difficult to grasp the depth of the pullback. More users' thinking is always that the current stage is a historical high, and once the depth of the pullback appears, will it trigger an avalanche effect? Everyone is afraid of a drop to 5000 points or even above 10,000 points. After all, it only took two days to rise from 70,000 to 90,000, but it took nearly half a month to stabilize. Even at this stage, most people still feel that the 90,000 mark has not stabilized. Lack of confidence is entirely due to misjudgment of the market. At this stage, do not overthink the trend; complex thinking is not conducive to entering the market. Everyone just needs to pay attention to the overall trend.

As for the trend aspect, Lao Cui no longer wants to talk about it. Basically, I have told everyone the daily approach: as long as there is a deep pullback, it is a good opportunity to enter long positions. Whether one can grasp it depends on personal thinking. As for the previous high position, it needs strong capital support. The recent trend is also very obvious, with the lows consistently getting higher and the highs also getting higher. This is a typical recovery market. Pulling up to the 20,000 position, the current stage is the time for the big players to change hands. Where there are exits, there are also entries. Currently, it seems that more people are entering than exiting. Lao Cui is willing to call it the Li Xiaolai effect, clearing Bitcoin around 20,000 and then starting to mock the crypto world, believing that the crypto world is just a game for fools. Who could have known that the high point back then was around 69,000? Before the market results come out, we are all clowns; only at the moment of certainty do we know who laughs last.

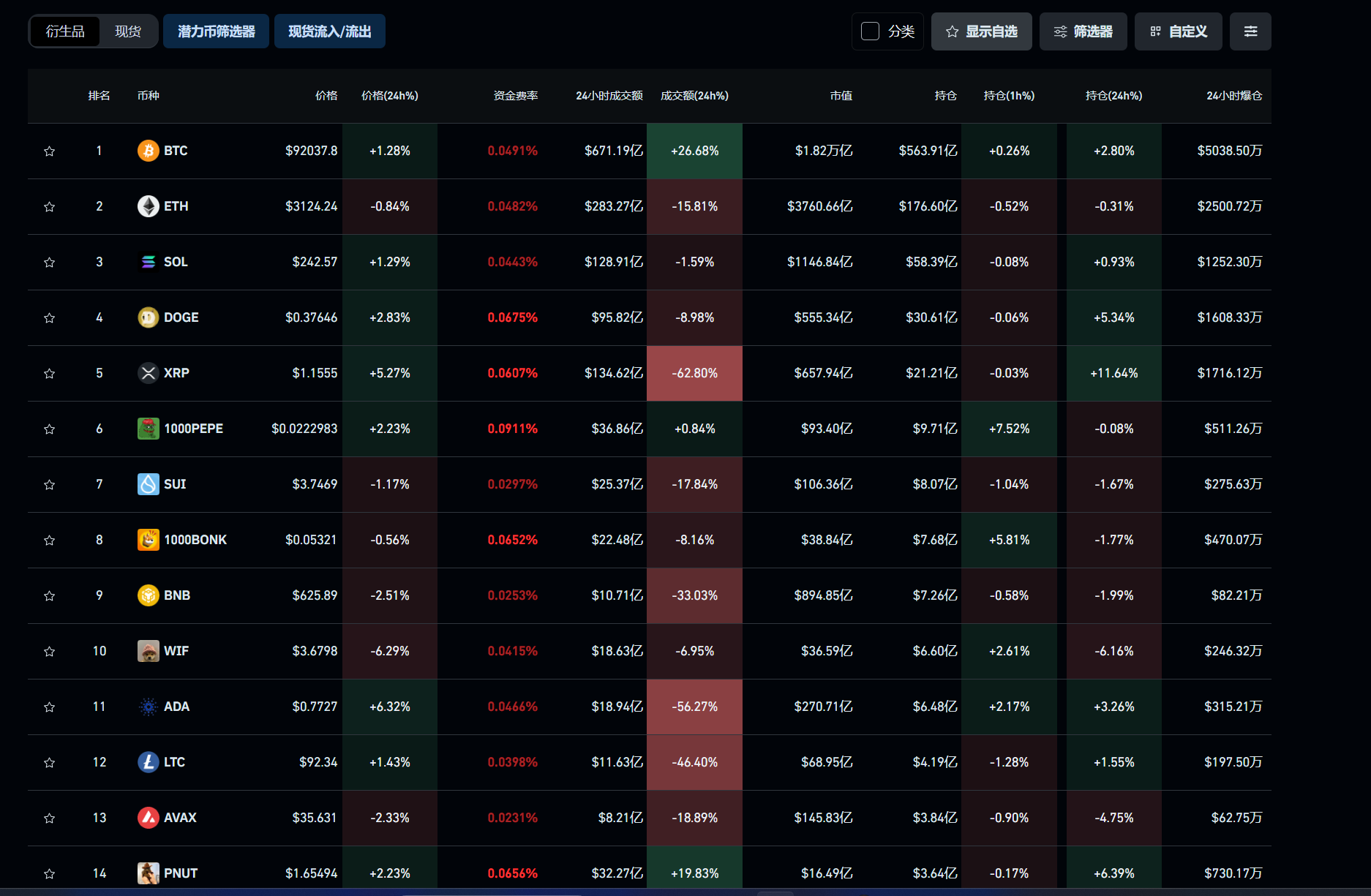

Getting a bit off-topic, let's return to the crypto market. Lao Cui directly gives everyone the result: the 100,000 mark will definitely be reached, and it can be touched before Trump takes office. Recently, based on Trump's actions, there has indeed been a favorable strategic trend for the crypto world, with some bias. It doesn't need to be implemented on the ground; just having this slogan is enough. For spot users entering the market, it depends on whether everyone can see the 10,000 profit from Bitcoin. If you can see it, entering at this stage is fine; if you think the risk outweighs the profit, you can choose other markets. Contracts may become the choice for most people, allowing you to leverage your position up to 10 times. In terms of conversion, this means Bitcoin can withstand at least 20,000 points for a mid-term game, and this profit can indeed be seen in specific returns before January. The choice is still up to everyone; the focus on risk and return considerations is still determined by one's own thinking. Recent capital movements can clearly indicate that the capital from Europe and the United States is showing an overall downturn, while the capital inflow during the Asian market is actually higher than during the European market.

However, judging the capital volume in the Asian market is indeed quite difficult to grasp. Lao Cui is also very puzzled about what point the Asian market capital can withstand. This round of trends is not driven by Asian market capital; the lower space and depth will definitely be higher. As the market stabilizes, it has given everyone much room for thought. Many friends are currently asking Lao Cui about Trump's slogan to strengthen the dollar at a low level. Will this have an impact on the exchange rate? The strength of the dollar will inevitably weaken the crypto world; these two are in complete conflict. Lao Cui will give everyone an overall answer to this thought: making America great again is almost every president's slogan. Let's not talk about whether the dollar will squeeze the living space of the crypto world. First, let's see if the dollar can become strong again. Everyone should not think that the low level of hegemony is unshakable. The essence of the market is barter; the premise of energy being linked to the dollar is the military strength and financial power of the United States. The current credit currency system was indeed first proposed by the United States. However, the drawbacks are also very obvious. As long as the national debt is not resolved, the dollar will not be at peace.

Everyone knows that the dollar may soon collapse, but no one dares to think about whether they can bear this result, making the whole world pay for America's inflation, which is not voluntary. This point of voluntariness is very important; forced directives will only breed resentment. Under such high pressure, strategies of compliance and resistance will inevitably emerge. For example, the appreciation of the renminbi that everyone sees, the furthering of relations with the Middle East, the shift of foreign trade towards the Asian economy, etc., have formed a situation where there are policies above and countermeasures below. On the surface, everyone can accept America's command, but behind the scenes, they are all calculating their own interests. Do not blindly view America's economy; first, acknowledge that they are the strongest country in history. This strength is a symbol of weakness. The biggest reason for the decline of American influence actually lies within themselves. Even without external interference, the credit currency system has become a historical lament, which is entirely a systemic issue, unrelated to anything else. The current solution that can be accepted by everyone is definitely not the legal currency of other countries.

The United States has learned from past experiences, as they inherited the world currency system from the sun never sets empire, abolishing the pound's power. They know very well that once currency loses credibility, the impact they bear is unbearable. Therefore, even if they launch the crypto world, they will not let others survive above them. Especially in the crypto world, Bitcoin's supply is still far ahead of the United States. Various signs indeed indicate the strategic arrangements of the United States. The biggest driving force behind the crypto world, even if it is not the U.S. government, is still their massive scale. In recent years, whether Hong Kong wants to become the financial center of the crypto world again or the U.S. is frantically seizing the market, both are forming their own rules against the crypto world. In comparison, the U.S. is indeed ahead of us, but from a strategic perspective, we may be one step closer to legal trading. A complete system is definitely beneficial for the development of the crypto world, but it does not necessarily benefit our investments. Moving forward, taxation is certain. The U.S. has already become the pioneer of the crypto world. If they want to recognize the legal low level, they will inevitably have to pay some protection fees. They start to support their own exchanges and suppress other exchanges; this series of operations must have a purpose. The future strategy of the U.S. will definitely not suppress the crypto world; the dollar and Bitcoin will not form a competitive relationship; it will always benefit the growth of Bitcoin.

So everyone must not overthink it. Currently suppressing the crypto world will only make the U.S. the biggest loser. Setting aside fixed thinking, we are not troubled by historical highs. If you are hesitant to enter the spot market, you can try short-term trading to see if you can achieve certain profits. You must try before drawing conclusions; do not use your time to witness the growth of others. Currently hovering around 92,000, the trend is waiting for the rise of altcoins to balance the overall market value. After the growth of altcoins ends, there will definitely be another wave of Bitcoin surges, which may coincide with the interest rate cuts in December. In the short term, the volatile market is actively entering long positions after the pullback. Both long and short can be profitable, including ambushing in the spot market. Yesterday, I emphasized that a deep pullback around 3,000 is a good entry point to wait for growth. Before Trump takes office, it will definitely reach 100,000.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。