The drastic fluctuations in Bitcoin's market have traders walking on thin ice. According to data from the cryptocurrency derivatives analytics platform Coinglass, since November, nearly 200,000 people have been liquidated daily, with the total liquidation amount reaching around $500 million. Since September, Bitcoin's price has skyrocketed, rising from $58,000 to $90,000 in just over two months, an increase of over 50%. In 2024, Bitcoin's cumulative price increase has already surpassed 100%. From an investment return perspective, the gains of mainstream alternative investment products like gold and crude oil during the same period have significantly lagged behind Bitcoin. Among them, gold, which performed the best, has seen a 24% increase this year. Compared to other major asset classes, Bitcoin exhibits the most pronounced divergence and controversy, showcasing the most extreme surges and drops. Some people have "woven" dreams of wealth from it, while many others have been wiped out.

According to a post by Cointelegraph on the X platform, the Bitcoin reserves on exchanges have fallen to their lowest level since 2018, a trend that may indicate rising demand and tightening supply could push prices higher.

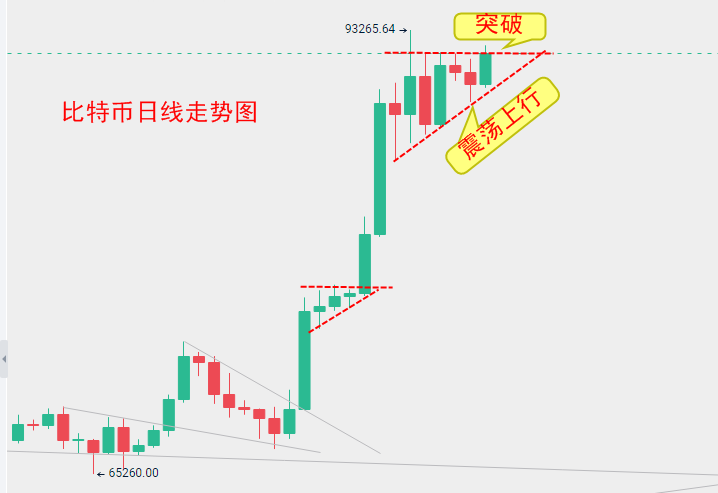

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 11.18

We have always emphasized that we are in a bull market. From last week's high near $93,000 to the current period, we have been oscillating and accumulating. Over the past few days, the price has been fluctuating between $85,000 and $92,000. The market experienced a short-term pullback over the weekend, but today it has started to move upwards, currently pulling up to around $92,000, with the current price fluctuating around $91,500. We still maintain that it is highly likely to reach $100,000 this week, so we are positioning for medium-term trades at the current price.

For short-term contracts, go long near $91,500, with a stop loss at $90,400 and a take profit at $93,000.

For medium to long-term trades, also enter long positions near the current price of $91,500, with a stop loss at $90,000 and a target of $95,000. When the price reaches $100,000, consider taking profits.

If you can remain calm during a bull market, you can outperform over 90% of the market!

Anyone who has been in the market should know that the real losses occur from now on during the entire cycle;

We have already gone through a very difficult bottom bear market and have also experienced a very important consolidation phase in the bull market, and we expect to soon enter the crazy second half of the bull market.

During the bear market, most people are lying flat and playing dead, so they naturally don't lose much. The accumulated energy and trading desire will explode once the bull market arrives or when a real bull market comes.

Once a bull market starts, most people will fall into a state of anxiety, which is the easiest state to lose rational control.

At this time, you will throw away some strategies and plans you previously made. Then, seeing others making money will cause you anxiety that keeps you awake at night, and daily rumors combined with profit opportunities will make it hard for you to resist.

Ultimately, this will amplify your desires. You have never seen wealth explode so quickly, so you can no longer suppress the excitement accumulated throughout the bear market, entering the battlefield and exchanging your USDT and Bitcoin for a bunch of unfamiliar coins that you heard could rise 100 times. They shout that they are Bitcoin killers, claiming to achieve a thousandfold return after three waves.

In the midst of these shouts, you gradually lose yourself, realizing that the assets you bought are mostly at a loss, and even if you occasionally make some profit, you might lose it back next time. In the end, through continuous exchanges, your chips become fewer and fewer, and your Bitcoin dwindles until you hand over all your chips.

Market sentiment has entered an extreme greed zone; remember this: how you can earn is how you can lose!

Specific Operation Suggestions (based on actual market prices)

For short-term contracts, go long near $91,500, with a stop loss at $90,400 and a take profit at $93,000.

For medium to long-term trades, also enter long positions near the current price of $91,500, with a stop loss at $90,000 and a target of $95,000. When the price reaches $100,000, consider taking profits.

Market conditions change in real-time, and there may be delays in article publication. Strategy points are for reference only and should not be used as entry criteria. Investment carries risks, and profits and losses are your own responsibility. For daily real-time market analysis, as well as experience exchange groups and practical trading groups, feel free to seek real-time guidance. Live explanations of real-time market conditions will be held at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。