The ETH Staking sector is likely to be the one with the highest direct returns, and Lido, as a leading project, may also escape its current price predicament.

Author: @Web3Mario

Abstract: We know the saying, "Buy the rumor, sell the news." Before the October elections, my article “The New Value Cycle of DOGE: Political Traffic Potential and Musk's 'Department of Government Efficiency' (D.O.G.E) Political Career” received a good response and met expectations, resulting in substantial investment returns for me. I appreciate everyone's encouragement and support. I believe that during this window period before Trump officially takes office, there will be many similar trading opportunities. Therefore, I have decided to start a series of articles titled "Buy the Rumor Series" to explore and analyze the current market hot topics and extract some trading opportunities.

Last week, a noteworthy phenomenon emerged: with Trump's strong return, the market has begun to speculate on the potential resignation of SEC Chairman Gary Gensler. You can find analysis articles about potential successors in most mainstream media. In this article, we will analyze which cryptocurrency stands to benefit the most directly from the anticipated improvement in the regulatory environment. To conclude, I believe the ETH Staking sector will be the one with the highest direct returns, and Lido, as a leading project, may also escape its current price predicament.

Reviewing Lido's Regulatory Dilemma: Samuels v. Lido DAO Lawsuit

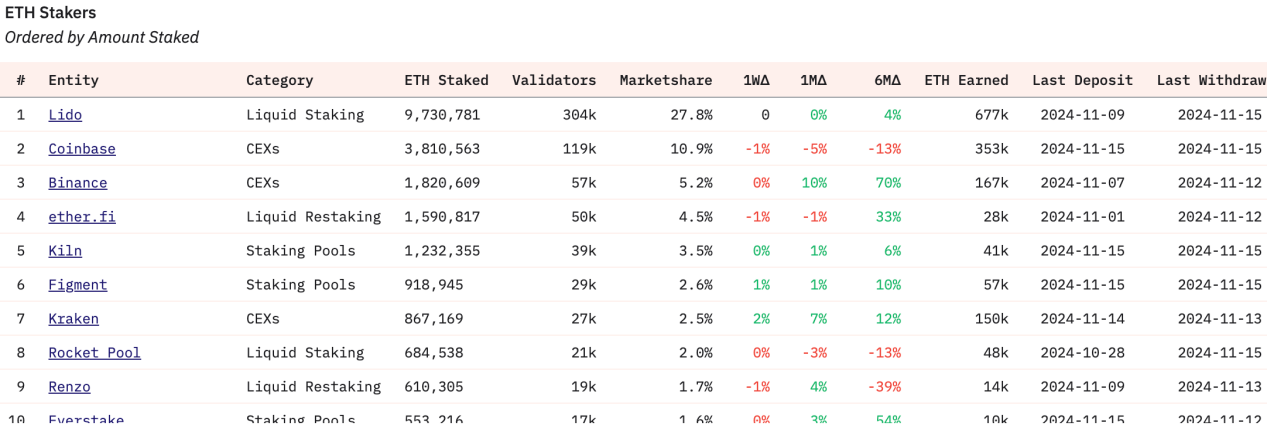

First, let’s provide some basic information. We know that Lido is the leading project in the ETH Staking sector, offering non-custodial technical services to help users participate in Ethereum PoS and earn returns, while lowering the technical threshold and the capital requirement of 32 ETH for Ethereum Native Staking. The project has raised a total of $170 million through three rounds of funding. Since its launch in 2022, Lido has maintained a market share of around 30% due to its first-mover advantage. As of now, according to Dune's data, Lido holds a 27% market share without any significant decline, indicating strong business demand for Lido.

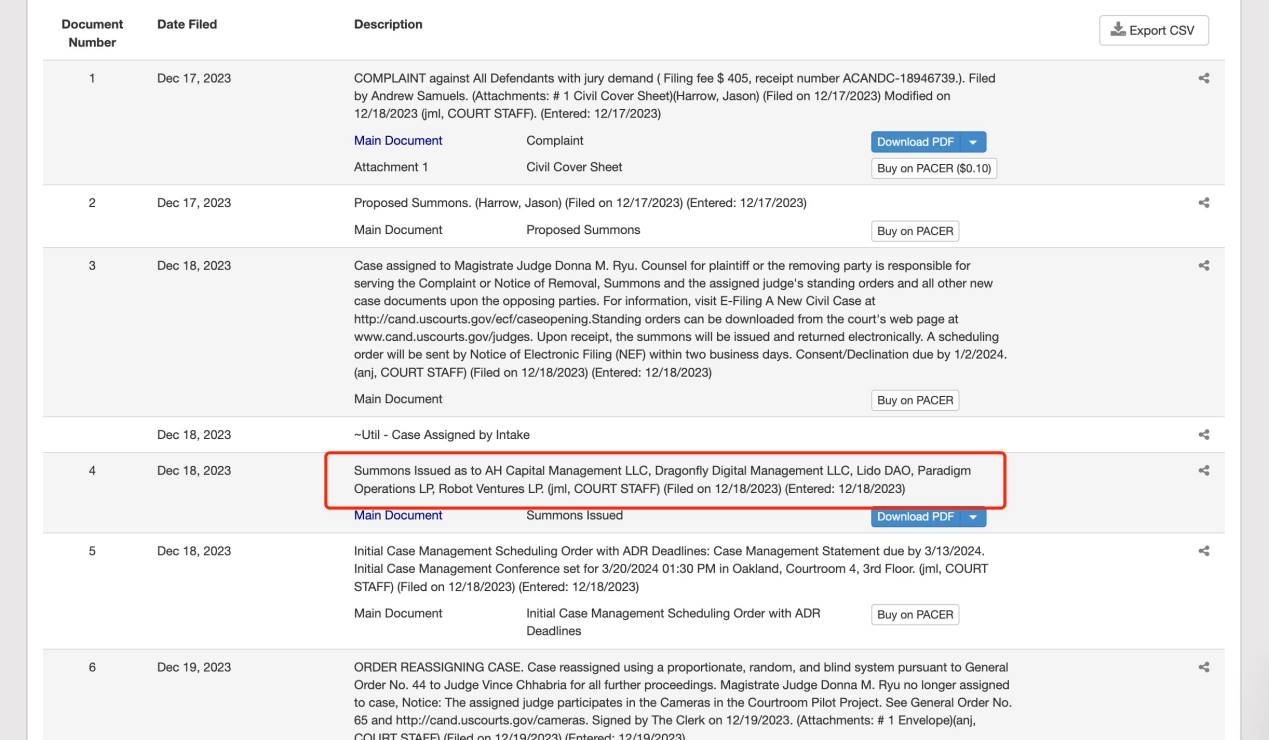

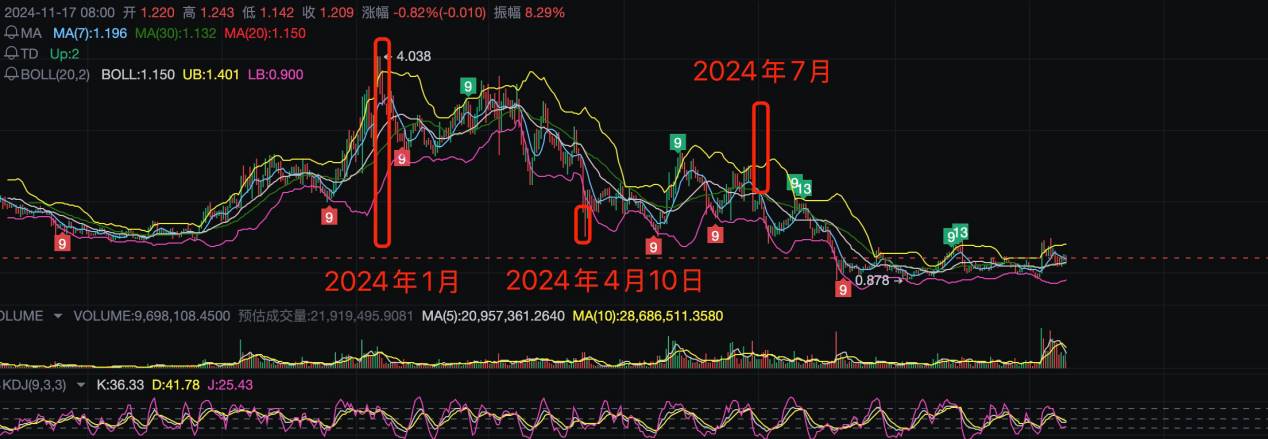

The reason for Lido's current price slump dates back to the end of 2023, when its governance token LDO reached an all-time high price, with a market cap of $4 billion. At that time, a lawsuit changed the entire price trajectory: the Samuels v. Lido DAO case, case number 3:23-cv-06492. On December 17, 2023, an individual named Andrew Samuels filed a lawsuit against Lido DAO in the U.S. District Court for the Northern District of California, accusing the defendant Lido DAO and its partnered venture capital firms of selling LDO tokens to the public in an unregistered manner, violating the Securities Act of 1933. Additionally, Lido DAO created a highly profitable business model by pooling users' Ethereum assets for staking but failed to register its LDO tokens with the U.S. Securities and Exchange Commission (SEC) as required. The plaintiff, Andrew Samuels, and other investors purchased LDO tokens believing in the potential of this business model, ultimately suffering financial losses, and thus they seek legal compensation.

This case not only involves Lido DAO but also includes accusations against its major investors, such as AH Capital Management LLC, Dragonfly Digital Management LLC, Lido DAO, Paradigm Operations LP, and Robot Ventures LP. According to the information on the case's progress, these institutions received subpoenas from the court in January 2024, at a time when LDO's price was at its peak. After that, the legal process was confined to the lawyers of the investment institutions and Andrew Samuels, so the related influence did not spread.

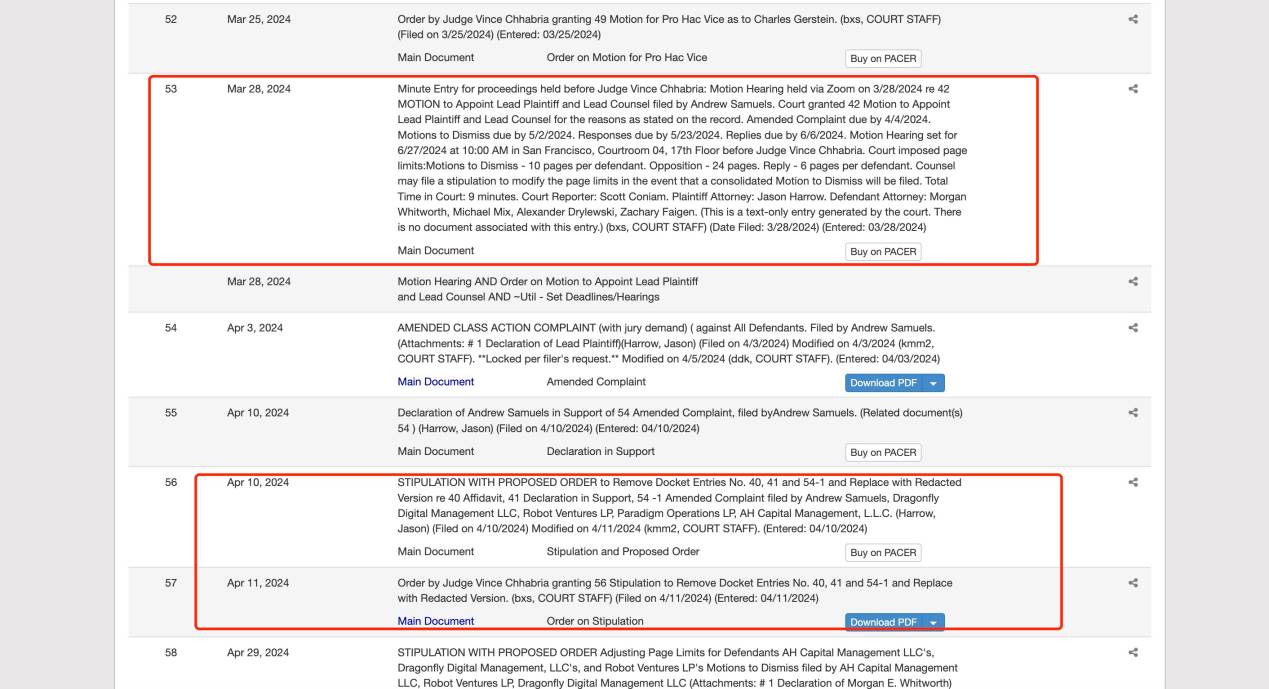

It wasn't until the first motion hearing on March 28, 2024, that the ruling was confirmed on April 10, 2024, and after modifying some relevant terms, the case was factually accepted.

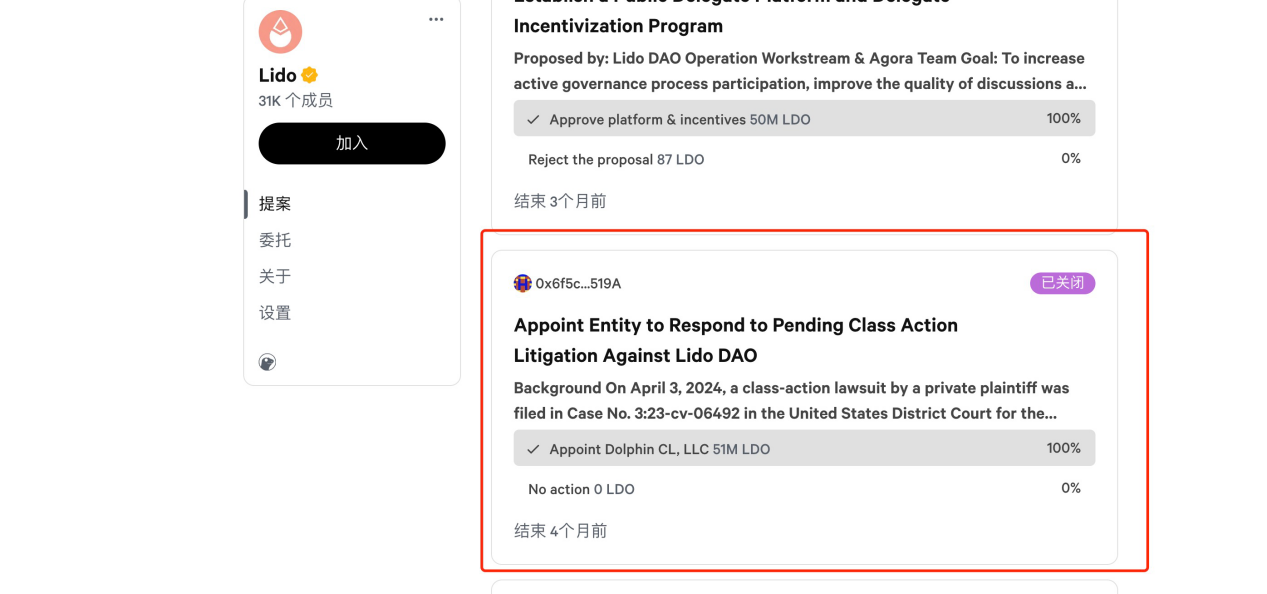

Subsequently, on May 28, 2024, Andrew Samuels' legal team unilaterally announced a motion to declare Lido DAO absent. This action was taken because Lido DAO believed it did not operate as a company and thus ignored the lawsuit. If declared absent, Lido would face some unfavorable judgments, such as not defending itself, and based on previous similar cases like Ooki DAO, the outcome for the absent party is typically unfavorable. The motion was approved by the court on June 27, requiring Lido DAO to respond within 14 days. Consequently, Lido DAO had to propose a community proposal on July 2, 2024, to hire Dolphin CL, LLC, based in Nevada, as its defense attorney and requested a budget of 200,000 DAI. At this point, the case became widely known within the community. After several rebuttals from both sides, the case seemed to enter a cooling-off period after September.

Meanwhile, another case had a substantial impact on Lido: the SEC's lawsuit against Consensys Software Inc. on June 28, 2024, case number 24-civ-04578. Note that this date is just one day after the ruling in the Lido case, where Lido DAO was fully informed of the lawsuit's judgment. In this lawsuit, the SEC alleged that Consensys Software Inc. engaged in unregistered securities issuance and sales through its service called MetaMask Staking and operated as an unregistered broker through MetaMask Staking and another service called MetaMask Swaps.

According to the SEC's complaint, since January 2023, Consensys has provided and sold tens of thousands of unregistered securities on behalf of liquidity staking program providers Lido and Rocket Pool, which create and issue liquidity staking tokens (known as stETH and rETH) in exchange for staked assets. Although staking tokens are typically locked and cannot be traded or used during the staking period, liquidity staking tokens, as the name suggests, can be freely bought and sold. Investors in these staking programs provide funds to Lido and Rocket Pool in exchange for liquidity tokens. The SEC's complaint alleges that Consensys engaged in unregistered securities issuance and sales by participating in the distribution of staking programs and acted as an unregistered broker in these transactions.

In this lawsuit, the stETH certificates issued by Lido to participating users were explicitly described by the SEC as a type of security. Thus, Lido officially entered a low period under regulatory pressure. The reason for outlining the timeline of the case's progress is to hope to correlate it with the price trend. In other words, the core factor suppressing LDO's price is the litigation impact brought about by increased regulatory pressure, triggering risk-averse sentiment among institutional or retail investors. If the judgment is unfavorable, it would mean that Lido DAO would face significant fines, which would undoubtedly have a huge impact on LDO's price.

Is stETH a security, and why Lido's subsequent development is the most noteworthy?

From the analysis above, we can identify that the current reason for LDO's price slump is not due to business underperformance but rather the uncertainty caused by regulatory pressure. We know that the core of the two cases mentioned above is to determine whether stETH is a security. Generally, whether an asset can be recognized as a security requires passing the so-called "Howey Test." Briefly, the Howey Test is a standard used in U.S. law to determine whether a transaction or instrument constitutes a security. It originates from the 1946 U.S. Supreme Court ruling in the SEC v. W.J. Howey Co. case. This test is crucial for defining securities, especially in the cryptocurrency and blockchain space, and is often used to assess whether tokens or other digital assets are regulated under U.S. securities law.

The Howey Test is primarily based on the following four criteria:

- Investment of money: Does it involve an investment of money or other value?

- Common enterprise: Is the investment part of a common enterprise or project?

- Expectation of profits: Do investors have a reasonable expectation of profits from the efforts of others?

- Efforts of others: Is the source of profits primarily dependent on the management and operation of the project developers or third parties?

If a transaction or instrument meets all of the above conditions, it may be classified as a security and subject to regulation by the SEC. In the current regulatory environment, which is not favorable for cryptocurrencies, stETH is recognized as a security. However, the cryptocurrency community holds an opposing view; for example, Coinbase believes that the ETH Staking business does not meet the four elements of the Howey Test and therefore should not be considered a securities transaction.

No monetary investment: During the staking process, users retain full ownership of their assets and do not hand over funds to third parties, so there is no investment behavior.

No common enterprise: The staking process is completed through a decentralized network and smart contracts, and the service provider is not a business jointly operated with users.

No reasonable expectation of profits: Staking rewards are the labor income of blockchain validators, similar to salary compensation, rather than the profit returns expected from investments.

Not relying on the efforts of others: The institutions providing staking services only operate public software and computing resources to perform validation, which is considered technical support rather than management behavior, and the rewards are not based on their management efforts.

From this, we can see that there is indeed room for discussion regarding whether the asset certificates related to ETH Staking will be recognized as securities, heavily influenced by the overall subjective judgment of the SEC. To summarize why I believe Lido's subsequent development is the most noteworthy:

The core factor suppressing the price is regulatory pressure, which has a high subjective component, and the current price is technically at a low point.

ETH has been defined as a commodity, so there is more room for discussion compared to other areas, such as SOL.

The ETH ETF has already been approved, and the top resources mobilized to promote the sale of the ETF will undoubtedly provide assistance. To expand slightly on this, there is currently information circulating about this, and it is generally believed that the inflow of funds for the current ETH ETF is not as good as that for BTC. The reason lies in the differentiation; for most traditional funds, BTC is the standard in the entire cryptocurrency space and is relatively easy to understand, while the appeal of the ETH ETF is not as strong. If the ETH ETF can provide indirect staking returns to buyers, it will significantly enhance its attractiveness.

The legal costs associated with resolving the relevant lawsuits are relatively low. We know that in the Samuels v. Lido DAO case, the plaintiff is not the SEC but an individual, so the legal costs associated with a dismissal of the judgment are smaller compared to cases directly litigated by the SEC, and the impact is also relatively minor.

In summary, I believe that during this window period, as the possibility of changes in the regulatory environment increases, Lido's subsequent development is worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。