Historically, the moments when Ethereum's market value surpasses Bitcoin often serve as clear signals that the ETH/BTC ratio has reached a peak.

Written by: Ignas | DeFi Research

Translated by: BitpushNews Yanan

The market always loves to shout "this time is different," but to be honest, I’m quite looking forward to that old routine making a comeback: if Bitcoin's four-year cycle can continue, the price might just hit new highs again in the fourth quarter of 2025.

Then comes the familiar process: as BTC rises, mainstream coins like ETH and SOL follow suit, and then another wave of tokens (perhaps meme coins will be the most active) will ride the coattails, all surging upwards.

However, the market has its own temperament; after rising to a certain extent, it must take a turn, and then we obediently enter a two-year "cooling-off period." Just think about it, after such a crazy year, who wouldn’t be exhausted? So, that two-year adjustment is like a little vacation for the market.

The crypto research team Delphi Research predicted the peak in the fourth quarter of 2025 as early as mid-2023.

I previously mentioned their predictions, and these forecasts are gradually becoming a reality. However, there are a few points that the team did not anticipate: the approval of Ethereum's ETF and the approval of Bitcoin ETFs triggered a strong FOMO sentiment in the market, which directly pushed Bitcoin's price to reach its previous historical high in early March.

A big thank you to Delphi for their insights!

With Trump's victory, the government may introduce more favorable cryptocurrency regulations, and we might see the final catalyst for a super crazy bull market.

The current optimism sharply contrasts with the cautiously optimistic market view I shared in July. Now, the market is no longer affected by negative factors such as the outflow of Grayscale ETF funds and the Mt. Gox incident.

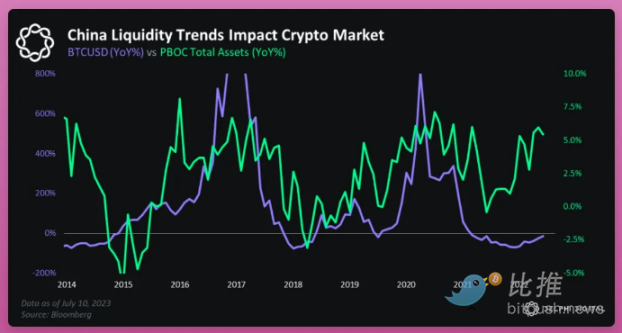

Delphi also mentioned that China is considering increasing its money supply due to deflation risks.

In fact, China has implemented the most aggressive stimulus policies since the pandemic, but many still feel the measures are insufficient, calling for further "turning on the printing press."

Historically, whenever China takes measures to inject liquidity, it often brings positive momentum to the global economy and the cryptocurrency market.

However, on social media platform X, it seems few people have noticed the potential positive shift in China's attitude towards cryptocurrencies: not only could it stimulate the economy by increasing the money supply, but it may also adjust its restrictive regulatory policies on cryptocurrencies.

Most importantly, past Bitcoin halving events have typically ended with a significant rise in Bitcoin prices, although this surge usually begins to manifest about six months after the halving: this time seems no exception.

If everything goes as planned, this will be the most predictable and manageable bull market in history.

How bullish is the market?

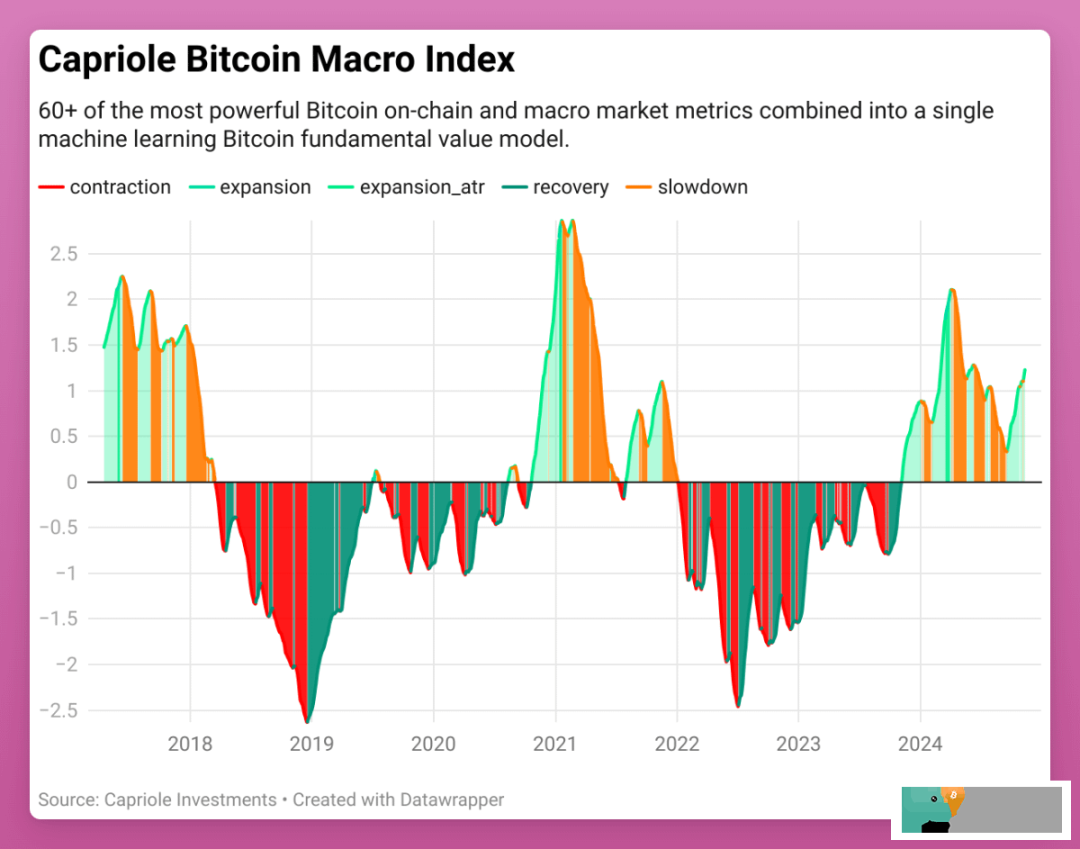

The research report charts provided by Capriole Investments are quite insightful and worth a detailed read.

Their flagship product—the Capriole Bitcoin Macro Index—comprehensively considers over 60 key indicators related to Bitcoin, covering various dimensions such as on-chain data (like dormant liquidity, supply, hash rate distribution, active address count, etc.), macroeconomic indicators, and stock market indicators.

The index is divided into several phases, and we are currently in the second expansion phase; however, its level has neither reached the peak of March 2024 nor is it close to the market peaks of 2017 and 2021.

In short, the outlook is bullish.

The founder of Capriole predicts that by the fourth quarter of 2025, Bitcoin's price will rise to at least $140,000. When I directly asked him about Ethereum (ETH), he confidently stated, "At least $5,000, and it could very well be higher."

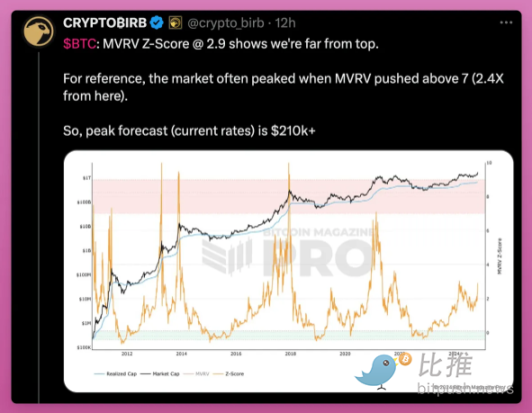

If you think the above predictions are too conservative, and you believe in technical analysis, you might adjust your estimate for Bitcoin's price peak to $210,000.

I plan to stick with the strategy from the last cycle, as I am deeply involved in SOL and ETH, and I am gradually exploring the DeFi space and meme coins.

As Bitcoin's price rises, many feel frustrated that their altcoins have not risen in tandem. Don't worry, my dear investors; altcoins often catch up after Bitcoin's price surges.

Moreover, the market still has ample room for growth.

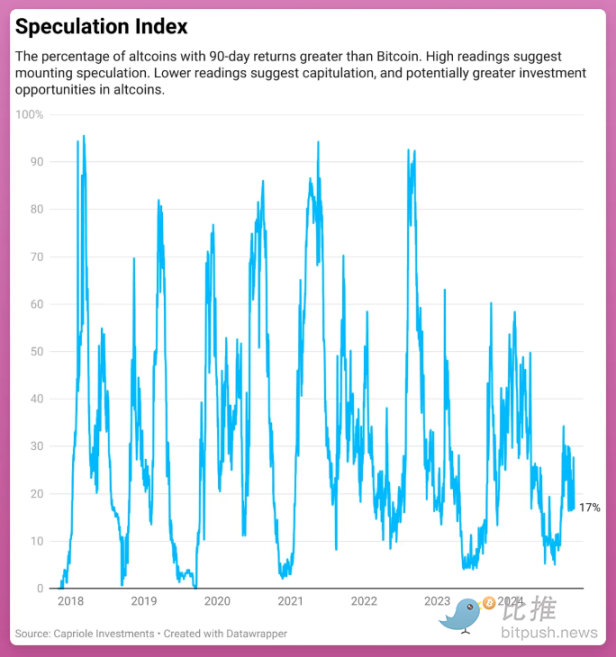

According to Capriole Investments' altcoin speculation index, the rebound trend for altcoins has not yet truly started. The index shows that a high percentage indicates a strong speculative atmosphere in the market, while a low percentage may suggest a reduction in speculative behavior, indicating better investment opportunities in altcoins.

Everything seems too good to be true, which inevitably raises some concerns.

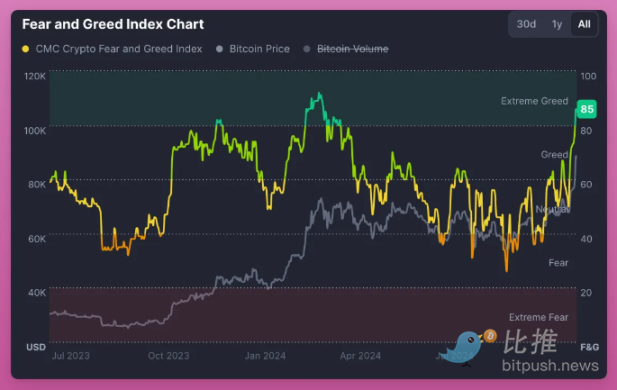

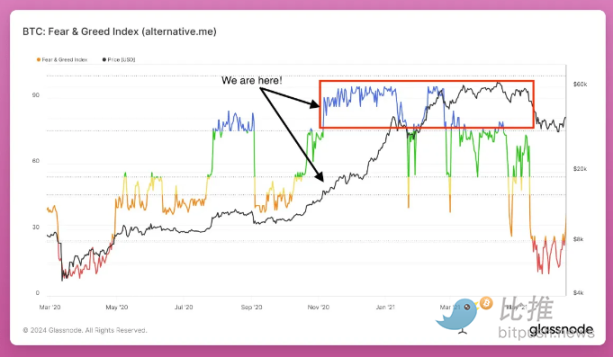

We have already entered a state of extreme greed.

However, this greed may persist for quite a while. From November 2020 to March 2021, the index remained above 80, with very little pullback during that period. (Data source: Crypto Koryo)

In summary, even though the current situation seems very favorable, we should remain calm and not blindly rely on leverage.

Meme Coins

A few days ago, I read an article in the Financial Times titled "The Astonishing Rise of Bitcoin Cannot Be Ignored."

The comments from ordinary readers were quite interesting, with remarks like: Ponzi scheme, scam, "it's worthless" popping up frequently.

These self-proclaimed smart people clearly did not grasp the essence of it. And suddenly, I had an epiphany.

Early entrants in cryptocurrency also held similar biases against meme coins: viewing them as scams, worthless, meaningless, and so on.

However, Bitcoin remained strong amidst the skepticism, while meme coins surprised those seasoned crypto veterans who were initially doubtful about memes. Both have seen their prices continuously rise, and their momentum is indeed remarkable. Just look at the astonishing performance of meme coins after the election—within just ten days, the prices of major meme coins doubled.

Meme coins have crossed a critical milestone: Binance and Coinbase have successively listed meme coins, which undoubtedly marks an important step towards normalization.

Before introducing a large number of meme coins, Binance released an in-depth research report indicating that retail investors are actively exploring new avenues for wealth growth, and meme coins embody the core idea of enhancing transparency and accessibility, which is "working to narrow the internal advantages and create a fairer participation environment for global investors."

Meme coins are not just an investment tool; they are a reflection of the "profound transformation of value and cultural significance within the modern financial system."

Considering that Binance naturally tends to list assets with growth potential, I have reason to believe that Binance will list more meme coins in the future.

SOL vs Ethereum

Oh, my dear Ethereum, when will you see the dawn of price increases?

As I watch meme coins' prices soar, my holdings feel heavier and heavier.

FOMO constantly tempts me to switch to those coins that are rising faster,

but I remain steadfast—hoping that my choices are not wrong.

In this round of the cryptocurrency cycle, Ethereum and its entire ecosystem seem unlikely to replicate the bull market glory of the past.

To leverage the $382 billion market cap of Ethereum, as well as those established decentralized finance (DeFi) projects and newly emerged low-circulation, high FDV tokens, the amount of capital required could easily stir waves in several other emerging fields. These fields include decentralized science (DeSci), Runes, DeFi projects within the Solana ecosystem, and other L1 projects, even the aforementioned meme coins.

Investors in Ethereum and DeFi tokens have already made a fortune in the last cycle, and now they are eager to multiply their wealth by 3 to 5 times for financial freedom. But perhaps the market won’t easily give them that opportunity? Let these tokens simmer a bit longer.

The capital needed to triple Ethereum's growth could allow those ecosystems injecting new ideas into the crypto space to grow tenfold.

This possibility is entirely real.

Recently, the ETH 3.0 (Beam Chain) roadmap proposed by Justin Drake has not sparked much interest in the community. Moreover, the plan is expected to be implemented only by the end of the 2020s, which clearly misses the current market cycle.

On the other hand, Solana is in a state of full bloom.

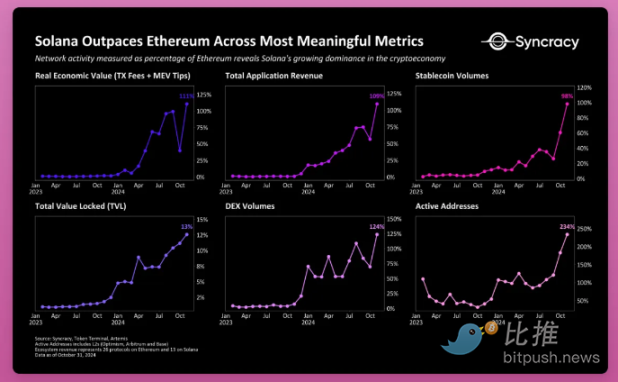

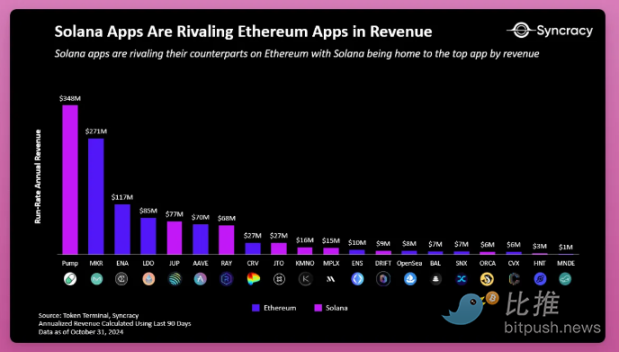

A recent research report by Syncracy provides a clear comparison of the competitive landscape between Ethereum and Solana.

The previous rise of Solana was driven by future potential, while this time it is propelled by solid fundamentals.

From the comparison of network activity, Solana excels in total value locked (TVL), decentralized exchange (DEX) trading volume, stablecoin trading volume, and the number of active addresses.

Objectively speaking, directly comparing Solana with Ethereum's L1 layer may be somewhat biased, as Ethereum's L2 layer should theoretically also be taken into account. However, since the L2 layer is largely still viewed as a "parasite" dependent on Ethereum's main chain, ordinary investors remain skeptical about the true value of the L2 layer, making it difficult to assess accurately.

Even if we shift our focus to the revenue situation of dApps, we find that dApps on Solana can now compete with those on Ethereum, demonstrating comparable strength.

Nevertheless, Solana's market cap is still only about one-third of Ethereum's. Considering the strong performance indicated by its economic metrics, this undoubtedly suggests that it has significant room for growth, and it may even reach parity with Ethereum in valuation in the future.

So, will SOL really step on ETH to rise? In my view, when the rhetoric of "SOL will surpass ETH" becomes increasingly prevalent, it might be time to consider repositioning and returning to ETH.

Historically, the moments when Ethereum's market value surpasses Bitcoin often serve as clear signals that the ETH/BTC ratio has reached a peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。