I. Introduction

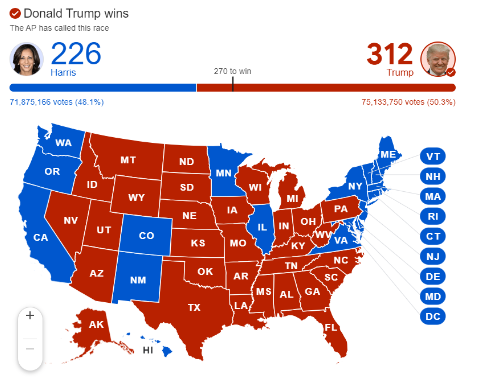

On November 6, the dust settled on the U.S. presidential election, with Donald Trump successfully elected. This result has garnered widespread attention globally, particularly in the cryptocurrency sector. Over the past few years, the regulatory environment for cryptocurrencies in the U.S. has been relatively strict and uncertain, and Trump's re-election is seen as a potential turning point for U.S. crypto policy. During his campaign, Trump expressed support for cryptocurrencies multiple times, promising to make the U.S. the "global cryptocurrency capital" and proposing policies such as establishing a national strategic Bitcoin reserve.

Expectations for a series of improvements in crypto policy following Trump's election have filled investors with optimism about the future of the crypto industry. The cryptocurrency market has surged significantly in a short period, with Bitcoin soaring and breaking the $90,000 mark this week, while other cryptocurrencies have also experienced a broad rally. This article aims to analyze the potential impact of Trump's election on U.S. cryptocurrency policy, forecast market trends, and propose corresponding investment strategy recommendations.

II. Trump's Cryptocurrency Policy Commitments

During the 2024 U.S. presidential campaign, Trump demonstrated a more proactive and open attitude towards cryptocurrency policy compared to Democratic candidate Kamala Harris, proposing a series of commitments aimed at promoting the development of cryptocurrencies.

1. Change of Attitude: From Skepticism to Support

As early as 2019, Trump stated on Twitter that he was "not a fan of cryptocurrencies," believing they "are not money" and pointing out their extreme price volatility and lack of reliability. He also criticized Facebook's Libra project, emphasizing its "almost no status or reliability" and hinted that U.S. regulators would regulate it.

However, entering 2024, Trump's attitude has changed significantly. He began to express support for cryptocurrencies in public, highlighting their potential in the future financial system. This shift may be influenced by various factors, including the rapid development of the cryptocurrency market, increased public acceptance of digital assets, and changes in the political environment.

2. Supportive Statements and Positions During the Campaign

- May 9, 2024: Statement at the NFT Dinner

At the NFT dinner held at Mar-a-Lago, Trump stated, "If you support cryptocurrencies, you will vote for Trump because they (the Biden administration) want to end it." When asked about his views on Central Bank Digital Currencies (CBDCs) and "government blockchains," Trump responded, "I think everything has its place." He continued, "We have some incredible things happening. I mean, looking back a few years at cryptocurrencies, people said it wouldn't succeed, but now its numbers are breaking records. I guess you could say it's a form of currency, and I think I support this, I'm increasingly supportive of this."

- May 28, 2024: Bitcoin and National Debt Issues

David Bailey, CEO of Bitcoin Magazine and a cryptocurrency advisor for Trump's campaign, revealed that Trump had asked whether Bitcoin could be used to address the U.S. national debt issue. This statement shows Trump's interest in the potential role of cryptocurrencies in the macroeconomy.

- June 8, 2024: Commitment at a Fundraising Event

At a fundraising event in San Francisco, Trump stated that he would become the "cryptocurrency president" and promised to stop the "crusade" against cryptocurrencies by Biden and SEC Chairman Gary Gensler within an hour of taking office in his second term. He emphasized that he would adopt a more friendly regulatory policy to support the development of the cryptocurrency industry.

- July 28, 2024: Speech at the Bitcoin Conference

At the Bitcoin conference held in Nashville, Trump stated that he would make the U.S. the "cryptocurrency capital of the earth" and a "superpower in Bitcoin." He also promised to fire the current SEC Chairman Gary Gensler on his first day in office, stating, "Bitcoin may be our last line of defense against CBDCs, and it will help us dominate in the energy sector."

3. Actions Related to the Cryptocurrency Industry During the Campaign

- Accepting Cryptocurrency Donations

In May 2024, Trump's campaign team announced that they would accept cryptocurrency donations, allowing supporters to donate using various cryptocurrencies through the Coinbase Commerce platform. This move demonstrates Trump's open attitude towards cryptocurrencies and aims to attract more cryptocurrency supporters.

- Participating in Bitcoin Transactions

In September 2024, Trump used Bitcoin to purchase burgers and beer at a bar in New York City that accepted Bitcoin payments, becoming the first U.S. president to conduct a transaction using Bitcoin. He stated that the payment process was "very simple" and praised the convenience of Bitcoin. This action is seen as a symbolic gesture of his support for cryptocurrencies.

- Launching NFT Projects

During the campaign, Trump launched several NFT projects, including "Trump Digital Trading Cards," to further showcase his support for cryptocurrencies and blockchain technology. These NFTs received a positive response in the market, demonstrating his influence in the digital asset space.

- Engaging with the Cryptocurrency Community

Trump actively participated in activities within the cryptocurrency community, including attending Bitcoin conferences and meeting with cryptocurrency entrepreneurs. He emphasized the importance of cryptocurrencies at these events and promised that under his leadership, the U.S. would become a global leader in cryptocurrencies.

4. Summary of Cryptocurrency Policy Commitments

- Establishing a National Bitcoin Reserve

Trump promised that if elected, he would establish a national Bitcoin reserve, retaining all Bitcoin held by the government as part of the national strategic reserve. He believes that Bitcoin has long-term appreciation potential and that the government should hold and utilize its value.

- Establishing a Cryptocurrency Advisory Committee

Trump has repeatedly stated that if re-elected, he would fire current SEC Chairman Gary Gensler, appoint a more cryptocurrency-friendly regulator, and establish a Presidential Advisory Committee on Bitcoin and Cryptocurrencies to formulate and implement policies favorable to the development of the cryptocurrency industry, ensuring the U.S. maintains its leading position in this field.

- Opposing Central Bank Digital Currencies (CBDCs)

Trump has explicitly stated his opposition to the U.S. issuing CBDCs, believing that this would lead to excessive monitoring of citizens' financial activities and infringe on personal privacy. He emphasized that the government should not control or monitor citizens' financial transactions and supports individuals' rights to self-custody of their digital assets.

- Supporting Bitcoin Mining

He stated that he would defend the rights to Bitcoin mining, believing that it not only contributes to the development of cryptocurrencies but also promotes innovation and growth in the energy sector. He pointed out that Bitcoin mining can help stabilize the energy supply of the power grid, bringing economic and environmental benefits.

- Formulating Comprehensive Cryptocurrency Policies

Trump promised to formulate comprehensive cryptocurrency policies covering everything from stablecoin regulation to Bitcoin self-custody rights, ensuring the U.S. maintains its leading position in this field. He emphasized that the government should provide clear guidelines for the cryptocurrency industry to promote innovation while protecting consumer rights.

- Reducing the Sentence of Silk Road Founder Ross Ulbricht

At the Libertarian National Convention held in Washington, D.C., Trump promised that if he were re-elected, he would reduce the sentence of Silk Road founder Ross Ulbricht on the first day. He believes that Ulbricht's case reflects the government's excessive crackdown on cryptocurrencies and pledged to adopt a more just approach to similar cases.

III. Current Status, Issues, and Possible Changes in U.S. Cryptocurrency Regulation

1. Current Regulatory Agencies and Their Functions

Cryptocurrency regulation in the U.S. involves multiple agencies, primarily including:

Securities and Exchange Commission (SEC): Responsible for regulating projects that consider cryptocurrencies as securities, particularly activities like Initial Coin Offerings (ICOs). The SEC has classified many cryptocurrency projects as securities and requires them to comply with relevant securities laws and regulations.

Commodity Futures Trading Commission (CFTC): Considers cryptocurrencies like Bitcoin and Ethereum as commodities and regulates their derivatives markets. The CFTC oversees cryptocurrency futures and options to ensure market fairness and transparency.

Financial Crimes Enforcement Network (FinCEN): Part of the Treasury Department, responsible for enforcing Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, requiring cryptocurrency exchanges and wallet service providers to comply with relevant regulations to prevent illegal activities.

Internal Revenue Service (IRS): Treats cryptocurrencies as property, requiring taxpayers to report their holdings and transactions and pay corresponding taxes.

2. Issues with the Current Regulatory Framework

Regulatory Fragmentation: The responsibilities of different regulatory agencies in the U.S. are dispersed, leading to fragmented regulation of the cryptocurrency industry. The SEC and CFTC have disputes over how to classify cryptocurrencies as securities or commodities, making it difficult for businesses and investors to understand the regulatory boundaries of their assets.

Lack of a Clear Legislative Framework: Although agencies like the SEC and CFTC have conducted cryptocurrency regulation in their respective areas, the U.S. still lacks a comprehensive legislative framework for cryptocurrencies, failing to provide clear legal guidance for the sector. Many projects spend significant resources ensuring compliance before launching in the U.S., and this uncertainty has led some projects and companies to relocate to countries with more favorable regulatory environments.

Restricting Innovation and Market Competitiveness: The SEC's strict securities regulation of crypto projects and the CFTC's limitations on commodity regulation have a suppressive effect on innovation, making it more challenging for U.S. cryptocurrency companies and startups to develop.

Tax Complexity: The IRS's tax requirements for cryptocurrency transactions are complex, especially during periods of high volatility, making it difficult for users to report accurately. For many ordinary users, this tax complexity increases the cost of cryptocurrency transactions, limiting market activity.

3. Possible Changes Under the Trump Administration

If Trump is elected, the regulatory environment for cryptocurrencies in the U.S. may undergo the following changes:

Relaxed Regulatory Environment: Dismissing the current SEC chairman and changing the leadership may lead to a shift in the SEC's regulatory attitude towards cryptocurrencies, easing regulations on crypto projects and encouraging innovation.

More Inclusive Policy-Making: Establishing a cryptocurrency advisory committee may make the policy-making process more inclusive, incorporating industry opinions and formulating regulatory policies that better meet market demands.

Increased Market Confidence: Establishing a national Bitcoin reserve would demonstrate the government's recognition of Bitcoin, potentially boosting market confidence and attracting more investors into the cryptocurrency market.

Enhanced Privacy Protection: Opposing the issuance of CBDCs may protect citizens' financial privacy and prevent excessive government monitoring of individual financial activities.

Accelerated Industry Development: Supporting Bitcoin mining and cryptocurrency innovation may promote the development of related industries and enhance the U.S.'s competitiveness in the global cryptocurrency sector.

IV. Market Reaction Since Trump's Election

1. Cryptocurrency Prices Soar

Following Trump's election, the cryptocurrency market reacted swiftly, particularly with Bitcoin's price breaking historical highs after the election results were announced, reaching $75,000 on the same day and surpassing $90,000 within a week. This surge reflects the market's positive expectations regarding Trump's crypto policies and investors' optimism about the future economic situation. Other crypto assets like Ethereum, Solana, and meme coins also rose, with the total market capitalization of the entire cryptocurrency market increasing by 26% within a week. As of November 14, the total market capitalization of crypto assets has exceeded $3 trillion.

Source: https://coinmarketcap.com/charts/

2. General Investor Sentiment is Optimistic

Investor sentiment is generally optimistic, with many leaders and investors in the cryptocurrency industry expressing support for Trump's election on social media. Michael Saylor, founder of Microstrategy, even referred to Trump as the "Bitcoin President," stating that this victory marks the arrival of spring for the cryptocurrency industry. Coinbase CEO Brian Armstrong also welcomed the "most crypto-friendly Congress in U.S. history," and this positive market atmosphere undoubtedly boosts investor confidence. This week, market sentiment has shifted from neutral to extreme greed.

Source: https://coinmarketcap.com/charts/fear-and-greed-index/

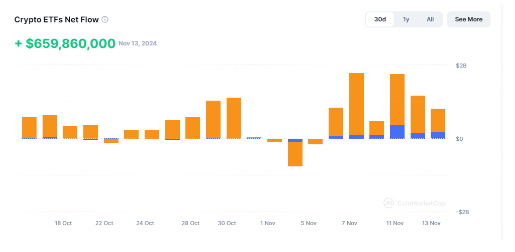

3. Rise in Crypto-Related Stocks and ETFs

Influenced by expectations of Trump's policies, crypto-related stocks and ETFs have performed positively. On the exchange side, major compliant exchanges like Coinbase and Robinhood have seen significant gains. Due to Trump's advocacy for developing Bitcoin mining domestically, mining companies like Cipher Mining, Riot Platforms, and Canaan Creative ADR have also experienced substantial growth. Since November 6, U.S. Bitcoin spot ETFs and Ethereum spot ETFs have seen continuous significant net inflows.

Source: https://coinmarketcap.com/etf/

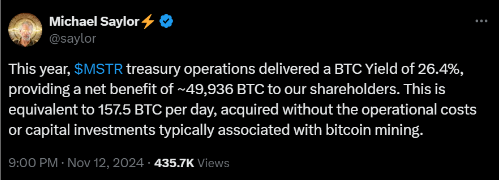

Bitcoin holding giant MicroStrategy (MSTR) rose about 13.2%. On November 12, MicroStrategy founder Michael Saylor posted on social media that this year, MicroStrategy's fund operations achieved a 26.4% BTC yield, bringing shareholders a net gain of approximately 49,936 BTC. This equates to 157.5 BTC per day, without incurring the usual operational costs or capital investments associated with Bitcoin mining.

Source: https://x.com/saylor/status/1856321148373393786?s=46&t=bcMyidYO0QkS5ajIW9CBdg

V. Analysis of Future Trends in the Cryptocurrency Market

1. Short-Term Trends

Market Reaction: After Trump's election, the cryptocurrency market rebounded rapidly, especially with significant price increases for mainstream digital assets like Bitcoin and Ethereum, reflecting the market's high expectations for Trump's policy commitments. This price volatility indicates investors' optimistic sentiment regarding future policies, and it is expected that the crypto market will continue to be driven by positive sentiment in the short term. Predictions suggest that Bitcoin's price may break $100,000 by the end of 2024, with some analysts even forecasting $150,000.

Investor Sentiment: Investors generally believe that Trump's election will bring a more relaxed regulatory environment and favorable economic policies. This optimistic sentiment may lead to more capital flowing into the crypto market, particularly increasing speculative trading.

Increased Trading Activity: With heightened market sentiment, trading activity may also significantly increase. Investors are likely to become more active in cryptocurrency trading, especially in the face of increasing policy uncertainty, where speculative trading may dominate. This situation will lead to increased market volatility, with prices potentially experiencing sharp fluctuations in the short term.

2. Medium to Long-Term Trends

Policy Implementation and Industry Development: In the long run, whether the Trump administration can fulfill its commitments to cryptocurrencies will directly impact the industry's development. If Trump can successfully implement relevant legislation, such as the "Financial Innovation and Technology Act of the 21st Century" (FIT21) and the "Stablecoin Payment Act," the U.S. is expected to become a global leader in cryptocurrencies. These policies will provide a clear regulatory framework for the industry, attracting more businesses and investors to the market.

Technological Innovation and Capital Inflows: The Trump administration is expected to support fintech innovation, including the development of blockchain technology and digital currencies. This may manifest in increased R&D funding, enhanced patent protection, and collaboration with the private sector. As more capital flows in, the status of cryptocurrencies as a safe-haven asset may also be elevated, further driving market development.

3. Potential Risks and Challenges

Policy Uncertainty: Despite Trump's commitment to supporting cryptocurrencies, if he fails to effectively implement his promises or if new regulatory measures emerge, it could lead to a decline in market confidence. Additionally, there may be resistance during the policy implementation process, introducing uncertainty.

Market Overheating Risks: Rapid market increases in the short term may lead to bubble risks, necessitating caution regarding price corrections.

Global Regulatory Environment: Changes in regulatory policies in other countries may also impact the global cryptocurrency market trends, requiring close attention.

VI. Investment Strategy Recommendations and Conclusion

1. Strategies for Different Types of Investors

Conservative Investors: It is recommended to primarily allocate funds to mainstream cryptocurrencies like Bitcoin and Ethereum, as they have larger market capitalizations and relatively lower volatility. Additionally, maintain a moderate cash ratio to cope with market fluctuations.

Moderate Investors: Based on holding mainstream cryptocurrencies, a portion of medium-cap, potential tokens can be allocated. It is also important to pay attention to the fundamentals and technological developments of the projects.

Aggressive Investors: In addition to mainstream and medium-cap tokens, a portion of emerging project tokens can be allocated, but thorough research on the project background is necessary to assess risks and implement stop-loss measures.

2. Risk Assessment and Management Recommendations

Diversified Investment: Avoid putting all funds into a single asset; diversification can reduce risk.

Set Stop-Loss Points: Establish stop-loss points for each investment to prevent losses from expanding.

Continuous Learning: Stay informed about market dynamics and adjust investment strategies in a timely manner.

Psychological Preparation: Given the high volatility of the cryptocurrency market, investors should remain calm and avoid emotional trading.

In summary, Trump's election has had a positive impact on the cryptocurrency market, with heightened market sentiment and rising prices in the short term. The medium to long-term trends will depend on the effectiveness of policy implementation, changes in the regulatory environment, and the market's own development. Investors should remain cautious, monitor policy developments and market risks, and formulate investment strategies that align with their risk tolerance, ensuring effective risk management and rational decision-making.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analyses of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space or a seasoned investor seeking deeper insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。