Abstract: This article will focus on the structure of MicroStrategy's bonds and analyze whether MicroStrategy might be forced to sell Bitcoin to repay bondholders in the event that bondholders demand cash redemption. Based on the current debt structure, we believe the likelihood of forced liquidation is extremely low. However, given the extreme volatility of Bitcoin prices, anything is possible.

MicroStrategy holds over 250,000 Bitcoins, and its stock price trades at a significant premium to its net asset value (NAV). This inevitably brings to mind the similar high premium phenomenon seen in the previous cycle with the Grayscale Bitcoin Trust (GBTC) before it converted to an ETF, which attracted a large influx of capital. However, we cannot explain why these two investment vehicles can trade at such high premiums. Even more perplexing is that MicroStrategy has been able to issue a large number of shares at a premium valuation to purchase more Bitcoin, thereby increasing the book value per share. This seemingly "infinite funding" cycle is puzzling. Since initiating its Bitcoin strategy, MicroStrategy has announced five equity offerings, raising a total of $4.4 billion.

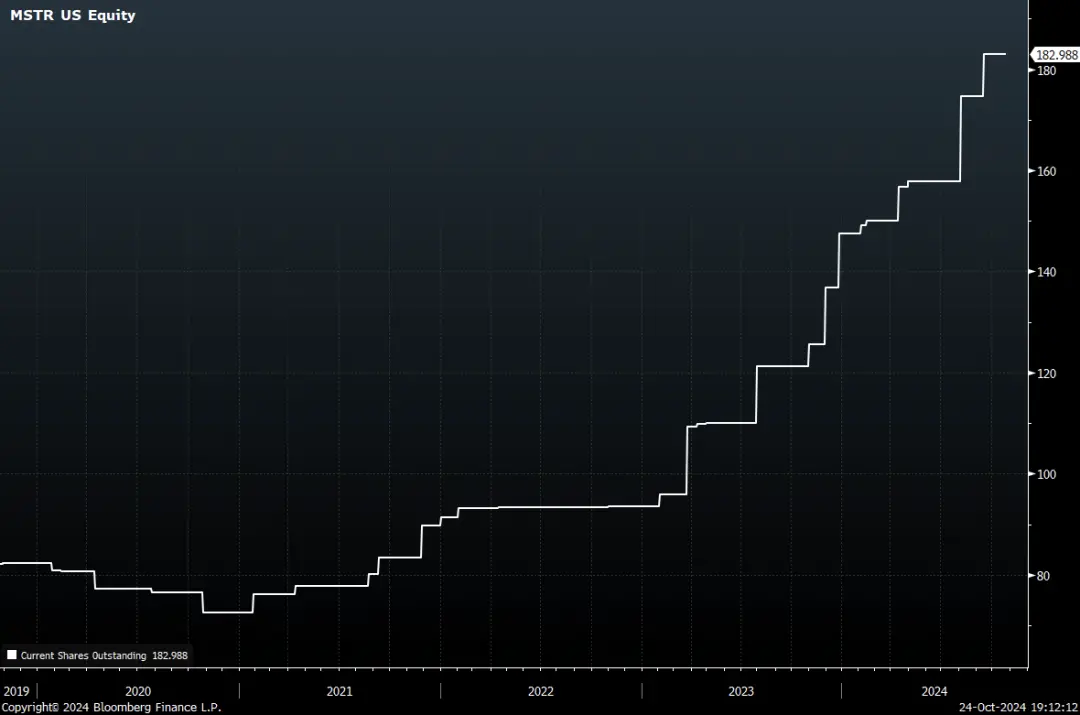

MSTR Circulating Shares (Million)

History seems to be repeating itself. Michael Saylor, the owner of MicroStrategy, is viewed by many as a "bad guy" in the Bitcoin space due to some controversial positions, including his apparent hostility towards supporting Bitcoin developers, opposition to privacy technologies, and his brief but outspoken opposition to self-custody. Similarly, Mr. Barry Silbert, who controls Grayscale, is also controversial for being a key organizer of the 2017 "New York Agreement," which proposed a doomed proposal for the industry to abandon Bitcoin in favor of an alternative coin based on the flawed and vulnerable BTC1 client, "SegWit2x."

As MicroStrategy accumulates a large amount of Bitcoin, with a market capitalization approaching $50 billion, concerns have begun to arise. In particular, questions have been raised about whether MicroStrategy's debt will force it to sell Bitcoin into the market, triggering a price spiral decline. Unfortunately, due to the complexity of the debt structure, there is no simple "yes" or "no" answer to this question. Nevertheless, we have reviewed relevant documents and will do our best to address this question in this article.

Disclaimer

We would like to state: we are not bond traders, bond market experts, or lawyers, and this serves as a disclaimer for this article. The corporate debt market can be quite complex, and non-professionals may find it difficult to navigate. This article is likely to contain many errors. Furthermore, this article oversimplifies the product and does not comment on many conditions and complexities. Please do not rely on any information in this article, and if there are errors, please feel free to point them out.

MicroStrategy's Bonds

To our knowledge, since announcing its Bitcoin strategy, MicroStrategy has issued seven rounds of publicly traded convertible bonds, as shown below.

First, it is important to note that two of these bonds have been fully redeemed and are therefore not related to the outstanding debt. Thus, MicroStrategy has five outstanding bonds with a principal value of $4.25 billion. Therefore, we will examine these five bonds.

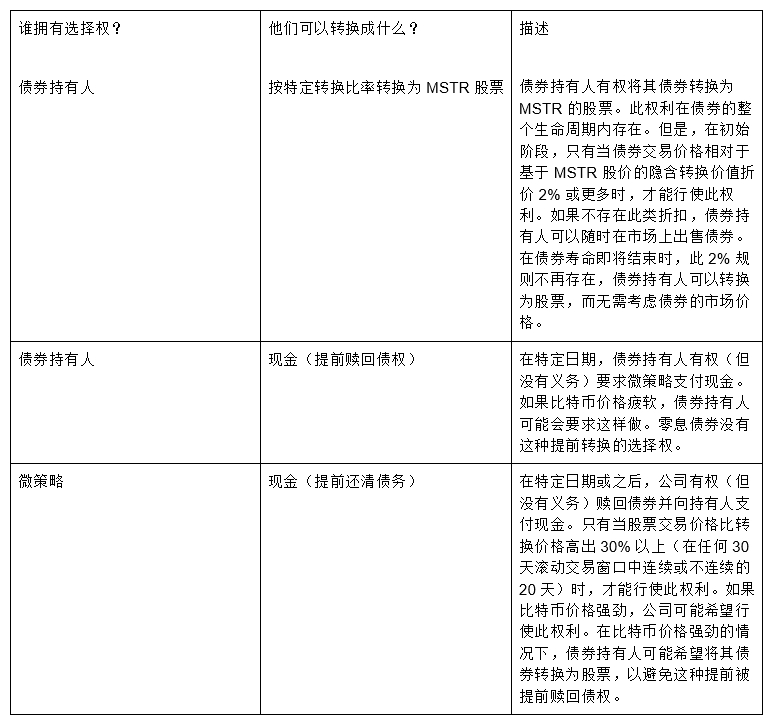

Redemption and Conversion Options

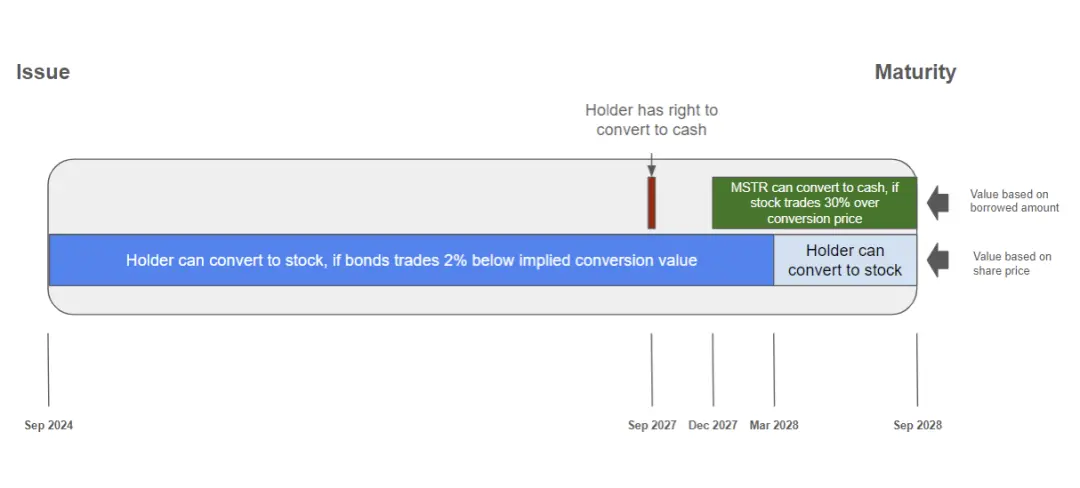

The structure of the bonds is relatively complex, and to our knowledge, there are four different types of conversion options before maturity. The following chart summarizes these conversion options for the latest instrument (the bond maturing in 2028).

MicroStrategy 0.625% 2028 Bond Timeline:

Overview of Convertible Bond Options:

To our knowledge, except for the zero-coupon bond issued by MicroStrategy in September 2021, the mechanisms of the other four convertible bonds are essentially the same, differing only in price and date. Holders of the zero-coupon bond do not have the right to redeem cash early before maturity unless there is a "fundamental change" in the business. This could be crucial if Bitcoin prices fall.

The table below lists the key dates related to the cash conversion options for the five bonds:

Source: Bond issuance documents

Note: The stock must trade at a price more than 30% above the conversion price for 20 out of any 30-day rolling trading windows, whether consecutive or not.

MicroStrategy's Conversion Rights

It is important to note that for the zero-coupon bond, the cash option date for MicroStrategy has passed in February 2024. The conversion price is $143.25, with a 30% premium making it $186.23. Currently, MSTR's stock price is $214, well above this price. However, in the past 30 trading days, it has only been above this price for 11 days. Therefore, this option is about to come into effect but is not yet exercisable. Exercising this option would create value for MSTR shareholders; however, bondholders are likely to be able to prevent this from happening by exercising their conversion rights.

These complex factors make bond valuation quite difficult, as convertible bonds have multiple potential outcomes. However, many creditors may be experienced professional bond investors who have models for making these calculations.

Bond Interest Payments

Among the five outstanding bonds, four come with interest payments. These coupons represent cash liabilities, and theoretically, MicroStrategy could be forced to sell Bitcoin to meet its payment obligations. However, given the relatively low interest rates and the fact that its traditional software business generates ample free cash flow to cover interest costs, even a significant drop in Bitcoin prices would not be enough to force the company to sell Bitcoin to pay bond interest. In summary, we believe that interest costs will not lead to MicroStrategy being forced to sell Bitcoin.

Conclusion

MicroStrategy's debt amounts to $4.25 billion, calculated based on its borrowed principal. Meanwhile, the company's stock currently has a market capitalization of $43 billion, and the value of its Bitcoin holdings is $17 billion. Thus, the bonds do not represent a significant portion of MicroStrategy's capital structure.

However, if Bitcoin prices were to drop significantly, for example, to around $15,000 each, and MicroStrategy could not incur further debt, analysts might need to consider the "forced liquidation" of Bitcoin. However, this potential forced liquidation timeframe would focus on the maturity dates and option exercise dates mentioned in this article, which are spread between 2027 and 2031 and are very specific. Therefore, even if Bitcoin were to drop to around $15,000, we believe the likelihood of MicroStrategy being forced to sell Bitcoin to repay bonds remains low.

While it is unlikely that MicroStrategy will be forced to sell Bitcoin, we believe a more likely scenario is that MicroStrategy may voluntarily sell Bitcoin to maximize shareholder value. Currently, MicroStrategy's stock price trades at a significant premium to its net asset value. Once this premium disappears or even turns into a discount (which is almost inevitable), and the bonds are nearing maturity, selling Bitcoin to raise funds to repay debt will become the best choice for shareholder interests. However, as long as the stock price maintains a premium, MicroStrategy can continue to leverage this for such "circular lending" operations, leaving no reason to sell Bitcoin. Of course, this state of significant premium cannot last forever.

Additionally, it should be noted that if MicroStrategy's stock price can continue to maintain a premium and the market demand for MSTR bonds remains strong, the company may issue more debt. This would increase its debt risk and the likelihood of being forced to sell in the event of a Bitcoin price crash. But for now, MicroStrategy's leverage is low, and the risk of liquidation is also at a low level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。