U.S. stocks plummeted, the yen and U.S. Treasuries rose, and the Trump trade saw a significant reversal. Additionally, some Federal Reserve officials indicated that it is still too early to determine whether the Fed should cut interest rates at next month's meeting.

Written by: He Hao

Source: Wall Street Watch

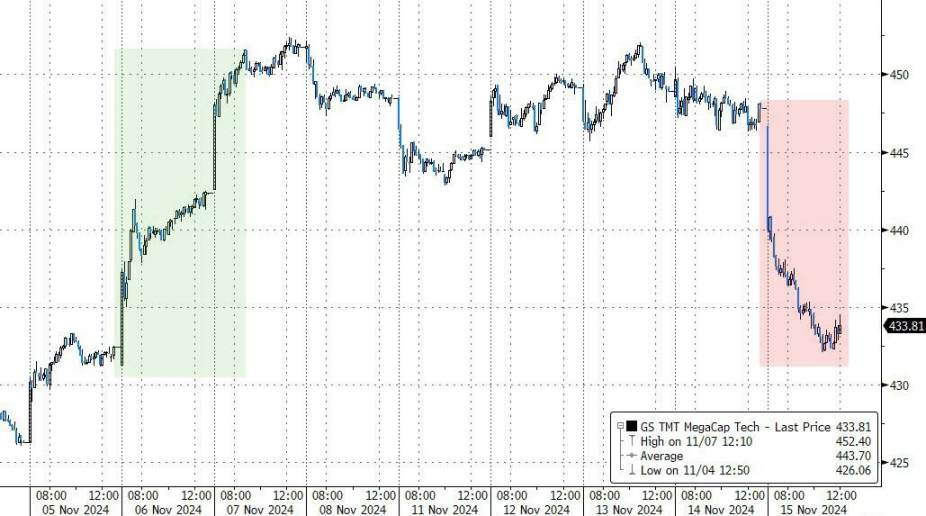

On Friday, U.S. stocks fell sharply, with the tech-heavy Nasdaq 100 index giving back most of its gains since the U.S. election results were announced. The Nasdaq 100 significantly underperformed the overall U.S. stock market, with large tech stocks particularly struggling, erasing all gains made after the U.S. election.

On Friday, U.S. retail sales, the New York Fed manufacturing index, and the import price index all exceeded expectations, serving as key triggers for the sharp decline in U.S. stocks:

U.S. retail sales remained robust at the start of the fourth quarter, with October retail sales rising 0.4% month-on-month, compared to an expectation of 0.3%, and the September figure was significantly revised up to 0.8%.

The New York Fed manufacturing index for November was 31.2, compared to an expectation of 0 and a reading of -11.9 in October.

The U.S. import price index rose 0.3% month-on-month in October, against an expectation of a 0.1% decline, with the previous value showing a 0.4% drop. The year-on-year increase for the October import price index was 0.8%, compared to an expectation of 0.3%.

Analysts pointed out that the latest U.S. retail sales data may indicate a strong holiday shopping season. Additionally, the New York Fed manufacturing index far exceeded expectations and October data, combined with earlier CPI and PPI inflation data that were also above expectations, suggests that the Fed is likely to remain cautious about further rate cuts.

After the economic data was released on Friday, the market generally reacted hawkishly, with U.S. stock index futures and U.S. Treasuries being sold off during pre-market trading, while the dollar index rose. The likelihood of a 25 basis point rate cut by the Fed in December dropped to about 55%, down from 60% before the data was released.

After the U.S. market opened, the decline in U.S. stocks widened amid heavy selling, while U.S. Treasuries saw a reversal in trend, as safe-haven sentiment increased, leading to a 1.5% surge in the recently declining yen. Major assets reflected a clear reversal of the Trump trade.

Federal Reserve officials also dampened market enthusiasm.

On Thursday afternoon U.S. time, Fed Chair Jerome Powell stated that the U.S. economy is strong and the Fed does not need to rush into rate cuts. Labor market indicators have returned to a more normal level consistent with the Fed's full employment goal. Inflation is expected to continue to decline towards the 2% target, although there may be some bumps along the way. The path of interest rates is not predetermined and depends on data and economic outlook; if the data suggests slowing down rate cuts, then slowing down would be a wise move. Congress generally believes that the independence of the Fed is very important, and it is too early to draw conclusions about the Trump administration's policies; the Fed will act cautiously until there is more certainty in policy.

Next year's voting member, Boston Fed President Collins, stated in an interview on Thursday evening that a rate cut in December is certainly possible, but it is not a done deal. From now until the December meeting, we will see more data, and we must continue to weigh what is reasonable.

The Fed's next meeting will be held from December 17 to 18. Fed officials will see November's inflation and employment data before the meeting.

Collins supported the Fed's two earlier rate cuts this year. Regarding the future, she said, "We will find an appropriate place to proceed more slowly and cautiously."

However, Collins did not use entirely hawkish language. She also stated that there is no evidence indicating that inflation is rising due to new momentum in the U.S. economy, which aligns with Powell's views. Both believe that the recent stickiness of inflation is a response or catch-up effect to the significant price increases over the past few years, such as the rising costs of auto insurance reflecting past increases in car prices, but car prices have since declined.

Collins believes it is appropriate to continue lowering rates to what is considered a neutral stance. In the absence of new evidence of price pressures, maintaining a restrictive policy makes no sense, and the current policy remains restrictive. Old dynamics may gradually resolve unevenly over time.

Renowned financial journalist Nick Timiraos, known as the "New Fed Communicator," wrote that U.S. stocks fell on Friday after the strong retail sales report was released, which may support the view that the U.S. economy is strong and does not need support in the form of rate cuts. Additionally, some Fed officials (including Boston Fed President Collins) indicated that it is still too early to determine whether the Fed should cut rates at next month's meeting.

Timiraos pointed out that the latest situation highlights the uncertainty expected by investors regarding whether the Fed can continue to cut rates significantly as anticipated, partly due to the continued strong momentum of the U.S. economy.

Timiraos quoted Jefferies analyst Thomas Simons in a letter to clients after the economic data was released on Friday: "Various comments from Fed officials indicate that they are increasingly concerned that the cooling of inflation is encountering obstacles. But we believe there is not enough evidence to confirm these assumptions before the next meeting."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。