The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to follow and like, and reject any market smokescreens.

After waiting for so many days, we finally witnessed the birth of a solid bearish candle, officially announcing that the era of deep corrections has arrived. It perfectly coincides with what we call the market cap peak. Many friends have been asking Lao Cui why, after reaching the previous bull market's market cap, Bitcoin shows signs of correction and stagnation. The core issue still lies in the level of capital. Don't think that after interest rate cuts, a large amount of capital will flood into the crypto market. You can compare the trends of Old A and the US stock market; both have liquidity fluctuating at the trillion level daily. The liquidity in the crypto market, primarily Bitcoin, is the best but only accounts for about 200 billion in trading volume, and this includes contract trading volumes. The scale of the crypto market is far from meeting the requirements of traditional capital markets. Currently, there has indeed been a rate cut, but it will take some time for capital to flow from the rate cut into the crypto market. Simply put, the current stage is about trading time for space. Moreover, the only market that has outperformed US stocks and the dollar is the crypto market. This level of return is already sufficient, and it can be said that Lao Cui is willing to give this round of growth a perfect score.

Recently, with the increase in novice users, Lao Cui's update frequency has indeed shown a slight decline. Therefore, please do not have too high expectations for Lao Cui's articles. Almost every day, Lao Cui receives questions from over twenty people in private messages, and I hope everyone can be understanding. Lao Cui will try to reply to everyone as much as possible. Since there are more novice users, Lao Cui would like to remind everyone that the current trend indicates that the bull market has almost traveled halfway. The possibility of bottom-fishing in the spot market is almost negligible. Therefore, recent strategies will definitely change. In the first half of the year, we focused on laying out spot positions, while in the second half, we need to return to our short-term market. The recent approach should prioritize speed, and the holding period must be reduced, preparing to clear positions daily. Spot users must also change their holding periods; from chasing from 70,000 to 90,000, profit-taking should be prioritized. After all, we ultimately need to see how much remains in our pockets. This statement does not mean the end of the bull market; it merely reminds everyone that the bullish trend still exists in our market.

Yesterday's decline was due to both the capital level of market value and Powell's speech, which Lao Cui had already warned everyone about. After the interest rate cut in November, there will definitely be speculation about the possibility of not cutting rates in December. This is a typical American way of doing things. Even if it is a foregone conclusion, there will still be suspense. They want to cut rates but do not want retail investors to profit so easily. The growth rate in the crypto market has definitely exceeded most people's expectations. The 100,000 mark for Bitcoin is indeed not so easy to break through, and the 90,000 mark has already shown signs of weakness. Think about it: in the last bull market, the biggest driving force among all participants was Musk and Grayscale. With Grayscale's continuous reduction this year, it has ultimately been replaced by BlackRock and traditional capital. There is a significant difference between the two; a change in hands means the market situation is improving, but it also means our opponents are becoming stronger. A pull of 20,000 points in a week was almost unimaginable before, but this year has created a historical precedent, with some rejoicing and others worrying. Instead of fearing a reversal of the bull market every day, it is better to take this opportunity to accumulate your own capital.

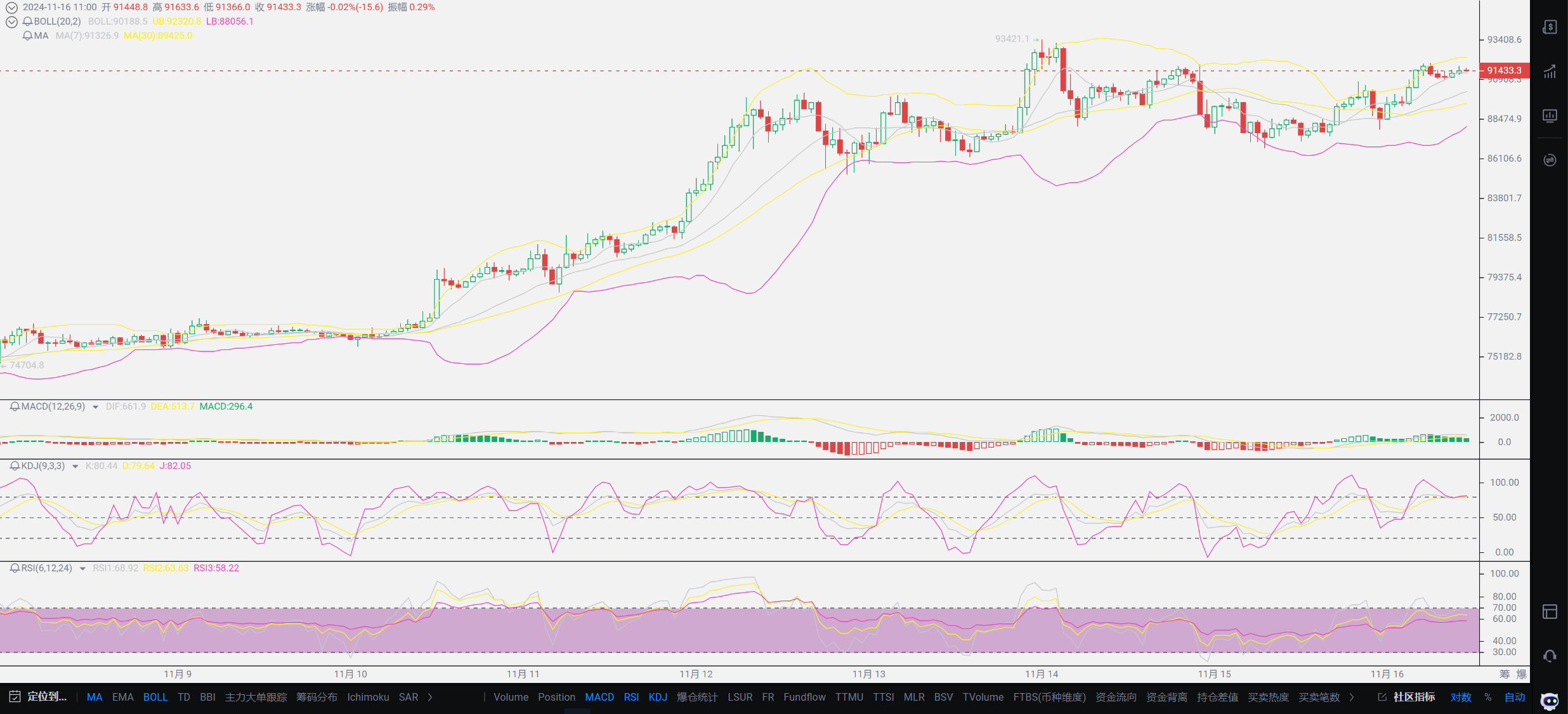

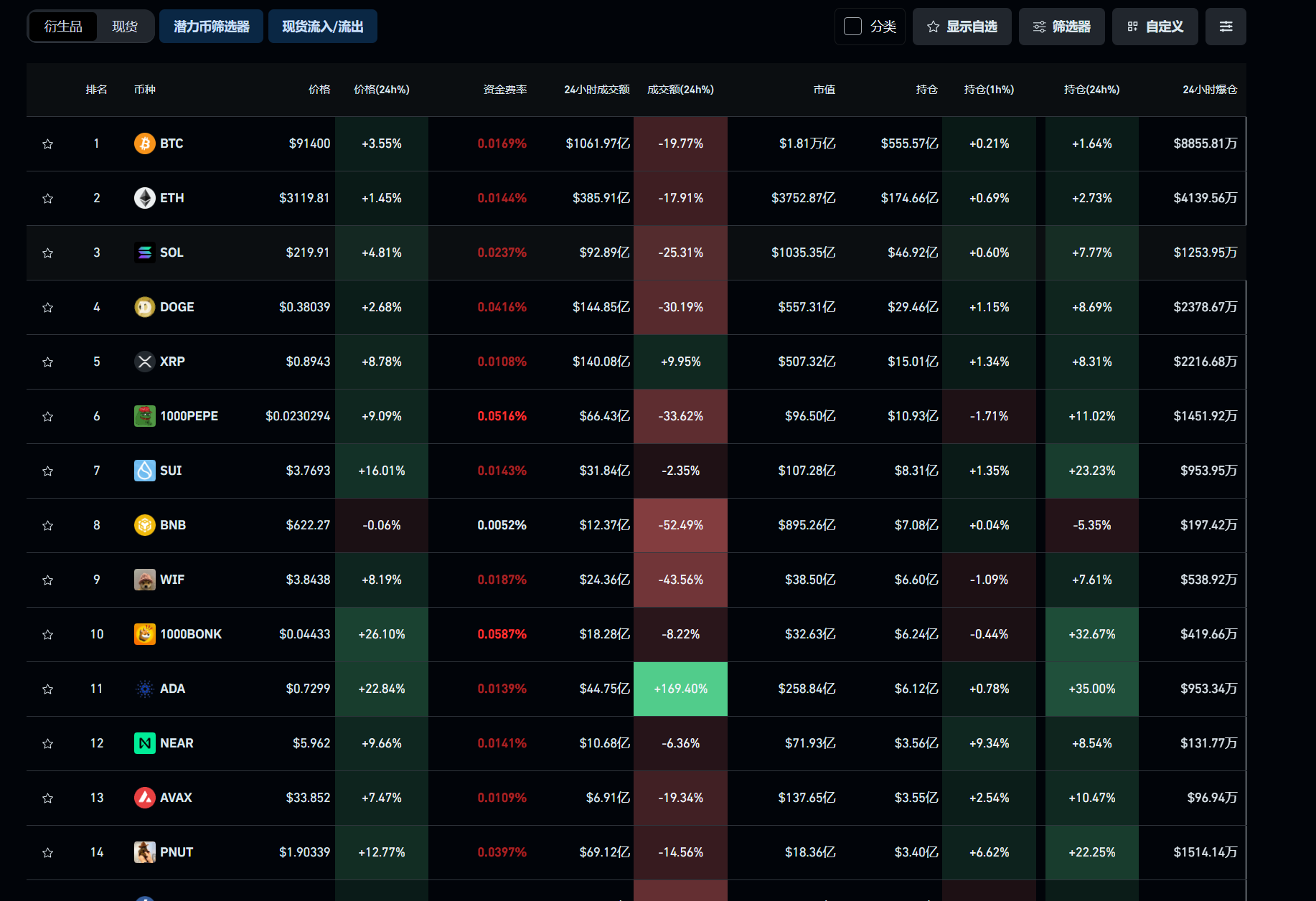

Regarding the future trend, today's trading volume has already indicated a significant issue. The trading amount for Bitcoin today is less than 130 billion, a decrease of nearly 50 billion compared to the same period. There seems to be signs of capital withdrawal, and high-level selling is quite evident, all thanks to Powell's words. Pay attention to the overall market value; there is no significant decrease in market value, which only indicates a deep correction after a surge. Large capital has not chosen to abandon the crypto market; there are still more people willing to be optimistic about the crypto market. Especially today, the news is quite interesting, directly revealing that Trump's allies are about to sell the Federal Reserve's gold reserves to prepare to purchase 1 million Bitcoins. Lao Cui calculated that this is nearly 90 billion US dollars in funds. If this capital system really enters the crypto market, it could become the next BlackRock in terms of scale, directly becoming the second-largest entity in the crypto market after Satoshi. Currently, Bitcoin has become the eighth-largest asset in the world, only 1 trillion away from the seventh-largest, Saudi Aramco. This bull market may directly break historical asset peak levels; let us wait and see.

This article was created on the 15th. The same old issue: indeed, as the market improves, the number of users in hand is gradually increasing, so I sincerely apologize for the efficiency of article production. For those who want to enter the market, still take the market as the standard. As long as there is a deep correction of more than 3,000 points, it is possible to set up long positions. The stop-loss position should reach the same point as the take-profit. For example, if the take-profit is 3,000 points, you must be able to accept a stop-loss of 3,000 points. When making trades, you must at least ensure that the risk and profit are equal. Regardless of whether it is a one-sided market or if you are completely confident in the market trend, you must maintain a clear mind when trading. Finally, I emphasize that when entering the market, you must first consider the risk. Only after being able to accept the risk should you choose the opportunity to enter. The bullish trend has always been our main focus, and there is no reason to short in the current crypto market, especially with Powell's remarks the day before yesterday. From Lao Cui's perspective, it is not aimed at the crypto market. The theory of not cutting rates has always been the American way of thinking, and its purpose is very clear. It is not like ordinary retail investors and foreign capital entering the US market at low prices. This is a form of indirect protection for their own capital. For us retail investors, we need to observe their own actions. A gentleman observes actions, not intentions. For example, everyone can observe whether the employment population has returned to expectations and whether their so-called industrial return has really provided sufficient tax revenue. Whether this tax revenue is truly enough for them to repay this year's national debt interest. If any of these cannot be achieved, a rate cut is inevitable. Just remember one thing: as long as the Americans have other methods, they will not easily cut rates. They will definitely choose to drag down our domestic economy. The current situation in the US has truly reached a point of desperation, relying only on verbal attacks and threats; a rate cut is a foregone conclusion.

Lao Cui's summary: Based on the capital movements in the financial sector, there is already sufficient capital eyeing the crypto market, and it is difficult to see signs of reversal in the short term. This means that the bull market will not directly turn into a bear market. The basis for this judgment is the continuous rate cuts in the US and Trump's attitude and strategy towards the crypto market. We should first set our overall trend and then judge the medium-term trend. In the medium term, the US stock market, gold, and Old A have shown signs of capital fleeing, while capital has indeed flowed into the crypto market. The previous pullback to the 86,000 mark has clearly shown that there is a large amount of capital lurking at the bottom support level, and the stabilization signs are very promising. Therefore, for medium-term positioning, everyone just needs to be cautious of the American verbal threats and respond by entering long positions during corrections. Do not blindly chase after rising prices. Historically, capital growth will definitely be accompanied by deep corrections. I have not emphasized this point before because there was no bubble in the crypto market before 90,000. The trend after 90,000 will depend on Trump's attitude. The emergence of a bubble does not mean it will burst; it is still a matter of time. In the future, if there is no negative news for the crypto market, we will be bullish. In the short term, the pressure levels are also very evident. Since the last surge, the historical high of 93,400 has not been seen again, and in the short term, it is likely to remain in this range of fluctuations, filtering out other retail investors before any pullback occurs. Especially since other cryptocurrencies have not followed suit in this round, with Ethereum even dropping 200 points, the signs of a surge are even weaker. Everyone's approach should be to wait for a deep correction, and some capital can currently enter long positions for positioning. In the future, replenishing positions is also fine. You must set up long positions in advance before the bull market starts; do not chase after rising prices. If you are unsure about the entry points, just ask Lao Cui. Lao Cui will also lay out long positions today and will wait for the right timing! Keep an eye on this fund from Trump's allies; the true historical high for Bitcoin may not be far away. Let us look forward to the wonderful things that are about to happen!

Original article created by: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。