Preface

I would like to thank everyone for their trust. Recently, many friends have approached me wanting to follow my operations, which is a positive phenomenon as it indicates that more friends are climbing out of the pit. However, there are also many friends who want to jump in and make money right away.

I have previously mentioned that investing carries risks. Before you invest, you must understand the product you are dealing with, including its prospects, trading volume, attention, and operational space coefficient, among other factors. Many novice friends think about making profits before they even understand what product they are dealing with. I can only say that this is unwise; even if you make a profit, it will only be temporary.

This is also my advice to novice friends: I can teach you how to operate and follow my suggestions to make profits, but the premise of cooperation is your understanding of the operations. No matter where you are, do not enter the market blindly or operate blindly; that is irresponsible to yourself!

Many new friends who come to me generally face a common situation: the market fluctuates too quickly, and their funds are trapped. What should they do?

Here, I want to talk about the root cause of being trapped. A very direct point is improper operations; not accurately observing market trends, combined with a gambler's mentality, always thinking that they are close to the highest (or lowest) point and can invest a bit more, only to end up trapped, with their funds sinking deeper. I can say without exaggeration that this is a very common phenomenon in the market!

For those friends, I have seen this situation quite often. I still recommend following the operations; there will always be people who doubt the accuracy of the trades and question my authenticity. But I just want to say that in the face of time, the truth cannot be hidden. If you don’t believe it, you can come and see for yourself. If you refuse to believe without understanding anything, then you are being too blind. Although there will always be people trying to take advantage of the market, there will still be some clear waters!

If you don’t make any attempts or changes, how can you change your current situation?

11.15 Bitcoin - Ethereum Analysis

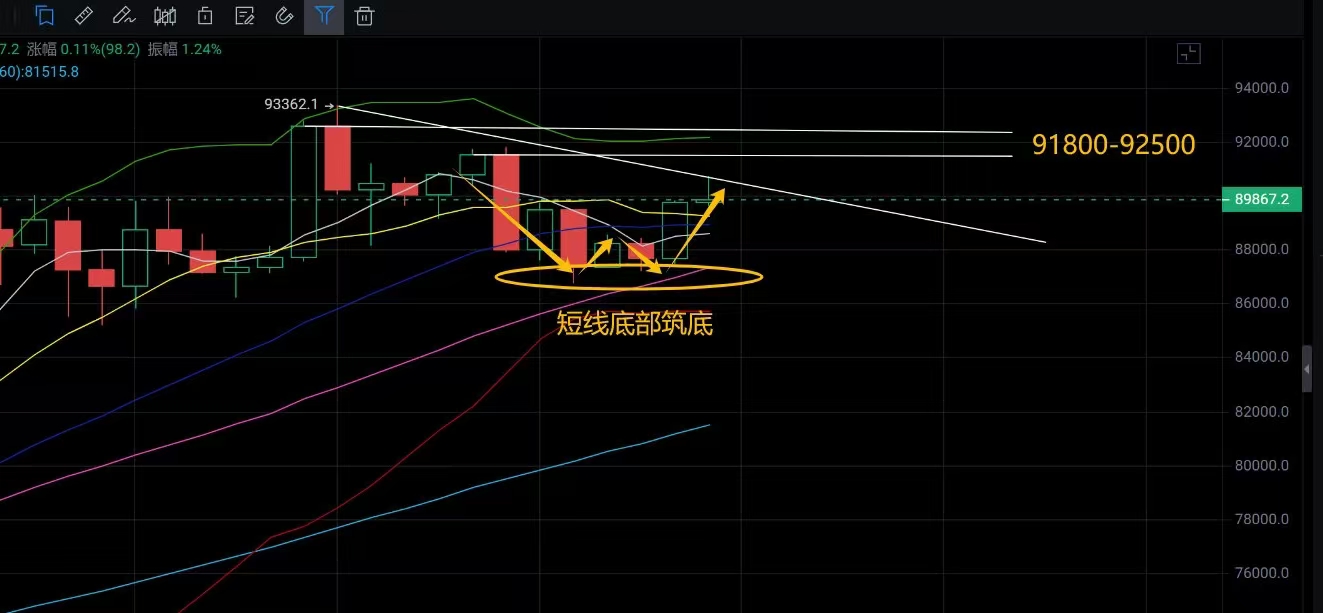

From the current market perspective, it is just past eight o'clock, and the four-hour chart has just closed. A strong bullish candle has surged from around 87500 at the bottom to the current price of around 89500, forming a short-term breakout signal. The K-line has stabilized near the middle band of the Bollinger Bands on the four-hour chart, and the moving averages have turned upwards, indicating a continued upward movement. It is expected that during the evening session from 8 to 12 o'clock, there will be further increases, testing the upper pressure again. Therefore, for evening operations, it is recommended to buy on dips for Bitcoin, with two pressure levels to defend. Once it breaks through, it can continue to look towards the previous high.

As for Ethereum, the thought process remains the same as yesterday. Although there has been a short-term rise, the overall performance has actually weakened further. Why do I say this? Because today the overall market has warmed up, and Bitcoin has already recovered beyond today’s decline, while Ethereum is still hovering below the trend pressure. Therefore, there is not much strong breakout momentum in the short term.

Additionally, although the four-hour chart closed with a bullish candle, it has not broken through the moving average pressure and is still under pressure from the upper resistance level. The Bollinger Bands on the hourly and four-hour charts are also synchronously narrowing, making the possibility of breaking through either side not very high. Thus, it will be relatively difficult for Ethereum to break upwards like Bitcoin during the evening session.

11.15 Evening Trading Strategy Reference

Bitcoin: Buy around 89000, defend at 88400, target 90300-91800 in batches.

Sell at 92000-92600, with an average defense of 500 points, looking down to 90500-89000 in batches.

Ethereum: Sell at 3155-3185, defend at 3225, target 3085-3015 in batches.

Buy at 3015-2995, defend at 2965, target 3065-3105.

Conclusion

Perhaps you don’t know if you are one of the fortunate few, but I hope that if you see this message, you can reflect on whether what I said makes sense. When we can face the truth, we are not far from standing outside of it, and we are also not far from making profits!

The investment market is like this, ever-changing. What we need to do is to protect our profits! Do not be greedy for big profits; be content with small gains. By following my trading points, we can make quick profits of thousands or hundreds of points in short trades. This is the best way for us to operate at this stage! Any friends who are unclear about the trends can contact me for inquiries, and I will answer everyone one by one.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。