Trump plans to appoint a new chair who is friendly to cryptocurrencies, and the market has high hopes for this. However, internal policy changes at the SEC may take time and complex procedures.

Written by: Daniel Ramirez-Escudero

Translated by: Koala, Mars Finance

With Donald Trump's election, a cryptocurrency-friendly regulatory body may replace SEC Chairman Gensler, opening the door for staking rewards for spot ETH ETFs.

As President-elect Donald Trump wins by a landslide, SEC Chairman Gary Gensler's days seem numbered.

Market and political observers expect Trump to appoint a new chair, a shift that could allow spot ETH ETFs to offer staking rewards, thereby boosting the price of Ether (ETH).

Trump has made several significant commitments to the U.S. cryptocurrency industry. One of them is to fire Gensler on the "first day" of the new administration. But this is easier said than done.

Internet and digital media lawyer Andrew Rossow told Cointelegraph, "The president has the authority to appoint and remove certain individuals, which extends to SEC commissioners."

However, he said, "Whether the president can directly fire the SEC chair is somewhat ambiguous."

Trump must provide justifiable reasons for the dismissal, such as neglect of duty, inefficiency, or misconduct. Directly firing Gensler would be an unprecedented move and could mean political backlash for the Trump administration.

Rossow stated that Trump might not be deterred by potential political consequences, as the digital asset industry is generally dissatisfied with Gensler's "enforcement-oriented" approach. Additionally, Trump's combative political style suggests he has little respect for systemic norms.

Carol Goforth, a professor at the University of Arkansas School of Law specializing in business associations and securities regulation, told Cointelegraph that there is a faster way to remove Gensler without kicking him out of the SEC: "The president can demote the chair at any time and replace him with one of the other sitting commissioners. This could happen immediately."

Rossow noted that the president has the authority to transfer the chair position among commissioners as defined in Reorganization Plan No. 10. He said Trump "might simply choose to transfer the chair position to another SEC commissioner, arguing that faithfully executing his executive power is constitutional."

However, "in most cases, SEC chairs tend to resign when there is a change in the White House during their term," Rossow added.

Goforth pointed out that Gensler's resignation would complicate the appointment of a new SEC chair, as it would require Senate approval, involving longer and potentially contentious hearings and legislative debates.

However, she stated that even Senate approval would be "relatively easy for President Trump to achieve," as the Republican Party has already gained control of the legislature.

Trump has made it clear that he hopes to appoint a SEC chair who is friendly to cryptocurrencies. One of the SEC's restrictive measures is considering staking as a security product, which has hindered the development of the U.S. crypto industry.

There are high hopes that the new SEC chair will halt ongoing enforcement actions and open the door for ETF issuers to provide staking services.

Ethereum staking could boost struggling spot ETFs

Ethereum's price has been below market expectations. There are many reasons for Ethereum's underperformance compared to Bitcoin or its direct competitor Solana. One factor is the poor performance of spot Ethereum ETFs since their launch.

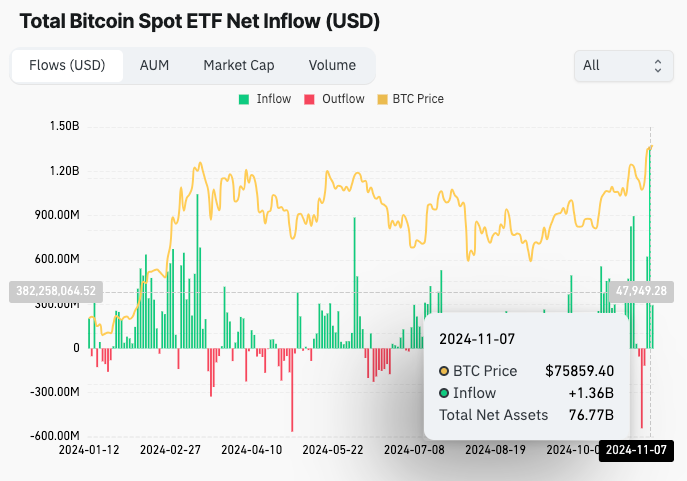

Market observers expect spot Ethereum ETFs to replicate the success of spot BTC ETFs. BlackRock's spot Bitcoin ETF saw inflows exceeding $1.1 billion on November 7, bringing the total assets under management (AUM) of BTC ETFs to over $25 billion.

On November 7, spot Bitcoin ETFs saw total inflows of $1.34 billion. Source: CoinGlass

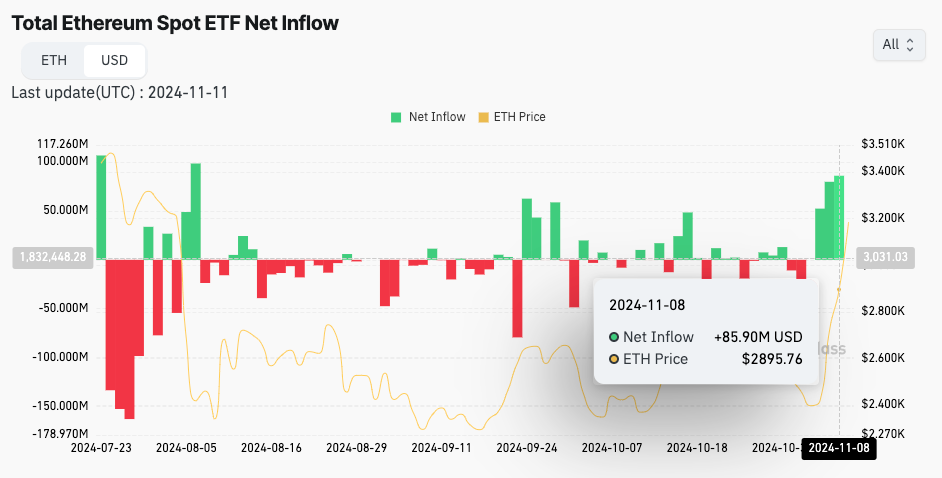

In contrast, BlackRock's iShares Ethereum Trust ETF recorded one of its highest inflows on November 8, with inflows nearing $86 million and total AUM exceeding $8 billion. However, this boost did not offset the outflows from Grayscale's Ethereum Trust ETF, which continues to hinder its overall momentum.

On November 8, the total inflow for spot Ethereum ETFs was $85.9 million. Source: CoinGlass

Federico Brokate, head of U.S. operations for crypto ETF issuer 21Shares, told Cointelegraph, "The liquidity of the ETH ETF has been somewhat disappointing." However, he remains optimistic, stating, "We see stable demand for Ethereum; however, we expect this demand to accelerate," adding, "As regulatory clarity around ETH as a commodity increases, institutional interest is expected to grow."

Brokate noted that the inability of ETF investors to participate in staking is a significant factor contributing to the poor performance of spot ETH ETFs. "Staking can be seen as a source of passive income for investors, so for what we expect to be early adopters from the crypto-native crowd or crypto-related individuals, they may have been sitting on the sidelines so far."

Onchain data researcher and former 21Shares analyst Tom Wan shared on X that he believes a spot Ether ETF could attract investors by promising passive income through staking, thereby competing better with spot BTC ETFs and attracting inflows.

The structure of providing staking rewards may vary depending on regulatory and operational setups. ETF issuers could charge staking rewards, effectively allowing them to offset management fees and market their products in this way.

Currently, the fees charged by ETH ETF issuers range from 0.15% to 0.25%, with Grayscale's ETHE being significantly higher at 2.5%. According to Wan, even staking 25% of managed assets could generate enough revenue to fully offset these fees. Wan stated that the prospect of a free or low-cost ETH ETF could attract institutional investors, especially appealing to retail investors.

Another possibility is that ETF issuers offer investors indirect staking rewards. Investors would not directly stake their assets but would benefit from the staking rewards generated by the ETF's pooled assets.

Wan pointed out that even moderate staking yields could have an impact. "If issuers offer 0% management fees plus about 1% yields, it would become a competitive alternative to BTC ETFs." While a 1% yield may seem trivial, he stated, "Yield could be a meaningful differentiating factor." The current staking rate for Ether is about 3.5% annual percentage yield (APY), depending on the specific staking method chosen.

Regardless of the chosen model, ETF issuers have enough flexibility to attract investors. Wan concluded, "Enabling staking rewards could be a game changer."

"A key factor hindering the potential of ETH ETFs is the lack of staking. For institutional investors who may be new to cryptocurrencies, Bitcoin is already a new asset—Ethereum is even newer. To attract inflows, ETH ETFs need a clear differentiating factor that is easy for investors to understand."

Investors still perceive Ethereum as a vague concept. Brokate stated that the widespread adoption of spot BTC ETFs is related to the branding of Bitcoin among institutional investors. "Ethereum's brand recognition is lower than Bitcoin's. Bitcoin is the flagship of the industry, and the narrative is simpler."

Allowing staking on ETH ETFs could become a powerful catalyst for adoption among both institutions and retail investors. Changes in SEC leadership would mark a significant step for the cryptocurrency industry, especially regarding the price outlook for Ether, as altcoin ETFs for crypto assets like XRP or SOL have yet to be approved.

New SEC chair cannot change everything about staking

The SEC is currently concerned that staking resembles an investment contract, where profits are generated not only from the asset itself but also through a structured process involving third-party efforts. This interpretation may require staking services to comply with securities regulations, including registration, disclosure, and investor protection.

While the crypto community hopes that the new SEC chair will adopt a more lenient approach, Goforth warns against assuming that regulation will shift quickly, even with a new, potentially crypto-friendly SEC chair at the helm.

She stated that SEC chairs often "set the tone for the commission, but they cannot unilaterally enforce policy changes." Commissioners can overturn the chair's decisions, allowing enforcement actions to continue.

Under Gensler's leadership, the SEC has already taken enforcement actions against several U.S. crypto companies offering staking services.

Some companies, such as the cryptocurrency exchange Kraken, chose to settle rather than face protracted legal disputes, agreeing to pay a $30 million fine on February 9, 2023. Other companies, such as the U.S.-based cryptocurrency exchange Coinbase, decided to take their cases to court.

Goforth stated that the SEC chair "cannot unilaterally dismiss ongoing cases." They need to convene a majority of commissioners to agree and have the enforcement department dismiss these cases. Nevertheless, Goforth indicated that the most likely route is to reach a settlement on terms favorable to the defendant's business, removing the case from the court's docket.

Goforth also noted that regardless of the SEC's stance, the Department of Justice can take criminal action under securities laws. If there are contentious cases with plaintiffs, courts can intervene without SEC approval, and even private individuals who have incurred losses through staking can file class-action lawsuits against exchanges.

Goforth stated that all the SEC can do is specify which actions can be brought to court; its analysis is not binding on the courts, and ultimately, it is up to the judge to decide what is legal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。