Recently, the explosive growth of Meme coins has surprised many investors. In particular, ACT and PNUT, two Meme coins that were listed on Binance, surged by hundreds of times, allowing many investors to achieve financial freedom overnight. The performance of Meme coins seems to always realize crazy increases amid extreme market emotions and speculative fervor. So, how can one seize the next explosive opportunity in these highly volatile Meme coin markets to achieve similar returns of hundreds or even thousands of times? This article will take you through an in-depth analysis of how to leverage Binance's listing dynamics, market sentiment, social media popularity, and other factors to uncover the next explosive Meme coin.

Market Drivers Behind Meme Coins: Liquidity, Social Media Popularity, and Monetary Policy

The explosive growth of Meme coins is not entirely due to random market fluctuations; they often ferment rapidly under specific market conditions and social sentiments, attracting capital inflows. We can understand the growth mechanism of Meme coins from the following aspects.

1. Macroeconomic Impact of Monetary Policy

The global easing of monetary policy, especially the large-scale monetary stimulus by central banks after the pandemic, has led to an increase in market liquidity. In this context, risk-seeking investors began to look for more potential high-risk assets. Meme coins, due to their low prices, low entry barriers, and potential high returns, have become a key area for capital inflows.

In a recent article from Binance, the official explained in detail the reasons behind the explosive growth of Meme coins. In short, the inflow of market funds is the key factor driving the rise of Meme coins.

The increase in money supply has not only promoted the growth of traditional assets but has also made risk assets, especially Meme coins, another option for capital seeking high returns. A large amount of capital flowing into the Meme coin market not only drives their short-term price surges but also further intensifies the speculative atmosphere in the market.

2. Participation of Retail Investors and the Role of Social Media

The rise of Meme coins is not only driven by market funds but also relies heavily on the widespread participation of retail investors and social media. A core characteristic of Meme coins is their "social nature," as these assets often generate extensive discussions on social platforms, especially on Twitter and Reddit, where the discussion heat and user sentiment can directly influence the short-term price fluctuations of the coins.

Main promoter KOL of ACT

Main promoter KOL of ACT

For example, the explosive growth of $ACT and $PNUT after their listing on Binance was largely driven by the discussion frenzy among social media KOLs. Since these projects do not possess traditional fundamental advantages, their prices are more determined by market sentiment and short-term capital movements. Therefore, the price fluctuations of Meme coins are highly dependent on market sentiment, and investors need to keep up with market dynamics and closely monitor trends on social platforms.

3. High Risk and High Return of Low Market Cap Assets

Unlike traditional mature assets, Meme coins generally have lower market capitalizations, which makes their price volatility extremely high in the short term. Low market cap assets are more likely to attract capital, and once a large amount of funds flows in, it can drive their prices to surge in a short period. However, such surges are often accompanied by rapid capital outflows, leading to the high instability of Meme coins. Therefore, despite the astonishing gains of Meme coins, they also face extremely high risks.

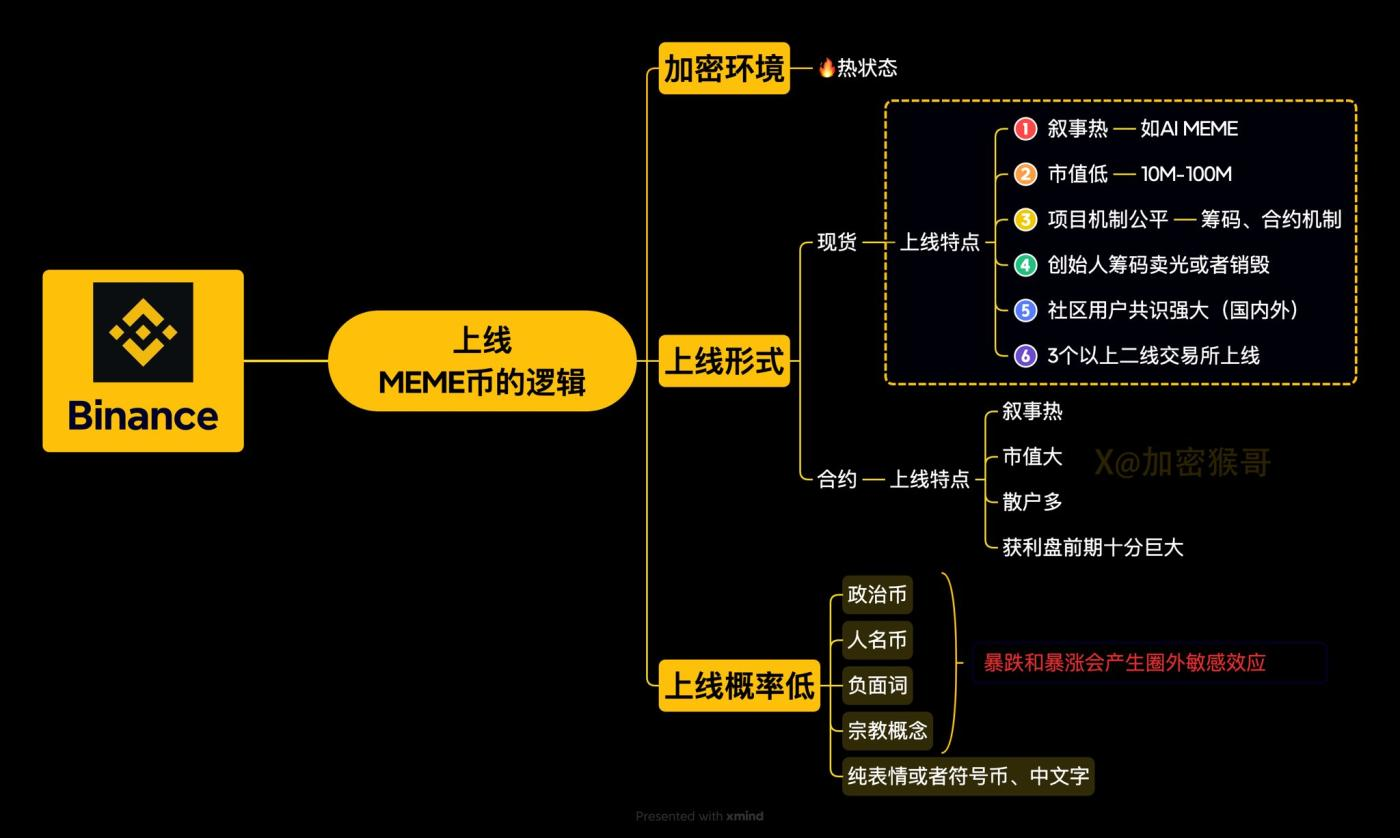

Impact of Binance Listing: The Logic from Announcement to Surge

As one of the largest cryptocurrency exchanges in the world, Binance's impact on the listing of Meme coins cannot be underestimated. The listing on Binance is not only an endorsement of the project but also a market validation of its potential. Each time Binance announces the listing of a project, it often triggers a frenzied market reaction, rapidly increasing investor attention and purchasing enthusiasm. Specifically, Binance's influence can be analyzed from the following aspects:

1. Market Reaction Triggered by Listing Announcements

According to Binance's announcements, the prices of ACT and PNUT surged 42 times and 20 times, respectively, after being announced for listing. This explosive growth not only reflects the market's recognition of Binance's liquidity and fund security but also indicates that Binance's exposure has a profound impact on Meme coins. Binance's liquidity, trading pairs, and global user base enable listed coins to quickly attract a large influx of funds, thereby driving their prices to rise rapidly.

2. Impact on Liquidity and Trading Volume

The listing on Binance not only enhances the market liquidity of Meme coins but also promotes the growth of their trading volumes. For example, $HIPPO surged 4 times within 5 minutes after being listed on Binance, significantly exceeding investors' expectations. The listing on the Binance platform provides these projects with a strong channel for capital inflow, while the platform's vast user base ensures sustained attention and investment enthusiasm for the projects.

How to Select Potential Meme Coins: Screening Criteria and Tools

1. Screening Hot Projects: Starting from Decentralized Exchanges (DEX)

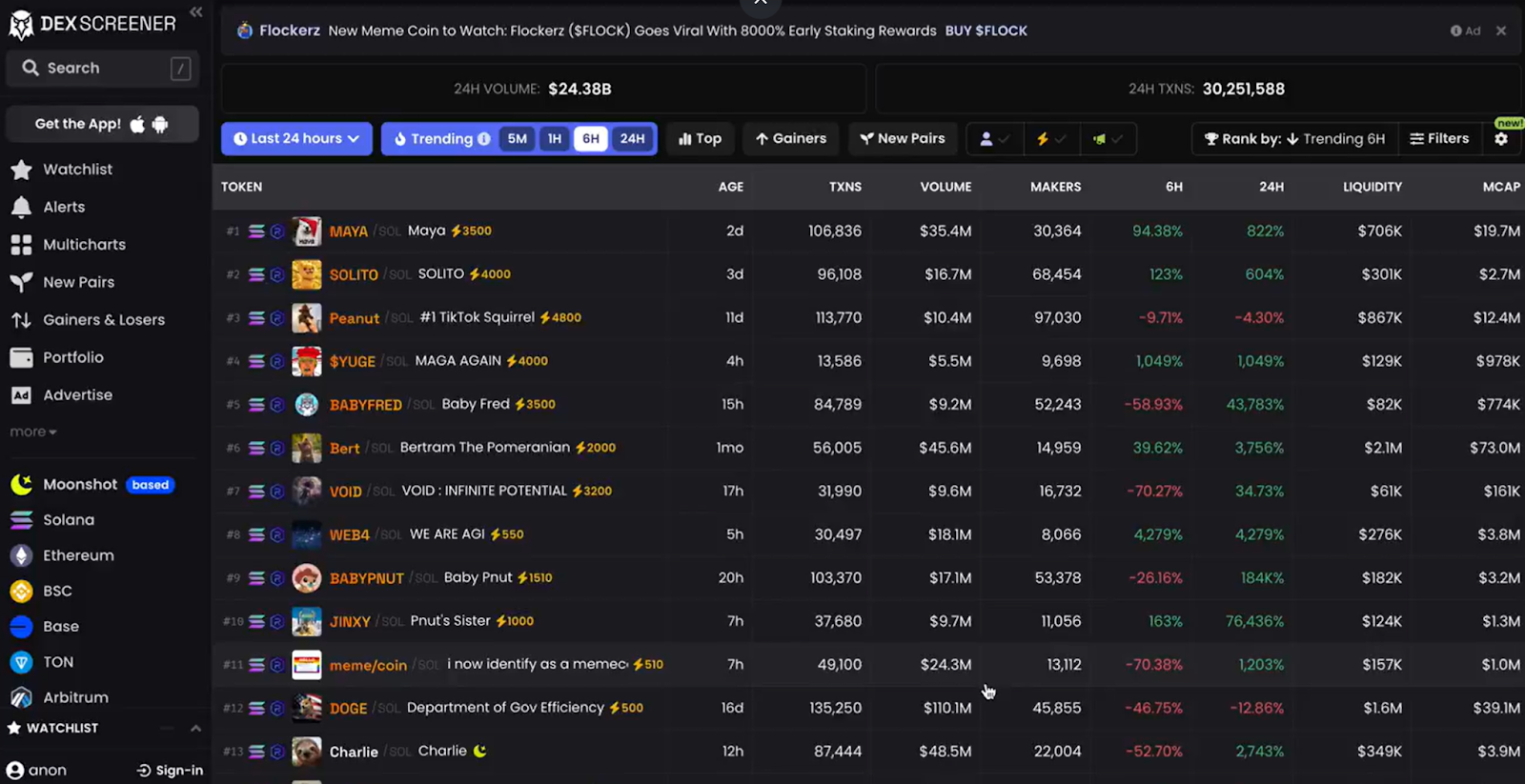

To uncover potential Meme coins, one should first focus on those currently active on decentralized exchanges (DEX).

By using tools like @dexscreener, investors can view coins that have seen significant price increases and high trading volumes within the last 24 hours. By conducting a preliminary screening of these coins, potential investment opportunities can be identified. Specific screening criteria include:

- Market cap greater than $15 million

- 24-hour trading volume greater than $5 million

- Liquidity greater than $300,000

- Listing time greater than 3 days

Tokens with a market cap below $5 million are considered too risky for the long-term prospects of Meme coins.

2. Using ToxiSolanaBot to Analyze Project Potential

For each potential project, investors can use tools like @ToxiSolanaBot for further screening.

This tool can help analyze the project's contract address, market sentiment, and historical performance, providing investors with more comprehensive data support. When using this tool, investors should pay attention to:

- Select the contract address for analysis;

- Choose the correct purchase amount and check the project's liquidity and market activity.

Through these analysis tools, investors can better assess whether a project has explosive potential.

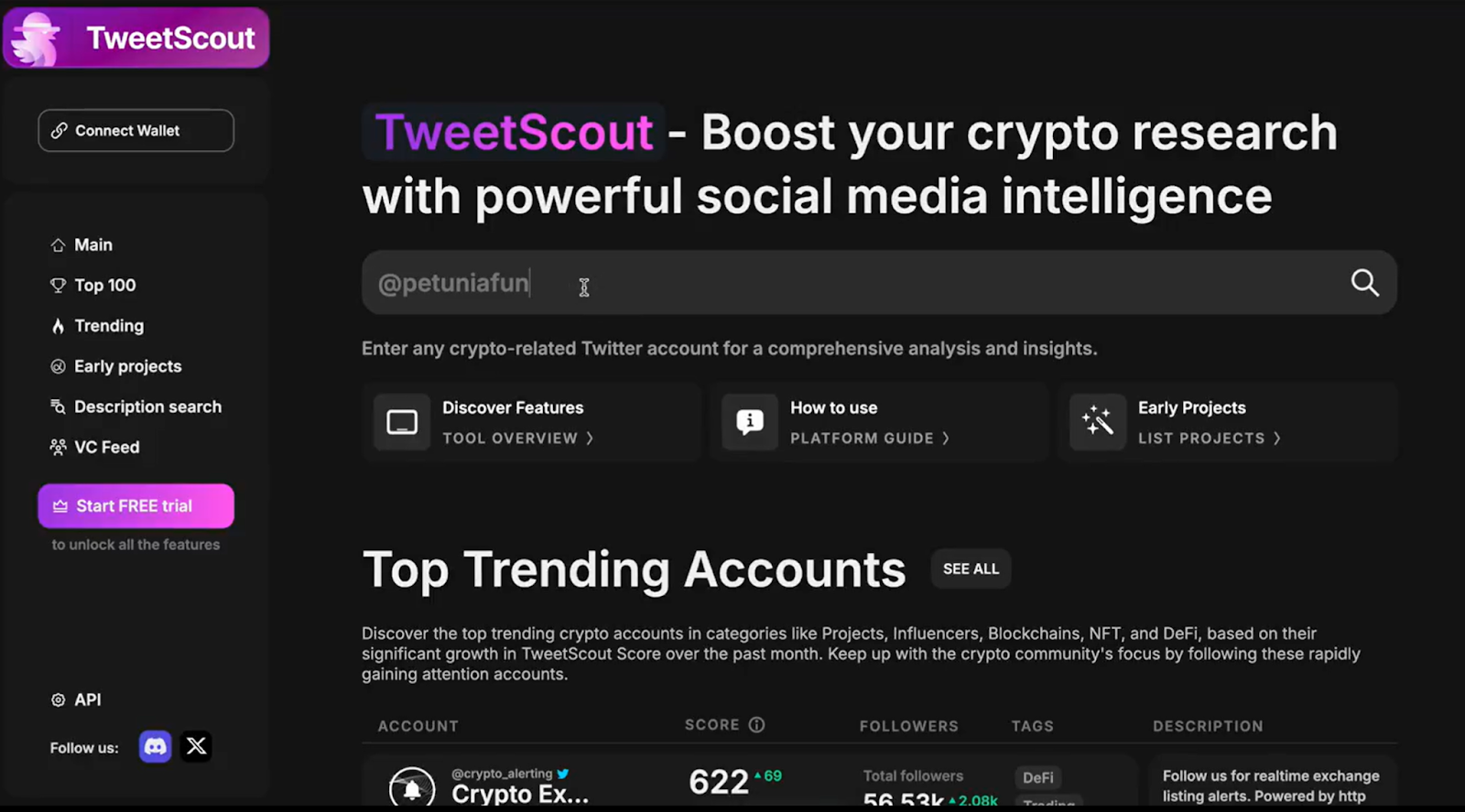

3. Social Media Popularity Analysis

Investors can also further verify a project's potential through social media. On Twitter, the discussion heat of a project often directly reflects the market's level of attention. By checking the project's official account and related discussions, investors can obtain real-time feedback about the project. Additionally, using platforms like @TweetScout_io can analyze the project's fan base and market influence, helping to assess its potential.

Mitigating Risks and Ensuring Steady Investment

Although the explosive growth of Meme coins is tempting, their high-risk nature cannot be ignored. Investors should reasonably diversify their investments before committing funds, avoiding concentrating all capital in a single project. In addition to technical analysis and social media analysis, investors need to closely monitor market dynamics, especially external factors such as policy changes and platform announcements that may affect Meme coin prices.

1. Diversify Investments to Avoid Single Risk

It is recommended that investors diversify their assets and avoid concentrating all funds in a single asset, especially in low market cap and illiquid projects. A diversified investment portfolio can include some mature projects and some potential stocks. By reasonably allocating funds, investors can ensure safety while achieving higher returns.

2. Track Market Dynamics to Seize Key Opportunities

The volatility of the Meme coin market is very high, and investors need to constantly track market dynamics, especially announcements from major exchanges and policy changes. Binance's listing announcements and the social media performance of projects can significantly impact prices. Maintaining sensitivity to the market and timely adjusting investment strategies is key to achieving success.

Conclusion: Grasping Trends and Seizing Opportunities

As a high-risk, high-return investment tool, Meme coins undoubtedly present enormous opportunities for investors due to their explosive growth potential. However, to seize the next hundredfold return project, investors must fully leverage market liquidity, social media popularity, and the listing dynamics of exchanges like Binance. By employing scientific screening methods, technical analysis, and social media heat analysis, investors can increase the probability of discovering potential projects, thereby positioning themselves favorably in this unpredictable market.

But like all high-risk investments, the speculative nature of Meme coins comes with significant risks. While pursuing high returns, investors should also ensure reasonable risk control and asset allocation to avoid substantial losses due to excessive market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。