According to Foresight News, from November 9 to November 15, 2024, there were a total of 18 investment and financing events in the cryptocurrency market, including 7 in tools and infrastructure, 3 in the DeFi sector, 2 in asset management, 2 in blockchain games and NFTs, and 4 in the Web3 sector. The total disclosed investment amount is approximately $164 million.

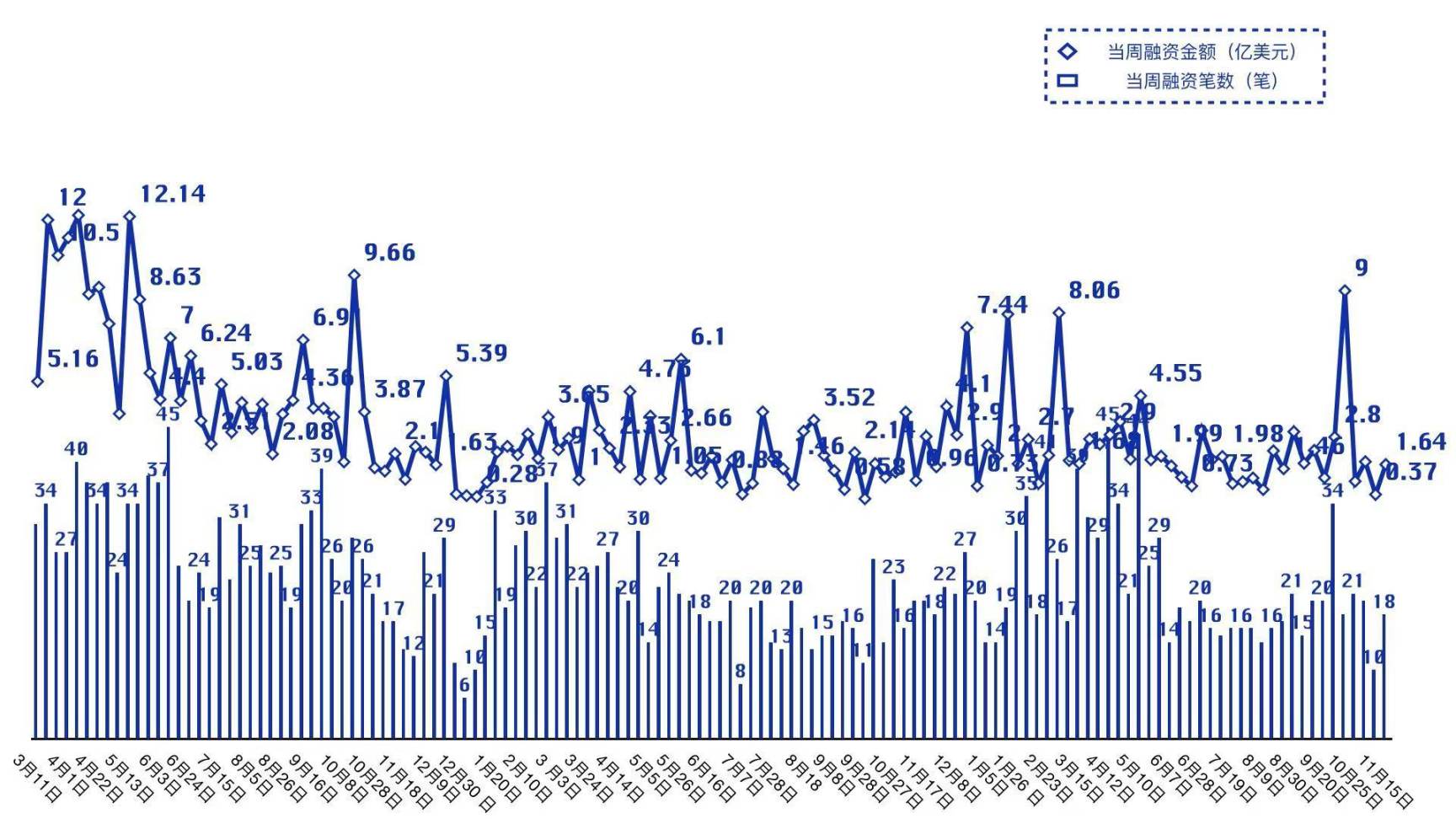

Weekly summary of disclosed financing amounts and number of financing events:

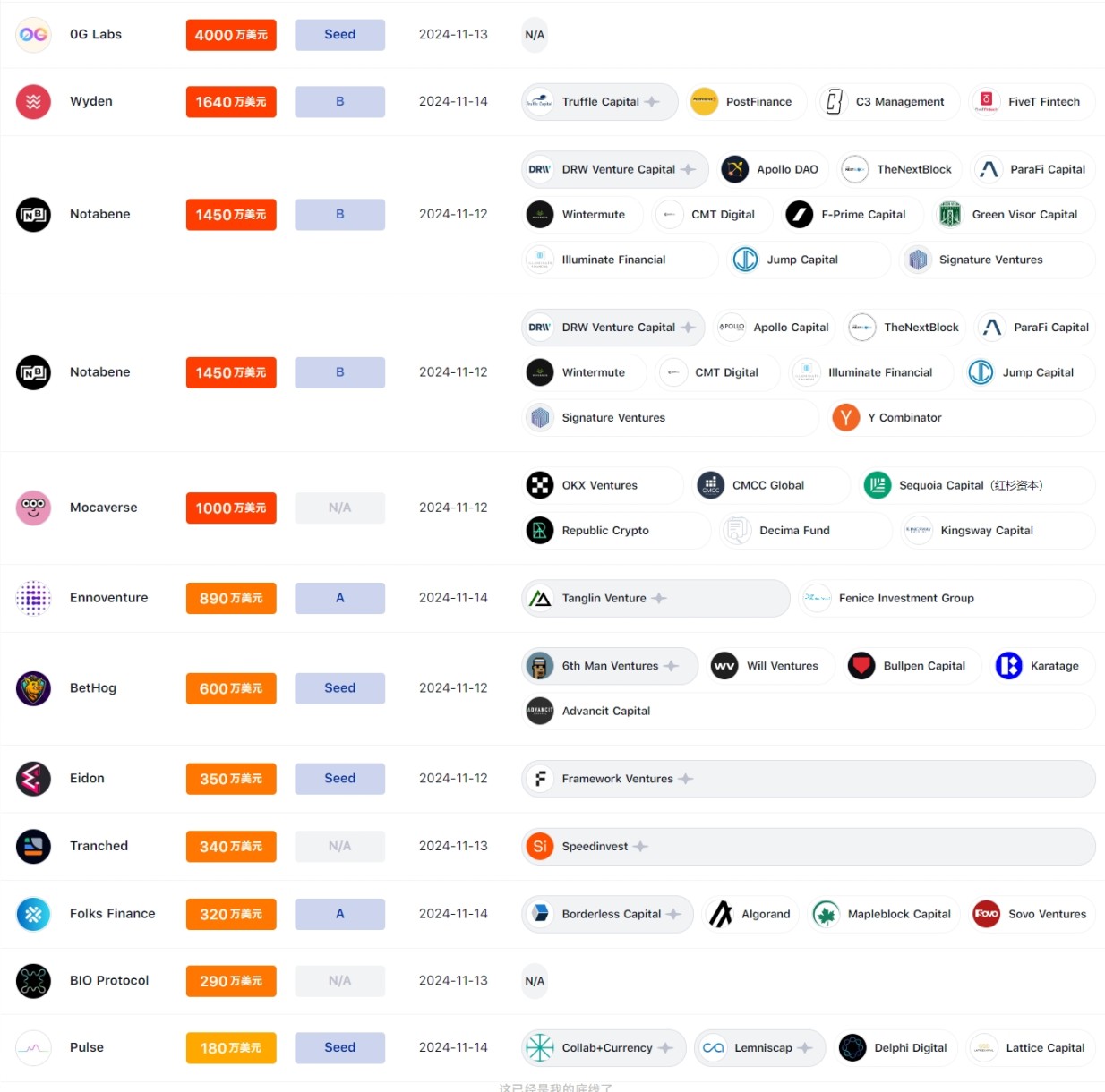

This week's investment and financing projects sorted by financing amount are shown in the following chart:

This week, there were 5 financing events of over $10 million, including Wyden, a digital asset infrastructure provider, completing a $16.4 million Series B financing led by Truffle Capital; 0G Labs completing a $40 million seed round financing and receiving a $250 million token purchase commitment; Notabene completing a $14.5 million Series B financing led by DRW Venture Capital; Mocaverse, a subsidiary of Animoca Brands, completing a $10 million financing; and StakeStone completing a $22 million financing led by Polychain Capital.

In the segmented investment and financing tracks, the tools and infrastructure sector was quite active this week, while asset management, NFTs, and blockchain games were relatively sluggish.

On the institutional side, active institutions this week included Polychain Capital and Binance Labs, primarily focusing on the tools and infrastructure sector.

Tools and Infrastructure

Brevis Network completes $7.5 million seed round financing

Brevis is a ZK co-processor or computing network designed to enhance blockchain scalability through ZK proofs. By performing complex tasks like data processing off-chain and only sending verified proofs back to the blockchain, it alleviates the blockchain's workload, increases speed, and reduces costs.

AI crypto signature solution provider Ennoventure completes $8.9 million Series A financing

Ennoventure, co-founded by Padmakumar Nair and Shalini V Nair in 2018, is an AI-based crypto signature solution provider for tracking packaged products.

0G Labs completes $40 million seed round financing and receives $250 million token purchase commitment

Zero Gravity Labs is a crypto AI startup.

Wyden completes $16.4 million Series B financing

Wyden is a digital asset infrastructure provider.

BetHog completes $6 million seed round financing

BetHog is a crypto project built by the founder of FanDuel.

TON expansion project TAC completes $6.5 million seed round financing

TAC aims to help TON and Telegram users access Ethereum Virtual Machine (EVM) applications within the app.

Pharos completes $8 million seed round financing

Pharos is a Layer 1 blockchain developer.

DeFi

Usual completes $1.5 million new round of financing

Usual is an RWA stablecoin protocol.

StakeStone completes $22 million financing

StakeStone is dedicated to building the first liquidity ETH/BTC asset standard based on a highly scalable staking network, which supports a risk-free consensus layer for various native assets.

DeFi platform Folks Finance completes $3.2 million Series A financing

Folks Finance is a DeFi platform.

Asset Management

Blockchain embedded asset financing platform Tranched completes $3.4 million financing

Tranched aims to simplify the asset financing process through blockchain technology, eliminating the structural complexity and high costs associated with securitization.

Notabene completes $14.5 million Series B financing

Notabene is a startup that helps cryptocurrency trading companies comply with anti-money laundering (AML) regulations, aiming to become the SWIFT for crypto trading. Currently, 165 companies use the platform, including some of the world's largest virtual asset service providers (VASP) such as Copper, OKX, and Ramp.

NFT and Blockchain Games

Mocaverse, a subsidiary of Animoca Brands, completes $10 million financing

Mocaverse advances its goal of accelerating Web3 mass adoption and interoperability, particularly by continuing to expand and build Mocaverse, which serves as an interoperable infrastructure layer for consumer cryptocurrency adoption, including accounts, identities, and reputation systems.

Sports GameFi project Bitball completes $5 million financing

Bitball aims to connect millions of sports fans with blockchain through immersive, data-driven gaming, merging the worlds of sports and Web3.

Web3

Pulse completes $1.8 million pre-seed financing

Pulse is a Web3 health tech startup that enables secure virtual records and personalized preventive healthcare. The Pulse wearable device tracks essential health metrics such as heart rate variability, sleep patterns, and blood oxygen levels across more than 50 activities.

BIO Protocol completes Genesis Round 2.5 community financing, raising a total of $2.9 million

BIO Protocol aims to leverage blockchain technology to transform the financing and commercialization of early scientific research.

Eidon completes $3.5 million seed round financing

Eidon is a Web3 AI company.

mbd completes $3 million pre-seed round financing

mbd has established a machine learning recommendation system that pre-trains on on-chain data, aiming to provide dynamic and relevant content and actions for each user.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。