Author: Stella L (stella@footprint.network)

In 2024, the mass adoption of blockchain games encountered an unexpected catalyst: Telegram. As major public chains rushed to establish a presence on this instant messaging platform with a vast user base, a core question emerged: Can this user acquisition strategy lead to genuine sustainable growth, or is it merely creating a fleeting data bubble?

The Rise of Telegram Games

The Telegram gaming revolution began with Notcoin's simple "tap-to-earn" mechanism, which quickly demonstrated the platform's immense potential as a Web3 entry point. This success triggered a chain reaction throughout the blockchain ecosystem.

What started as simple gaming experiments on TON has evolved into a full-blown competition. Aptos seized the opportunity, with its Telegram game Tapos pushing on-chain daily transactions to over 50 million in August. This groundbreaking achievement sparked a chain reaction, with public chains like Sui, Core, Starknet, and Matchain joining the fray, launching their own Telegram game-related projects.

This wave quickly attracted the attention of mainstream cryptocurrency exchanges. Binance was the first to list multiple Telegram-based game tokens, including Hamster Kombat and Catizen. Other exchanges followed suit, eager to get a piece of this emerging market.

Since the second half of 2024, institutional capital has also begun to flood in. Notably, Binance Labs strategically invested in Catizen game publisher Pluto Studio. Animoca Brands' mobile gaming subsidiary GAMEE (developer of WatBird) completed multiple rounds of financing in August, highlighting the growing confidence of institutional investors in Telegram game-related projects.

The Layout and Effectiveness of Major Public Chains

In 2024, several blockchain networks launched Telegram games, achieving varying degrees of success in user acquisition and retention. By analyzing specific data from Core, Sui, and Matchain, we can understand the immediate effects and long-term sustainability of this strategy.

Core: A New Attempt in the Bitcoin Ecosystem

Core blockchain is an EVM-compatible Layer 1 public chain driven by Bitcoin. At the end of September 2024, the social game TomTalk launched on Core, allowing users to earn points through chat activities within its Telegram mini-program.

According to data from Footprint Analytics, TomTalk had a significant impact on Core. As of November 12, the platform had accumulated 729,000 users (unique wallet addresses) and generated 757,000 on-chain transactions. During the peak period from October 28 to 31, the DAU (daily active users) reached 80,000, accounting for 14.3% of Core's total DAU, with daily transactions during the same period accounting for 7.6% of the total transaction volume.

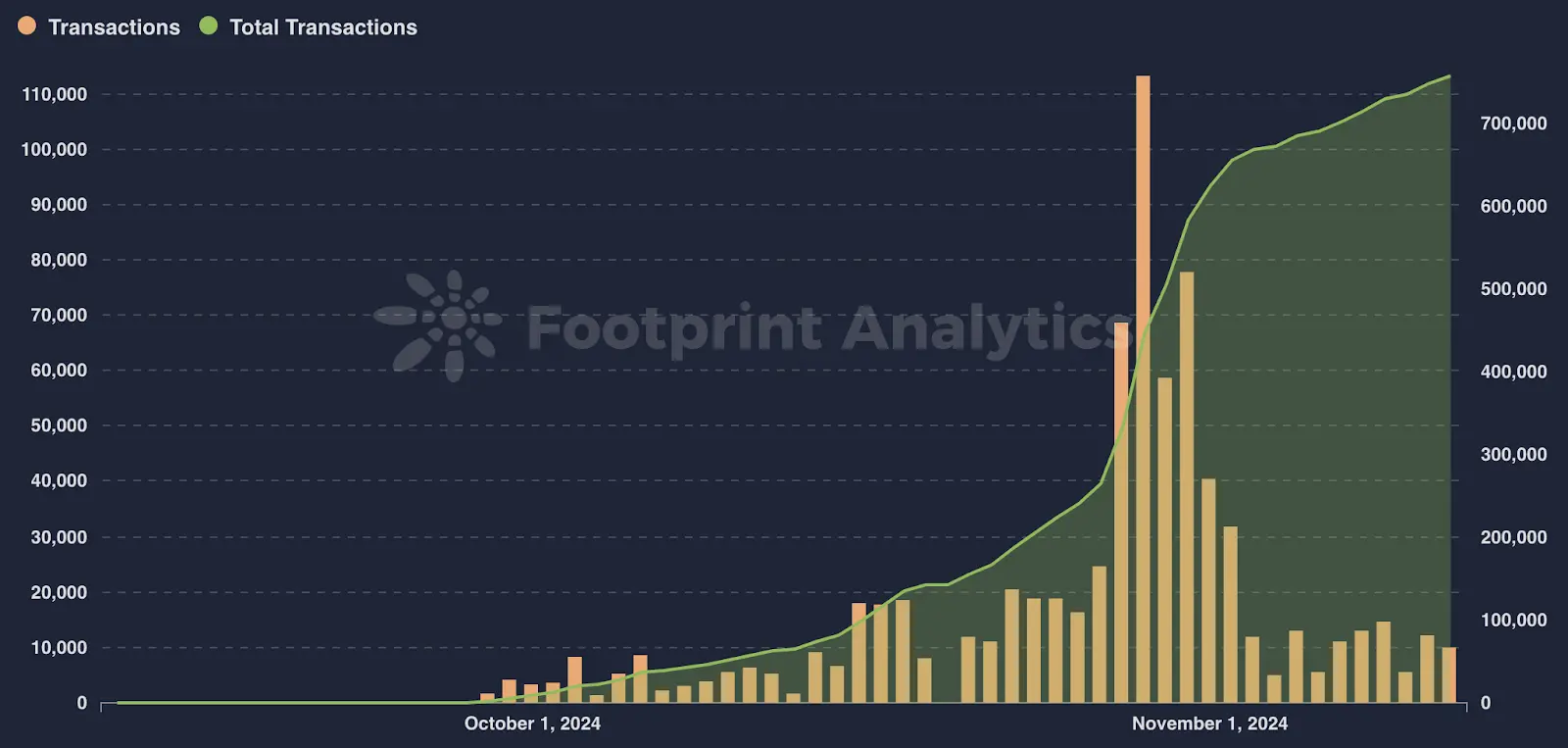

Data Source: TomTalk Daily and Cumulative Transaction Numbers

However, after experiencing an initial peak, TomTalk's data showed a clear cooling trend. By November 12, the game's daily active users stabilized at around 14,000, with daily transaction volume maintaining a similar level, and its Telegram mini-program had 16,000 monthly active users. This cooling trend highlights the challenges of maintaining user activity.

Sui: The Rising Dark Horse

Sui is a Move-based public chain known for its high-performance transaction processing. On September 25, BIRDS launched on Sui, cleverly combining Memecoin elements with GameFi features in this game.

BIRDS' data performance is impressive; as of November 12, it had attracted 751,000 unique wallet users and generated 17.7 million transactions on the platform. More impressively, BIRDS' influence within the Sui ecosystem has continued to rise, with its daily active user share increasing from 9.1% to 34.0% (as of November 12), and the transaction share rising from 4.3% to 13.5%.

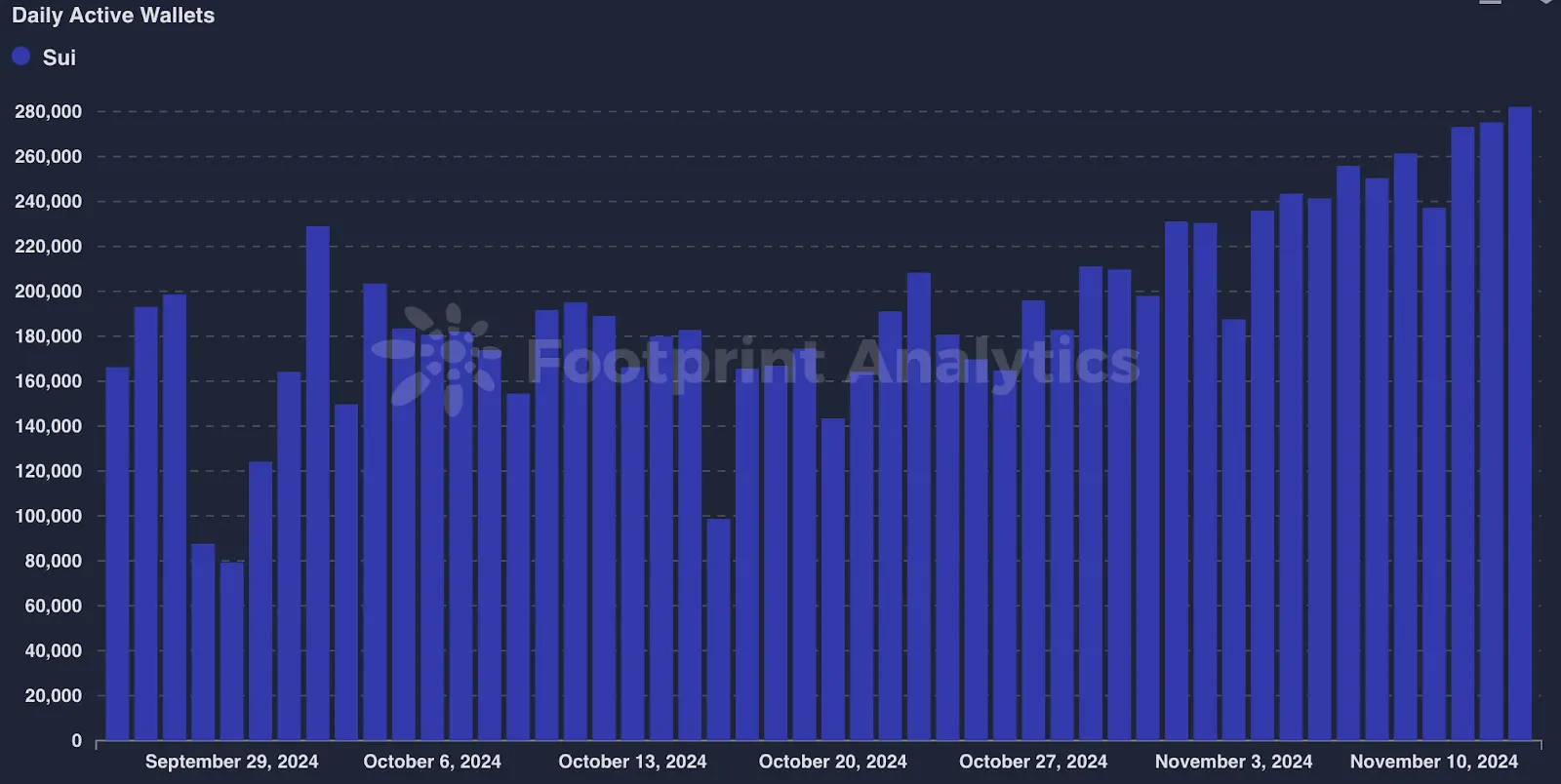

Data Source: BIRDS Daily Active User Numbers

Notably, unlike the general downward trend seen in other Telegram games after launch, BIRDS has maintained a stable upward trajectory. Its Telegram mini-program boasts 6.2 million monthly active users, while its average daily active users on the Sui chain in November reached 243,000, indicating significant user conversion potential and ample room for future growth.

Matchain: A Dramatic Rise

Matchain, a decentralized AI blockchain focused on data and identity sovereignty, has shown the most dramatic effects in Telegram game integration since its mainnet launch in August 2024.

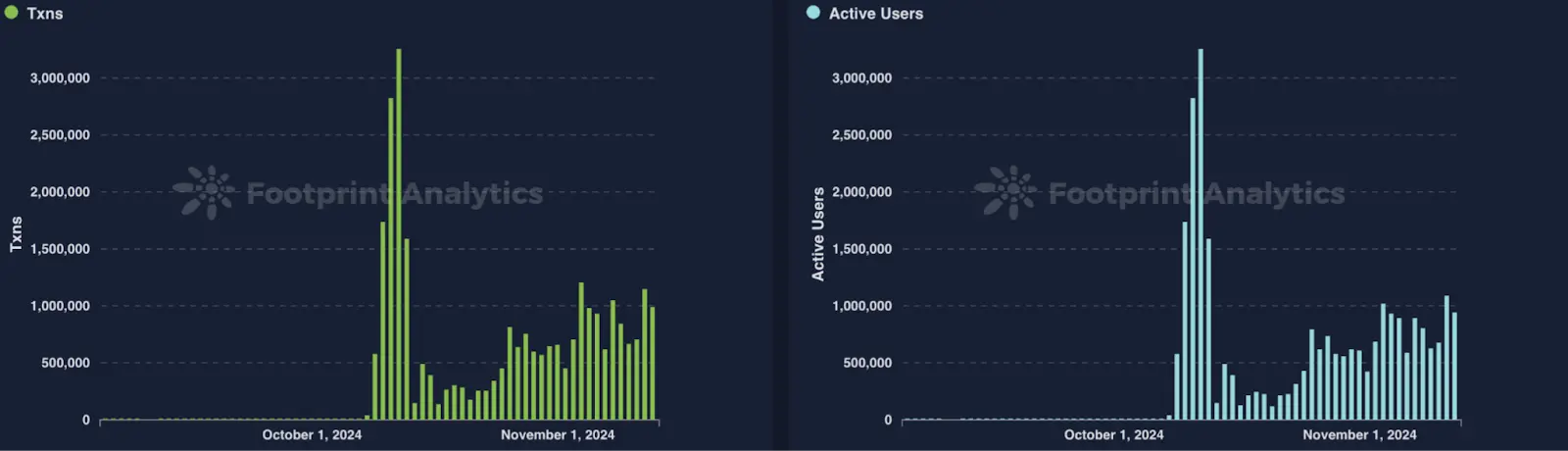

Starting from a mere 78 daily active users in September, Matchain's gaming segment surged to an average of 550,000 active users in October, driven by Telegram games like LOL, Jumper, and Digiverse, with daily transactions skyrocketing from 127 to 565,000.

From October 9 to 13, Matchain experienced its most glorious moment, with daily active users in its gaming segment surpassing 2 million, reaching a historic high of 3.3 million on October 12. Although the data subsequently declined, it stabilized at 615,000 users by the end of October and regained growth momentum in November, reaching 769,000 daily active users. This growth trajectory showcases the immense potential of Telegram-based blockchain games in user acquisition.

Data Source: Matchain Gaming Segment Data

Matchain's development trajectory may be the best example of the potential for Telegram games to drive blockchain adoption—leaping from negligible activity to maintaining hundreds of thousands of daily active users in just two months. However, the stabilization process following its rapid rise also highlights the challenges projects face in maintaining growth momentum after initial user acquisition.

Advantages and Disadvantages of Telegram Games

Telegram games demonstrate remarkable efficiency as a channel for blockchain user acquisition. Compared to traditional Web3 channels, which often exceed $10 in customer acquisition costs, and centralized exchanges that can reach $40 to $50, Telegram games have reduced acquisition costs to below $0.10. More importantly, these users generally possess a basic understanding of cryptocurrencies, making the threshold for converting them into active Web3 participants relatively low.

However, this seemingly perfect acquisition strategy still faces several key challenges. First, the current user composition is highly concentrated in Telegram's advantageous markets, such as Eastern Europe, Africa, and South Asia. Second, projects generally face significant declines in user retention rates after the initial launch period. Additionally, the large presence of studios and bot activities requires project teams to invest considerable effort to ensure the healthy and sustainable development of the ecosystem.

Future Outlook

As the early dividend period comes to an end, blockchain networks need to strategically position themselves within the Telegram ecosystem. The key to success lies in creating a viral marketing toolkit, designing sustainable growth mechanisms, establishing a comprehensive user behavior analysis system, and continuously optimizing acquisition funnels and retention strategies.

The phenomenon of Telegram games is not just a short-term trend but a paradigm shift in blockchain user acquisition models. Public chains or other types of Web3 projects that can effectively address retention issues while maintaining efficient acquisition advantages will hold a competitive edge in the next phase of Web3 mass adoption.

Author's Statement: The content of this article is for industry research and communication purposes only and does not constitute any investment advice. The market carries risks, and investments should be made with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。