Original | Odaily Planet Daily (@OdailyChina)

On November 14, stablecoin issuer Tether announced the launch of the asset tokenization platform Hadron by Tether, which aims to simplify the process of tokenizing various real-world assets (including stocks, bonds, commodities, real estate, funds, and loyalty points).

Tether claims that Hadron integrates all the technology and expertise accumulated over the past decade, providing asset tokenization services for institutions, fund managers, governments, and private companies. Odaily Planet Daily will briefly introduce its product features and impact in this article (with a little surprise at the end).

Highlights of Hadron

Hadron by Tether provides users with an intuitive platform for issuing and managing the entire lifecycle of digital tokenized assets, offering modularity, security, reliability, and a seamless user experience, including the following highlights:

- Comprehensive Compliance Framework

The RWA sector faces more compliance challenges than other blockchain sectors due to its close relationship with traditional finance. Different regulatory requirements in various countries and regions, as well as different management methods for real-world assets, pose challenges for the global circulation of asset tokenization.

Therefore, compliance is also a key focus of the Hadron platform. Hadron provides users with a comprehensive set of compliance tools, including KYC, anti-money laundering (AML), transaction monitoring, risk management, and secondary market ecosystem monitoring, covering both on-chain and centralized exchanges. A robust compliance framework helps build trust with investors and regulators, paving the way for the circulation of asset tokenization.

- Support for Multiple Real-World Asset Tokenization

In 2023, the RWA sector experienced a period of popularity, but at that time, DeFi protocols mostly chose to tokenize U.S. Treasury bonds or synthesize some assets, such as Sky (formerly Maker) and Synthetix, while there were very few attempts to tokenize other types of assets by leading players. This was due to the decline in on-chain DeFi yields, making on-chain U.S. Treasury bonds more popular, resulting in an uneven development of the RWA category and minimal benefits for real enterprises.

Now, Tether's newly launched asset tokenization platform Hadron not only supports the tokenization of ordinary assets, such as stablecoins pegged to fiat currencies or backed by commodities, stocks, bonds, and funds, but also supports the tokenization of more complex assets, such as structured products (backed by a basket of collateral), real estate, artworks, and loyalty points. With Tether's strong capabilities, this is expected to balance the development of the RWA sector and provide some nations and enterprises with opportunities for alternative financing and traditional capital markets.

- Seamless Asset Tokenization Experience with Non-Custodial Assets

The Hadron platform launched its testing on November 14, allowing users to tokenize assets in just four steps:

Registration: Users need to register and complete the KYC process to create their issuer account on Hadron;

Asset Tokenization: Connect a non-custodial wallet, select the blockchain for issuing tokenized assets and the KYC template, and set access permissions, controls, and blockchain key management before creating the first tokenized asset;

Distribution: Once created, users can invite potential clients to apply for and obtain the tokenized assets. With Hadron's KYC platform, users can use tools to conduct compliance due diligence on clients;

Issuance or Redemption: Hadron provides secure, user-friendly, and comprehensive tools to coordinate issuance, redemption, transfer, and other operations on the selected blockchain, without requiring users to have blockchain expertise.

In addition to providing a seamless and convenient asset tokenization experience, Hadron also enables users to have complete self-custody (users always retain full control and corresponding responsibility for their assets). It utilizes a very intuitive user interface to set up and configure multi-signature wallets, including hardware wallets.

Many previous RWA projects tended to adopt centralized management and operational methods, whether in asset review, asset custody, or user KYC verification. While this approach can make RWA operations smoother and more compliant with regulatory requirements, excessive centralization always poses significant risks. Hadron grants users sufficient rights and freedom in KYC, modularity, and asset custody, effectively balancing the user experience for issuers and decentralization.

Can Hadron lead RWA to prosperity?

On April 14 of this year, Tether CEO Paolo Ardoino announced on the X platform that Tether's asset tokenization platform would soon be open (exactly 7 months later) and indicated the platform's keywords: fully non-custodial, multi-chain, multi-asset types, customizable. The birth of Hadron may indeed integrate all the technology and expertise that Tether has accumulated over the past decade, while also opening the next decade for Tether.

Paolo Ardoino stated at the launch of Hadron: “We believe Hadron by Tether will significantly improve the financial industry. By leveraging all of Tether's technology (which has already issued $125 billion in USDT), we will make asset tokenization simpler, safer, and more scalable. Our goal is to create new opportunities for businesses and governments while making the digital asset space more accessible and transparent.”

Former VanEck advisor Gabor Gurbacs commented on the X platform: “By 2030, the value of tokenized assets is expected to reach approximately $10.9 trillion, with real estate, debt, and investment funds being the top three tokenized assets. Private equity, entertainment, collectibles, and data are other areas worth noting. At the same time, the Bitcoin capital market, stablecoins, and asset tokenization have the potential to lead the post-ETF world, bringing $10 trillion in inflows and changing the way a new generation invests.”

Quantum Economics analyst Alexandre Lores also commented: “Tether's Hadron will change the entire digital asset ecosystem—from Bitcoin to the tokenization of real-world assets. The era of large-scale RWA tokenization has arrived, which means a fairer and more equitable global economic competitive environment.”

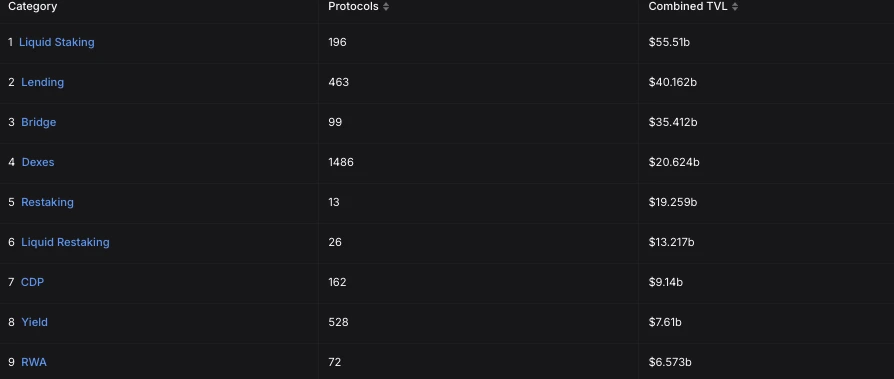

According to DefiLlama data, the current TVL of the RWA sector is $6.573 billion, which is more than 8 times lower than the $55.51 billion TVL of the LSD sector. If the RWA sector is indeed worth trillions of dollars, there is still significant growth potential from the perspective of TVL.

Tether currently holds a very important strategic position and capital volume in both the blockchain and traditional financial sectors. According to Tether's Q3 financial report, its group net profit for the third quarter of 2024 was $2.5 billion, with an annual profit of $7.7 billion and a stablecoin circulation exceeding $120 billion; in terms of reserves, Tether ranks among the top 18 holders of U.S. Treasury bonds globally, holding over $105 billion in cash and cash equivalents, with direct and indirect exposure to U.S. Treasury bonds reaching $102.5 billion.

If Tether serves as a bridge between traditional finance and the crypto world, it will have more say in this regard and truly promote the prosperity of RWA.

A Surprise

Although Hadron launched by Tether promotes the asset tokenization of the RWA sector, it also includes support for the Bitcoin ecosystem. Among the modular multi-chain options in Hadron is the Bitcoin L2, and on November 15, Paolo Ardoino specifically posted to state: “Among the many blockchain support options, Hadron has integrated the Bitcoin sidechain Liquid because we received positive feedback about Liquid from current test users (governments and institutions), especially regarding its support for crypto transactions.”

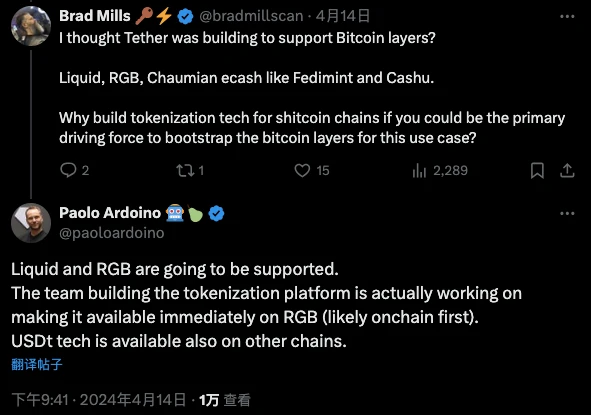

Although the Bitcoin sidechain Liquid may not be closely related to the current Bitcoin ecosystem, on April 14, when asked by users why Tether did not support the Bitcoin ecosystem but instead built tokenization technology for "garbage chains," Paolo Ardoino replied: “Liquid and RGB will soon be supported, and the team building the tokenization platform is actually working to make it available on RGB as well.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。