BTC is strong, with a market share reaching a three-and-a-half-year high.

On November 13, Bitcoin surged to $92,000, and the total market capitalization of cryptocurrencies reached $3.2 trillion, both breaking historical highs. In this round, only Bitcoin and meme coins are celebrating, while altcoins have not seen any increase.

The reasons for the lackluster performance of altcoins can be summarized as follows:

The market is not buying into the token economic models of new projects with low market cap and high fully diluted valuation, instead opting to invest in meme coins.

There have been no killer applications in this round.

The chart below shows Bitcoin's market share (BTC.D), which currently stands at 61%, a three-and-a-half-year high. Will BTC.D continue to rise? Can the aforementioned lackluster reasons be resolved in this cycle? Is there still an altcoin season? Let's take a look with WOO X Research.

Reference: TradingView

Logic for Altcoin Price Increase

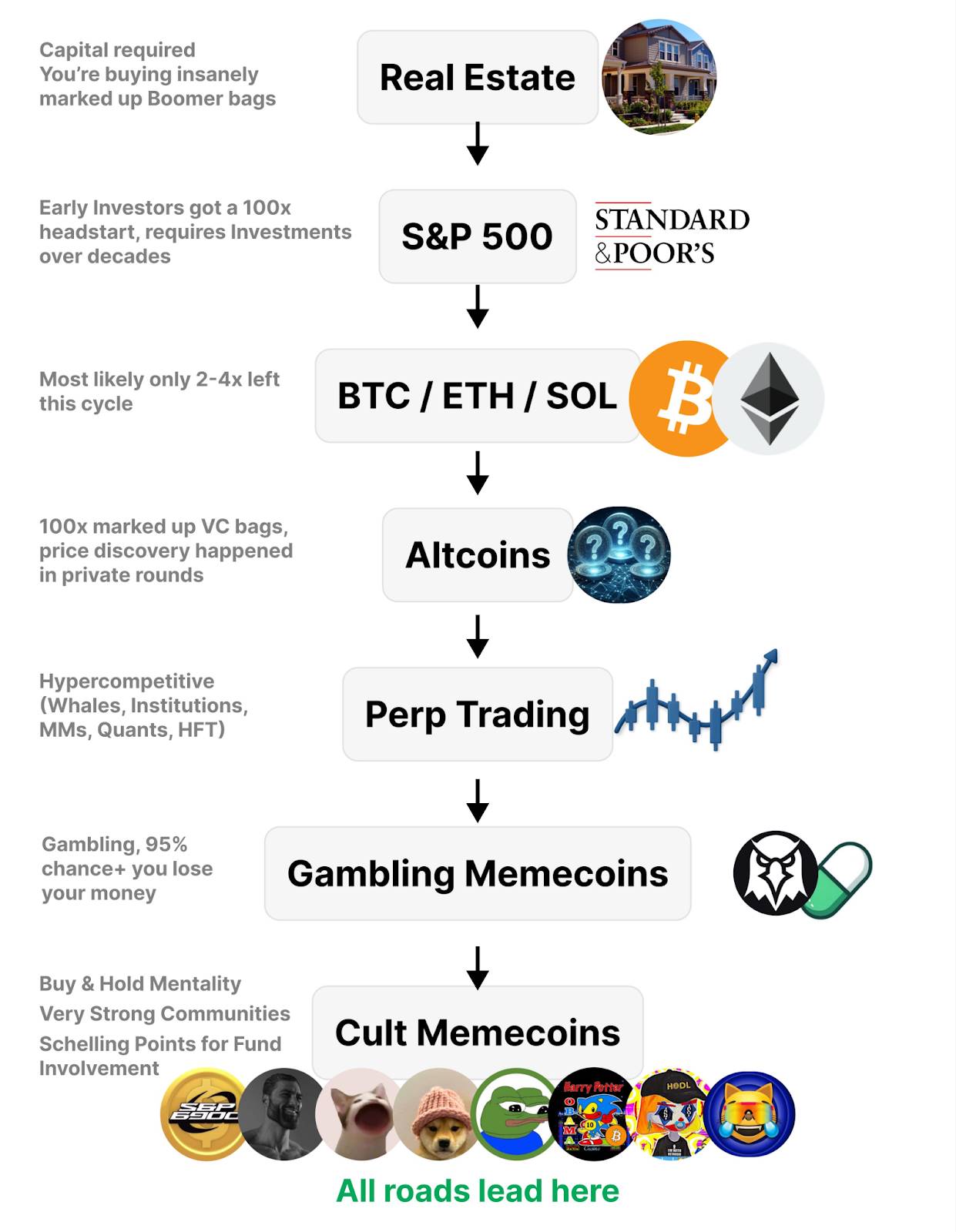

We are currently in the early stages of a rate cut cycle, which means the U.S. is releasing more liquidity into the risk market. The flow of funds has a directional path: starting from the traditional real estate market, funds overflow into the stock market, and when the stock market reaches a certain market cap, excess funds will flow into mainstream crypto assets (BTC/ETH/SOL). When the mainstream crypto assets increase in value and meet market cap standards, funds will then flow into the smaller altcoin market, thereby driving up altcoin prices.

One can imagine that these asset categories are like a series of basins, from large to small. When enough water is poured in to fill the upper basins, it will naturally overflow into the smaller basins below. This flow of funds indicates that capital will follow the characteristics of market liquidity, moving from relatively low-risk, larger assets to higher-risk, smaller assets.

Therefore, the prerequisite for altcoin price increases is: Bitcoin must rise first, until it can no longer increase, and funds are willing to move from Bitcoin to purchase altcoins.

Reference: @MustStopMurad

Current Market Cycle: The Eve of Altcoin Explosion

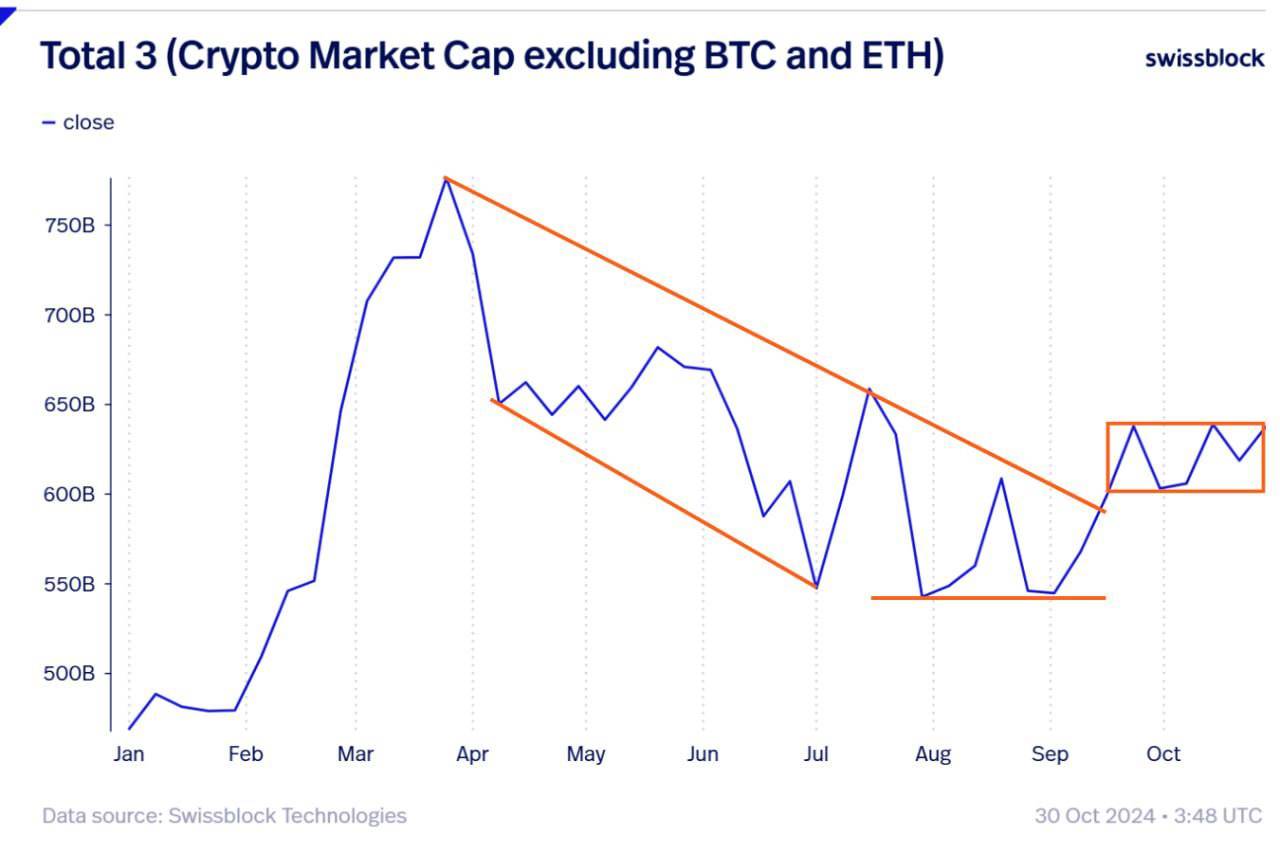

The chart below shows the change in total market capitalization of cryptocurrencies, excluding Bitcoin and Ethereum, since the beginning of this year (Total 3). This chart also represents whether altcoins can explode. It can be seen that from April to September this year, the overall market cap of altcoins showed a significant downward trend, dropping from $750 billion to $550 billion. However, starting in September, the chart shows a rebound in market cap, rising from $550 billion to the $600 to $650 billion range, breaking the downward trend, indicating that we have passed the lowest point for altcoins.

As mentioned earlier, BTC.D is currently close to 61%, a new high for this cycle and the past three and a half years. Based on past experience, the start of an altcoin season is usually preceded by a rise in Bitcoin that drains altcoins, causing BTC.D to soar. When it rises to a certain level, BTC.D will drop from the high point to the 50% to 55% range, allowing altcoins to catch up. We are currently in the cycle where BTC.D is soaring to its peak.

The current total market capitalization of cryptocurrencies is approximately $3.2 trillion. If the total market cap remains unchanged and BTC.D drops from 61% to 50%, it is expected that $320 billion of liquidity will flow into the altcoin market, which also means Total 2 (excluding Bitcoin's market cap) will grow by 28%!

(Calculation formula: [3.2T(61-50%)] / [3.2T*(1-61%)] = 28%)

Future Outlook from a Financing Perspective: Focus on DeFi and Applications

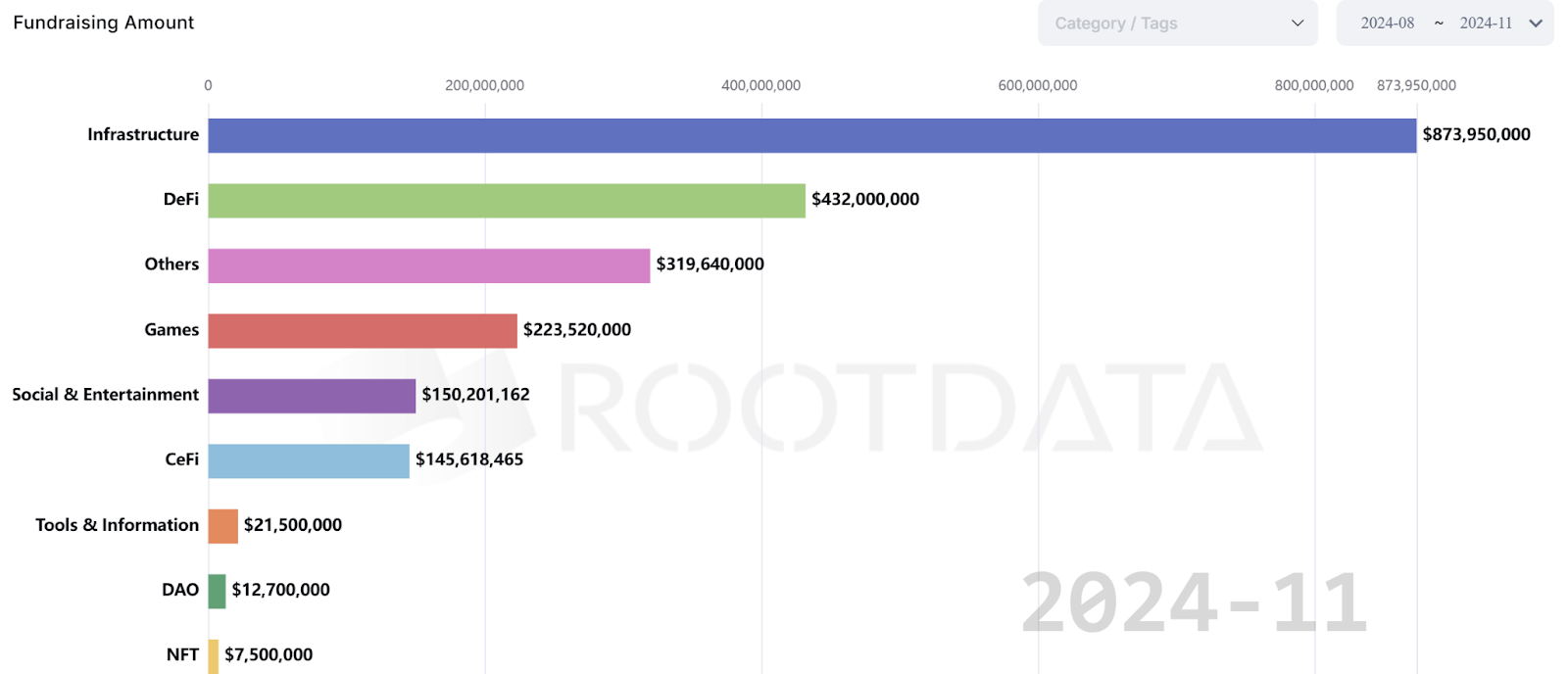

We have just assessed the current market position based on various market cap data, while the future outlook needs to consider the current financing situation. Financing represents confidence in the crypto market for the next 6 to 12 months and is a leading indicator of the development of altcoins in this cycle.

In the past three months, financing amounts have centered around infrastructure, with a total of $870 million raised. Infrastructure is a key track in the crypto market's financing landscape, as blockchain is still in its early development stage, and investors are keen to secure positions in building infrastructure. The second and third tracks to focus on are DeFi and others (usually referring to application DApps), with the former raising a total of $430 million and the latter $310 million, significantly outpacing other tracks.

The essence of financing is to invest in early potential projects. While many criticize the poor price performance of altcoins, investment institutions are beginning to position themselves in early DeFi and application projects, expecting a new wave of explosion in 2025.

Reference: Rootdata

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。