Author: Chainalysis

Translated by: Felix, PANews

In recent years, cryptocurrency has become a mainstream asset class, with institutional investment being a factor driving global adoption of cryptocurrencies. In 2024, several notable developments solidified the position of cryptocurrencies in traditional finance (TradFi). Institutions like BlackRock, Fidelity, and Grayscale have launched Bitcoin and Ethereum ETPs, providing a more accessible channel for retail and institutional investors to acquire these digital assets. These financial products have shifted attention towards understanding the investment value of cryptocurrencies compared to traditional securities.

Additionally, the tokenization of real-world assets (such as bonds and real estate) is becoming increasingly popular, enhancing liquidity and accessibility in financial markets. Siemens issued a $330 million digital bond, indicating that traditional financial institutions (FIs) are adopting blockchain to improve operational efficiency. While many similar institutions have begun incorporating crypto technology into their service offerings, others remain in the evaluation phase.

This article outlines considerations for the launch of cryptocurrency products, enabling financial institutions to assess market opportunities while addressing regulatory and compliance requirements.

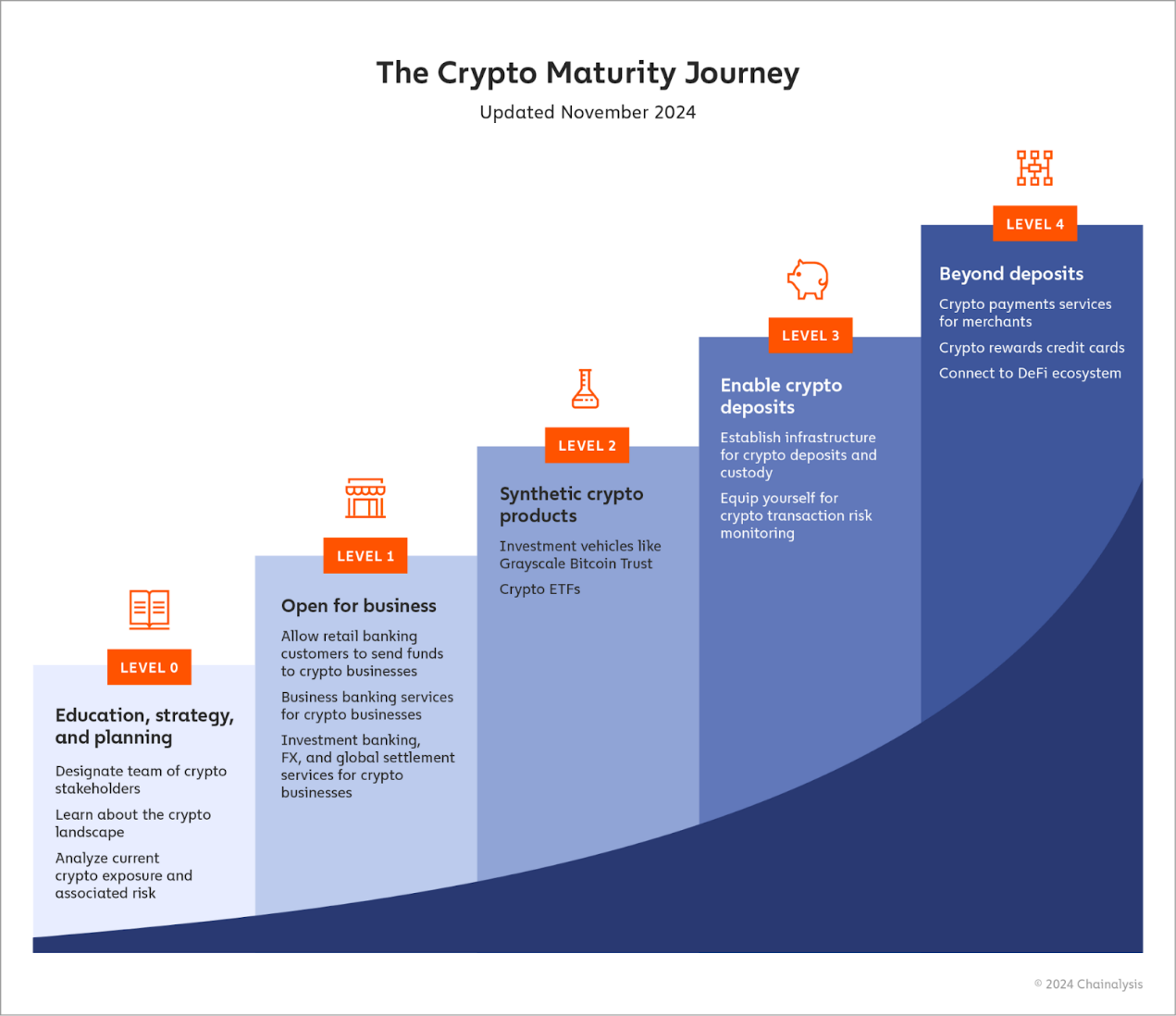

This article explores five typical levels of cryptocurrency adoption by financial institutions:

- Level 0: Education, Strategy, and Planning

- Level 1: Open for Business

- Level 2: Synthetic Cryptocurrency Products

- Level 3: Enabling Cryptocurrency Deposits

- Level 4: Complex Products, DeFi, etc.

Level 0: Education, Strategy, and Planning

Considering entry into the crypto space typically begins with identifying key stakeholders across multiple functions and appointing a leader for this initiative. This person may be hired from the crypto industry, although external recruitment can wait until the business is open, at which point the enterprise is exploring how to support cryptocurrencies or launch crypto initiatives. Generally, the designated stakeholders can be divided into two categories:

Those directly dealing with cryptocurrencies or crypto businesses; such as investment bankers, commercial bankers, traders, corporate lenders, and wealth managers.

Corporate risk professionals; who will determine which crypto products are viable, including specialists focused on market risk, KYC, anti-money laundering/counter-terrorism financing (AML/CFT), sanctions, financial crime and fraud, and compliance.

The above is just a sample, but these two groups will be the largest participants in launching any crypto products. However, when these products become a reality, they may require coordination and support across the entire company, as well as executive backing and involvement.

Once the initial crypto team is established, they should come together to figure out how to enter the crypto space in a way that aligns with the institution's risk appetite and identify the learning gaps that must be filled to properly assess the risks of any crypto opportunity, including any compliance risks. This part includes training the team to use blockchain analysis tools.

Banks at Level 0 can also start from their current cryptocurrency exposure and measure the associated risks. Given the current level of adoption, many banks have some financial connection to the cryptocurrency industry, whether through retail banking programs, multinational financial services, or corporate lending programs. In this process, banks may need to understand the specific crypto businesses they or their clients interact with and consider using industry intelligence tools to screen them.

Finally, any financial institution interested in entering the crypto space should start by learning as much as possible about the industry. There are many resources available.

- Educational content: Industry leaders regularly publish content that can help institutions better understand the opportunities and risks in the crypto ecosystem.

- Social media: The crypto industry is one of the most active sectors on social media, with Crypto X being a focal point. For example, Vitalik regularly shares his views on the latest industry developments, along with a host of insightful online journalists, commentators, and amateur investigators.

- Community: The crypto community can also engage in extensive real-time dialogue, as almost every project has its own Discord or Telegram channel for users to gather and chat. In an active channel, an hour can equate to several hours of research. Additionally, these chats often provide opportunities for face-to-face meetings and networking.

- Personalized consulting: You can schedule appointments with experts to learn how to better utilize these tools and gain more industry insights.

Level 1: Open for Business

Once financial institutions have designated their key stakeholders, educated them about the crypto ecosystem, and established their risk appetite and compliance procedures, they can begin to consider their customers. The first step is to start supporting crypto businesses and interacting with them, just as they would with any other business.

In retail banking, this means allowing customers to transact with crypto businesses that align with their risk preferences. Historically, financial institutions have struggled to accurately assess retail banking operations.

The lack of a standardized regulatory framework, reliable data sources, and transparency in crypto market activities has led to reduced risk exposure for customers and other crypto business counterparties, posing challenges for effective risk assessment. However, with tools like crypto compliance solutions, many banks have successfully modified their processes to accurately assess the risks of individual crypto businesses and expand their exposure to the industry in a secure and regulated manner.

Crypto-friendly banks can also begin accepting cryptocurrency businesses as clients. Notably, BankProl (formerly Provident Bank) is one of the oldest banks in the U.S. and now offers services specifically for crypto businesses, including dollar-denominated accounts and conversions from cryptocurrency to fiat. Banks like AllyBank and Monzo also allow customers to connect their accounts with external cryptocurrency exchanges, reducing friction between cryptocurrencies and TradFi, making it easier for users to manage their crypto alongside traditional assets.

Banks can offer more services to crypto clients. For instance, in 2018, JP Morgan Chase and Goldman Sachs advised Coinbase on going public through a direct listing. Recently, Coinbase sought consulting services from mergers and acquisitions expert Architect Partners to acquire the derivatives exchange FairX, following Architect's merger with crypto investment bank Emergent. Many crypto businesses have now evolved into global operations and require foreign exchange (FX) services, as well as more robust global settlement mechanisms.

Architect's acquisition of Emergent highlights another key need: the crypto expertise required to enter the crypto space. Fortunately, this can be achieved through targeted hiring rather than full acquisitions. Building one or more digital asset teams means recruiting experienced crypto experts in key areas such as compliance, security, and other specific services the company wishes to offer.

Level 2: Synthetic Cryptocurrency Products

Once banks become accustomed to working with crypto businesses, they may wish to help retail and institutional clients access the crypto market. However, this does not mean they must accept cryptocurrency deposits or hold cryptocurrencies on behalf of clients. Instead, financial institutions can offer synthetic investment products based on cryptocurrencies, allowing clients to gain some upside exposure to cryptocurrencies without actually accepting cryptocurrency deposits.

In 2024, Bitcoin ETPs became a groundbreaking tool for providing exposure to cryptocurrencies. Among the most prominent ETPs are BlackRock's iShares Bitcoin Trust (lBlT) and Fidelity's Wise Origin Bitcoin ETP (FBTC), both of which hold Bitcoin. Similarly, Ethereum ETPs have also gained traction. Major funds like VanEck and ArkInvest launched Ethereum ETPs in 2024, allowing investors to indirectly hold Ether, the native token of the Ethereum network. Given the critical role of Ethereum and smart contracts in DeFi, these ETPs provide a direct way to invest in blockchain development.

Looking ahead, ETPs may also emerge on other blockchains like Solana. While ETPs on Solana have yet to be approved, investors can already gain exposure through products like Grayscale's SolanaTrust (GSOL). As the Solana blockchain ecosystem continues to expand, it is likely that more ETPs will emerge to meet the growing demand from investors.

Level 3: Enabling Cryptocurrency Deposits

At Level 3, banks allow customers direct access to the crypto market, permitting deposits of digital assets and potentially even holding these assets on their behalf. In 2024, while only a few traditional financial institutions have taken this step, the growing interest from retail and institutional clients is driving more banks to support cryptocurrency deposits.

Similarly, New York Bank did not build trading monitoring tools from scratch but integrated Chainalysis software, using our product suite for real-time transaction monitoring to view real-time risk information on crypto companies that clients may interact with and investigate suspicious activities. This enables faster rollout of crypto solutions with fewer upfront resources while leveraging crypto-native expertise.

Fortunately, financial institutions are not exploring this space alone. Collaborating with crypto-native companies allows banks to outsource the technical complexities of holding digital assets. BNY Mellon launched its own digital asset custody solution in 2022. BNY Mellon did not build the entire platform itself but partnered with digital asset security company Fireblocks to obtain the infrastructure they needed.

Level 4: Complex Products, DeFi, etc.

In terms of cryptocurrency adoption, few financial institutions offer products beyond accepting deposits, but that does not mean it is unheard of. For example, Fidelity has expanded its custody services to allow institutional clients to pledge Bitcoin as collateral in DeFi-based loans, while SEBA Bank continues to collaborate with DeFi-native companies like DeFi Technologies, which may be the fastest-growing and most exciting area in cryptocurrency.

Payments are another area where cryptocurrency adoption is advancing. Visa continues to lead in this space, recently expanding its stablecoin settlement capabilities to allow USDC transactions with merchant acquirers. Similarly, PMC's IP Coin continues to support commercial transaction payments, further integrating blockchain into traditional banking.

Conclusion

As cryptocurrencies increasingly become mainstream, banks are recognizing the ways they can assist clients while driving revenue and attempting to incorporate them into broader strategies. While it may seem daunting at first glance, banks can adopt cryptocurrencies in a structured, incremental manner, allowing them to test and refine their products at each step.

The key is to identify the right types of products and services to build at each step; the inherent transparency of cryptocurrencies makes this easier. With the right tools, financial institutions can interact with blockchain-based transaction data alongside their proprietary records, observing how funds flow between different types of wallets and services, and using this data to inform business decisions, determining which crypto services best suit their desired client base. From there, it’s about hiring the right talent or partnering with the right crypto-native firms to build the necessary infrastructure and compliance tools for new cryptocurrency products.

Related reading: Japanese listed company Remixpoint acquires $5.27 million in crypto assets after its exchange was hacked and sold to SBI

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。