When an indicator becomes a target, it is no longer a good indicator.

Author: Metaquant

Compiled by: Deep Tide TechFlow

In this cycle, not everyone will succeed.

You need to change your mindset and step outside the conventional thinking framework. The ranking of the Coinbase app cannot tell you when the market peak will arrive.

Start thinking from different perspectives.

“When an indicator becomes a target, it is no longer a good indicator.”

In other words, when we set a specific goal, people often pursue that goal blindly, neglecting other equally important factors.

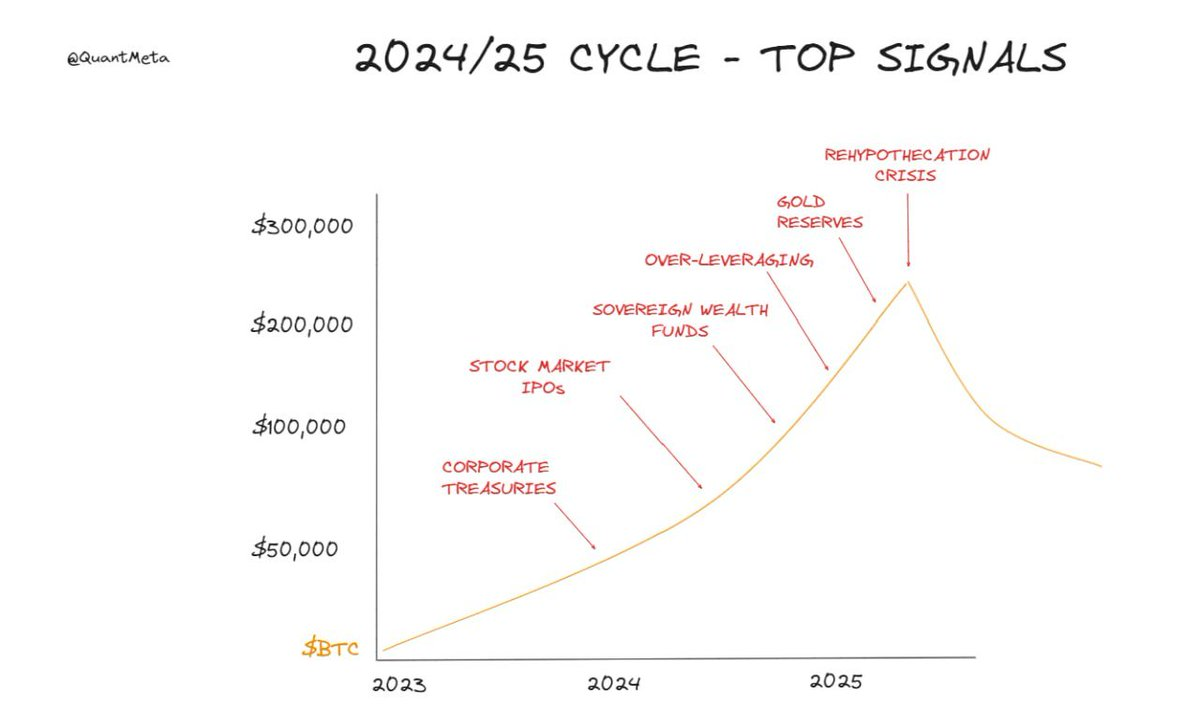

Additionally, I want to say that most of the peak signals mentioned this time on CT may no longer apply.

The obvious peak signals from 2017 were no longer apparent in 2021, and it will be the same in 2024-25.

We are entering a rapid growth phase of cryptocurrency adoption, where now all retailers understand cryptocurrency—some heard about it in 2017, and by 2021 almost everyone had heard of it. Do not mistake signs of adoption for peak signals. Do not let past traumas affect your judgment.

Another shift to note is the change in influence—companies like BlackRock now control Bitcoin. They are major ETF providers and hold shares in each other.

Therefore, they can now influence the market sentiment of BTC. They also control many media platforms and can guide public opinion at will.

In other words, if this market rally is primarily driven by institutional investors, then traditional retail indicators are no longer as important. The key indicators of this cycle will come from those who have not yet entered the market. Yes, it may be those retail investors who have not yet been exposed to cryptocurrency—“late majority” and “laggards”—but you need to think from a more macro perspective.

Sovereign Wealth Funds

Imagine that countries with sovereign wealth funds begin to diversify their investments into Bitcoin. Some countries are already investing in stocks, so this scenario is possible.

• Saudi Arabia - $400 billion

• Abu Dhabi - $800 billion

• China - $1 trillion

• Norway - $1 trillion

• Australia - $150 billion

• Qatar - $300 billion

• Singapore - $500 billion

Corporate Finance

In 2021, we saw Tesla purchase Bitcoin, and recently Reddit disclosed part of its cryptocurrency holdings. This trend is just beginning. When you see more and more companies diversifying their assets into cryptocurrency daily, it may be time to consider reducing risk.

Stock Market IPOs

Coinbase's IPO in 2021 was the first significant cryptocurrency company to go public. This time, we may see dozens of cryptocurrency companies go public, and one of these listings may mark the market peak.

Over-Leveraging

In the final stages of a bull market, large hedge funds, companies, and even small countries may over-leverage, ultimately suffering losses, which could be another scenario we see in this cycle.

Rehypothecation Crisis

The next collapse similar to Luna may stem from the rehypothecation space and could trigger a bear market. It seems many people overlook the significant impact that de-pegging events or liquidation events could have in this area.

Gold Reserves

The ultimate super peak signal may be when governments diversify a portion of their gold reserves into Bitcoin—referred to as “digital gold.”

Some Additional Minor Signals

Labor Shortages in Low-Income Countries

Another significant signal is the labor shortage in low-income countries, as these workers earn $300 to $600 a month by mapping roads through hivemapper or other DePIN projects, which is higher than their usual wages. In the last cycle, Axie and StepN had this phenomenon on a small scale, and this time it may occur on a larger scale.

Las Vegas Sphere

In 2021, Times Square was filled with various low-quality meme coin advertisements. In this cycle, cryptocurrency ads playing continuously for weeks on the Las Vegas Sphere will become a similar phenomenon.

Funding Rounds

A relatively reliable signal is to observe the flow of venture capital funding. When funding rounds surge, potentially exceeding traditional financial investments, this may be an indicator to consider exiting the market.

“Financial markets are often unpredictable. Therefore, we must be prepared for different scenarios… The idea that you can accurately predict future developments contradicts the way I observe the market.” — George Soros.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。