When market makers sell out-of-the-money call options, they hedge their short delta risk by buying stocks.

Author: Jay

Translation: Deep Tide TechFlow

Kenny G Wins Again

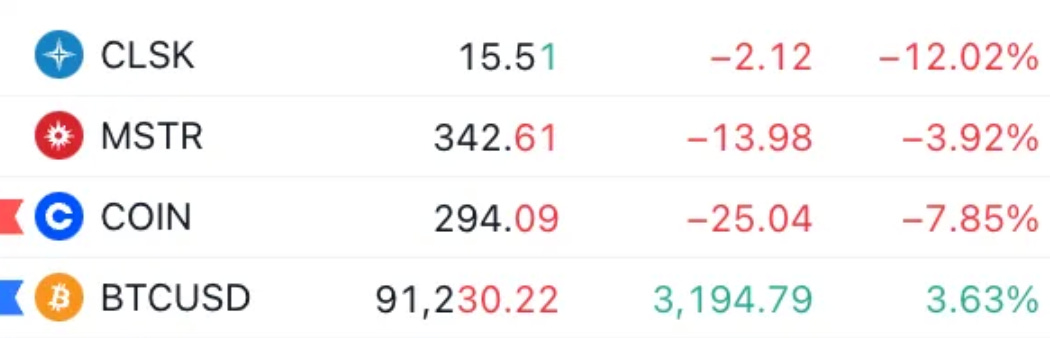

So, why are cryptocurrency stocks performing poorly?

I will explain how the options market affects the fundamental dynamics of the underlying stock prices.

One important factor is the upcoming monthly options expiration (mopex), which will occur this Friday, November 17—specific dynamics include:

Overly high expectations for price volatility

Market makers unwinding their hedges

I will use Coinbase as an example, but these factors apply to most cryptocurrency stocks.

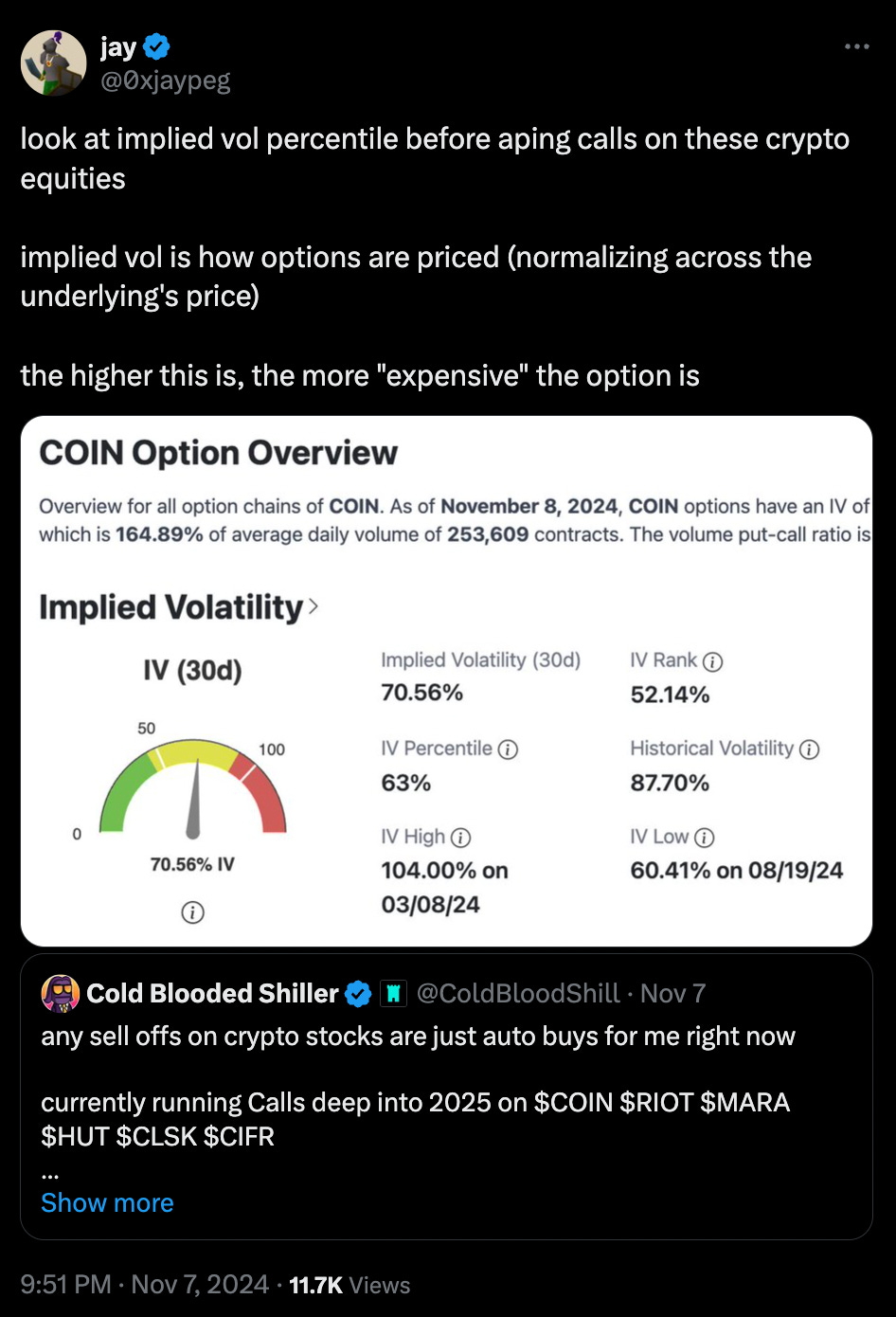

I previously mentioned that after Trump's victory, due to the dynamics I am about to describe, you need to check the implied volatility before considering buying call options.

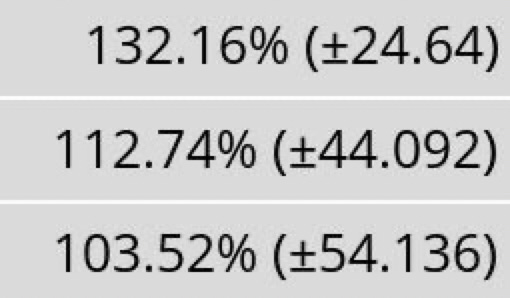

Here is the implied volatility data for Coinbase expiring on November 15, 22, and 29.

A volatility of 132% means that, with a 95% probability, the expected daily price movement of the underlying asset is ±16.62%. Such expectations seem very high.

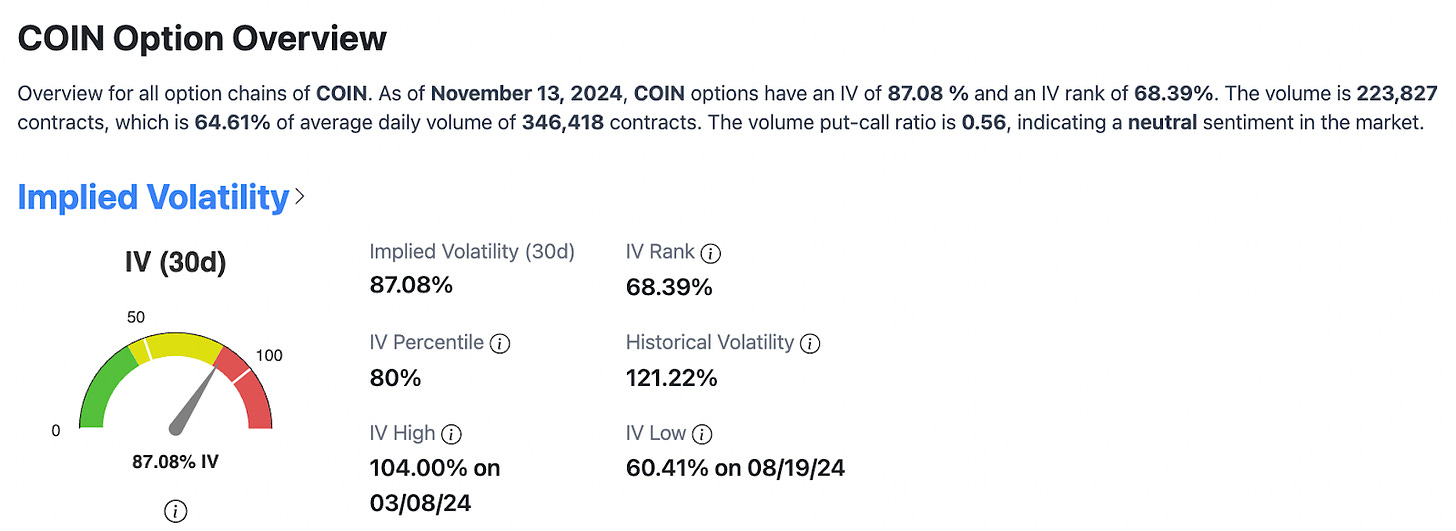

The implied volatility percentile over the past 30 days reached 80%. This means that in the next 30 days, this implied volatility (or expectation of Coinbase rising) is higher than 80% of historical periods. This seems unusually high without a quarterly earnings call.

So, what happens when market expectations are this high? What actions do market makers take at this time?

When market makers sell out-of-the-money call options, they hedge their short delta risk by buying stocks.

As the expiration date approaches, the delta of these out-of-the-money call options decreases, so market makers will sell stocks to avoid directional risk.

As we get closer to November 15, the delta loss of the out-of-the-money call options accelerates (assuming other conditions remain constant).

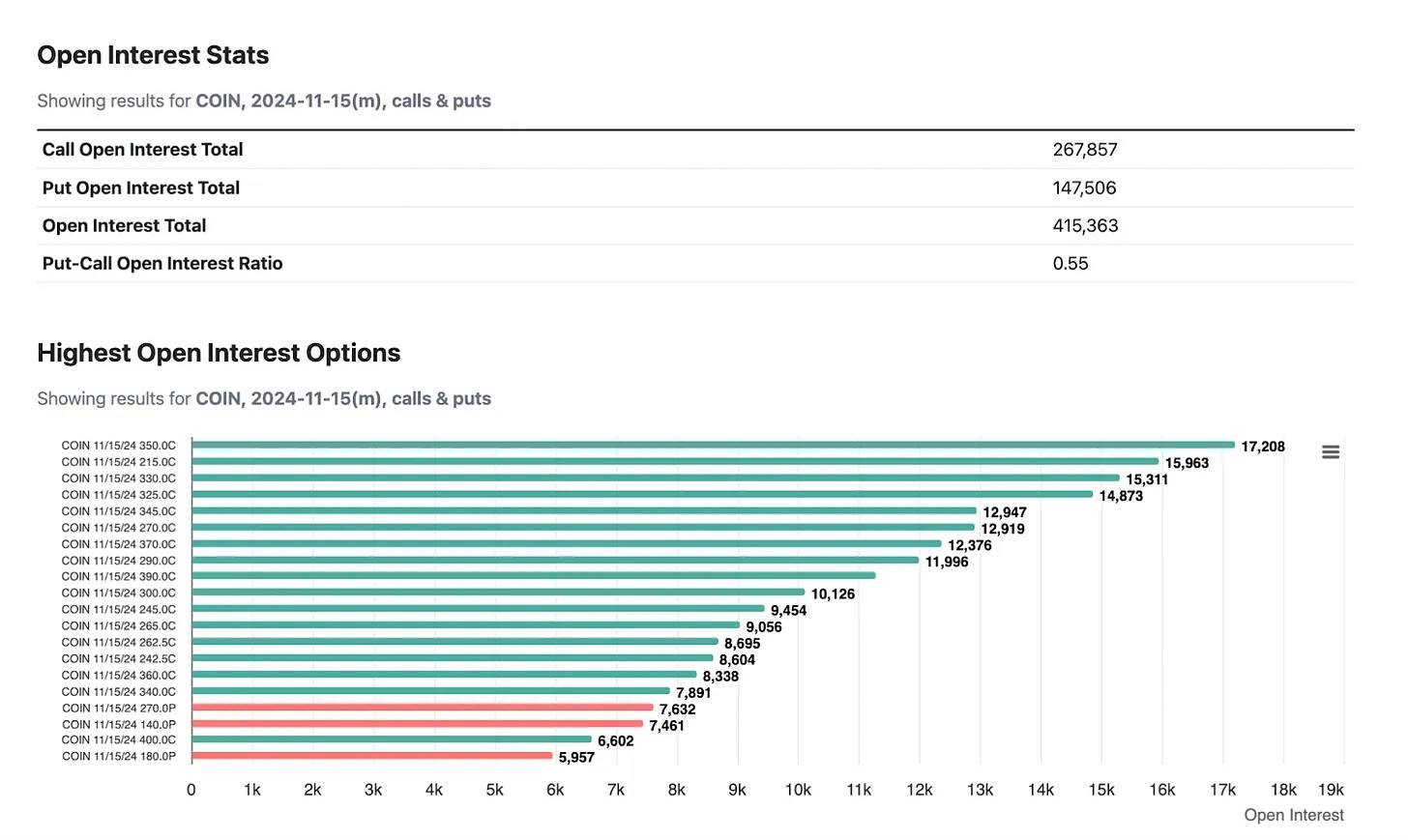

Observing the open interest in options, there is a clear bias towards out-of-the-money call options (with almost no put options visible on the chart).

As the expiration date approaches, the directional volatility in the market intensifies due to the reflexive effect of market makers' hedging actions. As a result, market makers sell stocks more aggressively (unless other entities are buying Coinbase more actively).

At the same time, as investors take profits (closing call options, market makers selling the hedged stocks), this cycle continues to strengthen. This creates a large reflexive cycle.

How did we get here?

Last week, Coinbase's options positions appeared very bearish (as seen from the historical put-call ratio and 25 delta skew).

Trump's victory led to a massive unwinding of positions (resulting in a situation completely opposite to what I previously described), with market makers repurchasing stocks as they unwound their short put options.

The market's pendulum swung violently in the opposite direction, causing the implied volatility (price) of these options to spike sharply—along with this change, the delta of out-of-the-money call options increased (thus making the hedging actions more aggressive and inevitably unwinding).

Due to short covering, market makers unwinding their hedges, and the general expectation of a "super cycle," the expectations for price movements shifted excessively in a positive direction. This situation is reflected in the implied volatility of all cryptocurrency stocks.

This is also why I chose to sell a large amount of volatility at this time—these expectations rarely materialize, and it is also a good strategy for hedging spot positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。