Coin listing hit rate of 70%, overview of UDC conference projects.

Written by: Shaofaye123, Foresight News

As the market strengthens, the wealth effect of new listings on Upbit becomes more apparent. Recently launched AGLD saw a maximum increase of 150% on its first day, DRIFT reached 190%, and tokens like SAFE, CARV, and PEPE also experienced 100% increases. The team behind the formula made over a hundred million through news trading in this round. With algorithms outpacing us, how can we seize the wealth wave from new listings on Upbit?

The UDC conference serves as a barometer for new listings on Upbit. According to statistics, from 2018 to 2023, the coin listing hit rate reached 76%. On November 14, the UDC conference was held as scheduled, and this article provides a quick overview of the projects participating in UDC.

About the UDC Conference

UDC is a representative blockchain conference in South Korea hosted by Dunamu since 2018, aimed at promoting the development of the blockchain industry, ecosystem growth, and popularization. It has been held for seven years. This year's UDC conference is themed "Blockchain: Driving Real-World Change." It explores the processes of blockchain expansion into various industries and the resulting real-world changes under themes such as trends, finance, policy, technology, and culture.

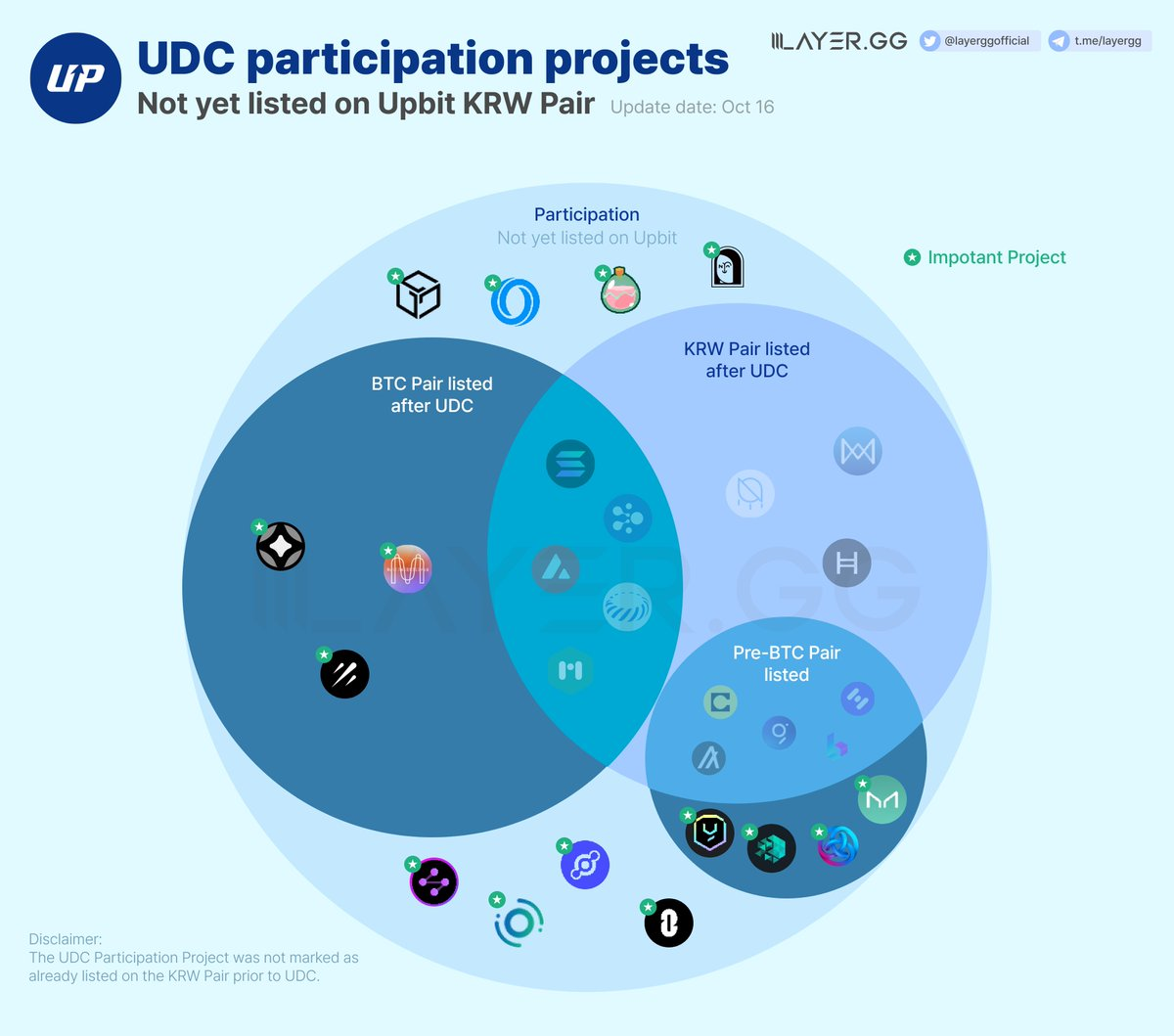

According to data from Layerggofficial, approximately 66 projects participated in UDC from 2018 to 2023, of which 37 projects had already launched on KRW Fair before participating in UDC. Among the remaining 29 projects, 13 were launched in the form of KRW pairs after UDC (44.8%).

Why does the UDC conference hold such significance? Where does Upbit's wealth effect come from?

As South Korea's largest exchange, Upbit leads the market in both trading volume and user numbers, holding about 73% market share. South Korean investors can purchase cryptocurrencies directly with Korean Won (KRW), and the convenience of deposits along with a significant wealth effect has led to cryptocurrency trading volumes surpassing those of the domestic stock market. This ensures strong buying pressure for new tokens on Upbit. Although the UDC conference, hosted by Upbit's parent company Dunamu, is smaller in terms of event duration and participant numbers compared to KBW, its importance is undeniable. Among the projects that participated last year, tokens like ZRO, MNT, and STG have already launched on Upbit this year, and their indicative effect remains.

Data source: https://x.com/layerggofficial/status/1714145904943587774?s=46

UDC 2024 Participating Projects

This year's UDC conference was held yesterday, and among the participating projects, Axelar, Taiko, Zetachain, Mantle, and Cyber have all launched on Upbit. As of this year's conference, there are still 10 projects that have not yet launched on Upbit or have not launched KRW trading pairs.

- The projects that have not launched include SLP, HNT, GALA, NFT, and ROSE;

- Those that have launched BTC trading pairs but do not yet have KRW trading pairs include: MKR, YGG, and IOTX;

- Projects that have not issued tokens but have participated in UDC include: Linea and Magic Eden.

Combining this year's UDC conference theme and trends, compliance and AI remain strong narratives. Although Oasis Network did not participate in this year's UDC conference, leveraging the AI narrative, ROSE experienced a surge on November 5. Additionally, there is high interest in the NFT and gaming markets in South Korea, making it likely that the token for Magic Eden will also launch on Upbit.

In addition to the forward-looking effects of the UDC conference, another exchange in South Korea, Bithumb, also has a certain correlation with new listings on Upbit. Influenced by narratives, both exchanges tend to concentrate on new listings during certain periods, such as launching AI tokens at the beginning of the year and currently focusing on Memecoins. To protect investors, South Korean exchanges typically avoid new coins with smaller market caps and shorter histories, favoring older coins that have undergone longer periods of consolidation, have larger market caps, and exhibit relatively stable prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。