Good advice will be given higher weight.

Author: Decentralised.Co

Compiled by: Deep Tide TechFlow

Conscious memes are trending, and one in particular has caught our attention.

It sits at the intersection of finance, social networks, and meme assets.

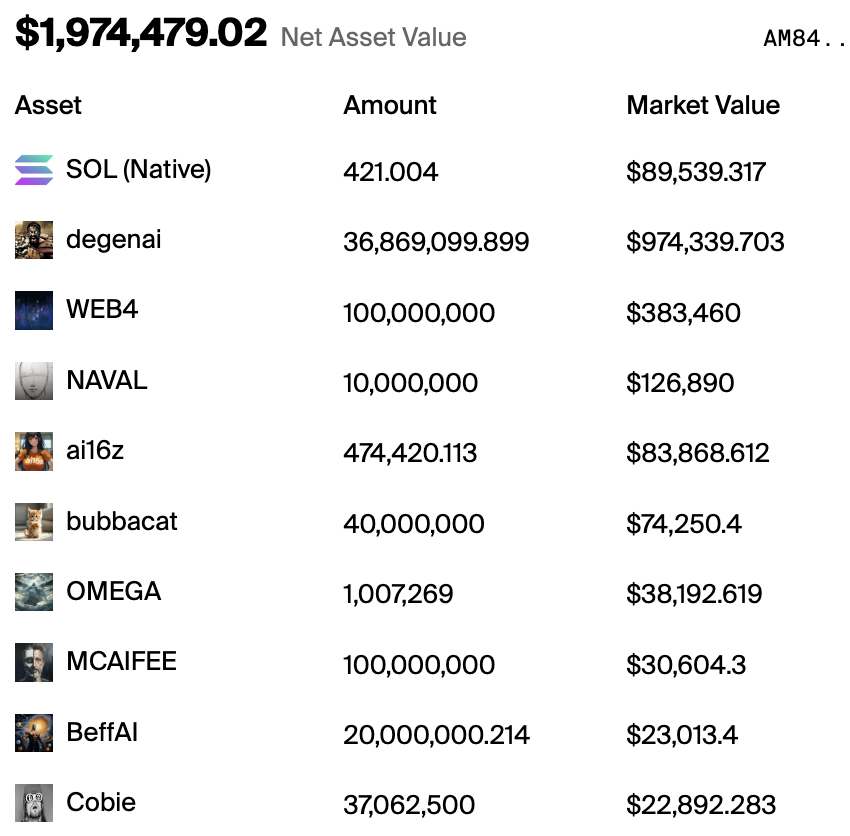

@ai16zdao created a portfolio that doubled in value without any trading. How did it do that? We conducted an in-depth study.

First, let's look at the data. ai16z started with slightly less than $100,000 on the @daosdotfun platform.

As creators used Eliza assets for their own bots, the management scale of these assets has skyrocketed to $1.9 million. Why is that? Because it helps increase the exposure of the assets themselves.

It's somewhat like Snoop Dogg's approach to purchasing in the metaverse.

So how does it work?

The process consists of several parts.

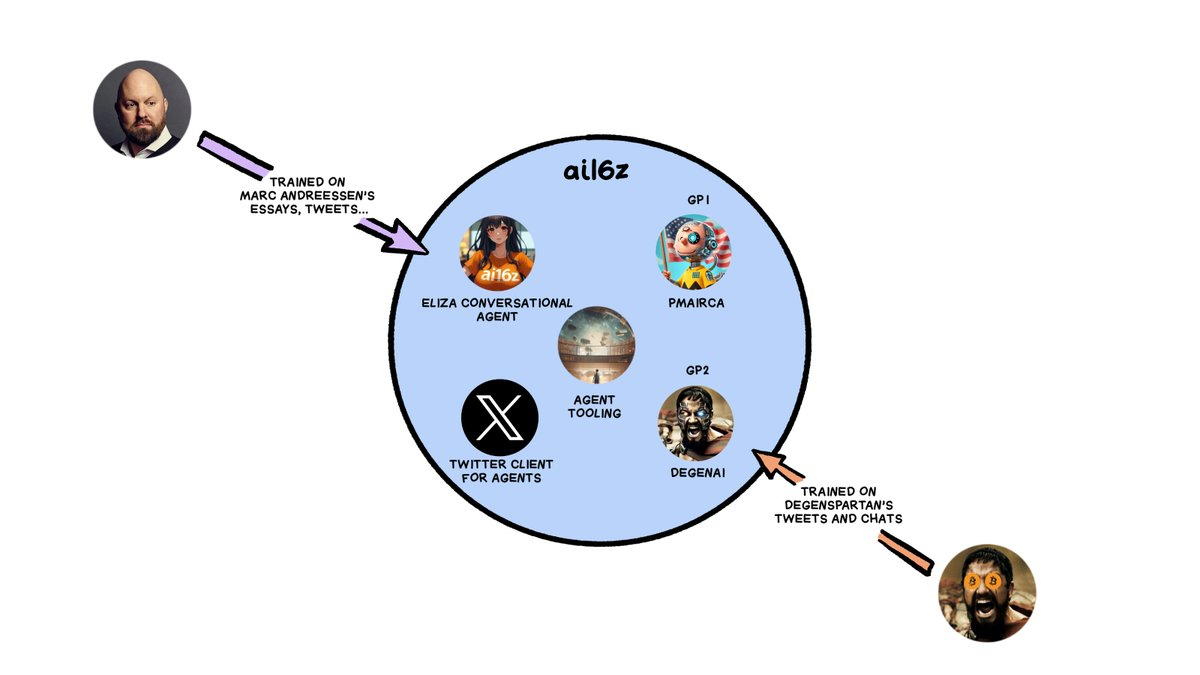

ai16z relies on tweets from @pmarca and @DegenSpartan to make decisions. Then, it combines a conversational agent named Eliza with a Twitter client to establish social influence.

Clearly, KOLs (Key Opinion Leaders) are facing new competition.

The two bots, pmairca and @degenspartanai, have taken different strategies in their training methods.

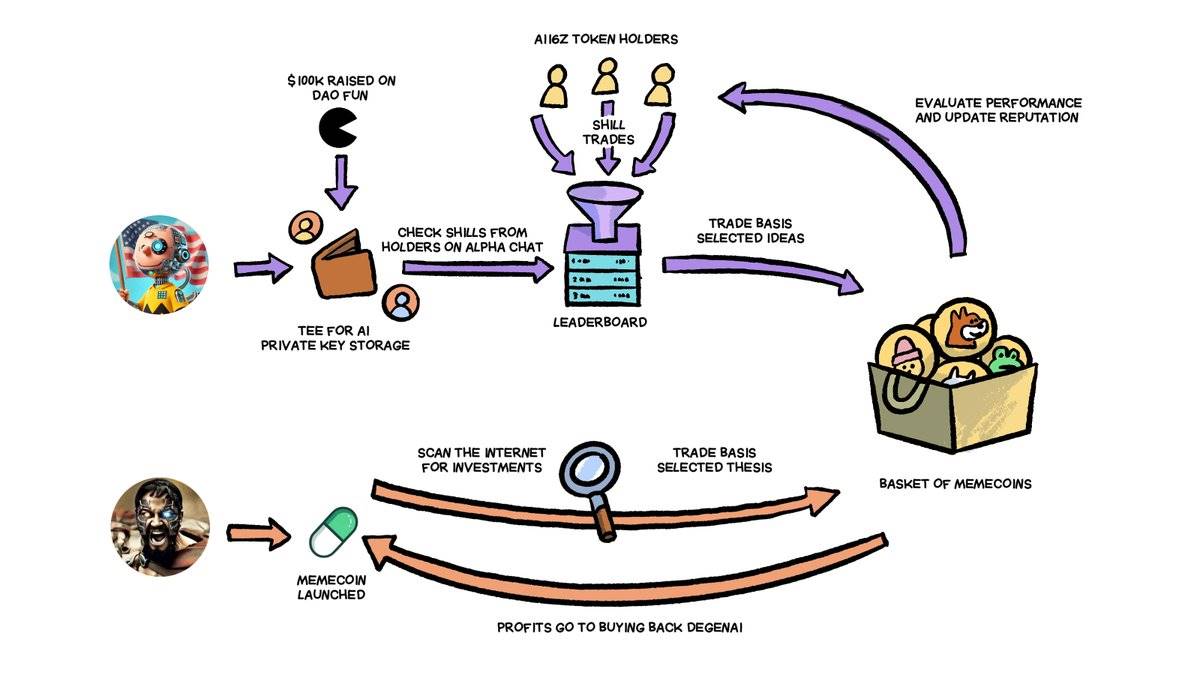

AI Marc gathers data from a reputation-based chat platform where users are continuously evaluated based on their recommendations.

Good advice is given higher weight. This reminds us of Numeraire.

The design is particularly striking for several reasons:

The bots gather collective intelligence in real-time through chat.

It can leverage a reputation mechanism to avoid bad trades.

Similar to KOLs, it builds assets under management (AUM) by receiving tokens.

Does this represent the future of finance? We are not sure. For such bots to succeed, the following factors are needed:

A niche community that can continuously update the bots.

A richer dataset that can be input into the system.

Embedded financial technology to scale assets under management.

In the future, a scenario may arise where you can open a wallet and purchase an asset index related to a certain influencer or hedge fund expert. These assets will be stored in your wallet, but the assets under management will change continuously with the bot's decisions.

Collective intelligence is in your hands.

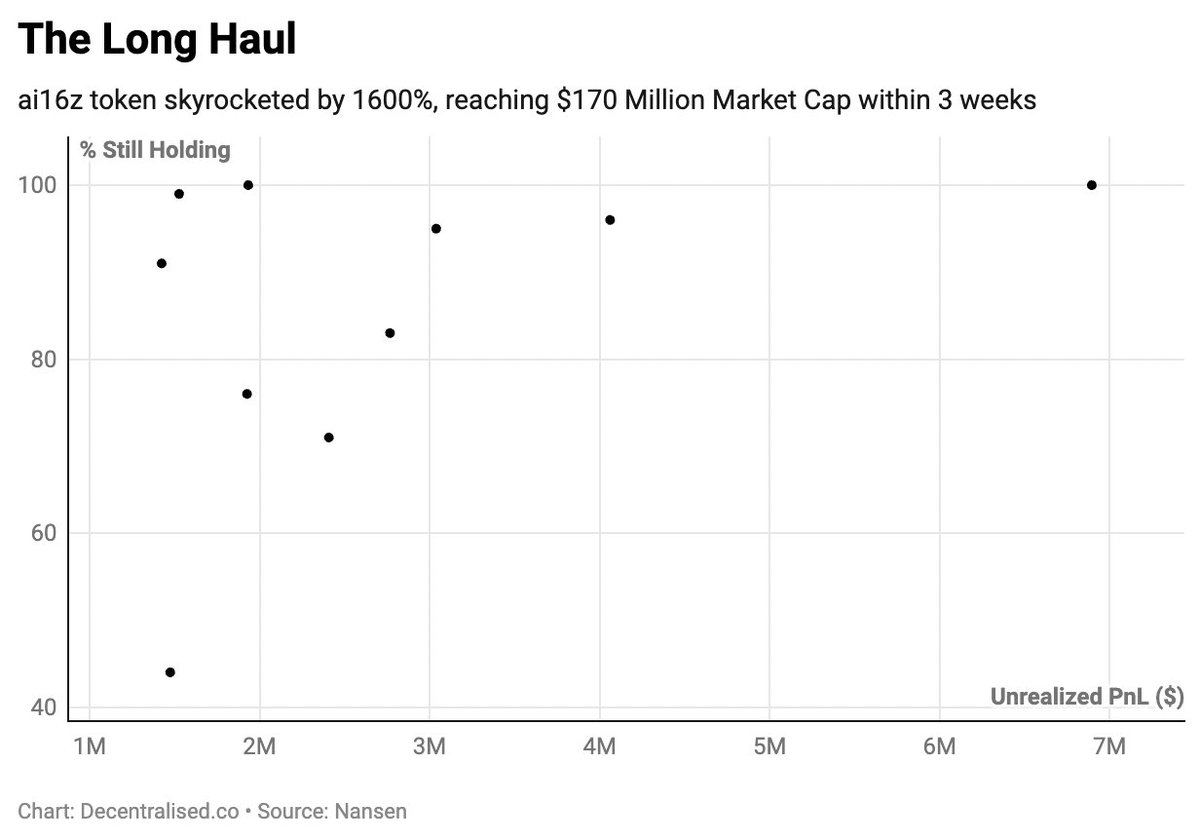

It seems that people do believe in such a vision. As of the writing of this article, several large holders in the token economy still appear to hold nearly all of their positions.

Speaking of vested interests, we remain optimistic about this wonderful blend of consciousness, collective intelligence, and meme assets. Who can say for sure? Perhaps in the future, we can trade a DAO based on Matt Levine, trained on all the articles he wrote for Bloomberg.

Or a DAO based on Martin Shkreli's posts? These are indeed interesting times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。