Source: Financial Associated Press

Author: Xiaoxiang

Financial Associated Press, November 15 (Editor: Xiaoxiang) — Following Federal Reserve Chairman Jerome Powell's latest remarks early Friday morning Beijing time, stating that the Fed is not in a hurry to cut interest rates given the strong economy, these hawkish comments quickly stirred up a storm in global markets.

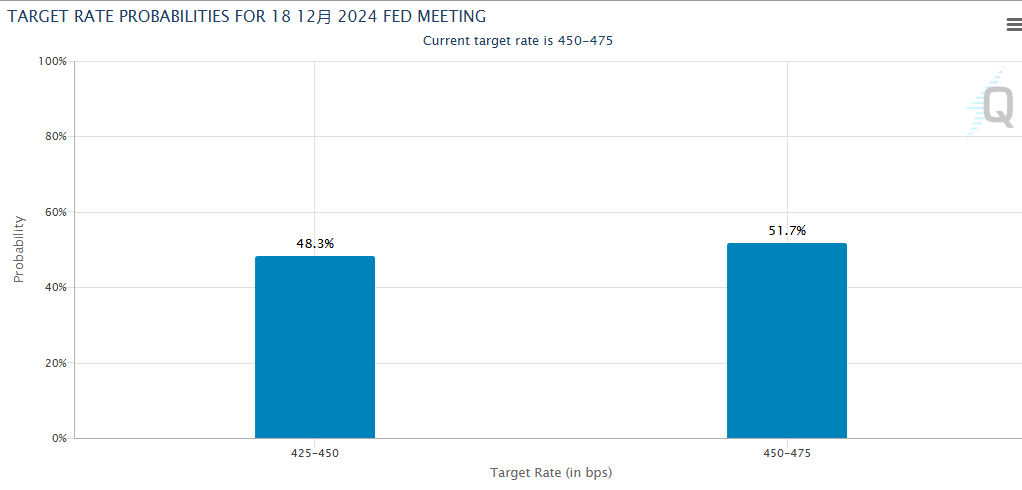

After Powell's speech, U.S. stock markets closed near their intraday lows, while the dollar surged alongside U.S. Treasury yields, with the ICE dollar index reaching its highest level in a year. Traders reduced the probability of a Fed rate cut in December from 80% the previous day to around 50%, contrasting sharply with the CPI release the day before.

During a dialogue hosted by the Dallas Fed with local business leaders, Powell stated, “The economy has not conveyed any signals that necessitate an urgent rate cut; the favorable economic conditions allow us to act cautiously in our decision-making.”

Regarding inflation, Powell noted, “The inflation rate is getting closer to our long-term target of 2%, but it has not yet been achieved. We are committed to completing this mission, and with the labor market conditions roughly balanced and inflation expectations well anchored, I expect the inflation rate to continue to decline towards the 2% target, although there may be bumps along the way.”

To combat inflation, the Fed raised interest rates to a 20-year high last year and maintained that level for over a year to ensure that price pressures do not resurface. Since mid-2023, U.S. inflation has significantly decreased, but the slowdown in price growth has sometimes been uneven, including over the past two months.

In response, Powell reiterated that the Fed's policy rate path will depend on upcoming data and the evolution of the economic outlook, closely monitoring core inflation indicators for goods and services excluding housing, which have been declining over the past two years.

The Fed has cut rates in its last two meetings, first making a significant cut of 50 basis points in September when signs indicated that the labor market might be weakening. In last week's meeting, officials lowered the benchmark rate again by 25 basis points to a range of 4.5%-4.75%.

The Fed's next meeting will be held on December 17-18. In his latest remarks, Powell did not comment on the possibility of a rate cut at the December meeting. However, his related statements clearly had a significant negative impact on market expectations for a rate cut next month. The CME FedWatch Tool indicates that the likelihood of the Fed achieving a third consecutive rate cut next month has once again become a 50-50 proposition.

And sharp market traders undoubtedly reacted quickly.

Global markets face a "new storm."

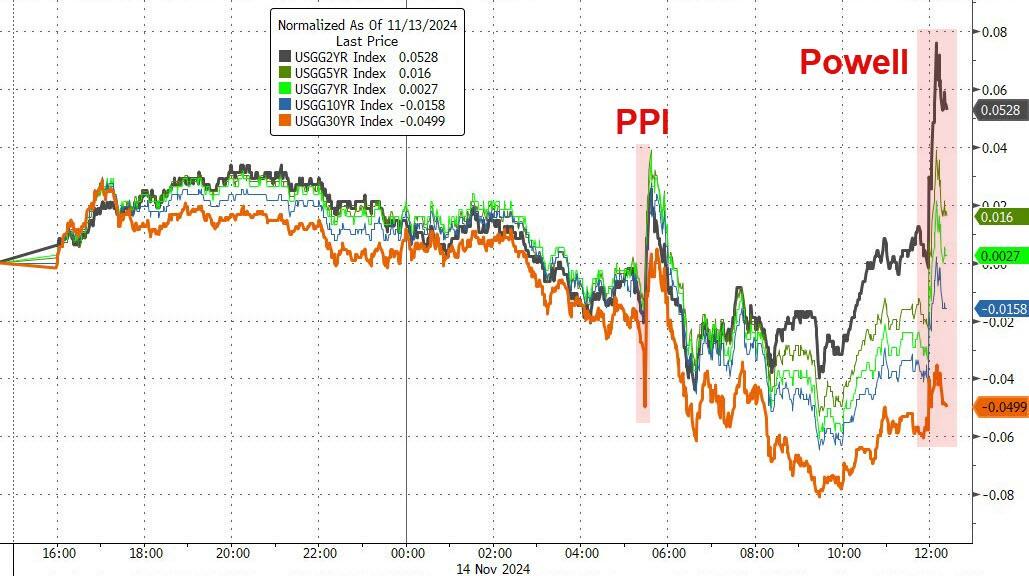

Most maturities of U.S. Treasury yields rose following Powell's overnight speech, particularly short-term yields, with the 2-year Treasury yield quickly rebounding by 8 basis points to 4.36%.

Major U.S. stock indices also fell in response. The Dow Jones Industrial Average dropped 0.5%. The S&P 500 and Nasdaq both fell 0.6%, marking the largest single-day decline of the month.

In the foreign exchange market, the dollar strengthened further against major currencies on Thursday, with the ICE dollar index breaking above the 107 mark, reaching a new high for the year, and rising for the fifth consecutive trading day.

Zachary Griffiths, head of U.S. investment-grade and macro strategy at CreditSights, stated, “Powell's remarks leaned more towards a hawkish stance, with a focus on risk management in future monetary policy handling.”

“Powell's speech is hawkish,” noted Neil Dutta, head of economic research at Renaissance Macro Research. “I believe they will still cut rates in December because the rate policy remains restrictive, and they want to reach the neutral rate setting. However, I think Powell (and the broader consensus) is complacent about the economy. The downside risks in the short term are greater than people realize.”

In fact, even setting aside Powell's hawkish speech, a series of recent U.S. economic data seems to offer little support for a rate cut. As shown in the chart below, the number of initial jobless claims in the U.S. has fallen to a six-month low, and inflation data has generally exceeded expectations, suggesting that the economic and inflation situation still faces the risk of "no landing."

Paul Nolte, market strategist and senior wealth advisor at Murphy & Sylvest, stated that based on the data from the past two days (consumer prices, producer prices, and weekly jobless claims), it is difficult for Powell to become super dovish. All information indicates that job growth remains substantial, and inflation continues to exceed the 2% target.

This inevitably raises a question: If a scenario arises where "Trump comes to power, and Powell pauses rate cuts" (it currently seems likely that the Fed will slow its easing pace early next year), how angry would the "smart king," who has always been critical of Powell, actually be?

Michael Feroli, chief U.S. economist at JPMorgan, predicts that Powell's remarks may suggest that the Fed will slow its rate cuts before March next year. He wrote, “We still believe that the FOMC may cut rates in December. However, today's remarks open the door to slowing the easing pace as early as January.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。