Trump's victory, Bitcoin surges to $100,000, how does the Trump bubble affect the market?

Written by: @packyM, Not boring

Translated by: Blockchain in Plain Language

In the upcoming 2024 U.S. presidential election, Trump is re-elected. The capital markets also experience a wave of excitement, the U.S. dollar index hits a new high, and the crypto market is unstoppable, with the total market capitalization of the global crypto market surpassing $3 trillion for the first time. After Bitcoin breaks the $90,000 mark, it seems that $100,000 is within reach.

Trump's election undoubtedly injects a dose of excitement into the capital markets, especially the crypto market. Whether the various positive expectations released during the campaign can materialize, how will the future crypto market develop? @packyM provides an outlook on the "Trump bubble," which Blockchain in Plain Language has excerpted and translated.

Here is the main text:

It is well known that one of the biggest risks facing current crypto companies is that government regulation may slow their development or even lead to stagnation. Over the past week, I have closely followed the political developments in the U.S. and found that the current situation bears many similarities to the topics I usually discuss, and it is more optimistic than expected. My intuition tells me that we are standing at the beginning of all bubbles—a bubble machine, birthing countless bubbles: the Trump bubble.

One of the most shocking things about last week's presidential election was that many people seemed unusually excited about Trump's victory, and the extreme excitement of some about a certain future vision is precisely a sign that a bubble is beginning to form.

Over the weekend, I read "Boom: Bubbles and the End of Stagnation" by Byrne Hobart and Tobias Huber. The core argument of the book is that certain types of bubbles play a significant role in pushing the world forward. They believe that bubbles are a good remedy for stagnation.

While reading this book, I noticed that the post-election reactions are strikingly similar to those productive bubbles described in the book: the Manhattan Project, the Apollo Program, Moore's Law, the golden age of corporate R&D, the shale gas revolution, and Bitcoin.

Byrne and Tobias summarize five common characteristics of all the technologies and top projects they studied:

- Obvious optimism and focus

- Fear of missing out (FOMO) and living in the moment (YOLO) mentality

- Over-risk-taking and over-investment

- Parallelization and coordination

- Reflexivity and hyperstition

Defending the Bubble

The term "Trump bubble" may sound concerning. When the average person hears the word "bubble," they usually associate it with "something that is over-inflated and destined to burst," and the term often carries negative connotations, especially when it originates from some bad bubbles. However, not all bubbles are of this type. In "Boom," Byrne and Tobias describe two types of bubbles:

1) Mean Reversion Bubble: "The basic bet is that the future will continue along the current trend." For example, the subprime mortgage crisis. If you bet that the future will remain roughly unchanged, you can increase your stake by leveraging.

2) Turning Point Bubble: "Investors believe the future will be significantly different from the past." For example, the internet bubble. If you believe that significant changes will occur in the future, you will buy assets that can benefit from those changes.

They argue that turning point bubbles drive progress. This view is similar to what I mentioned in "Infinity Missions": turning point bubbles drive progress by directing vast resources to important projects that cannot be executed under normal cost-benefit analysis.

Take the Apollo Program as an example:

In May 1961, President John F. Kennedy announced, "This nation should commit itself to achieving the goal, before this decade is out, of landing a man on the Moon and returning him safely to the Earth," at a time when no one knew how to achieve this goal. Rockets, launch pads, spacesuits, hardware, software, zero-gravity food—none of these existed, and there were no experts in the relevant fields. Not only did the space program lack the conditions necessary to achieve a moon landing—scientists at the time were even uncertain whether it was possible.

Turning point bubbles drive future progress by concentrating vast amounts of financial and human capital on very specific future visions, allowing for wasteful exploration and parallelization that would not typically occur in pursuit of that goal.

Without bubbles, some things might never happen. Byrne and Tobias point out that Moore's Law itself is a classic bubble phenomenon: "The industry exhibits classic bubble behavior: predictions about the future—especially bold and nearly irrefutable predictions—ultimately drive the actions that make those predictions come true." For example, expectations of continuous improvements in chips prompted the design of products that could utilize better chips, which in turn made chip manufacturers aware of the existing demand, stimulating investment in continuous improvements in chips.

In other words, a sufficiently compelling vision can make it a reality. As Stripe Press writes on the "Boom" website, "Optimism can be a self-fulfilling prophecy."

Source: Boom Website

As Peter Thiel, Byrne, and Tobias emphasize, not all optimism is positive. Excessive optimism—merely assuming that everything will go smoothly—is as destructive as pessimism. Therefore, the first common characteristic of productive bubbles is clear optimism: the belief that the future will be better and having a concrete plan to achieve that goal.

What Exactly is a Bubble?

In the early post-election period, I began to notice the common characteristics of bubbles, and I observed that the only unresolved question is its clarity—where the attention is focused.

Simply "making everything better," such as "making America great again," is too vague and imprecise to fit the book's definition of a positive bubble: "The key is whether this vision includes a specific and actionable plan to transition from the present to the future."

For example, creating an atomic bomb before the Germans (or Soviets) is a clear and specific goal: landing on the Moon within a decade. Every bubble discussed by Byrne and Tobias is also clear and specific. But what about Trump's bubble? What kind of bubble is it?

Elon Musk played a significant role in Trump's victory and is likely to continue to exert influence during his presidency. He referred to Tesla's Gigafactory as "the machine that makes the machine." If the Gigafactory operates well, producing cars will become simple. And America, like "the machine that makes the machine," is just that its gears have accumulated dirt.

America can still create excellent companies that produce excellent products. But the slogan "make America great again" does not resonate with me because I have always believed that America is still the greatest country in the world, even though it is now slower and clumsier than before. Comparisons with other countries obscure a deeper fact: America has not reached the greatness it should have achieved.

If Trump's bubble takes shape, it will be about upgrading and clearing the dirt from "the machine that makes the machine," allowing America's machine to operate at full speed. For those who believe in America, capitalism, and the self, there is no more inspiring vision than this. This vision seems strong enough to inflate the strongest bubble in history.

Signs of a Bubble

While the Manhattan Project and the Apollo Program are two cases directly regulated by the government in the book, I believe that Trump's bubble is more likely to develop like Moore's Law.

As Byrne and Tobias write: "Moore's Law may be the most compelling and enduring example of a bidirectional bubble, where the expectations of progress in one field drive the development of another field, which in turn promotes growth in the first field."

There is also a bidirectional relationship in the Trump bubble. The message conveyed by the Trump administration is that building, investing, and achieving big goals will become easier, and this expectation itself has already sparked greater enthusiasm among people to build, invest, and achieve big goals. The more energy and excitement people invest, the easier it becomes for the government to fix the machine.

Augustus Doricko of Rainmaker expresses this sentiment perfectly: "We have four years to give it our all."

With control of the Senate, House of Representatives, and the executive branch, the government promises to simplify processes and eliminate friction. In return, the private sector plans to increase risk, investment, and innovation.

While the actual difficulty of simplifying processes and eliminating friction may far exceed expectations, the mere belief in the possibility of this is enough to trigger a bubble.

Armed with the belief that anything is possible, people are sharing what they think the government could do.

Notice this meme: Make America X Again. Bryan Johnson posted a photo of himself with RFK Jr. and captioned it "MAHA," which stands for Make America Healthy Again.

Bryan Johnson is a tech founder, and if he can connect with key figures responsible for the U.S. health system, will people start to feel that the government might be willing to listen to his suggestions about health and other matters?

You might think this is a good thing or a bad thing, but what we need to focus on now is the dynamics of the bubble. The characteristic of a bubble is that people begin to feel that they are just one tweet away from influencing government policy. This also means that more and more people are starting to share their policy suggestions on Twitter. Interestingly, some of these ideas might actually become a reality.

Of course, the government cannot see all the proposals, and it only considers a small fraction of them, with even fewer being implemented. But just like a lottery or incentive mechanism, it is almost certain that the government will attempt to push some previously unimaginable proposals, some of which may succeed. And when these successes occur—such as addressing global warming through sulfate injection—the government will become bolder in trying things that were previously unthinkable.

By making people believe that change is possible—even if it's just projecting their hopes onto that change—the Trump administration is making collaboration with the government "cool." Bryan Johnson is one of them, and the world's richest man, Elon Musk, who just caught a 22-story rocket with chopsticks, is also among them. Those geniuses who had never thought of collaborating with the government are now looking for opportunities to get involved. Sean Maguire from Sequoia revealed that he received inquiries from some PhD physicists asking how they could work in the Trump administration.

This is parallelization and coordination at the national level. The parallelization lies in the increasing number of entrepreneurs who want to build within a more efficiently operating American machine; the coordination lies in the growing number of talented individuals who wish to participate in the work of fixing this machine because they believe there is now an opportunity to do so.

These phenomena once again validate the self-fulfilling prophecy. An increasing number of talents are investing in the work of repairing the government, and they have strong public support, which will make them more likely to succeed in fixing the government. This, in turn, will enable those dedicated to building complex enterprises—whether in the cryptocurrency sector or the energy sector—to achieve greater success in constructing their "machines."

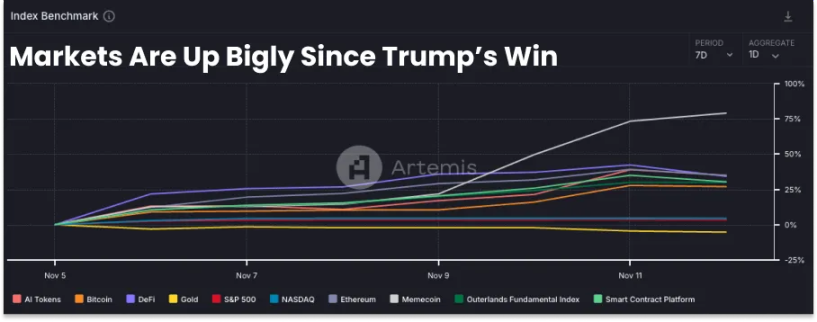

People believe that ambitious projects striving to advance within the existing government framework will ultimately succeed, and this belief has triggered a genuine "fear of missing out" (FOMO). This phenomenon is particularly evident in the cryptocurrency market, where the high liquidity and rapid price fluctuations heighten this anxiety.

As of November 12, 2024, Source: Artemis Terminal

Investors are asking what achievements cryptocurrencies could attain if the SEC no longer attempts to exclude them through means that currently lack clear legislation.

Interestingly, this process has also birthed a mini-bubble. Byrne and Tobias mention the case of Bitcoin in their book "Boom," pointing out that: "The value, security, and network effects of any currency are driven by adoption, and Bitcoin is no exception."

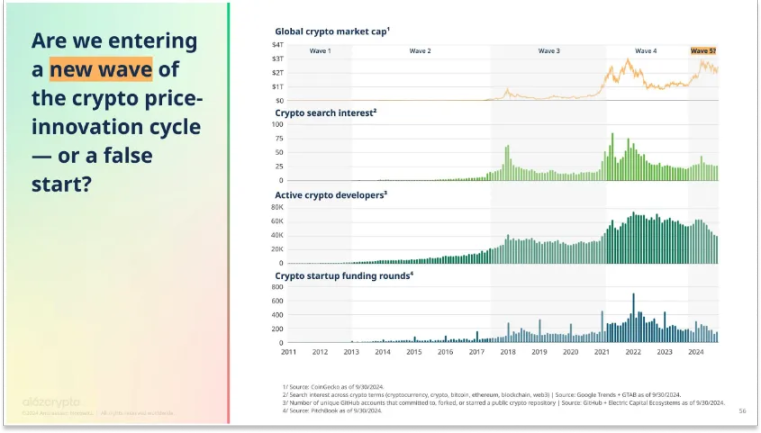

a16z Crypto has been emphasizing the price innovation cycle in cryptocurrencies: when prices rise, they attract more attention and developers, who then begin to build products, making cryptocurrencies more valuable over time.

2024 Cryptocurrency Status, Source: a16z crypto

This cycle is particularly evident in the cryptocurrency field because cryptocurrencies inherently possess liquidity, but similar dynamics are playing out across various industries: rising prices attract talent, and talent creates things that support rising prices. This is a manifestation of hyperstition and reflexivity.

I believe the strength of the Trump bubble lies in its ability to spawn these "little bubbles" everywhere, like a "bubble machine."

When the construction of cryptocurrencies becomes legitimate, more people will dive in to create more valuable crypto products; when the approval process for new nuclear reactors becomes feasible, more companies will begin to build these reactors; when SpaceX can launch rockets freely without FAA interference, it will launch more rockets.

This also makes us feel the concepts of FOMO and YOLO once again. If you are paying attention to these trends, it is hard not to feel that something significant is happening, and you urgently need to be a part of it. I also feel that I am not participating enough, of course, I mean financially, but I also refer to something deeper, a kind of spiritual feeling. I feel I have done enough, but now I realize I should do more and need to double my efforts to catch up—and this mindset is a characteristic of bubbles.

Byrne and Tobias mention in "Boom" that bubbles are often accompanied by a spiritual pursuit; they write: "To identify the fields of future technological advancement, one can start from the transcendence they bring on a spiritual level."

It indeed feels like we are facing an unprecedented opportunity to truly create the future we envision and realize that vision ahead of time. It’s just that no matter how much you invest, there will always be someone who invests more than you. It is precisely this atmosphere filled with dynamism that will coordinate thousands, even millions, of people to participate in this great project, whether it is improving the existing system or creating a brand new, more achievable system. All of this is almost destined to trigger excessive risk-taking and investment overheating, which is also a characteristic of bubbles.

Although "hardcore technology" (such as vertically integrated companies) is increasingly valued, many investors still tend to act cautiously, believing that the construction of these technologies is fraught with uncertainty and capital intensity, even though once successful, the returns are extremely lucrative. However, I expect that in the coming months, we may see phenomena of over-investment similar to those in the cryptocurrency market across fields such as nuclear energy and aerospace.

But this is actually a good thing! The allure of bubbles lies in the fact that even if some investors may incur losses, it will not trigger a systemic collapse, and the world will still make progress in solving major problems. Ultimately, those companies that might not have survived will stand out and drive the world toward a better direction.

Of course, all of this will not be smooth sailing; it will inevitably be filled with volatility and uncertainty. But I firmly believe that this process will yield extraordinary results.

How the Bubble Machine Forms

In 2021, Musk shared his five-step method for improving manufacturing and design processes in a very famous video with Everyday Astronaut:

Source: https://www.youtube.com/watch?v=t705r8ICkRw&feature=youtu.be

Source: https://www.youtube.com/watch?v=t705r8ICkRw&feature=youtu.be

- Make requirements more reasonable

- Eliminate unnecessary parts or processes

- Simplify or optimize

- Accelerate cycle time

- Automate

If you view America as "the machine that makes the machine," then the methods Musk employs in building SpaceX's "machine that makes the machine" are not only worth noting but also a very interesting point. Because this method is very similar to the plans proclaimed by the Trump administration:

- Make requirements more reasonable → Regulatory reform (e.g., NEPA, NRC)

- Eliminate unnecessary parts/processes → Eliminate agencies like the Department of Education

- Simplify/optimize → Streamline remaining processes

- Accelerate cycle time → Increase approval speed

- Automate → Modernize government systems

Clearly, these changes may bring some risks! For example, SpaceX's rockets sometimes explode, indicating that overly aggressive innovation may encounter problems.

However, once these improvements and optimizations are implemented, many things will become smoother. This is also why people are filled with enthusiasm, as they believe this is the first government in years to truly challenge limits and test the boundaries of the existing system.

But more critically, this "breaking of norms" symbolizes a renewed attitude toward embracing risk.

Conclusion

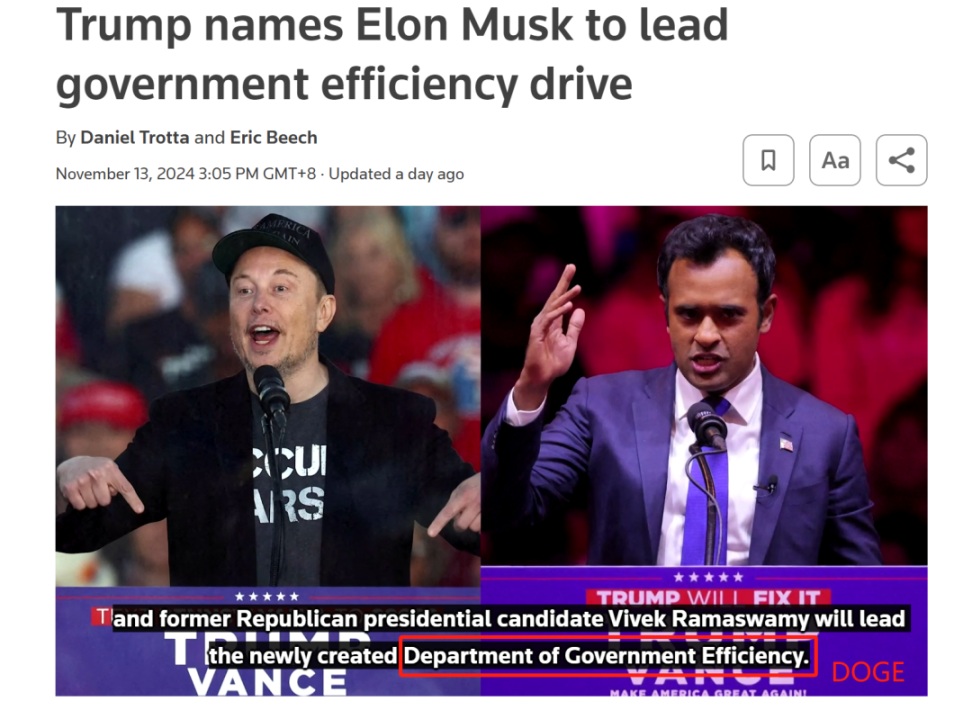

On November 13, Trump announced that Elon Musk and Vivek Ramaswamy will jointly lead the newly established "Department of Government Efficiency."

According to Trump, DOGE will "clear bureaucratic obstacles for my government, cut excessive regulations, reduce wasteful spending, and reshape federal agencies." He also stated that this would "pioneer an unprecedented entrepreneurial approach to government management" and "unleash our economic vitality." In simple terms, the goal is to fix "the machine that makes the machine" and drive a series of reforms.

Can you understand why people are so excited? I mentioned Musk's machine-fixing process in the previous section, and I thought this metaphor was somewhat "too fitting," only for Trump to appoint Musk to co-lead the organization responsible for "fixing the machine" right after I finished writing. Musk is undoubtedly the best candidate for this position, and he gladly accepted the task.

Although many point out that DOGE has no actual decision-making power and can only make suggestions, that is not the point. The key is that both supporters and opponents are beginning to believe that the government might really become more efficient. Even if Musk and Vivek cannot directly cut agencies and regulations, they can at least reveal the most wasteful parts of the federal government and drive change through public power.

This is a long-awaited opportunity, and people feel they might personally participate in making the "big machine" of America run more smoothly. Musk also stated on the X platform that they will publicly share all actions of DOGE.

Vivek tweeted that DOGE will collect public opinions through crowdfunding: "Americans vote for comprehensive government reform; they should have the opportunity to participate in fixing the government."

This is exactly what was mentioned earlier, any good, healthy bubble can stimulate people's sense of participation. People will feel that they can really fix the government, and thus invest more energy in trying to improve it. This may manifest in submitting suggestions or calling congressional representatives to push them to adopt DOGE's recommendations.

Whether the final result is exactly as expected is not the most important thing. The key is that when a bubble forms, people firmly believe that things will move in that direction, and this belief itself will shape their actions.

The question is no longer about Democrats versus Republicans; regardless of the dissatisfaction and divisions in people's hearts, what matters more is the action between those who believe that the American people can change the status quo and make America and the world better, and those who think the bureaucratic system should do these things for us. This is far more important than mere political struggle!

No one wants to pay more taxes to fund a wasteful bureaucratic system. No one wants to feel that their country has problems but is powerless to change it. No one wants to see things progress 100 times slower than they should or cost 100 times more than they should. We can actually reach a consensus in many ways.

This is a "meta-bubble" that may give rise to turning point bubbles in the coming decades; welcome to the Trump bubble.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。