This is Vitalik's first video interview with a Chinese Web3 media outlet. In nearly 90 minutes, Vitalik discussed a large number of new Web3 applications and his thoughts on them, sharing many observations about Chinese elements.

Written by: Zhou Zhou, Foresight News

Chiang Mai, an internationalized rural area, is where Vitalik has recently stayed for about 42 days. For someone who averages 55 flights a year and is almost "moving" every week, staying in one city for such a long time is quite rare.

During these 42 days, a grassroots, decentralized social experiment with an increasing number of participants took place, ultimately attracting over 1,000 blockchain practitioners from around the world to Chiang Mai, spontaneously forming 8 or 9 cities and villages (Pop-Up City). They aimed to establish a "Web3 City" lasting six weeks.

Vitalik referred to this as Zuzalu 2.0. Since he initiated the first "pop-up city experiment" Zuzalu in Montenegro in 2023, he has been looking for ways to continue this social experiment. "Watching the development of Zuzalu 2.0 feels like watching my son grow up step by step," Vitalik told me.

The crypto industry often wears two distinct faces: one face is filled with various high-risk financial transactions and activities, while the other face is characterized by idealists attempting to create a new "utopia" based on blockchain decentralization and incentive mechanisms.

"Over these six weeks, there were 1,606 events held, including meditation, hiking, Muay Thai, sound healing, Web3 lectures, and geek boot camps… The village with the most participants, Edge City, had nearly 500 people," said Jiang, co-founder of Social Layer. Here, builders initiated activities using Social Layer rather than the more standardized and commercialized Luma. Beyond Edge City, there were other "villages," such as "Invisible Garden," centered around global ZK developers, and "Shan Hai Wu," focused on Chinese Web3 practitioners, both exceeding 100 participants. This has allowed experiments like Zuzalu to have a legacy.

The significant increase in the density and breadth of Web3 talent has made this place a temporary "playground" for Vitalik's ideas. He visits two or three "Web3 villages" almost every day to engage with the villagers. When he spoke to me about this, I found that he could recall the location and characteristics of each village in detail, even down to the distance and direction of each one.

The intensive visits and conversations undoubtedly brought him many new ideas, and some new systematic thoughts began to take shape in his mind. In this conversation, Vitalik extensively discussed his thoughts on Ethereum ecosystem applications, pointing out that the technology has reached a certain level of maturity, and it is time to start focusing on applications. He shared several of the latest Web3 applications he learned about in Chiang Mai. Additionally, he talked about his observations regarding crypto institutions like Solana and Binance, as well as Chinese elements such as Tencent AI Labs and "The Three-Body Problem," and finally shared his lifestyle, habits, and hobbies.

To this end, Foresight News invited Vitalik for an offline interview in one of the "villages" in Chiang Mai—Shan Hai Wu—to share his observations and thoughts during this period. The following is the text content.

In Chiang Mai for 42 Days

Joe: Hello everyone, I am Zhou Zhou from Foresight News. I am very pleased to invite Ethereum founder Vitalik for this interview. Vitalik, could you introduce yourself?

Vitalik: Hello everyone, I am Vitalik Buterin, a famous Dogecoin holder.

Joe: That's a very iconic introduction. You have stayed in Chiang Mai for a long time, over 30 days. What kind of people and events attracted you?

Vitalik: I often move from one place to another. I remember averaging 55 flights a year, not including layovers. However, in Chiang Mai, I haven't moved for six weeks, and it feels like a great opportunity to work and rest at the same time. Of course, I found that I have many activities every day in Chiang Mai.

Last year in Montenegro, I conducted a Zuzalu experiment, and people reported that it was very successful as an experiment, but we were all unclear about what the next step would be. During the time between Token2049 in Singapore and Devcon in Bangkok (about 7 weeks), some people initiated pop-up activities in Chiang Mai. It started with just a few, and then more and more. It can be said that it eventually evolved into Zuzalu 2.0, supported by the same fund (the Zuzalu Fund). I am the initiator and founder of Zuzalu 1.0, and watching the development of Zuzalu 2.0 feels like watching my son grow up step by step.

There are really many interesting things and communities here, with seven or eight larger pop-ups, each with its own unique characteristics. For example, (we are currently) in Shan Hai Wu, where many interesting activities are happening, both technical and non-technical, including various meditation activities.

Invisible Garden is 900 meters away from here, focusing on ZK and Ethereum-related projects; 3 kilometers to the east is MegaZu, a project emphasizing developer culture in Ethereum L2 technology, conducting a boot camp for developing applications; one kilometer east of MegaZu is Queen, a Vietnamese community with some interesting talks and activities; another kilometer east is Edge City, which is very large, possibly having 300 people now, with different content every week. They had a stablecoin-related event last week, and this week there is one about Dapps.

Every time you visit a pop-up, you will find different people, different activities, and different topics of discussion, which makes it particularly interesting.

Joe: You participate in activities almost every day in Chiang Mai. During this process, what new changes have you noticed in your understanding of Crypto?

Vitalik: In Shan Hai Wu, I found that people in the Ethereum community discuss two questions. The first question is why they are interested in Ethereum; the second question is what the challenges of Ethereum are.

On the internet, many people express some ideas that I find strange, such as the notion that Ethereum's values are useless and that Crypto is a gambling market. However, in the Ethereum community, there are some people, including many Chinese, whose goal in participating in Ethereum is because we have some values and life ideals that we particularly care about. We want to create an open world, a decentralized blockchain and platform, and we aim to develop sustainable applications that contribute to a better society. This is what our community members would say.

But we haven't achieved this for a long time. Why? Because before this year, our technology wasn't good enough. In 2021, we only had L1, without L2. The transaction fees for Ethereum's L1 could be $1, $5, or even more. Last year, we had many L2s, but they weren't secure enough, and the user experience of their wallets was poor.

This year, we can see some changes. First, Optimistic and Arbitrum in L2 have reached Stage 1. According to a framework I developed two or three years ago, if you are not Stage 1, you are essentially a multi-signature wallet, which doesn't have a secure connection to Ethereum. But Optimistic and Arbitrum have reached that stage. First, security has improved, and second, transaction fees have decreased significantly. In February of this year, the average transaction fee on L2 was $0.4, and now it can sometimes be as low as $0.004.

There has been an interesting trend in the tech industry over the past two decades: people have proposed some interesting ideas early on, but it may take many years for anyone to realize them. However, suddenly, ten or twenty years later, when the technology becomes good enough, these ideas come to fruition.

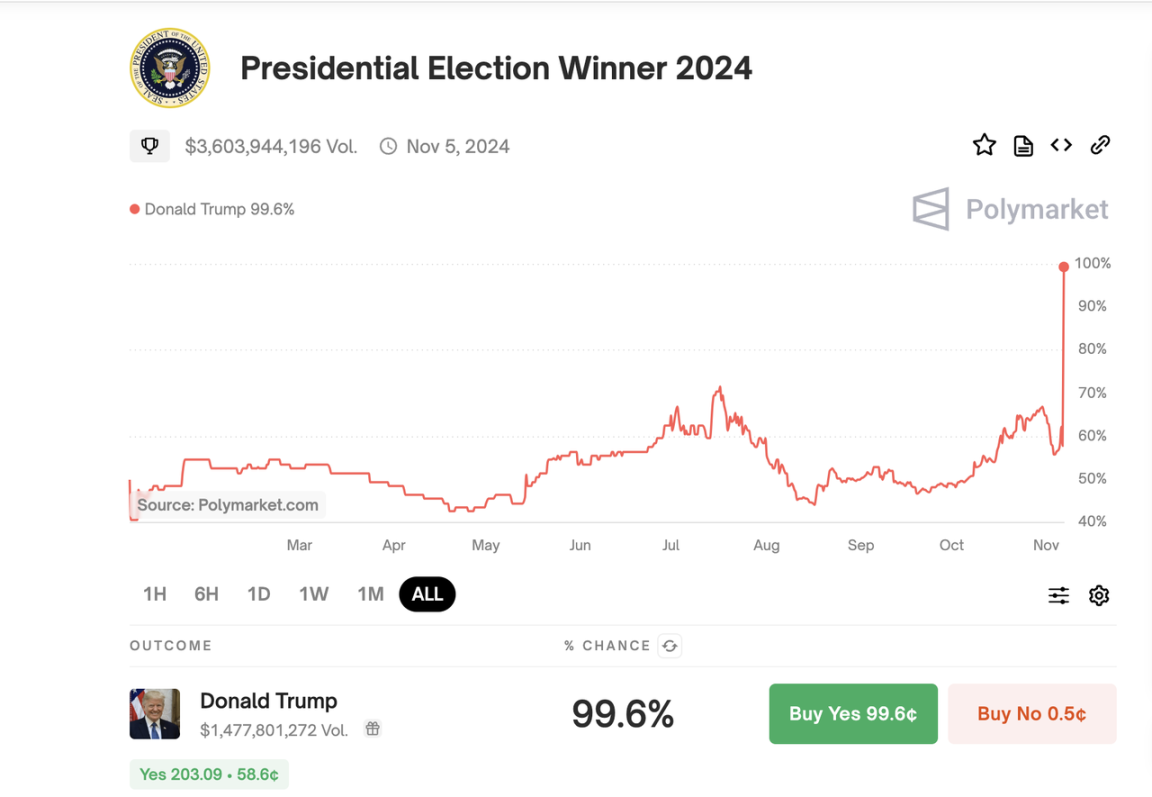

Since 2014, I have been interested in the topic of prediction markets. I participated in Augur (a prediction market platform founded in 2014) in 2020, but at that time, there weren't many users, and my own user experience was poor. In early 2021, I wrote an article titled "Prediction Markets Tales from the Election," where I earned $58,000, but I paid $1,000 in transaction fees. Now, Polymarket, based on Polygon, can be said to be almost free.

Prediction markets existed in 2014, and for ten years, entrepreneurs have been trying to create prediction markets, but it wasn't until 2024 that Polymarket suddenly became popular. Why can these applications become a reality? I believe two key reasons are lower transaction fees and faster transaction confirmation speeds.

Blockchain is not a standalone technology; it may require the maturity of various other technologies before applications can explode. If you are a developer wanting to create blockchain applications, the first scenario is that users have to pay $5 for each transaction, the second scenario is $0.5, and the third scenario is $0.005. In the first scenario, the only possible successful applications are high-value, high-risk financial products.

Farcaster is another very interesting example. They use a hybrid on-chain and off-chain architecture. Their important information, such as account registration, is on-chain, while the messages users send are off-chain. They have a very interesting decentralized off-chain storage method. Every time you register an account or deal with important information, they need to send a transaction, which incurs a transaction fee. If a transaction costs $5 or $15, that application is completely unlikely to succeed. However, if the transaction fee is $0.001 or $0.05, it becomes feasible.

Thus, our industry has entered a situation where many idealistic blockchain practitioners want to create non-financial applications, solve identity issues, and develop decentralized governance, etc., but the only successful applications are high-risk financial ones. Because if the transaction fee is $5, high-risk finance is the only thing you can do. If the transaction fee drops to $0.005, many previously impossible things become possible.

So I think many blockchain applications have undergone a new trend of change; many things that were previously impossible are now becoming possible.

Joe: Besides Polymarket and Farcaster, which you often mention, what other interesting applications did you see during your time in Chiang Mai?

Vitalik: I found that MegaZu is working on some particularly fun applications.

Back in 2018, I saw a very interesting application where they wanted to create a platform for crypto events. Sometimes an event would have 200 people registered, but neither the organizers nor the registrants knew whether 100, 50, or even just 20 people would actually attend.

So the model they wanted to implement was "trustworthy commitment." If someone wanted to participate, they would have to send 0.01 or 0.02 Ether. If they ultimately did not attend, they would lose their Ether. If they did participate, they would receive a portion of the Ether contributed by those who did not attend. This way, it ensures that most of the registrants will actually show up for the event.

I think the idea behind this application is particularly interesting; it can help us solve some everyday problems. This application was developed in 2018, but there hasn't been much news about it since. I suspect this is because the blockchain transaction fees and user experience were not good enough back then. Now, MegaZu has many developers working on applications based on this idea, which I find intriguing.

"Many Web3 applications are now becoming possible"

Joe: How do you and the Ethereum Foundation view the current situation where the community believes there are too many infrastructures and not enough applications?

Vitalik: I see some critics in our community who say that Ethereum philosophers particularly like to talk about technology and do not like to discuss applications.

Why is that? At first, we couldn't do applications very well because our technology wasn't complete. Now that our technology has reached a certain level, we can start developing applications. So now we need a community focused on application development. We need both technology and applications; both are necessary. This is also the advantage of the diversity within the Ethereum community.

I think the best approach is not to tell those working on L1 to focus on applications; the best thing they can do is to care about L1 issues. What we need to do is give some new people more opportunities and more space in the community. The first point is to give them freedom, and the second point is to provide them with a bit more support.

Joe: Will there be more specific measures?

Vitalik: The first is support within the community. If some people are working on important applications, they can share what they are doing in the community; that’s the first step.

Second, many people are particularly good at creating user-friendly products, but they may not be as skilled in blockchain technology and the integration of L1, L2, and wallets. We also need organizations that connect with teams more, such as community organizations, hackathons, etc.

Another point is that the foundation is looking to expand a team recently, and the goal of this expansion is to maintain more relationships with wallets, such as MetaMask, OKX, Rabbit, etc. Because wallets have a lot of direct contact with users.

Joe: What are the top three products you hope to see built on Ethereum?

Vitalik: I have mentioned Polymarket and Farcaster a lot in the past year, not just because I like these two examples, but because they both represent a very promising category. Polymarket can be classified as a combination of finance and new media. Twenty years ago, we had traditional media; ten years ago, we had social media, but now many people no longer trust traditional and social media.

Everyone is talking about wanting to create better Web3 social media, but they are just adding a crypto payment feature to existing products, and this approach has failed. How did social media succeed? When Twitter first came out, its goal was not to become the next Facebook; when Douyin and TikTok first emerged, their goal was not to become the next Twitter. We need to invent a new category and track, rather than just tweaking existing categories and tracks to do better.

I would place Polymarket in the media category. If I want to know what is happening in the world, I now have a habit of checking Polymarket. Or when the media reports that something has happened, I will check Polymarket to see if it is significant. Or I will directly check Polymarket to see if anything important has happened recently. If you see a large amount of betting on an event on Polymarket, you will be curious about what exactly happened.

Image source: Polymarket (2024 U.S. election, $3.6 billion wagered globally)

The coexistence of traditional, social, and Web3 media in three different ways is interesting. Polymarket has two ways to participate: the first way is if you have money, you can participate in the market; the second way is if you don’t have money, you can still observe the market results. I believe that this combination of market and non-market will definitely present many opportunities. I don’t yet know what these opportunities are, but I believe there will be many.

As for Farcaster, I think social products need to incorporate some crypto elements. Right now, a major issue for crypto entrepreneurs is that they tend to split into two extremes: one group only creates applications that can make money but lack long-term sustainability and significance; the other group focuses solely on users but has no revenue.

The first issue is that entrepreneurs are not making money, and the second issue is that if users are not idealists, they are unwilling to participate. A successful Web3 application will combine these two aspects.

SocialFi also has a history outside of blockchain. For example, in 2012, there was a project called Diaspora that aimed to create a decentralized Facebook, but they ultimately failed. Now, some projects like Bluesky and Threads are facing two problems. The first problem is that they cannot make money, so they lack the resources to do great things.

The second problem is that if users are not idealists, what motivation do they have to move from Twitter? If we can find a way to combine these two aspects, it would be perfect. But no one has fully achieved this yet. Finding a way to combine idealism with profitability is very important.

Joe: Do you pay attention to applications in ecosystems like Solana and TON?

Vitalik: Sometimes I chat with people from Solana to see what they are interested in and what topics are currently being discussed. There are indeed some people who are turning Depin into the internet or the next generation of infrastructure.

As for exchanges like Binance, they have a lot of development in some developing countries. In 2021, when we went to Argentina, I found that many people were using crypto, but I also noticed that many of them were crypto users but not blockchain users.

One Christmas, I was walking outside and approached a café. The owner immediately recognized me and showed me his Binance account. I asked him if I could use Ethereum to buy coffee, and he said yes. The payment process took about five minutes, and the transaction confirmation time was particularly long, but that issue has now been resolved. The reason I am also concerned about this topic is that we hope some exchanges can accept on-chain transactions on Ethereum within 12 seconds.

Joe: You just mentioned that many people are crypto users but not blockchain users. Could this be related to the fact that many on-chain activities are happening on the web rather than on mobile?

Vitalik: There are now some wallets that encourage this, such as Daimo on Base, which is a great example. Their goal is to create a decentralized wallet.

The "Crisis" of Ethereum

Joe: What do you think is the biggest crisis Ethereum is facing right now? And in the past two years, what do you think has hindered the development of Web3?

Vitalik: I wonder if 2022 and 2023 were the most dangerous times; I feel we are in a slightly better place now.

In 2022, AI exploded, and many people began to see AI as the future opportunity. Meanwhile, crypto was seen as relatively useless, merely a place for gambling, causing many idealistic individuals who wanted to positively impact the world to leave crypto. As I mentioned earlier regarding transaction fees and technology issues, they became disillusioned with crypto. I remember when I visited Silicon Valley in April 2022, chatting with some well-known AI practitioners who all told me that crypto was useless. This was before the FTX collapse, and the situation worsened after FTX.

Now, crypto has made many successful technological advancements, and there are also more successful applications, so I think the situation is somewhat better now.

I still see a risk in that our community has become particularly diverse; some people focus on finance, some on cyberpunk, and others on culture, art, and philosophy, and their ideas are all different. A failed scenario would be if they start to disrespect each other, with some only creating money-making applications while doing nothing else, and others wanting to do meaningful things but lacking funds. I hope these two can be combined.

Joe: Solana is becoming increasingly powerful, and many believe it has become Ethereum's most important competitor. What is your view on this issue?

Vitalik: I think they are indeed much more centralized than Ethereum.

First, running a Solana node is much more difficult than running an Ethereum node; second, Solana's PoS is more centralized; third, many community initiatives are directly supported by the Solana Foundation.

They focus heavily on applications and like to talk about Depin, which they are developing in collaboration with some large companies to sell hardware and work with telecom companies to create a new internet. These applications have a characteristic: their demand for decentralization is much lower than that of Ethereum. I believe their market goals are genuinely different from those of Ethereum.

If you want a blockchain with 100 TPS, Ethereum's L1 will never meet that requirement. You only have two choices: the first is to go to other high-performance blockchains, and the second is to use Ethereum L2, including Arbitrum, Base, MegaETH, etc.

So what can Ethereum do that other faster chains cannot? I assure you it is a long-term decentralized, neutral, and secure blockchain. You can look at some data charts comparing the decentralization of Ethereum's PoS mining pools with Bitcoin's mining pools, and you will find that Ethereum is more decentralized than Bitcoin.

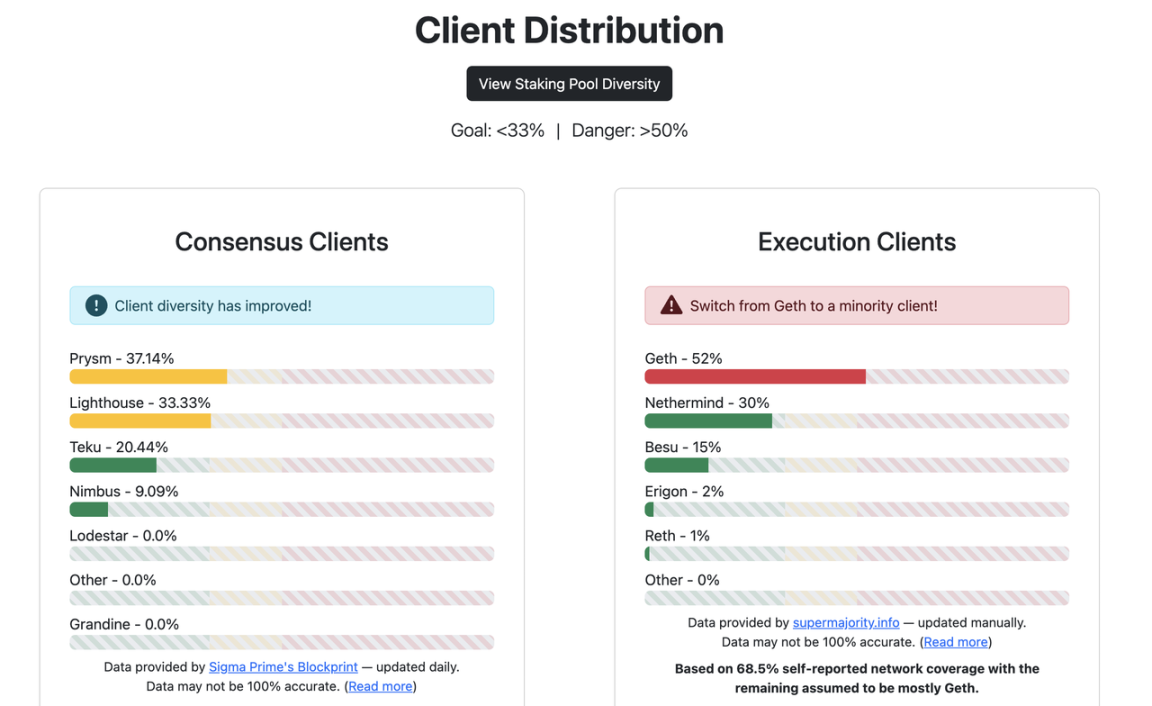

We have a successful experience and history in addressing some of our centralization issues. One example is the client issue; three years ago, the Ethereum network was using Geth and Prysm, and now no single client exceeds fifty-two percent.

Another example is the crisis we had two years ago with Tornado Cash. Some people started banning certain crypto transactions, and everyone was worried that the Ethereum chain might become non-neutral. A year later, you can look at the situation and see what percentage of blocks would censor those transactions. You might find that two years ago it was over 80%, but now it has consistently been around 20% to over 50%. A year or two from now, you will see the results of how we resolved these issues.

Ethereum L1 is not the best place for high-performance applications. If you want to create a game, L1 is also not the best place, so we need L2. This is how Ethereum's architecture is designed. The architecture of Ethereum L1 is decentralized, neutral, and secure, and it should be the only one comparable to Bitcoin. L2 can focus on transaction efficiency and speed, providing a good blockchain for mainstream users.

Joe: Does this mean that Ethereum's ultimate form should be seamlessly hidden behind all L2s?

Vitalik: In a way, yes. The only exception is that if Ethereum as an asset is not known to anyone, it cannot succeed. So from this perspective, Ethereum cannot completely become a background entity.

Ethereum needs to be known for its existence. Ethereum will not become something completely invisible like Google Cloud. The advantage of Ethereum compared to Google Cloud is that it is normally invisible, but in the most necessary situations, it can be seen; there is a distinction there.

So until a particularly necessary situation arises, we still need to talk about the existence of Ethereum L1 and its advantages and characteristics.

Joe: You just mentioned AI. How frequently do you use AI products? Do you often use products like ChatGPT?

Vitalik: Yes, I sometimes use ChatGPT. I specifically bought a relatively powerful GPU for my computer, so I can also run some local models. Some of the graphics in my articles are actually created using local AI.

Joe: What new things do you feel have emerged from the combination of AI and Ethereum?

Vitalik: I feel that AI and crypto have had a significant connection over the past decade, particularly with AI participating in decentralized exchanges. This example is very interesting and represents a large and promising category.

What is this category? Crypto can use smart contracts to define the rules of a game, ensuring that the execution of the game is secure, and AI can participate in this game. What is this game? Decentralized exchanges are the first example, and prediction markets are the second example. In the future, there may be many more examples.

Joe: There are also voices from the outside saying that Ethereum is becoming increasingly centralized from a technical mechanism perspective. How do you view this issue?

Vitalik: I find it strange that they say this because I feel that Ethereum is becoming increasingly decentralized. The problem we now face is the consequences of decentralization. For example, in L1 client development, five years ago we had only one client, Geth, while now we have Geth, Nethermind, Besu, and others.

Now you can visit a website called ClientDiversity.org, where you can see what percentage of the Ethereum network is using different clients. You will find that Geth has fifty-two percent, while others have a bit less. But no single client currently exceeds 66%.

What happens if Geth has a problem now? First, the Ethereum network will not finalize because finalization requires 66% of nodes to agree. So there will be a fork, but this fork will not finalize. At this point, client developers will investigate which client has the issue. When they find that the Geth client has a problem while others do not, Geth will be modified.

In 2016, there was a similar situation where Geth had about eighty-five percent of the network at that time. As a result, everything was normal after 12 hours. Now this network will not finalize. If there are applications with particularly high security requirements, they will immediately know that there might be a problem and will wait to confirm. After 12 hours, when a new version of Geth is released, there will be no issues. So the development of client decentralization is very good.

You can also look at the companies behind the clients and how they earn their money. In 2021, the clients were theoretically different companies, but their funding all came from the Ethereum Foundation. So it can be said that the degree of decentralization was not very strong in 2021. Why did we do this? Because we want different client companies to exist, and we want to give them a chance to grow. Now some client companies do not need funding from the foundation; we have recently provided very little sponsorship.

There is also a protocol-related aspect. Five years ago, I was almost the only protocol researcher. Now we have a research team of at least 20 people, some from the Ethereum Foundation and others from different teams outside the foundation, including some from Paradigm, who publish their own ideas about the protocol, along with many other teams.

Additionally, within the Ethereum ecosystem, five years ago, the largest organization was the Ethereum Foundation, followed by ConsenSys, and there was nothing else. Now we have the aforementioned client companies, ETH Global as an independent organization, and various wallets like MetaMask, Rainbow, Trust Wallet, Rabbit, etc., whereas three years ago there was only MetaMask.

This year, a particularly concerning issue for everyone is interoperability. There are many different L2s and wallets, and their integration has encountered some problems. If we were centralized, we would not have these issues.

So the problem we most want to solve now is how to maintain a decentralized ecosystem while still being able to coordinate in some important areas where coordination is necessary. We can still improve some important standards.

Joe: You just mentioned that decentralization also brings some problems. I have also noticed that there are discussions about L2s fighting among themselves, and Ethereum not forming a cohesive force. How do you view the perspective that various ecosystems seem to dilute Ethereum's resources?

Vitalik: I remember that in August, there was a lot of discussion about the issues with different L2s and Ethereum activities, creating a sense of competition. However, I found that after discussing these matters, L2s, wallets, and activities were all very willing to address this issue.

The day before yesterday, we had an event in Chiang Mai focused on L2 and wallet interoperability. At Devcon, there will be a larger event where everyone agrees that we need more standards and interoperability between L2s, and they are willing to promote this aspect. I feel that some outsiders, in order to criticize Ethereum, say that L2s are fighting among themselves, but if you listen to what the people from L2s say and think, you will find that they do not want to fight; they want to cooperate.

Turning 30, just turning 30

Joe: Finally, let's talk about some more personal topics. Confucius said that one should stand firm at thirty, and you just turned 30 this year. Ten years ago, you wrote the Ethereum white paper, and today, ten years later, have you fulfilled the dreams you had back then? What will you do in the next ten years?

Vitalik: You could say I have partially fulfilled them, and I have also realized that my understanding of what we need to do has changed a lot.

A significant change is in my thinking. Ten years ago, I focused on theory, discovering new mechanisms through economics and mathematics. But now, the times have changed; most of the mechanisms we can invent have already been invented. Now, what we are doing more is not inventing completely new mechanisms but optimizing what we already have. The optimization process cannot rely solely on theory; in some areas, it can, such as in cryptography and zero-knowledge proofs. However, in many areas, the only way is to experiment. Experimenting to see where it succeeds, where it fails, and continuously improving.

For a specific example, ten years ago, I had an idealistic idea of inventing a governance model that could be proven optimal and correct through mathematics. In many cases, you can mathematically prove that something is correct, but outside of the mechanism, there are different participants, and you cannot create a governance mechanism that will definitely be stable.

In "The Three-Body Problem," there are scientists who conducted many experiments but ultimately found that physics did not exist, leading them to commit suicide. I feel that economics does not exist in the same way. If we want to do more, the only way is to experiment. If we want to optimize our public goods mechanisms now, the only thing we can do is to conduct another experiment, change the mechanism, conduct another experiment, and again modify our mechanism. I may spend more time doing such things now and in the next ten years.

Joe: What hobbies do you have outside of crypto?

Vitalik: Walking, running, reading different books or exploring various things on the internet, and learning different languages in different places.

Joe: What types of books do you enjoy?

Vitalik: Most of them are non-fiction books, such as economics, history, or sociology. You will see some people online writing long articles, which are essentially equivalent to writing a book.

Joe: Where do you generally draw your energy from? How do you adjust yourself in the morning to achieve your best state?

Vitalik: One of the most interesting aspects of my life is that I have two types of work. The first type is more introverted work, such as writing code, writing articles, and discussing topics with developers. The second type is extroverted work, which involves attending events.

I have found an interesting point about the relationship between these two types of work. One serves as a rest for the other. When you do one too much and need a break, you can switch to the other.

Joe: Who are your favorite writers, musicians, and philosophers?

Vitalik: This question is really hard to answer because it's difficult to say one is better than the others.

Joe: If you weren't working in crypto, what would you be doing?

Vitalik: Before getting into crypto, I was involved in online education, so I think that's a pretty important topic.

My goal over the past two years has been to combine crypto with other important technological directions. If it weren't for crypto, I might be working on some DApps, including those related to healthcare and DCI (Data Center Interconnect). If I were to work on something related to crypto, I would focus on community notes.

Joe: Would you retire? Or disappear like Satoshi Nakamoto?

Vitalik: If I weren't doing my current job, I would feel lonely.

Joe: What aspects of Chinese culture do you like the most?

Vitalik: I have always found the Chinese community to be very friendly. They have various interesting ideas, and they care about building a particularly good community, as well as the values on Ethereum and blockchain. There are also simpler points, like how delicious Chinese food is.

Joe: What Chinese dishes do you like?

Vitalik: Greens and steamed fish.

Joe: Alright, this conversation is coming to an end. Thank you, Vitalik, for accepting the interview with Foresight News. I also want to thank some Web3 practitioners from the Chinese-speaking community who provided questions for this interview, including Yisi, co-founder of Mask Network; Jiang, co-founder of Social Layer; Forest, co-founder of Foresight Ventures; Yuanjie, co-founder of Conflux; Sandy, co-founder of Scroll; and KOL Jason. Their questions also represent the voices of the Chinese-speaking community. Of course, I would also like to extend my gratitude to Audrey from Shanhaiwu for her support, and thanks to photographer Shaka. Thank you, everyone.

Vitalik: Alright, thank you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。