Author: OKG Research

Recently, OKG Research researchers published an article on FT Chinese titled "After Successfully Predicting the Election, Can Polymarket Continue the 'Success of Web3'?" The article argues that Polymarket has fully demonstrated the power of "rational consensus" in Web3 applications during the prediction of the recent U.S. presidential election. This is a "victory" for Web3 applications: prior to this, no on-chain application had been able to break through the "barriers" of the internet without relying on tokens or other external incentives, taking the initiative in competition with Web2 platforms and capturing the highest market share. As one of the few on-chain innovations that can "reverse output" to the real world today, Polymarket not only shows us the potential for Web3 applications to replace existing Web2 services but also holds the promise of discovering more replicable successful experiences.

The following is the original text:

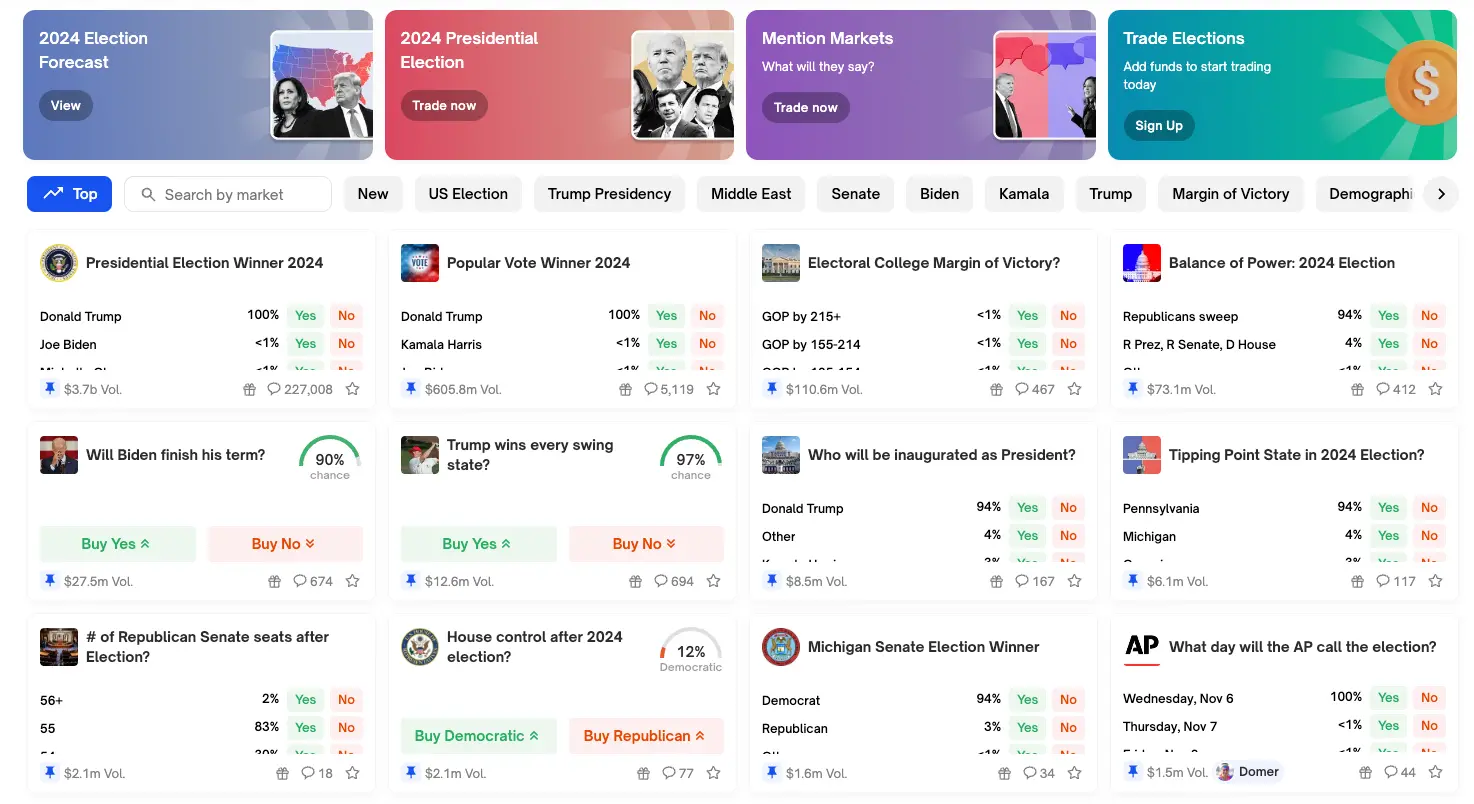

With the dust settled on the U.S. election, Republican presidential candidate Trump will return to the White House in January. Looking back at the entire election cycle, Polymarket, as a prediction market, has been frequently mentioned, occupying over 80% of the total betting amount for this election, and demonstrating the power of "rational consensus" in the prediction of "who will be the next president": traditional polling agencies generally believed that Trump and Harris had similar chances of winning, while Polymarket, which uses real money, had already shown that Trump's chances of winning were far higher than Harris's.

More importantly, as one of the few on-chain applications that can "reverse output" to the real world today, Polymarket not only allows us to see Web3 applications replacing existing Web2 services but also holds the potential to explore more replicable "successful" experiences.

1. The "Restrained" Polymarket, Gathering Rational Consensus

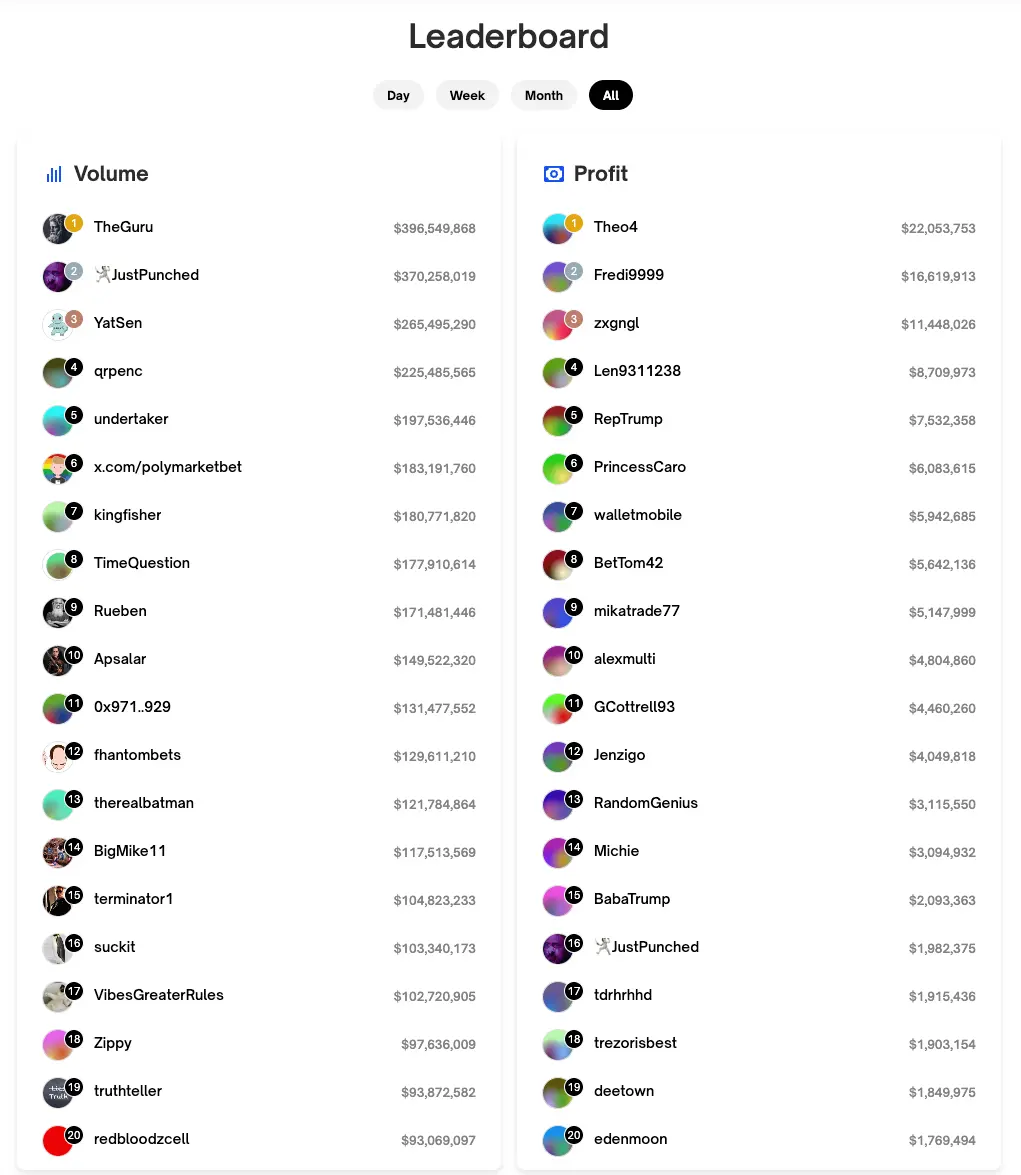

Unlike the "wealth creation myths" that may be generated by gambling speculation and meme coins, Polymarket does not bring substantial returns. Compared to traditional prediction platforms, Polymarket does not limit the scale of bets, but to avoid significant deviations in results, the odds are controlled within a reasonable range. This makes it difficult for users to achieve high returns through betting. With the election results revealed, accounts such as Theo4, Fredi9999, and zxgngl have already gained over $10 million in profits, with more than 78 addresses earning over a million, but the overall investment return rate is not particularly "exaggerated," and only about 15% of addresses have achieved positive profits.

This "restrained" investment return rate has caused some speculative users to lose interest, but it has also, in an invisible way, completed user screening, helping Polymarket to gather more "rational consensus." For Polymarket, what is always important is to leverage the efficiency of the free market to enhance prediction accuracy, rather than to bring excessive returns and increase trading volume. The relatively restrained "economic incentives" allow most users to make objective analyses of events more rationally, rather than making "profitable" choices out of speculative demand: this also makes Polymarket's predictions of future events have higher informational value compared to guesses and polls.

Authoritative media such as Bloomberg and the Financial Times often cite Polymarket's prediction data alongside traditional polling results when analyzing election trends; Elon Musk has even stated that Polymarket is "more reliable than polls, as it involves real money betting."

Polymarket is, as founder Coplan often claims, likely to become "the future of media." Although it currently only shows advantages in a few political topics such as elections and interest rate cuts, through integration and connection with media platforms like Substack and Bloomberg, Polymarket is becoming a "reverse oracle," conveying the most authentic data and viewpoints from the Web3 on-chain world to the traditional world.

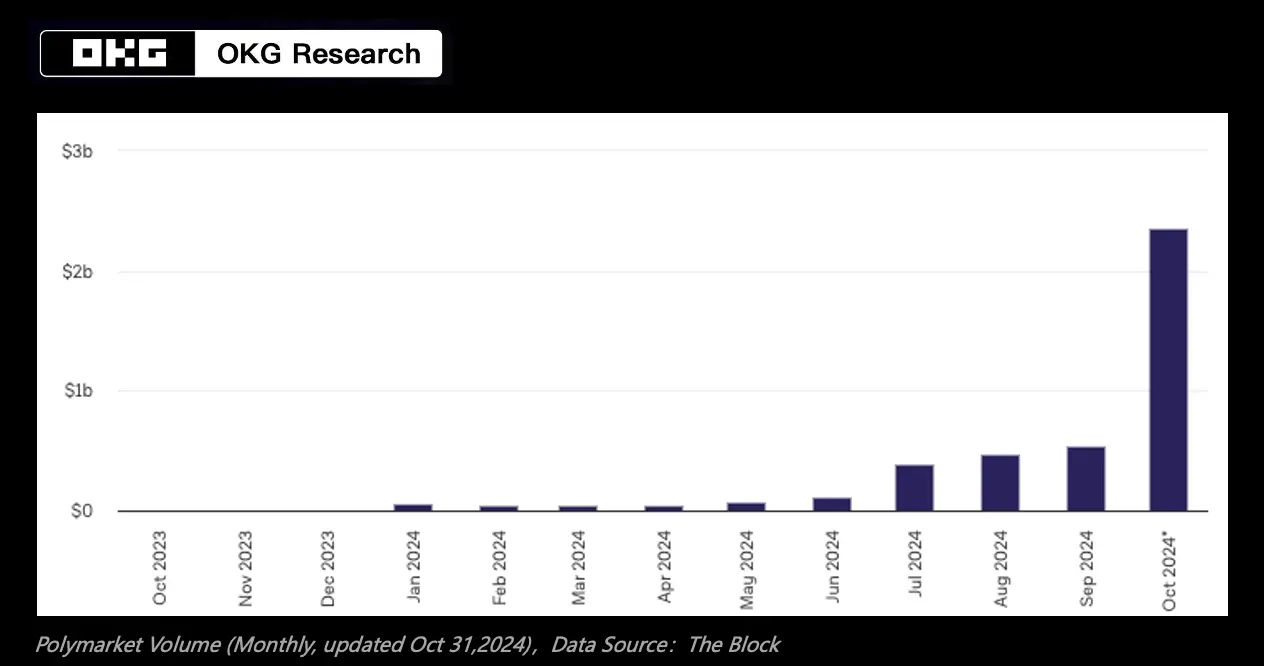

During this election cycle, Polymarket has achieved great success in competition with traditional prediction platforms and has almost become synonymous with "prediction markets." According to incomplete statistics from OKG Research, as of November 6, 2024, Polymarket's cumulative trading volume has exceeded $4.8 billion, with a monthly trading volume of over $2.3 billion in October alone, achieving an astonishing 4.5 times growth compared to September.

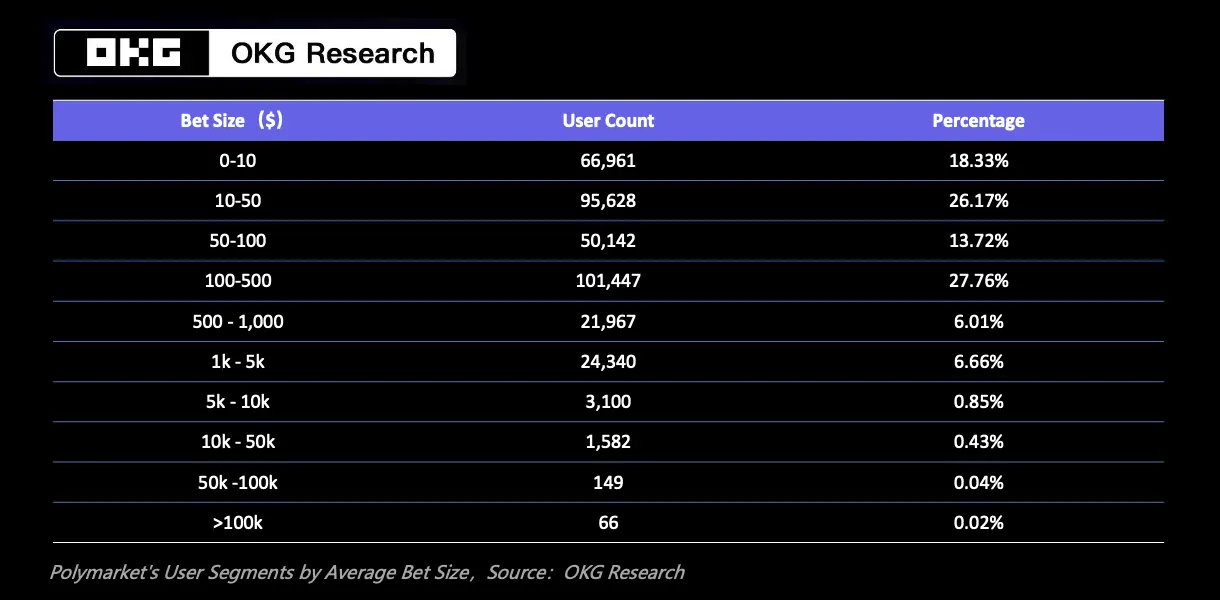

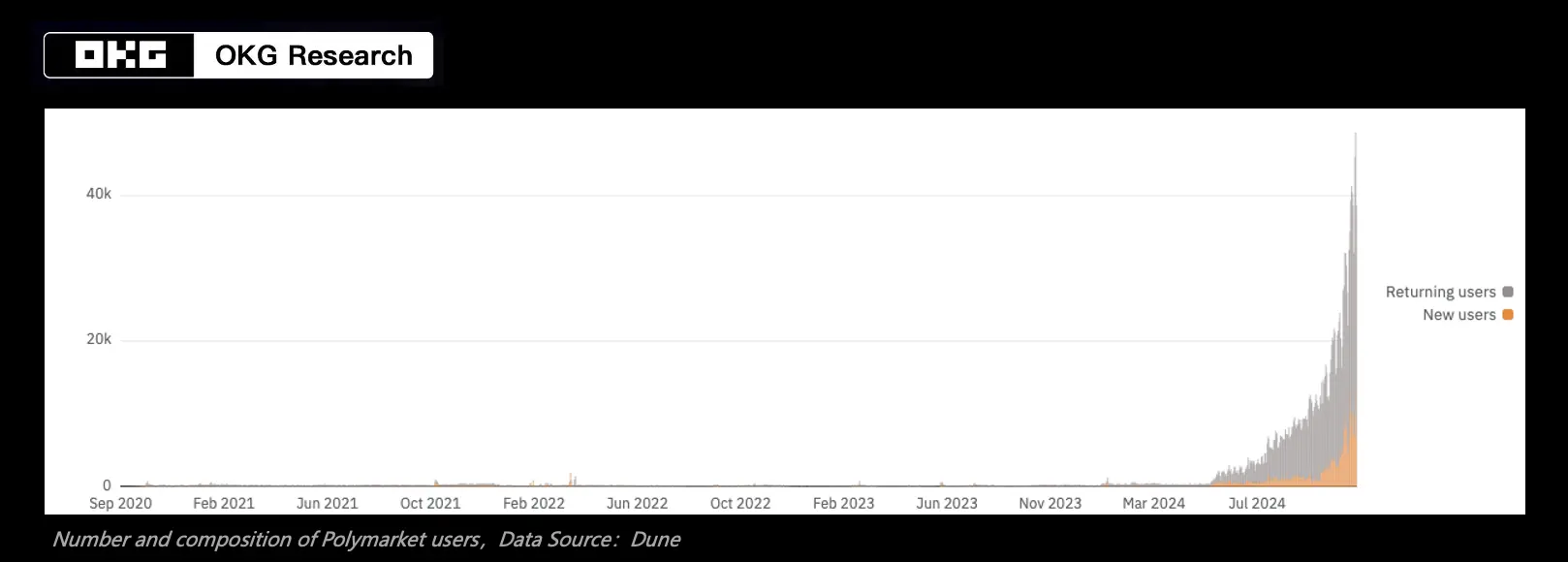

Since May 2024, Polymarket's daily active users (DAU) have also been continuously rising, reaching a new record of 53,000 on November 6, more than 100 times the number six months ago. However, we also note that while both trading volume and the number of active trading users are increasing, the average bet amount has been continuously declining, with over 85% of users betting amounts below $500, and more than 40% of users betting amounts below $50.

This may indicate that Polymarket is attracting more users with lower economic capacity or risk tolerance into the market, rather than just being a "rich man's game." Therefore, although this seems to be a "negative" indicator, it is positive for Polymarket in the long run. The origins of prediction markets and their past failures all emphasize the importance of broad participation; their rational analysis and continuous reassessment of new information are the cornerstones of the prediction market's ability to be "accurate": only with more users participating in event predictions can the trends shown by the data more accurately reflect market consensus.

The reason Polymarket has experienced such rapid growth is also due to leveraging the power of blockchain and cryptocurrency to build the broadest market consensus more authentically and effectively. The value of technology here mainly lies in achieving the timeliness of economic incentives and the transparency of betting data. Polymarket uses USDC as the trading currency for betting, greatly reducing transaction friction due to its inherent global and digital attributes, allowing users to participate in predictions more freely; the idea based on smart contracts and AMM also brings better market mechanisms to the prediction market—no entry barriers and better liquidity. More importantly, compared to traditional Web2 prediction platforms that may have "behind-the-scenes operations," Polymarket operates on the Polygon blockchain network, where all betting data is public and transparent, allowing users to query at any time and analyze and make decisions based on current real-time situations.

2. How to Find the Next "Polymarket"?

In the total betting amount for this year's U.S. election, Polymarket has shown an absolute advantage compared to traditional Web2 prediction platforms. This is a "victory" for Web3 applications: prior to this, no application created in an on-chain environment had been able to break through the "barriers" of the internet without relying on tokens or other external incentives, taking the initiative in direct competition with Web2 platforms and capturing the highest market share.

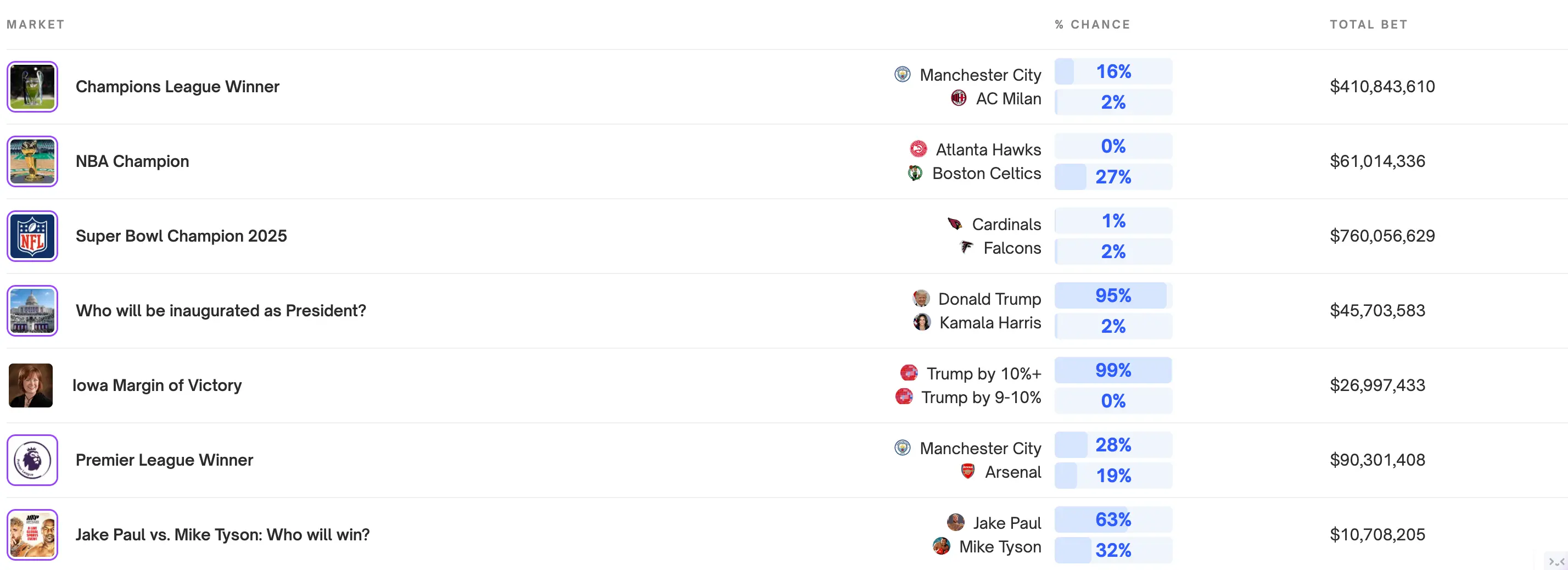

Many people worry that Polymarket's reliance on election "blockbusters" will leave it lacking in sustainability. However, from the on-chain situation, although Polymarket's data has declined after the election, it has shown a significant improvement compared to before October, with the average daily trading volume currently stabilizing at $30-40 million, and the number of daily active users also remaining above 20,000, roughly on par with the end of October. After the "election heat," sports topics have officially taken over, with the Super Bowl champion prediction reaching a transaction volume of $760 million, and the UEFA Champions League champion prediction attracting over $400 million in betting.

Of course, just as the betting results of prediction platforms cannot represent the "truth," we cannot assess whether Polymarket's "victory" can continue. But rather than that, we are more concerned with whether we can replicate Polymarket's "victory" in other fields.

In the past two years, the infrastructure of Web3 has gradually matured, even showing signs of "oversupply," and the industry has shifted more focus to the application layer. However, as Web3 accelerates its mainstreaming process under internal and external forces, applications that previously only catered to the crypto user base can no longer succeed. How to accelerate penetration into the real world, attract more Web2 users, and optimize or even replace existing Web2 services with on-chain applications has become an important direction for Web3 application innovation. However, before Polymarket, it was difficult to find cases where Web3 applications truly replaced existing services.

The reasons for the poor performance of these on-chain applications are well known: aside from compliance issues, the blockchain environment and the resulting entry barriers and usage thresholds have kept most ordinary users "off-chain." Moreover, innovations that can truly achieve mass adoption are mostly simple or even "mindless." If users have to "think" too much when using something, it will undoubtedly create fear and drive them away. Before Polymarket, Augur, as the first on-chain prediction market, was also highly regarded but failed to sustain user attraction and operation due to its overly complex mechanism.

To encourage more participation, the most direct way is to lower the usage threshold, simplifying the user interface to the extreme, ideally allowing for "one-click completion." Just like today's mobile payments, where you can complete a transaction with a simple scan of a QR code, this is how you can gain acceptance from more ordinary users. Polymarket clearly recognized this early on and abandoned complex protocol designs at the product level, maximizing the reduction of unnecessary complexity that burdens users, always focusing on meeting core needs (such as betting), and discarding other concepts like decentralization and permissionlessness.

However, Polymarket still actively leverages the advantages brought by blockchain and cryptocurrency, making it appear more attractive. But the value of on-chain applications does not lie in achieving decentralization; rather, it is about providing a more efficient, trustworthy, and accessible application environment for more real-world scenarios based on blockchain and crypto assets. Therefore, Polymarket does not insist on having all activities occur on-chain but adopts a hybrid model: only allowing core transactions and settlement processes to occur on-chain, while some metadata storage and transaction order matching are completed off-chain. This not only provides greater flexibility and scalability but also ensures that users can complete transactions at low cost and high efficiency.

In the early days of Web3 applications, such a product model that aligns with existing user habits may be more conducive to achieving seamless migration for more users, replicating Polymarket's "success" in different fields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。