Ethena provides an interesting case study worth noting, which may offer insights for Uniswap, Blur, and others on balancing stakeholder incentives when activating fee conversions.

Written by: Kazu Umemoto, Bankless

Translated by: Bai Shui, Jinse Finance

Investors hoping for Donald Trump's return to the White House believe it will bring a clearer legal framework and a more favorable regulatory environment for cryptocurrencies. They are exploring DeFi tokens like UNI, which may soon "turn on" their fee switches, essentially allowing token holders to start accumulating returns just by holding the tokens.

Perhaps the hottest protocol sparking this interest is Ethena. This occasionally controversial growth monster has been making waves in the stablecoin space, with its ENA token holders able to earn substantial returns from stablecoin yields.

Let’s take a deeper look at what Ethena is doing and why its community is considering this move for ENA.

Ethena's Opportunity

Ethena is a decentralized stablecoin project that provides synthetic dollars for DeFi and Web3 users.

While Tether and Circle back their centralized stablecoins with cash-equivalent assets like short-term treasury bills, ensuring each token is fully collateralized, they retain the earnings from these assets, benefiting the issuers rather than the stablecoin holders. This arrangement places the risk of decoupling events on stablecoin holders while issuers profit from the yields of the underlying assets. However, Ethena is taking a new approach to seize this opportunity.

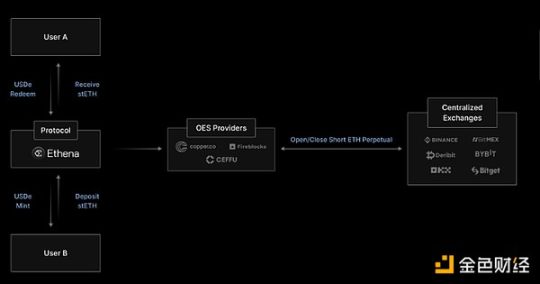

When users mint USDe, Ethena creates a delta-neutral position to support it. Ethena's approach is to establish long positions by purchasing tokens like stETH, ETH, or BTC, and then matching them with short perpetual positions of the same size. This strategy helps ensure the value of USDe remains stable.

Additionally, if the futures price of ETH or BTC is higher than the spot price, Ethena's short positions will charge funding fees to traders holding long positions. Although the yield on stETH is moderate, around 3-4%, the primary source of returns comes from the funding generated by shorting futures.

As the cryptocurrency market heats up and bullish sentiment grows, the gap between futures and spot prices widens, leading to an increase in funding rates. This means that the returns from Ethena's short positions will be higher, potentially adding value for ENA holders if the fee switch is activated.

"Money Printer"

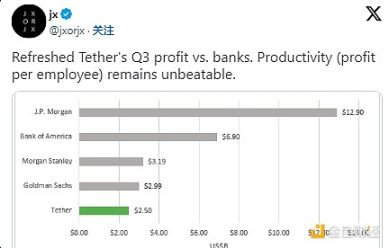

Tether reported a net profit of up to $2.5 billion in the third quarter, bringing its annual total to $7.7 billion, primarily from holding government bonds. However, USDT holders do not benefit from these profits. In contrast, Ethena's model allows stablecoin holders to benefit from the generated yields, opening new profit avenues for USDe and potential ENA holders.

Through Ethena's approach, they can not only capture the yields from staked assets but also profit from financing and basis through their delta-hedged derivative positions. Additionally, Ethena holds stablecoins like USDC and USDS, with its USDC earning about 5% annualized yield through Coinbase, while USDS earns about 6% annualized yield through Sky (formerly Maker).

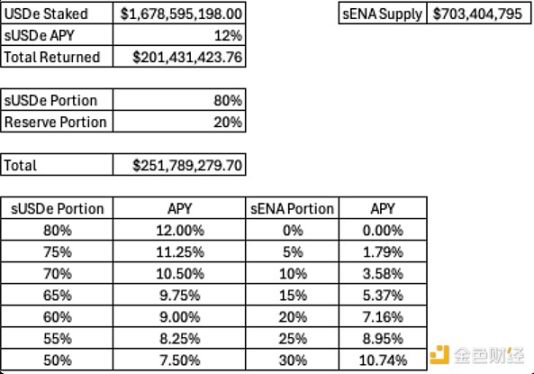

Thanks to this approach, Ethena generates approximately $250 million annually (based on current figures). Of this, 80% is directly provided to sUSDe holders, who earn a competitive 12% annualized yield on their stablecoins, while the remaining 20% supports Ethena's reserve fund.

With the substantial yields from sUSDe, ENA holders are eager to access this profit. A recent forum post from the Ethena Foundation sparked discussions about activating fee conversions. The post raised important points, such as clarifying the amount of income, the impact of fee conversions on sUSDe rates, and average protocol income.

If ENA holders join the profit distribution, the APY for sUSDe holders may slightly decrease, but it would still offer highly competitive returns compared to other stablecoins. For example, adjusting the split so that sUSDe holders receive 60% and sENA holders receive 20% would still provide sUSDe holders with a stable annualized yield of 9%, while sENA holders would receive about 7% annualized yield, derived from actual earnings rather than token issuance.

As Ethena actively seeks integration to expand USDe, the growth potential of the stablecoin looks promising. If the fee conversion is initiated, sENA holders could see substantial returns.

Conversion Incentives

If Ethena's ENA token holders decide to activate the fee switch, it would allow sENA holders to receive a share of the profits from USDe positions. Then, ENA holders may compete for a larger proportion of the yield, thereby reducing the amount allocated to the reserve fund or sUSDe holders.

Ethena may not be able to provide sufficient yields for sUSDe holders. This could alter the risk-reward balance, diminishing the appeal of sUSDe and potentially prompting users to turn to alternative stablecoins.

Additionally, suppose there is a scenario where the funding rate is negative, meaning Ethena must pay funding fees in the futures market. This would force Ethena to draw funds from its reserve fund to provide financing for long position holders.

While the reserve fund serves as a safeguard, and financing rates have historically been positive, the cryptocurrency market is no stranger to economic downturns. Given the volatility of interest rates, it is uncertain how long the reserves can sustain these expenditures if negative financing rates persist in the future.

DeFi Outlook

Ethena aims to revolutionize a multi-billion dollar industry that has yet to return value to token holders. The potential fee conversion offers ENA holders a unique opportunity for token appreciation and actual income gains.

Ethena presents an interesting case study worth noting, as it may provide insights for Uniswap, Blur, and other companies on balancing stakeholder incentives when activating fee conversions. It will also be intriguing to see how aligned the long-term interests of token holders are with Ethena's goals, and how the Ethena team will respond if ENA holders demand excessively high returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。