Author: Frank, PANews

Apots and Sui, originating from the same school, are often compared, especially with the recent market surge. The SUI token has led the public chain sector, rising as much as 117% in two weeks and reaching an all-time high, while APTOS is also making strides, with the world's largest asset management company BlackRock's BUIDL fund expanding to Aptos.

PANews conducted an investigation using on-chain data to compare the ecological development of Apots and Sui.

Price Surge with Capital Support

Apots and Sui are public chain networks created by former members of Facebook's (now Meta) Diem blockchain project team. Their similar team backgrounds have led to many similarities between the two projects, such as both using the Move programming language and emphasizing high performance and low latency. As new public chains launched in the past two years, Aptos and Sui have garnered significant expectations from the market during this bull run.

From a news perspective, both Apots and Sui have made notable progress recently, particularly with the backing of large capital.

On November 13, BlackRock's BUIDL fund announced its expansion to the Aptos, Arbitrum, Avalanche, OP, and Polygon chains, which is seen as a significant positive for Aptos. At the end of last month, Tether announced the introduction of the USDT stablecoin to the Aptos network. Additionally, on November 12, Bitwise announced the launch of the world's first Aptos Staking ETP on the Swiss Stock Exchange on November 19. Institutional-grade products may attract more investor attention and new capital inflows to Aptos. This is also viewed as an endorsement, boosting market confidence.

It is also worth mentioning that Aptos recently gained attention due to the song "APT" released by Korean star Mars and has seemingly embraced this publicity. On November 14, Aptos specifically retweeted the Chinese hip-hop song "Public Chain Cheetah" created for Aptos by music creator 0xRasTrack.

Meanwhile, the Sui network seems to have received support from Binance. On November 11, Binance announced the addition of WBETH, BNSOL, and SUI assets to its dual-coin investment. On November 13, Binance announced the launch of the HIPPO 75x contract, which, as the only meme coin in the Sui ecosystem with a market cap over $100 million, saw its value double following this news. As of November 14, HIPPO's market cap had surpassed $200 million. In addition to its interaction with Binance, asset management company VanEck announced on November 13 that it would list the Sui ETN on Euronext Amsterdam and Paris. This product allows investors to participate in the development of the SUI token without directly holding the token.

Overall, both projects have recently attracted market attention through the endorsement of large capital. The prices of their governance tokens have also seen significant increases recently. The SUI token rose from a low of $1.59 on October 29 to a high of $3.52 on November 14, an increase of over 117%, making it one of the best-performing tokens among mainstream coins. The APT token rose from $7.74 to a high of $14.11 between November 5 and November 12, with a maximum increase of over 83%. However, APT experienced a significant pullback in the following days, with a maximum retracement of about 20%. Historically, the current APT price is still nearly half of its high of $20.4 in 2023. As of November 14, SUI's market cap was approximately $9.5 billion, ranking 14th, while APT's market cap was about $6.3 billion, ranking 22nd.

No Significant Growth in On-Chain Data, Sui's MEME Ecosystem More Active

In terms of on-chain data comparison, both Apots and Sui have not created new excitement within their ecosystems recently.

The daily new coins, active addresses, and daily transaction numbers on the Sui chain have not reached the highs seen earlier and have shown a noticeable decline. The popularity of MEME coins within the ecosystem reflects this as well; on November 14, among the tokens with trading volumes exceeding $1 million, only one, PNUT, was created that day, while the others were created over a month ago. The daily transaction volume on the Sui network is around 15 million, with daily active users maintaining between 700,000 and 900,000.

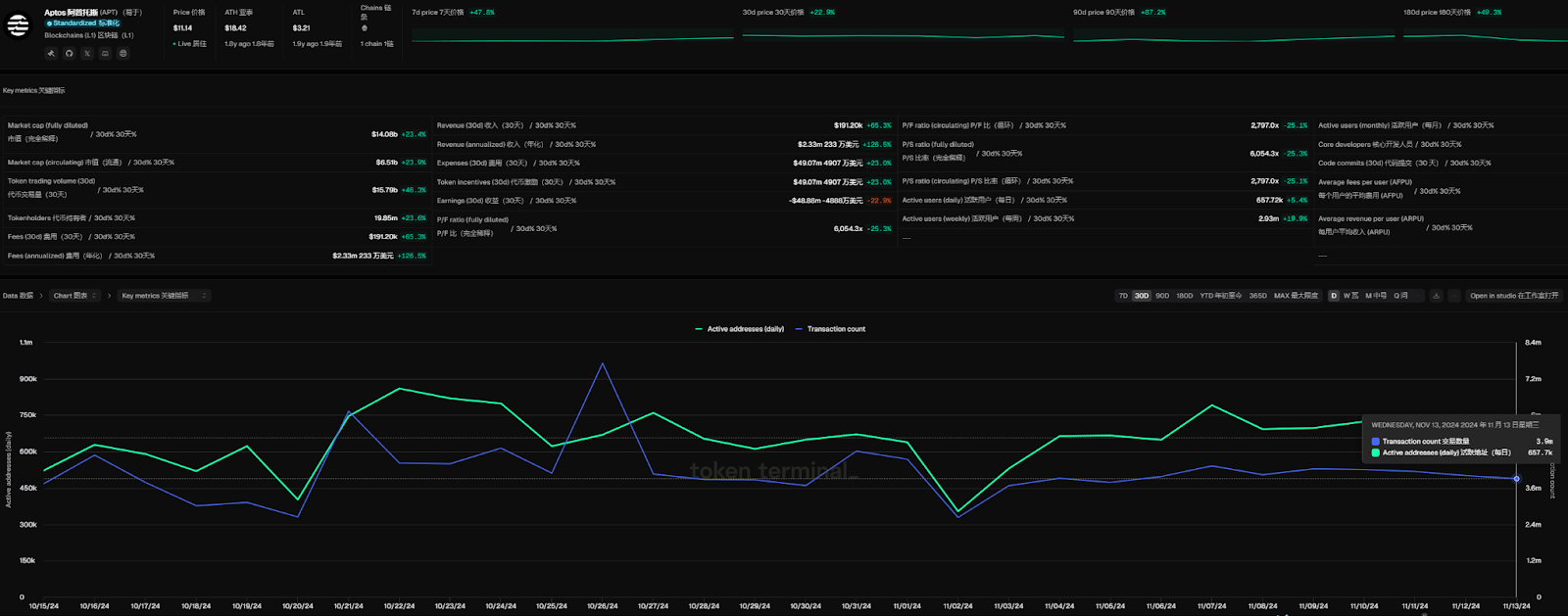

Aptos's on-chain data also shows no significant changes, with user transaction volumes generally around 3 million daily and daily active users around 700,000.

From the on-chain data, the activity levels of both are relatively close. However, they both lag significantly behind the Solana chain.

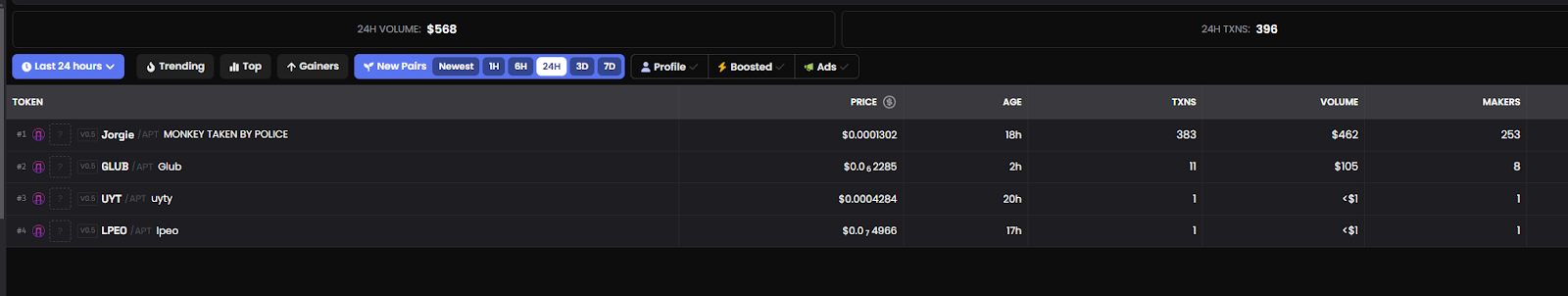

In terms of MEME ecosystem performance, the top MEME token on Sui, HIPPO, has a market cap of approximately $193 million. The current MEME coin on Aptos, PNUT, has a market cap of only $1.1 million. According to data from November 14, there were 9 trading pairs on the Sui chain with trading volumes exceeding $1 million that day, while Aptos had only 5. On November 14, Aptos added only 4 new token trading pairs, with the largest trading volume being $460. From this perspective, Aptos's MEME environment can only be described as minimal. The Sui ecosystem appears to be more active, with 176 new trading pairs created on the 14th.

Capital Inflow Situation: Sui Far Exceeds Aptos, DeFi Scale Comparable

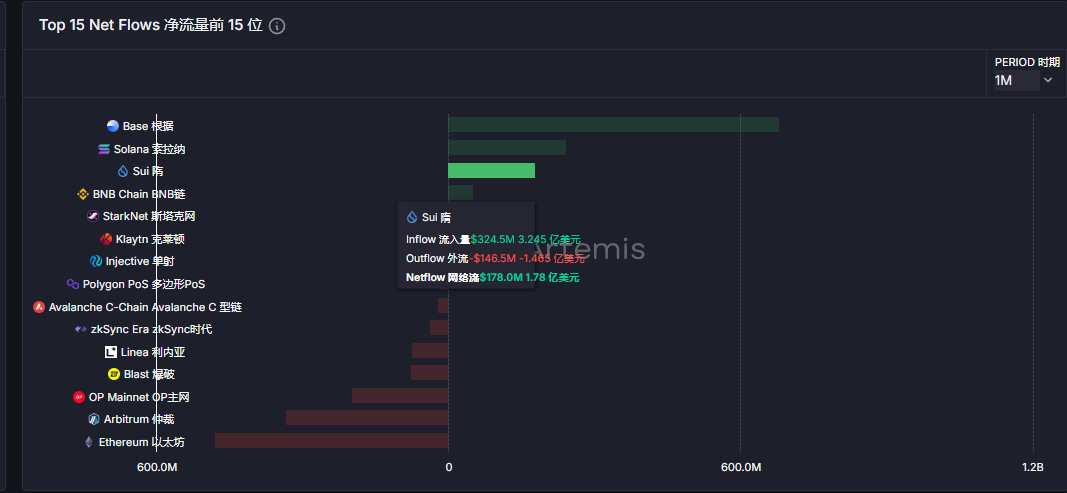

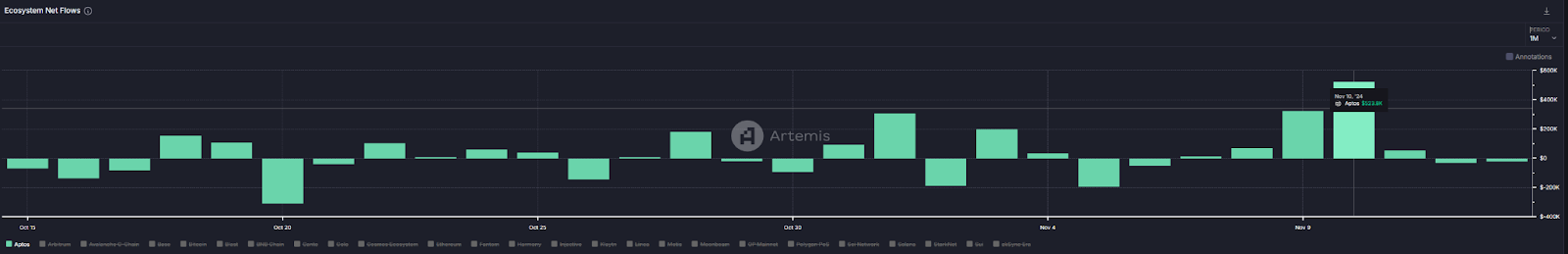

In terms of capital flow, the Sui network has seen a net inflow of $178 million over the past month, ranking third in the entire network, only behind Base and Solana. In contrast, Aptos's scale is significantly smaller, with a total capital inflow of $10.6 million and total outflow of $9.7 million over the past month, resulting in a net inflow of about $900,000.

In the past month, there have indeed been signs of increased capital flow on the Aptos chain, with a net inflow of $520,000 on November 10. However, in terms of scale, this capital inflow data does not represent a significant entry of funds.

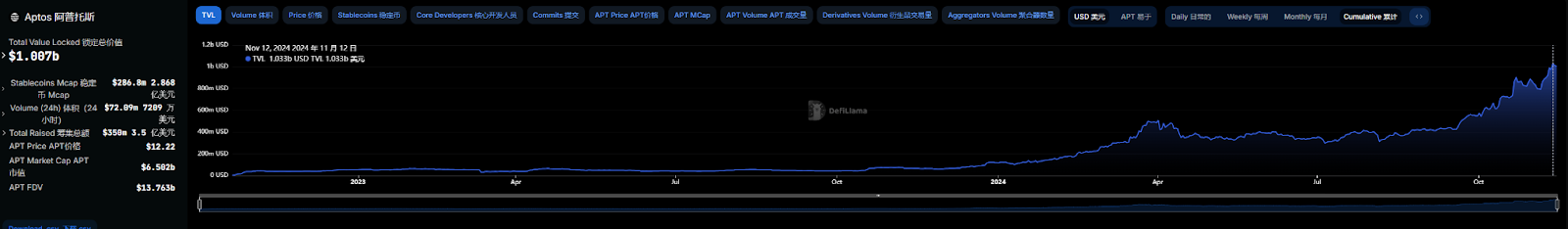

From the perspective of DeFi development, Aptos's TVL data has been on an upward trend since the beginning of this year, surpassing the $1 billion mark for the first time on November 12, representing a growth of over 10 times in the past year.

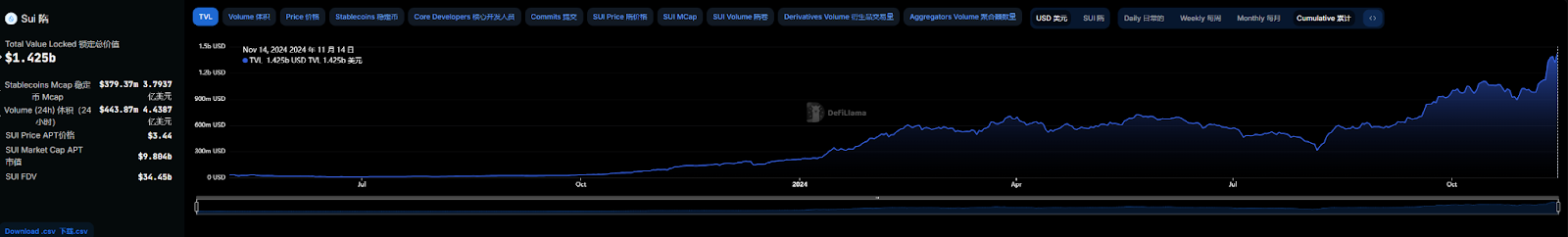

As of November 14, the Sui network's TVL is $1.425 billion. In terms of growth, Sui's TVL has also increased by over 10 times in the past year. Comparing the two, the gap in TVL between Sui and Aptos is not significant.

Overall, in the comparison between Apots and Sui, the Sui network clearly has the upper hand at this stage. Whether in terms of capital inflow or ecosystem activity, the Sui network has gradually established itself as a mainstream public chain, riding the wave of MEME popularity.

Aptos, on the other hand, seems to emphasize its performance advantages and focus on DeFi development. Despite the recent popularity of the APT song, Aptos has not managed to leverage this trend for more practical conversions, indicating that the application enthusiasm for Aptos still lacks momentum. If one must say who is leading the development of the "Facebook series" public chains, the current result still favors the Sui network. Fortunately, the market is still in a bull run, and anything can happen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。