The trajectory of Bitcoin moving towards the $100,000 mark may face temporary pressure from short-term investors' concerns about inflation.

Written by: Marcel Pechman, CoinTelegraph

Translated by: Deng Tong, Jinse Finance

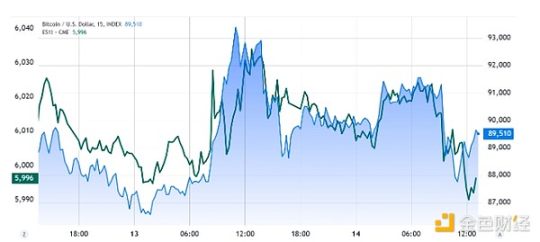

On November 14, U.S. inflation data slightly exceeded market expectations, causing Bitcoin's trading price to drop by 4.1%. This decline reflected the movement of S&P 500 futures, which fell from 6023 to 5980 within four hours.

As a result, traders are now beginning to question the degree of this correlation and when Bitcoin's inflation-hedging properties might provide some protection in a persistently inflationary environment.

S&P 500 futures (left) compared to Bitcoin/USD (right). Source: TradingView

Despite the U.S. Producer Price Index (PPI) rising 2.4% year-on-year in October, slightly above the consensus of 2.3%, this did not change the consensus outlook for a 0.25% rate cut by the Federal Open Market Committee (FOMC) in December. However, there is growing skepticism about the Federal Reserve's ability to maintain a rate-cutting trajectory before 2025.

Persistent Inflation and Bitcoin's Hedging Role

Historically, Bitcoin has benefited from concerns about inflation. However, in 2021 and 2022, the liquidity injections driven by government stimulus checks and the Federal Reserve's balance sheet expansion weakened these effects. At that time, despite rising costs, the risk of economic recession was minimal. Today, the situation has changed; although the labor market remains relatively strong, traders are cautious, anticipating that corporate earnings may face pressure.

Despite the new government's cost-cutting measures and strategies aimed at strengthening the dollar under Donald Trump, these actions may pose short-term challenges to risk assets. For example, a Reuters report indicated that the $7,500 tax credit for electric vehicle buyers might be canceled, leading to a nearly 5% drop in Tesla's stock price on November 14.

Similarly, the recent appointment of Elon Musk and Vivek Ramaswamy to lead a new government agency aimed at streamlining bureaucracy and restructuring federal agencies may result in job losses for some and reduce the funds available for individuals and businesses to invest. This dynamic could impact the stock market and potentially spill over into other sectors, including real estate, commodities, and Bitcoin.

U.S. government spending (left) compared to Bitcoin/USD (right, logarithmic). Source: TradingView

U.S. Fiscal Policy and Its Impact on Bitcoin Demand

One of Bitcoin's primary roles is as an alternative reserve asset, providing a hedge against currency devaluation when government spending expands. If the U.S. government successfully limits spending growth, the demand for Bitcoin as an inflation-hedging tool may decrease, as the risks of holding dollars diminish for investors.

However, given Bitcoin's appeal as a censorship-resistant and transparent asset, it remains uncertain whether investors will genuinely lose interest in Bitcoin's scarcity value. Unlike gold, stocks, or real estate, Bitcoin's issuance schedule is extremely predictable, which can support its demand even without directly competing with the dollar, especially in the initial stages of adoption.

Bitcoin's recent intraday performance has aligned with the stock market, reflecting concerns about persistently high inflation. However, from a broader perspective, the fiscal challenges in the U.S. may still persist, as government spending is unlikely to be significantly cut in the face of recession risks.

Ultimately, the trajectory of Bitcoin moving towards $100,000 and beyond may endure temporary pressure from short-term investors' concerns about inflation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。