Written by: Tyler

From a certain perspective, the $1.75 trillion market cap of Bitcoin (latest CoinGecko data as of November 12, 2024) is the largest "sleeping pool of funds" in the crypto world.

Unfortunately, for most of the time, it has neither generated returns for holders nor injected vitality into the on-chain financial ecosystem. Although there have been many attempts to release the liquidity of Bitcoin assets since the DeFi Summer began in 2020, most of them have been repetitive wheel reinventions, and the overall influx of BTC funds has been quite limited, failing to truly leverage the BTCFi market.

So what is the main battlefield for BTCFi? Or what problems must Bitcoin staking solve first? This is an answer worth at least hundreds of billions of dollars and is a must-answer question for the Bitcoin ecosystem, especially for Bitcoin staking projects.

As the current number one seed in the Bitcoin Staking field, Solv has provided a forward-looking solution, and the core of the answer lies in the concept of "standardization" within the SAL (Staking Abstraction Layer).

Bitcoin Trapped in "Liquidity Fragmentation"

Let's first take a look at the development history of the Ethereum Staking ecosystem.

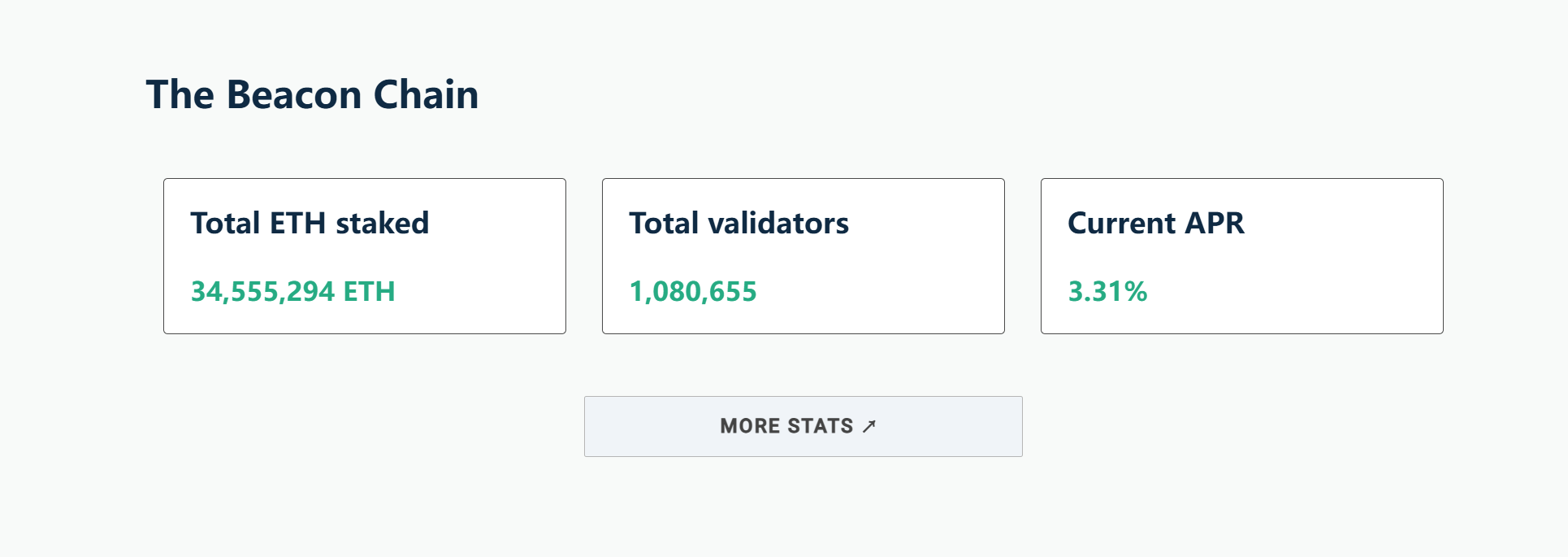

As of November 12, 2024, the total amount of staked Ethereum has exceeded 34.55 million ETH. Meanwhile, data from CryptoQuant shows that the proportion of staked ETH to the total supply of ETH has significantly increased from 15% in April 2023 to about 29%, nearly doubling, with a total scale surpassing $100 billion.

ETH Staking Amount / Source: Ethereum

However, during the same period, the Bitcoin ecosystem, which began to rise with the Ordinal wave, has a staking penetration rate far lower than that of Ethereum. Even though the market cap and price increase of BTC far exceed those of ETH, it has never been able to catch up with the expansion speed of the Ethereum Staking ecosystem.

It is important to note that even releasing 10% of BTC liquidity would create a market as high as $17.5 billion, and if it reaches a staking rate similar to ETH, it would release about $50 billion in liquidity, pushing BTCFi to become a super on-chain ecosystem that surpasses the broader EVM networks.

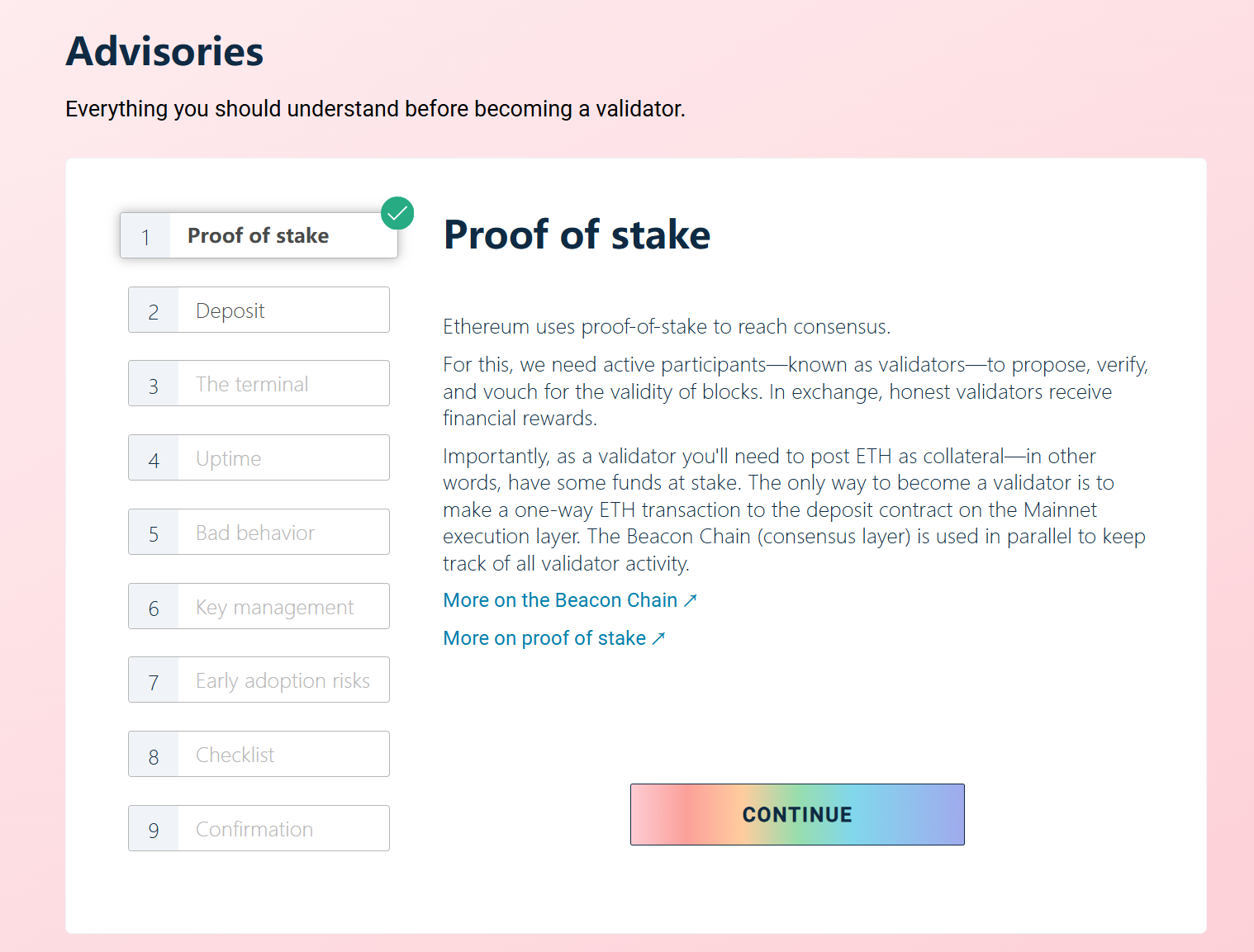

To some extent, the excellent performance of the Ethereum Staking ecosystem is due to the advantages of programmability and the Ethereum Foundation's leadership in establishing a clear and complete set of standards for ETH staking at the protocol level, including a clear staking threshold of 32 ETH, a slashing penalty mechanism, and comprehensive considerations of hardware and network costs, covering everything from the funding requirements for ordinary users to the economic security of node operations.

Validators must stake at least 32 ETH, adhere to the slashing penalty mechanism, and meet hardware and network thresholds, all of which comprehensively consider the funding thresholds, hardware and network costs, and economic security required for ordinary users to run nodes.

This unified standardized framework design not only enhances the decentralization and security of the network but also lowers the barriers to development and participation, facilitating the rapid rise of projects like Lido Finance, Rocket Pool, and Frax Finance, and enabling the Ethereum Staking ecosystem to achieve rapid scaling and diversification in a short period.

Official ETH Staking Process / Source: Ethereum

In contrast, the Bitcoin ecosystem, characterized by "no founder" and "no centralized promoting organization," has formed its unique "chain sentiment" of extreme decentralization. This is both a unique advantage of the Bitcoin ecosystem and, to some extent, a "development curse":

This completely decentralized structure means that key technical standards like staking mechanisms lack a leading role akin to the "Ethereum Foundation," requiring broad consensus among global developers and node operators to implement, and this consensus-building process is often long and complex.

Therefore, the entire set of clear standardized frameworks in the Ethereum ecosystem has laid a solid foundation for the rapid growth of its staking and liquidity ecosystem. For BTCFi to achieve similar progress, it is essential to introduce similar standardized mechanisms in the staking field to address various liquidity and asset management challenges.

Especially in the current context of accelerating fragmentation of Bitcoin asset liquidity, the need for "unification" has become particularly urgent:

- On one hand, when BTC is bridged to Ethereum and other EVM-compatible networks in various forms like WBTC and cbBTC, it provides users with opportunities to use Bitcoin assets to participate in DeFi for returns, but it also leads to further dispersion of BTC liquidity across different chains, creating "liquidity islands" that are difficult to circulate and utilize freely, greatly limiting the development potential of BTCFi (including recent community concerns about WBTC due to custody risks, making decentralization and standardization imperative);

- On the other hand, with the launch of Bitcoin ETFs and the further strengthening of global asset consensus, Bitcoin is accelerating its expansion into CeFi and CeDeFi, with more and more BTC flowing into institutional custody services, forming large pools of dormant funds;

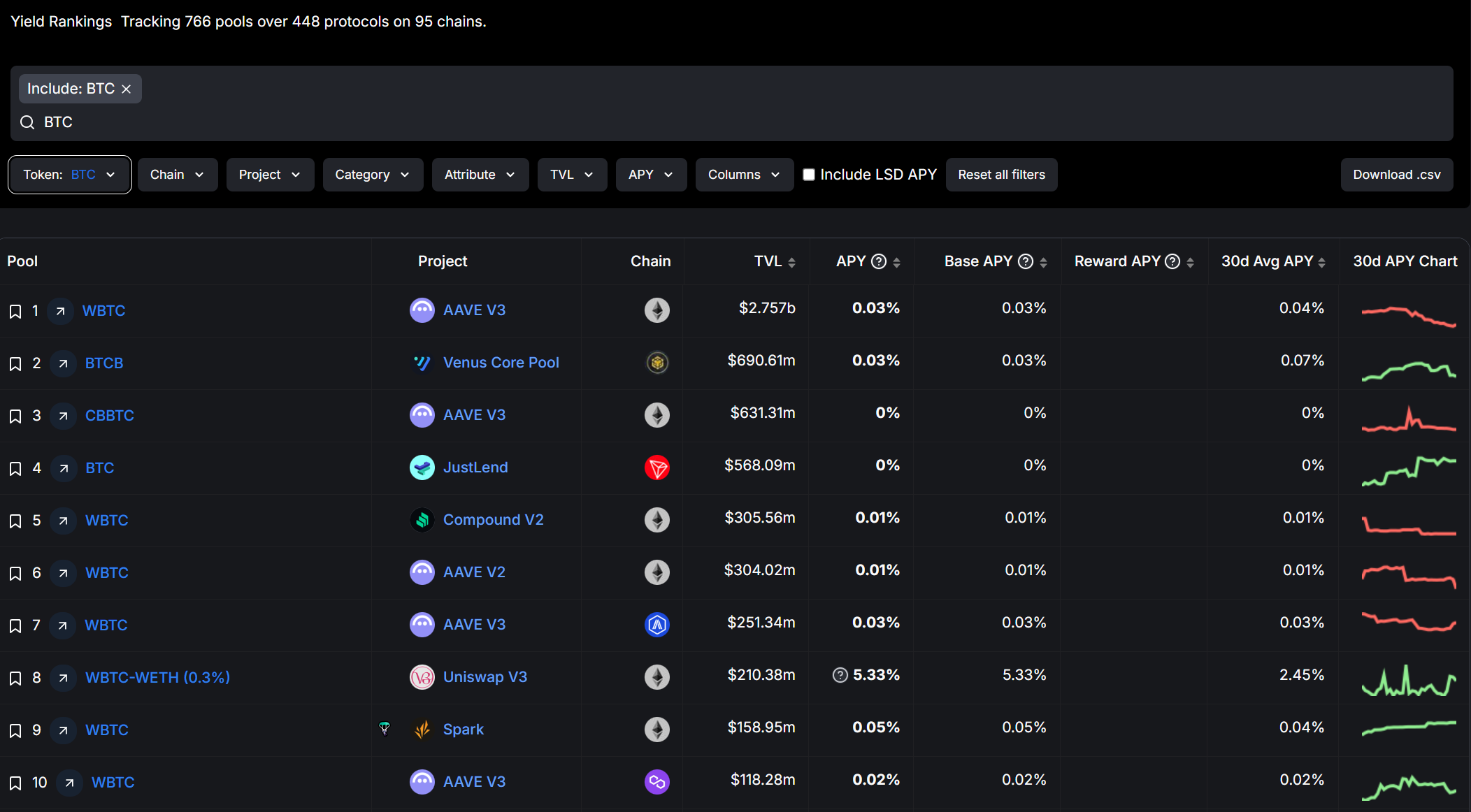

BTC Liquidity Statistics / Source: DeFiLlama

According to data from DeFiLlama, the currently yield-generating Bitcoin has been dispersed across 95 chains, 448 protocols, and 766 liquidity pools. However, due to the lack of a unified staking standard and cross-chain liquidity mechanisms, cross-chain, cross-platform, and cross-institutional BTC assets not only incur high friction costs but also cannot be efficiently integrated and utilized.

In this context, if BTCFi and the Bitcoin staking ecosystem are to continue to scale, there is an urgent need to establish a universal, standardized industry safety standard and framework to efficiently integrate the dispersed Bitcoin liquidity resources across multiple chains and platforms.

Therefore, objectively speaking, the BTCFi and Bitcoin ecosystem currently calls for a leading role that can dominate these standardization processes, allowing for the integration of cross-chain Bitcoin liquidity to form a consensus and establish a unified technical framework and norms, thereby bringing broader applicability, liquidity, and scalability to the Bitcoin staking market, further promoting the financialization process of staking assets and driving the BTCFi ecosystem towards maturity.

Solv: The "Elephant in the Room" of Bitcoin Staking

As the largest Bitcoin staking platform in the current market, Solv has quickly seized the opportunity in the Bitcoin staking field over the past six months. Since April of this year, it has attracted over 25,000 Bitcoins (including BTCB, FBTC, WBTC, etc.), accumulating over $2 billion in asset management scale.

More than 70% of SolvBTC has been allocated to various staking scenarios, making Solv the protocol with the highest TVL and capital utilization efficiency in the current Bitcoin space.

With the strongest liquidity and market penetration, Solv has taken the lead in proposing a new narrative for the Staking Abstraction Layer (SAL), aiming to aggregate the dispersed BTC liquidity across the entire chain and provide a scalable and transparent unified solution.

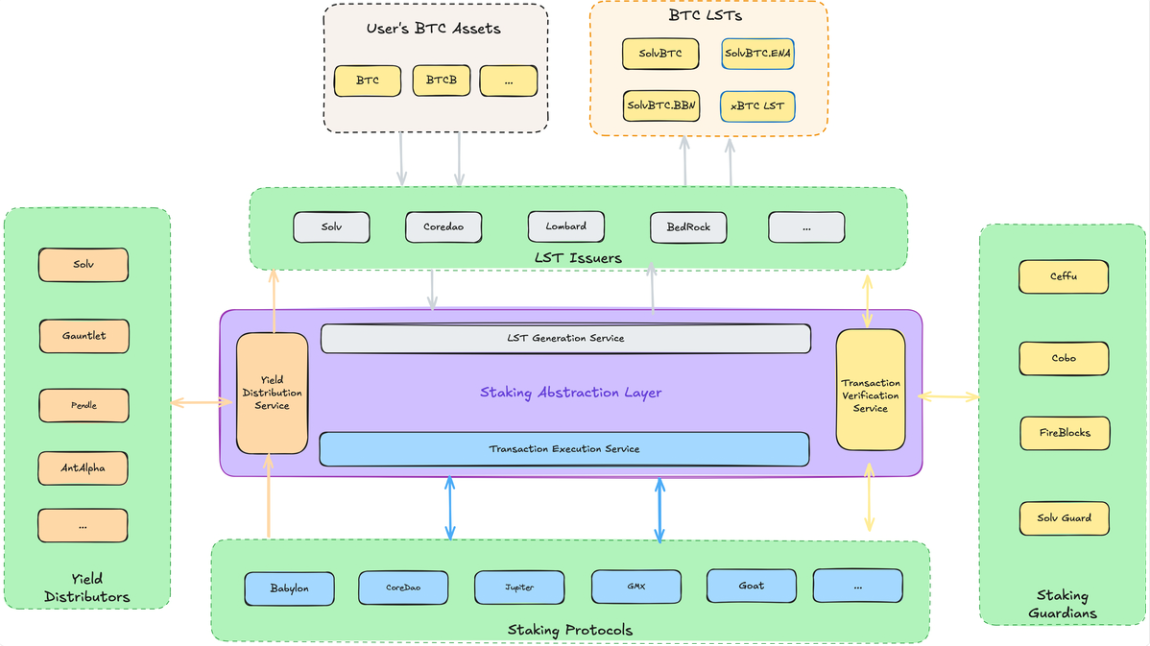

To achieve this goal, Solv first conducted a systematic review of the Bitcoin staking ecosystem and categorized its core participants into four key roles, from bottom to top:

Staking Protocols: Protocols that allow users to deposit Bitcoin assets and generate returns through staking activities, such as Babylon, CoreDao, Botanix, etc.;

Staking Validators: Entities responsible for verifying the integrity of the staking and transaction processes, ensuring that LST issuers genuinely execute staking and preventing errors or fraudulent activities, such as Ceffu, Cobo, Fireblocks, and Solv Guard;

Yield Distributors: Entities that manage the distribution of staking rewards, responsible for efficiently and fairly distributing rewards, such as Pendle, Gauntlet, Antalpha, and most LST issuers also play the role of yield distributors;

LST Issuers: Protocols that convert users' staked Bitcoin assets into liquidity tokens (LST), allowing stakers to earn returns while maintaining control over the liquidity of their assets, such as Solv, BedRock, etc.;

These four roles complement each other, forming the core structure of the Bitcoin staking ecosystem—staking protocols serve as the foundational layer of the entire system, managing and supporting all other roles; staking validators operate above the protocols, maintaining on-chain security; yield distributors allocate rewards according to protocol rules, ensuring the incentive mechanisms of the system operate; and LST issuers provide liquidity to staked assets through tokenization.

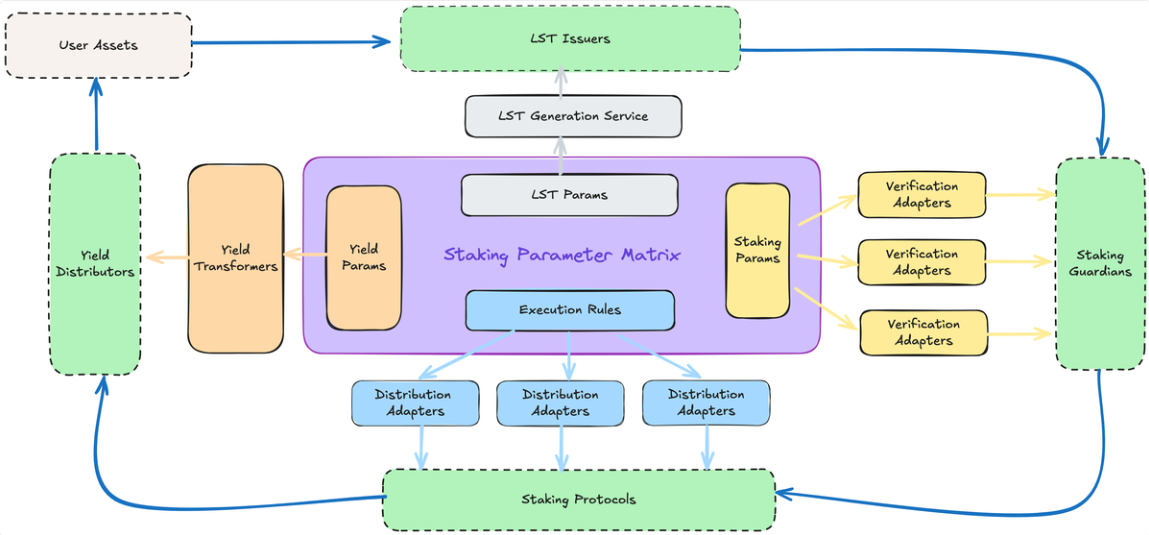

Therefore, the design of SAL closely revolves around these roles, launching key modules that cover the entire process, including LST generation services, staking validation services, transaction generation services, and yield distribution services, efficiently integrating them using smart contract technology and Bitcoin mainnet technology:

Specifically, SAL includes the following five core modules:

Staking Parameter Matrix (SPM): The core parameters required for the abstract staking process, including Bitcoin script configuration, staking transaction parameters, LST contract parameters, and yield distribution rules. These parameters are not only shared among SAL's various modules but also support cross-role collaboration in the staking process;

Staking Validation Service: Based on Bitcoin mainnet algorithms, it ensures the correctness and completeness of each staking transaction while verifying that the issuance of LST matches the underlying BTC quantity to prevent malicious behavior;

LST Generation Service: Responsible for the issuance and redemption of BTC LST, while supporting interactions between the Bitcoin mainnet and EVM chains;

Transaction Generation Service: Automatically generates staking transactions, estimates optimal transaction fees, and broadcasts transactions to the Bitcoin mainnet;

Yield Distribution Service: Transparently calculates staking yields and proportionally distributes rewards to users through oracle mechanisms or yield exchange services;

Through these modules, SAL not only effectively integrates the technical differences among different protocols in the Bitcoin ecosystem but also provides a clear operational framework for different roles, building a new system for efficient collaboration:

For Staking Users: SAL provides a convenient and secure staking process, reducing asset risks caused by operational errors and protocol opacity;

For Staking Protocols: SAL's standardized interface allows protocols to quickly access the Bitcoin staking market, shortening development cycles and achieving ecological cold starts;

For LST Issuers: SAL provides comprehensive yield calculation and verification tools, enhancing user trust while simplifying the issuance process, allowing them to focus on product innovation;

For Custodians: SAL opens up new business models for participating in the Bitcoin staking ecosystem, bringing additional revenue opportunities to custodians.

This greatly simplifies the participation threshold in the Bitcoin staking ecosystem, providing a unified solution that effectively meets the needs of multiple parties for co-construction and sharing.

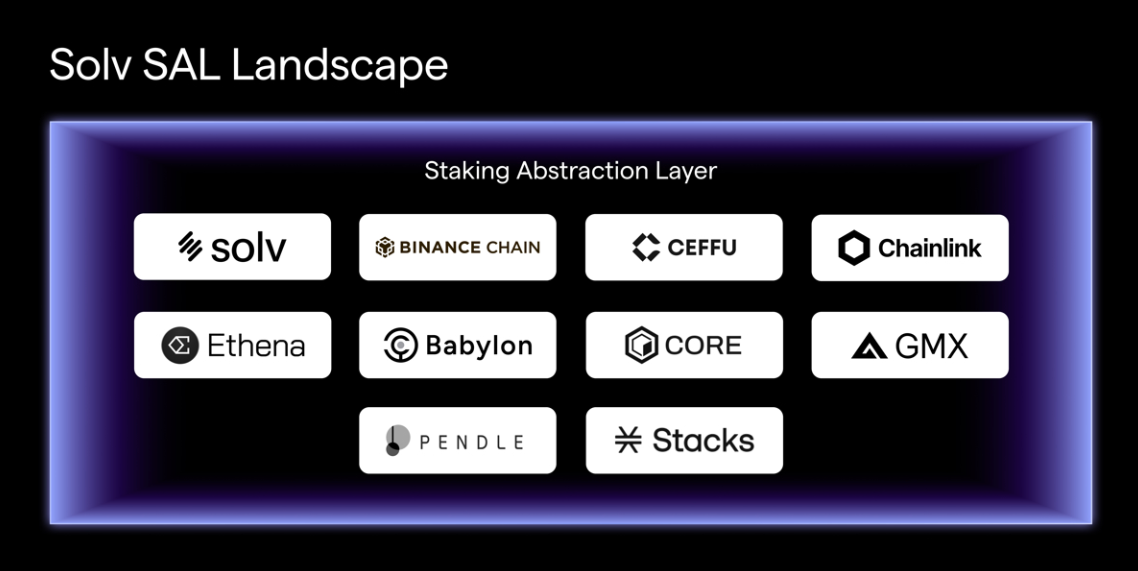

As of now, several protocols and service providers have joined the SAL protocol ecosystem, including BNB Chain, Babylon, ChainLink, Ethena, CoreDAO, etc., which not only proves the wide applicability of SAL but also brings richer application scenarios to Bitcoin staking, accelerating the sustainable development of business models in this field.

Revitalizing the Diversified Yield Ecosystem of Bitcoin Staking

Data from DefiLlama shows that in the Ethereum LSD track, Lido Finance holds the top position with a market share of 68.53% (9.81 million ETH). Although its centralization concerns have long been questioned, it is undeniable that Lido has promoted the deep integration of staking assets with the DeFi yield ecosystem through the innovative design of LST, significantly improving the utilization efficiency of staking assets.

Bitcoin staking also needs a foundational framework that can promote the efficient use of assets, and SAL (Staking Abstraction Layer) was launched for this purpose: it lowers the participation threshold for all parties, provides a consistent user experience for the Bitcoin staking ecosystem, and significantly enhances capital utilization efficiency through a unified liquidity management mechanism, allowing Bitcoin assets to flow freely across different chains and laying the groundwork for various financial innovations in the DeFi ecosystem.

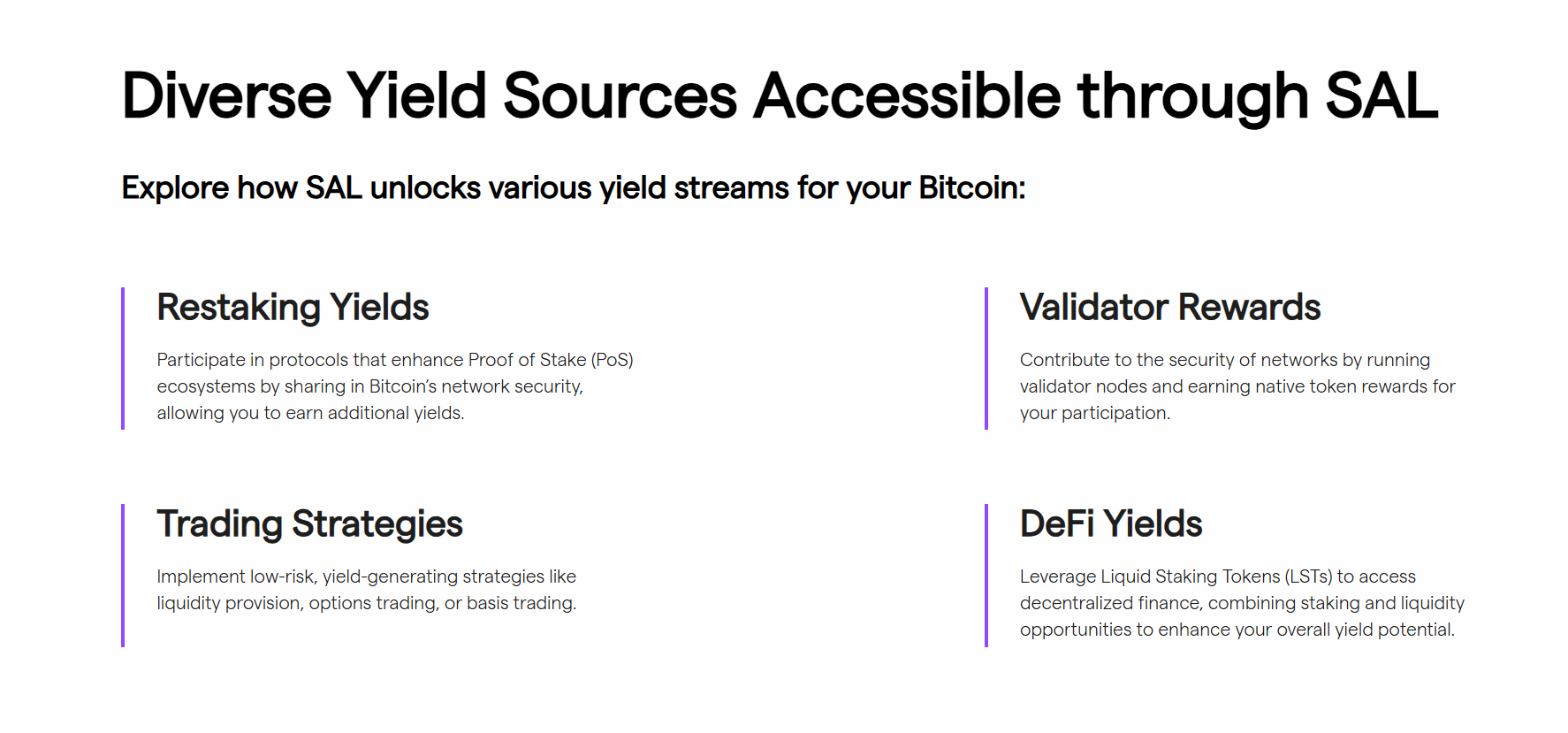

Therefore, a more promising imaginative space is that SAL can essentially derive a diversified yield solution based on all-chain BTC, enabling Bitcoin holders to obtain diverse and dynamic income streams without affecting liquidity, opening up new development space for BTCFi (Bitcoin Financialization).

This mainly relies on SAL's cross-chain functionality, supporting users in unlocking various income-generating opportunities, transforming Bitcoin from a passive store of value into an income-generating & productive asset that can participate in DeFi and other on-chain use cases, creating new value:

Users can stake Bitcoin on platforms that benefit from Bitcoin's economic security (such as Babylon) to earn local token rewards;

Users can participate in the security maintenance of Bitcoin L2 networks based on their held BTC by running validator nodes or delegating Bitcoin to earn validator rewards;

SAL enables Bitcoin holders to obtain relatively stable yields in DeFi through trading yield strategies such as "Delta Neutral";

Users can also utilize liquid staking tokens (LST) for further operations in DeFi, combining staking and liquidity opportunities to maximize overall yield potential;

1. Achieving Bitcoin Staking Yields through Restaking

First, based on SAL, Bitcoin holders can stake Bitcoin on platforms that benefit from Bitcoin's economic security to earn local token rewards, such as Babylon, EigenLayer, and Symbiotic.

In addition, these platforms also rely on Bitcoin's economic security to provide users with Restaking-based yield opportunities, transforming Bitcoin's security attributes into financial returns, allowing users to benefit from Bitcoin's economic security and achieve further appreciation of BTC assets.

2. Earning Rewards through Validator Nodes

Secondly, users can also participate in the security maintenance of Layer 2 networks by running validator nodes or delegating Bitcoin to earn validator rewards.

By staking BTC, users can earn rewards while ensuring network security. Currently, this includes:

CoreDAO and Stacks: Allow users to stake BTC to maintain L2 security and receive the platform's local tokens as rewards;

Botanix: Users can run validator nodes in the Botanix network, contributing computing resources and Bitcoin support to earn validator rewards.

These validator node rewards not only help users earn continuous BTC income but also provide security guarantees for the BTCFi ecosystem, enabling BTC holders to directly participate in ecological construction and enjoy returns.

3. Trading Yield Strategies such as "Delta Neutral"

SAL also provides Bitcoin holders with trading yield strategies such as "Delta Neutral," allowing them to obtain relatively stable yields in DeFi.

Taking the "Delta Neutral Strategy" as an example, Bitcoin holders can obtain stable yields by hedging market volatility on cooperative platforms like GMX, Pendle, and Ethena—assuming the BTC price is $80,000, users can deposit 1 BTC while selling 1 BTC futures, forming a "Delta Neutral" investment portfolio:

If BTC is initially $80,000, the total value of the portfolio is 80+0=80,000, so the total position value remains $80,000;

If BTC drops to $40,000, the total value of the portfolio remains 40+40=80,000, so the total position value remains $80,000 (the same applies if it rises);

At the same time, since 1 BTC of perpetual futures is shorted, users can earn funding fee income from the long position (historically, the funding rate for Bitcoin has been positive for the majority of the time, which also means that the overall yield of short positions will be positive, and this situation is even more pronounced in a bullish market with strong long sentiment).

These trading strategies help Bitcoin holders obtain stable yields without directly bearing market risks, making BTC a multifunctional financial tool and further enhancing the utilization efficiency of Bitcoin in the DeFi ecosystem.

4. DeFi Yields in Various Scenario Use Cases

Finally, based on SAL, it connects to smart contract public chains like Ethereum, providing scenario use cases such as DEX, lending, LSD, etc., allowing it to couple with multi-chain ecosystems like Ethereum to obtain farming yields from diverse scenarios in DeFi.

This immediately builds a quadruple yield for Bitcoin holders who were originally in a zero-yield income situation, and with the accumulation, SAL essentially introduces Bitcoin into a broader range of application scenarios, revitalizing Bitcoin as the highest quality native crypto asset that has been dormant, while providing BTC holders with diversified income sources and improving capital efficiency, which can be considered a win-win situation to some extent.

Conclusion

For any industry or track, unifying measurement standards is a key move to liberate productivity.

From the current development status of the Bitcoin staking ecosystem, it is indeed appropriate for Solv to take the lead—based on the influence and extensive network of the leading player in the track, SAL can bring significant collaborative effects by providing a clear standardized framework and a co-construction and sharing solution:

From ordinary staking users to staking protocols, validators, LST issuers, and even custodians, SAL's universal standardized framework brings tangible benefits to all participants, greatly enhancing the collaborative efficiency of the ecosystem and allowing Bitcoin assets to play a more diverse role in the DeFi ecosystem, potentially triggering a series of chain reactions in the Bitcoin market and paving the way for the large-scale application of BTC staking business.

The $17.5 trillion of dormant assets leads to yield opportunities and capital efficiency being core issues throughout the Bitcoin ecosystem, especially in BTCFi2, and Solv's SAL solution can, to some extent, be likened to the "infrastructure project" of the Bitcoin ecosystem:

It is expected to activate the optimal quality native crypto asset of Bitcoin, which has a trillion-dollar scale, on the basis of providing a unified framework for the Bitcoin staking ecosystem, which is highly imaginative but also quite challenging.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。