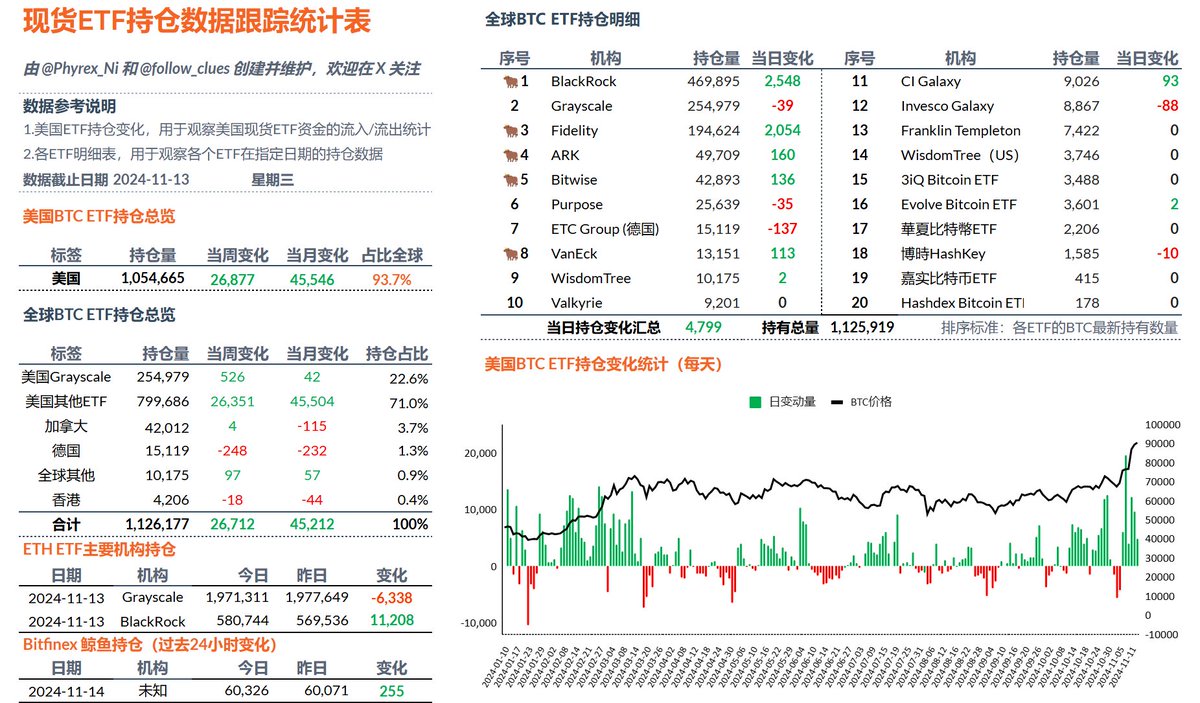

The data for the BTC spot ETF and ETH are actually not much different. We can see that American investors are experiencing a certain level of FOMO, and BlackRock's investors have started to reduce their purchases. In the past 24 hours, BlackRock's net inflow of BTC has decreased by 70% compared to yesterday. Although Fidelity has also made purchases, the net increase is not as significantly ahead as #ETH, and is still lower than BlackRock.

This is actually the issue I mentioned in the ETH data. If you are optimistic about the upcoming bull market, then compared to the two ETFs, ETH may be undervalued. Therefore, the market is willing to speculate that undervalued assets will have a chance for a rebound. Besides BlackRock and Fidelity, there are still four ETF institutions that have a net increase of over 100 #BTC, which can be ignored.

On the selling side, only Grayscale's GBTC and Invesco are involved, and the amount sold is not significant, having almost no impact on the market. It's a bit strange in the past two days; the prices have been rising well during the main trading hours in Asia and Europe, but there is a significant pullback during U.S. trading hours. I still believe we are in a phase of competition among investors, which may be caused by the adjustment of FOMO sentiment among American investors.

Some may ask, if there is still FOMO, why is the FOMO sentiment adjusting? This is because after the CPI data was released yesterday, BTC surged to $93,000, which is definitely the power of FOMO. However, it started to pull back in the early morning, which could indicate a correction in FOMO sentiment, as the rise was too rapid, with new highs every day, which is not necessarily a good thing.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。