After the results of the U.S. election were announced, Bitcoin received a positive market reaction, breaking through the $80,000 mark in just a few days and facing almost no resistance as it continued its march towards $90,000. Early today (November 14), Bitcoin once again broke through $93,000, setting a new high and showing strong momentum towards the $100,000 mark.

- AICoin's real-time data shows that as of now, BTC broke through $93,000 early this morning, rising to a high of 93,459 USDT, with the current value at 91,198 USDT, a 24-hour increase of 5.73%, leaving less than 9% to reach the “$100,000 mark.”

- In addition to BTC, ETH and SOL also surged due to positive news, with ETH's price breaking $3,400 on November 12, currently priced at 3,213 USDT; SOL's price also surpassed $225, rising 7.57% in 24 hours, currently at 219.33 USDT.

- DOGE surged after Musk proposed the "Department of Government Efficiency" (D.O.G.E) and Trump officially announced yesterday that Musk and Vivek Ramaswamy would lead the proposed "Department of Government Efficiency" after Trump's election, peaking at 0.439 USDT.

The total market capitalization of cryptocurrencies has also surged, ushering in a bull market. AICoin data shows that as of now, the total market cap of cryptocurrencies has exceeded $3.1 trillion, currently standing at $3.068 trillion.

Image source: AICoin

According to AICoin's Fear and Greed Index, current market sentiment is optimistic, with today's value at 88, reaching the "Extreme Greed" level.

Long-term Bullish: $100,000 is Unstoppable

The First Cryptocurrency President Trump Elected, Long-term Positive

In the long term, BTC's upward momentum remains strong. Trump, after being elected President of the United States in 2024, is hailed as the "First Cryptocurrency President."

Trump's presidency is seen as a long-term positive for the cryptocurrency market, especially as it may provide a more lenient regulatory environment for cryptocurrencies at the policy level. Trump has repeatedly expressed support for cryptocurrencies during his campaign and after his victory, promising to include Bitcoin in the U.S. strategic reserve assets. His policy commitments include establishing a Bitcoin reserve, promoting Bitcoin mining, and firing the current SEC chairman, all of which are viewed as significant positives for the market.

Large Institutions Continue to Accumulate Bitcoin

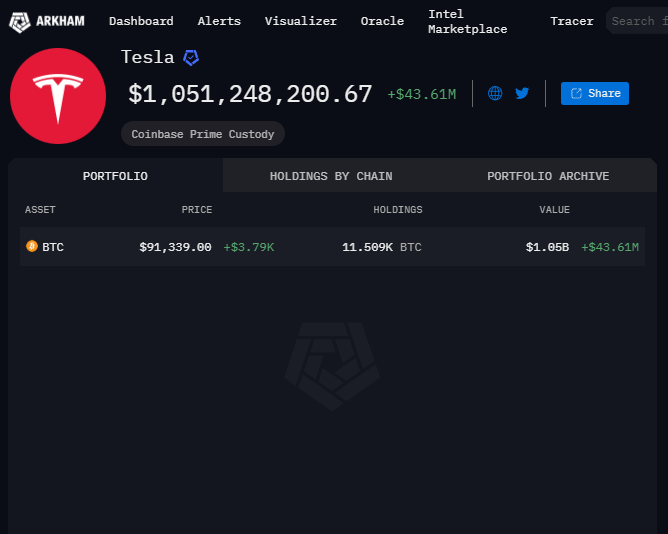

Institutional investors' interest in Bitcoin is growing, with many industry giants and institutional investors continuing to accumulate Bitcoin. For example, MicroStrategy announced plans to continue increasing its Bitcoin reserves on its balance sheet, currently holding 279,420 Bitcoins worth over $25.1 billion. Tesla is also continuing to accumulate Bitcoin, currently holding 110,509 Bitcoins valued at over $1 billion.

Bitcoin spot ETFs are also seeing continuous inflows. According to the latest data from AICoin, yesterday (November 13), Bitcoin spot ETFs saw a single-day inflow of $510 million, with a historical cumulative net inflow of $28.232 billion. According to the latest disclosures, BlackRock's Bitcoin ETF IBIT has surpassed its gold exchange-traded fund iShares Gold ETF (IAU) in asset size, achieving this in just 10 months.

The continued accumulation of Bitcoin by large institutions has enhanced market liquidity and increased Bitcoin's credibility as a store of value.

Several institutions and prominent figures have also provided positive forecasts for the future market, with "$100,000" seemingly becoming the next key level for BTC.

Short-term Caution on Corrections and Leverage Risks

Delay in Acceptance of Trump's Crypto Policies

Researchers at TD Cowen wrote in a report on Monday that bipartisan cryptocurrency legislation covering stablecoins and market structure is more likely to pass during Trump's second term, but "will not be a top priority."

The researchers stated in the report: "We believe that once Trump appoints a new SEC chairman, cryptocurrency enforcement may be put on hold, regardless of whether Gary Gensler resigns from the SEC. He can appoint a new chairman on January 20. This does not mean that the cryptocurrency industry will enter the Wild West without any SEC oversight. The new chairman will reassess existing cases and look for ways for crypto companies to comply with existing laws, which is beyond our expectations."

Short-term Price Consolidation

Analyst Willy Woo pointed out that Bitcoin's price is likely to experience short-term consolidation, stating, "88-91k is the first target. We have reached it. There should be consolidation here. This comes from local fib levels and liquidation levels, as most shorts have been cleared, marking the end of forced buying of shorts."

Active Options Trading Market, Beware of High Leverage

According to the latest data from AICoin, the current total open interest for OKX BTC options contracts is 27,724.28 BTC, with a 4.55% increase in the past 24 hours, indicating increased activity in the options trading market. This active market performance also comes with corresponding risks, as high-leverage operations may trigger large-scale liquidation events. Therefore, investors need to closely monitor the dynamics of open contracts to guard against potential market risks.

Image source: AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。