In the recent market turmoil, Bitcoin once again broke through the historical high of $93,000 early today (November 14), instantly igniting market sentiment, and everyone is curious about the reasons behind this surge…

CPI Meets Expectations

The Consumer Price Index (CPI) data for October in the United States met economists' expectations, rising 0.2% month-on-month. The inflation data remained stable, enhancing market expectations for further interest rate cuts, which provided additional upward momentum for Bitcoin's price.

According to AICoin data, after the CPI announcement, Bitcoin saw a positive impact, rising 0.3% within 5 minutes. Previously, AICoin's prediction tool indicated that if the CPI data met expectations, the probability of Bitcoin rising was 100%, aligning with AICoin's anticipated trend before the announcement.

Image Source: AICoin

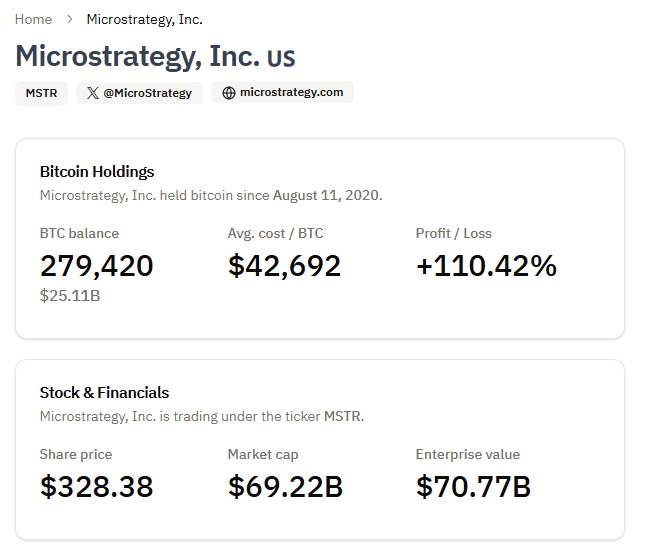

MicroStrategy Continues to Hold

MicroStrategy, a company known for holding a large amount of Bitcoin, continues to increase its Bitcoin reserves on its balance sheet. The company reported in the third quarter that it plans to raise $42 billion over the next three years to purchase more Bitcoin. This move is seen as a strong confidence in Bitcoin's long-term value, driving positive changes in market sentiment.

According to the latest data, MicroStrategy currently holds 279,420 Bitcoins, valued at over $25.1 billion.

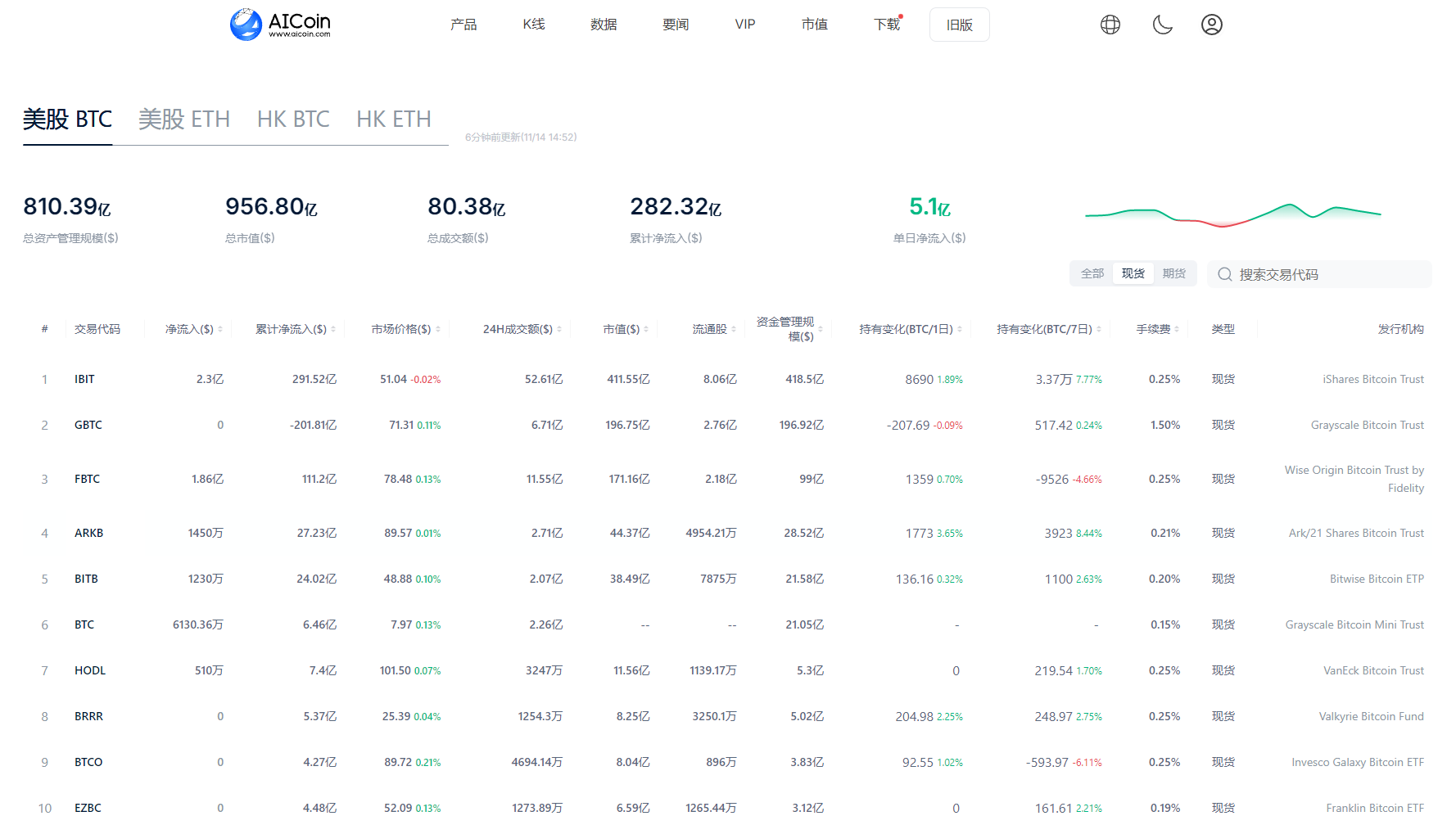

ETF Inflows

The inflow of funds into ETFs indicates an increased interest from institutional investors in Bitcoin, which not only provides strong support for Bitcoin's price but also drives further market increases.

According to AICoin data, as of yesterday (November 13), the total net asset value of Bitcoin spot ETFs was $95.397 billion, with a net inflow for six consecutive days.

Yesterday, the single-day net inflow for Bitcoin spot ETFs was $510 million, with Grayscale Bitcoin Mini Trust ETF BTC seeing a single-day net inflow of $61.3036 million. Currently, the historical total net inflow for Grayscale Bitcoin Mini Trust BTC is $646 million. The Bitcoin spot ETF with the highest single-day net inflow yesterday was BlackRock ETF IBIT, with a net inflow of $231 million, bringing IBIT's historical total net inflow to $29.152 billion. Following that was Fidelity ETF FBTC, with a single-day net inflow of $186 million, currently having a historical total net inflow of $11.12 billion.

Image Source: AICoin

Federal Reserve Rate Cuts

The Federal Reserve's rate-cutting policy is also seen as an important driving force behind the rise in Bitcoin's price. Since September, the Federal Reserve has cut rates by a total of 75 basis points, and after the CPI data was released in line with expectations, the market generally anticipates another 25 basis point cut in mid-December. The loose monetary policy reduces the attractiveness of traditional financial markets, thereby enhancing the investment value of risk assets like Bitcoin.

Historical Data—Halving Events

Historical data for Bitcoin also indicates that the fourth quarter is typically a strong performance period. According to AICoin's historical records, the investment returns in the fourth quarter following Bitcoin halving events usually perform well. Several halving events since 2012 have shown a clear upward price trend, providing optimistic expectations for market participants.

Image Source: AICoin

What’s Next for Bitcoin? Analysts Weigh In

Many analysts hold an optimistic view of Bitcoin's future.

Renowned analyst PlanB predicts that by the end of 2025, Bitcoin's price could reach $1 million. His prediction is based on Bitcoin's scarcity model and emphasizes the potential impact of changes in the policy environment on the market.

“Almost there… just as predicted in July,” analyst Omkar Godbole tweeted, “BTC is following the technical ratio (NDX/SPX) as usual, closing at $100,000.”

Matt Hougan, Chief Investment Officer of Bitwise Asset Management, shared his views on Bitcoin's trajectory in a blog post this past Tuesday (November 12), stating that despite the recent price surge, this digital asset is still in the "early" stages before reaching $500,000.

Matt Hougan wrote, “Everyone is focused on newcomers buying Bitcoin. This is very real. But another reason for this rebound is that people have stopped selling.” He added, “Long-term holders are no longer willing to sell Bitcoin below $100,000, and short sellers do not want to stand in front of a freight train.”

Bitcoin Archive tweeted today, “$0 to $100,000 is just a proof of concept for BTC; above $100,000 is Bitcoin Takeover.”

Conclusion

Bitcoin's new all-time high is not a coincidence; it is driven by multiple factors working together. From MicroStrategy's steadfast holdings to the institutional fund inflows brought by ETFs, and the loose monetary policy along with expected economic data, all these provide strong support for Bitcoin's price. In the future, as the market environment changes and policies adjust, Bitcoin's price may further fluctuate, but its potential as a long-term investment tool remains widely recognized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。