The exit time window may only last a few months, so make sure to seize it.

Author: Duo Nine⚡YCC

Compiled by: Deep Tide TechFlow

The waiting moment has finally ended.

Your efforts are about to be richly rewarded.

Everything you learn in this newsletter will converge into a complete cycle in the coming months.

This period is crucial for your current and future success. It is a key moment for you to showcase your talents and apply what you have learned. Congratulations on reaching this point.

Now, let's get to the point. A brief summary will be at the end.

We have just entered the final phase of a four-year cycle. This is the most exciting yet challenging time. The market is highly volatile, with prices potentially experiencing double-digit fluctuations overnight, constantly setting new records.

What is your exit strategy? To succeed, you need an exit plan. We will discuss this in detail later.

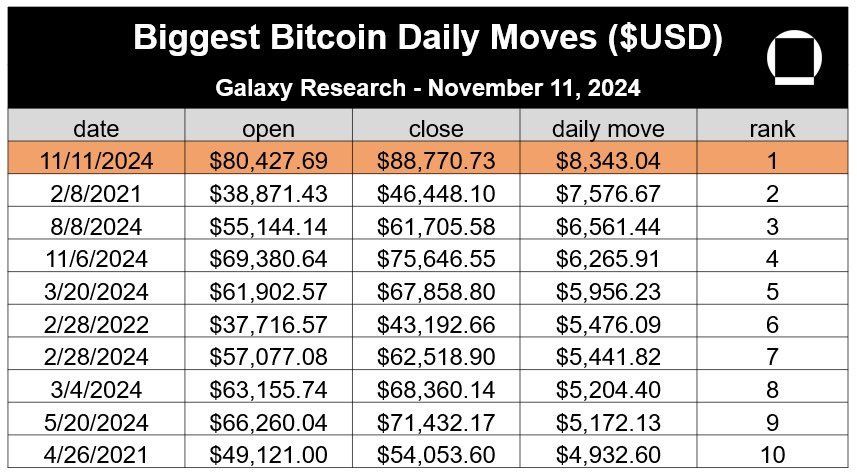

Just this week, Bitcoin reached a new high of $90,000. This is not only a new price record but also the day with the largest nominal increase within 24 hours. Bitcoin rose over $8,300 in a single day. Please see the table below.

Soon, daily fluctuations of $10,000 will become the norm. Even writing this feels a bit crazy, but there is already an 83% chance of it happening. No wonder, in my last alpha post, I suggested not to overcomplicate things and just buy one coin.

That is Bitcoin.

At that time, the price was $70,000. Since then, Bitcoin has risen nearly 30%! Many people are looking for investment opportunities in altcoins, while the biggest opportunity is right in front of them every day.

Bitcoin has the best risk/reward ratio in cryptocurrency. When you consider risk and volatility, no other investment can compare to its returns. Keep this in mind when looking for emerging coins that carry higher risks.

However, altcoins are also experiencing rapid growth. For example, since early November, the price of DOGE has nearly tripled. I have been recommending it for several months, when it was around 10 cents, and now it is about 40 cents. This is a phase in the cycle where everyone can easily make money.

This is a time when everyone can easily make money.

However, this situation will not last long. This is usually the shortest phase in a cycle and the final stage before the cycle ends. The faster and higher the prices rise, the sooner we may reach the peak of the cycle. Therefore, if this momentum continues for several weeks, we will soon reach the peak.

Here is the most optimistic scenario:

- Bitcoin reaches $300,000 by April 2025. Only five months away.

Can this happen? I have good news, please keep reading.

If the current momentum reflects the pink section mentioned above, which is the most aggressive bull market of the previous cycle (from October 2020 to April 2021), then Bitcoin could rise another four times after breaking through. We have just had a similar breakthrough in this cycle.

If you look at the predictions, you can see that past price trends reflect resistance levels of $100,000, $200,000, and $300,000. This seems like a strange coincidence. What will happen, we will all know, but there is reason to remain optimistic.

There are rumors that some countries are entering the Bitcoin market out of fear of missing out.

Additionally, we have confirmed that institutional investors are allocating a portion of their funds to Bitcoin and conveying the message that "you must gain exposure." The launch of Bitcoin ETFs this year is a good thing because now anyone can buy.

What should you do?

If you have been following me for a while, you should already know that this is not actually the time to gain market exposure because you are already late. You gain exposure during bear markets or when the market is calm (or stagnant). We are currently in the opposite situation. Market sentiment is high, and FOMO is starting to show.

The final phase of this cycle is about selling and locking in profits. This does not mean you cannot continue to buy and make money. You can, but the risks are higher now.

Bitcoin has entered the price discovery phase.

This means Bitcoin has broken through previous historical highs, and no one can predict how high it can go or where it will peak. Prices will fluctuate wildly, filled with uncertainty.

Buyers and sellers will test each other while searching for price peaks. This is a very dangerous process because when the market suddenly turns, you do not want to be the last one holding the bag. Please pay special attention to your use of leverage, as market volatility will be very high.

Therefore, your goal is to exit while the market is active. According to the chart above, the market may reach its most active state in early 2025. This is your best exit opportunity. Do not focus too much on specific prices, but rather complete your exit during that period. In the next section, I will share more related advice.

1. Sell all altcoins when the market is most active

A good way to determine when to sell altcoins is to observe the performance of Ethereum and Solana. If they reach new historical highs, it is a good signal that you can gradually take profits as altcoins rise.

It is important to note that most altcoins, like DOGE, have their own market cycles and may rise earlier or later due to other factors. In the case of this internet culture-based cryptocurrency, it is driven by Elon Musk and President Trump continuously promoting it.

Trump's recent statements are big news for DOGE holders. Considering the exposure it will gain from this newly established government efficiency department (i.e., DOGE), its price could rise to $1.

Importantly, try to sell all altcoins when Bitcoin reaches its peak. Do not get stuck when the next bear market arrives.

2. Do not sell Bitcoin unless absolutely necessary

I do not recommend selling Bitcoin because, in the long run, its performance will continue to improve, with expectations of reaching a million dollars by 2030 or later. In this case, would you want to sell? It depends on your choice.

If you decide to sell, you can start from above $100,000 and gradually sell no more than 10% at a time. You want to sell gradually as the price rises, preferably as you approach the peak. A similar strategy can be applied to altcoins.

If you hold less than one Bitcoin, you should focus on accumulating as much as possible or preparing funds to buy more in the next bear market. If you hold more than one, you can try to sell part of it at the peak to have funds for future purchases. In any case, use the profits from altcoins to buy Bitcoin in the next bear market.

In any case, do not risk losing your Bitcoin. It is an important asset for achieving your financial freedom. Focus on long-term goals. However, if this money means a lot to you, please seriously consider the reasons for selling. If it is used to purchase property, that property should ideally appreciate to several million in the future. Remember, Bitcoin is the strongest asset in the world!

3. Control the fear of missing out (FOMO), or you may suffer losses

A common mistake is that people see the price continue to rise after selling and rush to buy back in. Doing so is likely to lead to re-entering at market peaks, resulting in losses.

This is a common trap that many people fall into. Therefore, you need to develop a clear and practical exit plan. After selling, put the profits in a place that is not easily accessible, such as a hardware wallet, or invest in gold (like PAXG), and do not touch those funds for at least a year.

When the market panics and enters the so-called "death mode" (i.e., when the media reports that Bitcoin is dead), you can return to the market with profits. At that time, buy as much Bitcoin as possible. I will be there to help, so rest assured.

Share your exit strategy in the comments and leave your expected target for Bitcoin below.

Summary and Recommendations

We are in the most exciting phase of this crypto cycle, which is about to end;

This is your time to sell and lock in huge profits, with the goal of completely exiting altcoins;

The end of the cycle is full of opportunities, but the risks are also extremely high;

Have a clear exit plan and execute it without being swayed by the fear of missing out (FOMO);

The exit time window may only last a few months, so make sure to seize it;

Your ultimate goal should be to accumulate more Bitcoin and focus on the long term!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。