USUAL has a total supply of 4 billion tokens, with an initial circulation of 494,600,000 tokens (accounting for 12.37% of the total token supply) and a total of 300 million tokens from Binance Launchpool.

Written by: 1912212.eth, Foresight News

This article was first published on June 5

The holy grail of the cryptocurrency industry has always been to achieve a monetary status. Since the birth of Bitcoin, the dream of realizing monetary attributes has been continuously pursued. Interestingly, the cryptocurrency that has truly achieved large-scale payment attributes is not the originally created BTC, but stablecoins. Stablecoins are also the first use case for RWA. Whether it is fiat-backed stablecoins or algorithmic stablecoins regarded as the crown jewel, they are all competing for the holy grail. USDT leads with its total market capitalization, USDC has made a name for itself through compliance, and the rising star algorithmic stablecoin USDe is making waves with celebrity endorsements and continuous brand collaborations.

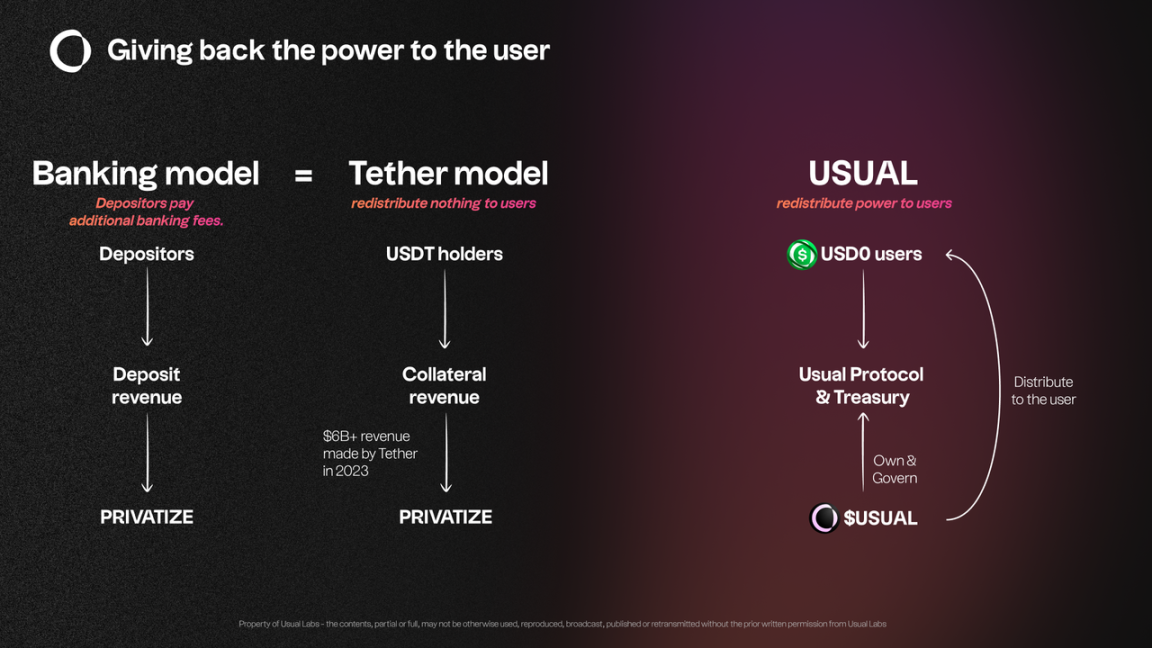

Stablecoins are also profit printing machines. In the first quarter of this year, Tether, the issuer of USDT, made over $4.52 billion in profit, setting a historical high. In comparison, Tether's net profit for the entire year of 2023 is only $6.2 billion, illustrating how exaggerated its profit margin growth is.

The profitable track never lacks new entrants. The stablecoin startup Usual Labs completed a $7 million financing round in April this year, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, StarkWare, and others. Usual Labs subsequently launched the stablecoin USD0 at the end of May.

What is Usual Labs?

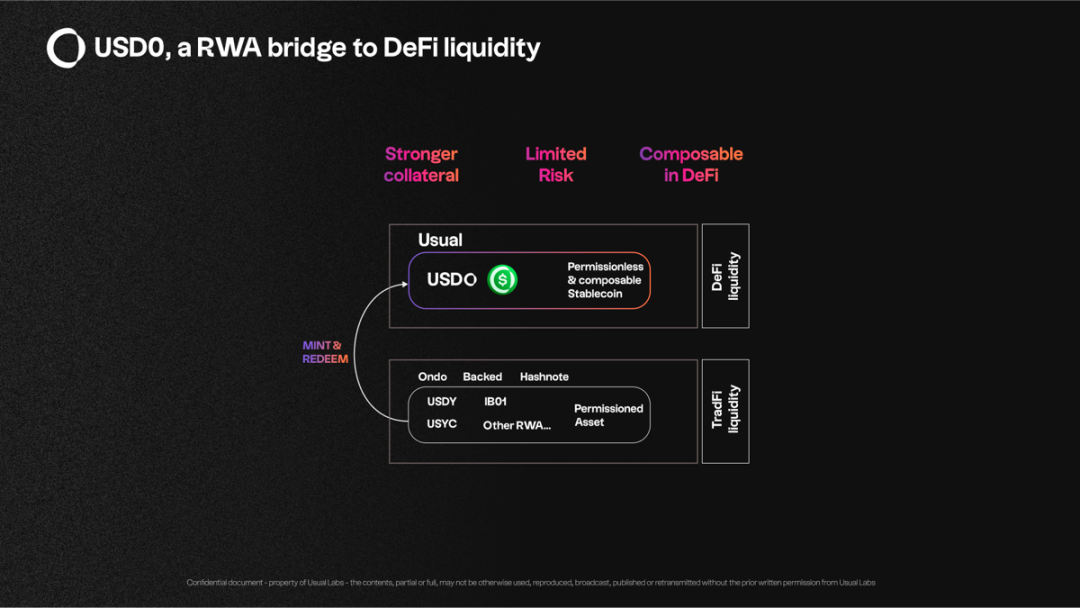

Usual Labs is a stablecoin startup that is building the DeFi protocol Usual Protocol, with its core product being the stablecoin USD0. According to Usual, the problem with the traditional financial system is that customers' deposit profits flow into the banks' own pockets while transferring risks to the public. Fiat-backed stablecoins are not without flaws; the centralized participants behind them share the same structural issues as traditional banking.

How does Usual Protocol operate?

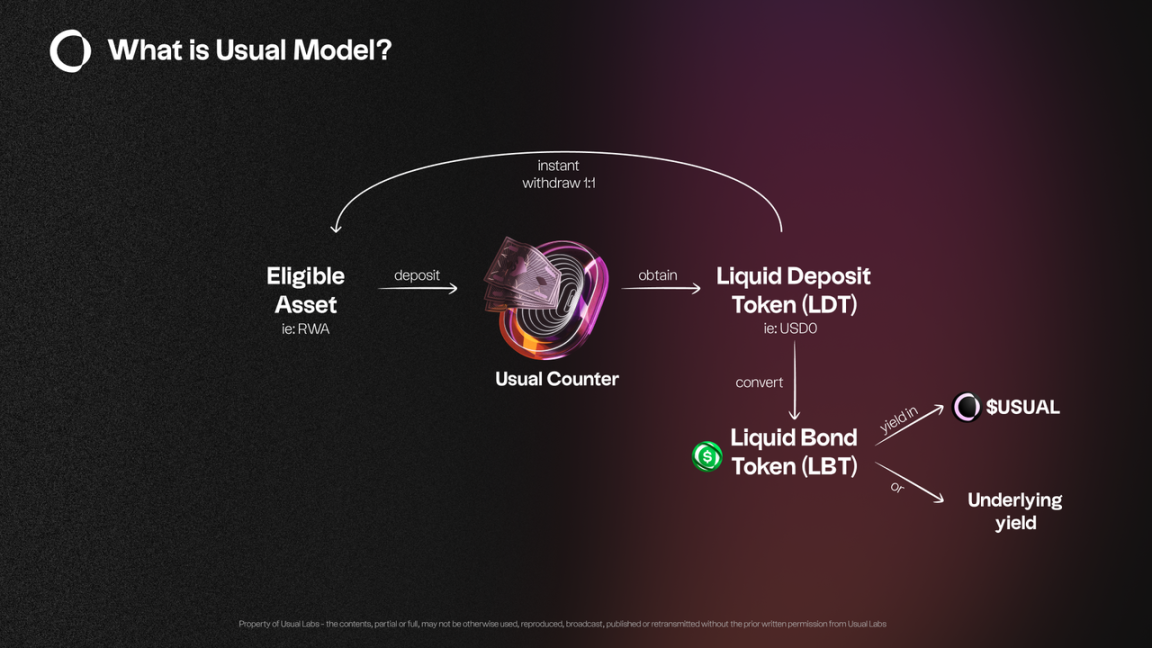

When users deposit assets, they receive a synthetic asset called Liquid Deposit Token (LDT), which represents their initial deposit value in the Usual protocol. LDT can be freely traded without permission and is backed 1:1 by the original assets deposited in the protocol. LDT provides holders with permanent withdrawal rights, allowing them to redeem the underlying assets at any time under normal circumstances.

In this way, users can leverage LDT to unlock profit potential, such as providing liquidity or issuing Liquidity Bond Tokens (LBT). LBT is created by locking LDT for a period of time, providing liquidity, transferability, and composability, facilitating seamless integration and trading within DeFi. Participating users will also receive Usual's governance tokens.

What are the characteristics of the stablecoin USD0?

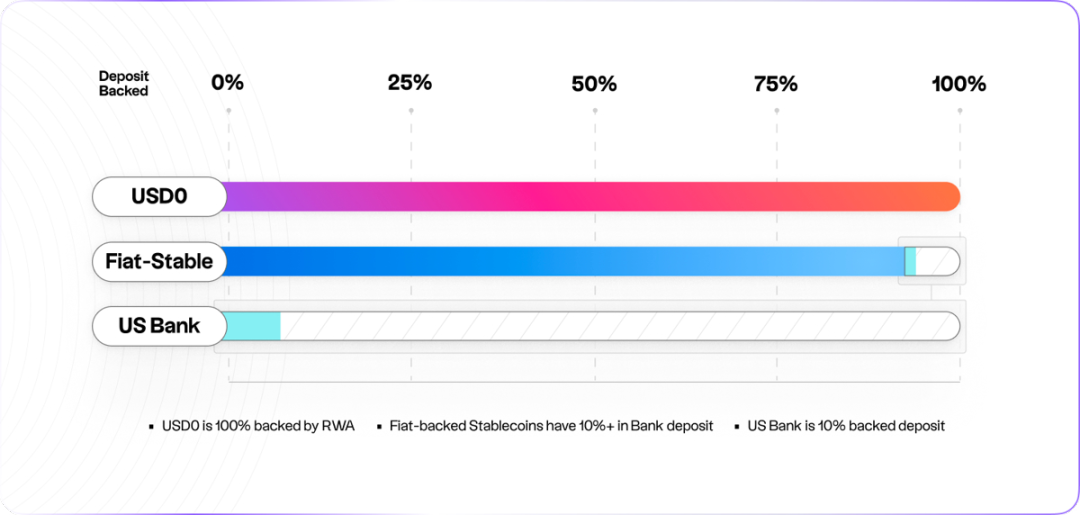

The stablecoin USD0 is the most important product on the Usual protocol and is also the first LDT on the protocol. Its name comes from being the equivalent of central bank money (M0) on Usual, hence the name USD0. Unlike stablecoins such as USDT and USDC, USD0 is backed 1:1 by ultra-short-term real-world assets (RWA).

Due to the reserve system of some banks, fiat-backed stablecoins also face risks. The Silicon Valley Bank incident last year demonstrated the systemic risks in DeFi caused by insufficient collateral in traditional commercial banks.

USD0 addresses this from multiple angles. First, it chooses government bonds as its best option due to their high liquidity and safety. Second, to ensure asset stability, the issuer must use assets with extremely short maturities as collateral for the stablecoin, ensuring that holders receive a high level of security. This strategy can prevent forced liquidation at discounted prices during large redemptions and can also mitigate the impact of volatility events that may reduce collateral value.

Usual has now integrated with Hashnote, and is awaiting confirmation with Ondo, Backed, M^0, Blackrock, Adapt3r, and Spiko. It is expected that the completion of these integrations will significantly enhance its liquidity.

Usual token distribution: 90% to the community

According to Binance's announcement, the total supply of USUAL is 4 billion tokens, with an initial circulation of 494,600,000 tokens (accounting for 12.37% of the total token supply) and a total of 300 million tokens from Binance Launchpool. The personal hourly reward cap for the BNB pool is 265,625 USUAL tokens, while the FDUSD pool is 46,875 USUAL tokens. The total reward for the BNB pool is 255,000,000 USUAL tokens (accounting for 85%), and the total reward for the FDUSD pool is 45,000,000 USUAL tokens (accounting for 15%).

The uses of the Usual token mainly include governance and utility. Usual adopts a deflationary mechanism design, allowing early adopters to receive more tokens. As TVL increases, the distribution of Usual tokens decreases. Additionally, Usual holders have control over the treasury, and when acting as governance tokens, holders can participate in the decision-making process. Staking tokens can also yield returns while supporting the security of the protocol.

Unlike other protocols that allocate 50% of the total tokens to VCs and advisors, Usual allocates 90% of the total tokens to the community, with internal team members receiving no more than 10% of the circulating supply. This highlights the community's spirit of "decentralization" amid the growing calls for "fairness."

Conclusion

Usual has chosen RWA support to redesign the stablecoin USD0 in the competitive landscape of fiat-backed and algorithmically supported stablecoins. The stablecoin market has immense potential, and it will be interesting to observe how USD0 performs in the market in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。