On November 14, Binance announced that the 61st project on Binance Launchpool - Usual (USUAL), a decentralized fiat stablecoin issuer, is now live.

Sources: Golden Finance, Binance, Usual Whitepaper, Usual Official Website, Twitter

Compiled by: Golden Finance

On November 14, 2024, Binance announced that the 61st project on Binance Launchpool - Usual (USUAL), a decentralized fiat stablecoin issuer, is now live. Users can stake BNB and FDUSD in the USUAL reward pool on the Launchpool website starting from 08:00 (UTC+8) on November 15, 2024, to earn USUAL. The USUAL event will last for a total of 4 days. The website is expected to update approximately twenty-four hours after this announcement, prior to the event opening.

Pre-market Trading

Binance pre-market trading will list Usual (USUAL) at 18:00 (UTC+8) on November 19, 2024, and will open the USUAL/USDT trading market. The end time for pre-market trading and the spot listing time will be announced later. Eligibility to participate in Binance pre-market trading depends on the user's country or region of residence. The maximum individual holding limit is 40,000 USUAL.

I. Launchpool Details

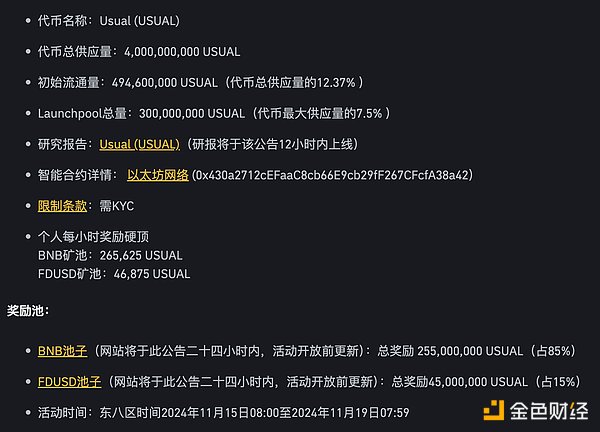

- Token Name: Usual (USUAL)

- Total Token Supply: 4,000,000,000 USUAL

- Initial Circulating Supply: 494,600,000 USUAL (12.37% of total supply)

- Launchpool Total: 300,000,000 USUAL (7.5% of maximum token supply)

- Smart Contract Details: Ethereum Network (0x430a2712cEFaaC8cb66E9cb29fF267CFcfA38a42)

II. Usual (USUAL) Project Introduction

1. What is Usual?

USUAL is a secure and decentralized fiat stablecoin issuer that redistributes ownership and governance through the $USUAL token.

Usual is a multi-chain infrastructure that aggregates an ever-growing pool of tokenized real-world assets (RWA) from entities such as BlackRock, Ondo, Mountain Protocol, M0, or Hashnote, transforming them into permissionless, on-chain verifiable, composable stablecoins (USD0).

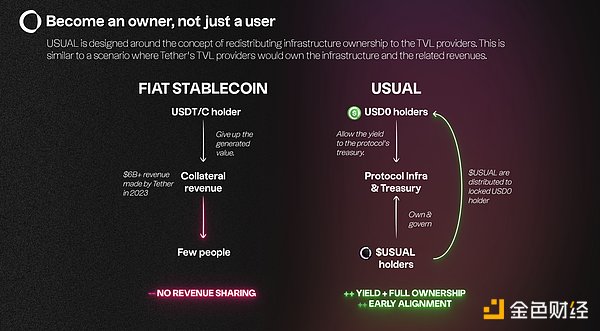

It is typically built around the redistribution of power and ownership to users and third parties, similar to the scenario where Tether's TVL providers own the company and its associated revenues.

2. Why Choose Usual?

Usual is based on three key observations:

- Tether and Circle generated over $10 billion in revenue in 2023, with valuations exceeding $200 billion. This wealth created has not been shared with the users who contributed to their success.

- Real-world assets (RWA) are on the rise, but despite the emergence of on-chain U.S. Treasury bonds, their integration with DeFi remains challenging. This is evident from the fact that there are fewer than 5,000 RWA holders on the mainnet.

- DeFi users want to understand the success of the projects they support. The current revenue distribution models do not adequately incentivize those who take greater risks by joining early and contributing to the project's success.

III. Usual's Vision

1. Rebuilding Tether On-Chain: Neutrality and Transparency

Cryptocurrency needs a fully on-chain fiat-backed stablecoin supported by infrastructure that ensures enhanced neutrality, transparency, and security.

Usual introduces a model designed to fully rebuild Tether on-chain. In this system, the issuer is controlled by holders of Usual governance tokens. This includes decision-making on risk policies, collateral nature, and liquidity incentive strategies.

2. Fiat Stablecoins Need to Move Away from Bankruptcy

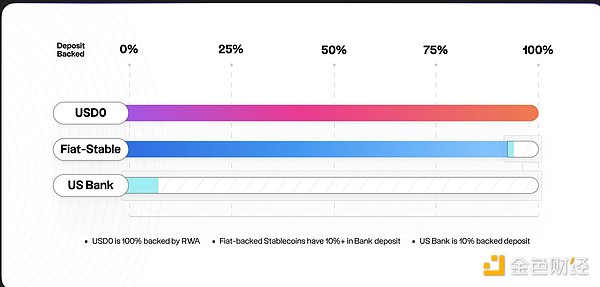

Fiat-backed stablecoins are partially guaranteed by reserves held by commercial banks. This exposes them to the influence of these banks' fractional reserve practices, undermining the security and stability of the stablecoins. The recent collapse of SVB Bank highlights the systemic risks posed to DeFi by commercial banks due to insufficient collateral.

The fiat-backed stablecoins face greater risks due to banks' fractional reserve exposure.

The primary requirement for stablecoins is to ensure that their value remains stable relative to the currency they represent. Users must have strong confidence in the safety of their capital. The collateral model provided by Usual is not tied to the traditional banking system but is directly linked to short-term bonds. The security provided by this prudent approach is reinforced by strict risk policies and insurance funds.

3. Ending Profit Privatization

Tether and Circle generated over $10 billion in revenue in 2023, with valuations exceeding $200 billion. However, this wealth has not been shared with the users who contributed to their success. Usual aims to provide an alternative fiat-backed stablecoin approach that privatizes the profits from customer deposits while socializing the losses. The centralized participants behind major fiat-backed stablecoins replicate the problematic structure of traditional banking, which contradicts the principles of decentralized finance.

Usual's approach aims to create a fairer financial system by redistributing value and power more equitably among all users.

Usual's goal is to make users the owners of the protocol's infrastructure, funds, and governance. By redistributing 100% of the value and control through its governance tokens, Usual ensures that its community holds the dominant power.

The Usual protocol allocates its governance tokens to users and third parties that contribute value, readjusting financial incentives and returning power to participants within the ecosystem.

Usual redistributes 100% of the value and control through its governance tokens.

4. Transforming Stablecoin Ownership and Revenue Redistribution

Some models redistribute a portion of the revenue generated by stablecoins. However, Usual adopts a different model where users pool the earnings generated from stablecoin collateral. This revenue constitutes the protocol's funding. In return, users will receive governance tokens, allowing them to control the protocol, funds, and future income.

This mechanism not only redistributes income but also redistributes ownership of the system. It provides incentives for early adopters, offering them significant upside potential.

The transparent and public distribution of governance tokens ensures alignment of interests among all participants.

IV. Usual Token Economics

According to the Binance announcement, the total supply of Usual (USUAL) tokens is 4 billion, with an initial circulating supply of 494,600,000 USUAL (12.37% of total supply). Usual's smart contract will be deployed on the Ethereum network. The total rewards for Launchpool are 300 million Usual, accounting for 7.5% of the total token supply. Of this, 85% of the rewards (255 million Usual) are allocated to the BNB pool, and 15% of the rewards (45 million Usual) are allocated to the FDUSD pool.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。