Original | Odaily Planet Daily (@OdailyChina)

This afternoon, Binance announced that it will launch its 61st project Usual (USUAL) on Launchpool at 18:00 Beijing time on November 19, and will open pre-market trading. Users can lock BNB and FDUSD to participate in mining, with the mining period from 00:00 Beijing time on November 15 to 08:59 on November 19, 2024. Following this news, the price of BNB briefly touched $660, currently reported at $648, with a 24H increase of over 6%.

Below, Odaily Planet Daily will bring you the latest information on Binance Launchpool's newly launched project Usual and its token economic model.

Project Introduction

Image source: Official Twitter

Usual is a secure, decentralized fiat stablecoin issuer that will distribute ownership and governance of the platform through its platform token USUAL in the future. Usual is a multi-chain infrastructure that integrates the growing tokenized real-world assets (RWA) from BlackRock, Ondo, Mountain Protocol, M0, and Hashnote, transforming them into permissionless, on-chain verifiable, and composable stablecoin USD0.

Among them, USD0 is the first liquid deposit token (LDT) provided by Usual, backed by real-world assets (RWA) at a 1:1 ultra-short term, ensuring its stability and security. At the same time, USD0, as an RWA stablecoin aggregating various U.S. Treasury bond tokens, can be minted on Usual in two different ways:

Direct RWA Deposit: Users deposit eligible RWA into the protocol and receive an equivalent USD0 at a 1:1 ratio;

Indirect USDC/USDT Deposit: Users deposit USDC/USDT into the protocol and receive USD0 at a 1:1 ratio. This indirect method involves third-party collateral providers who supply the necessary RWA collateral, allowing users to obtain USD0 without directly handling RWA.

According to ROOTDATA data, Usual has completed two rounds of financing this year, totaling $8.5 million, specifically including:

On April 17, Usual announced the completion of a $7 million financing round, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid3, Bing Ventures, Breed, Hypersphere, Kima Ventures, Psalion, Public Works, and X Ventures;

On November 9, Usual announced the completion of a new financing round of $1.5 million, with participation from Comfy Capital, early crypto project investor echo, Breed VC founder Jed Breed, among others, with specific valuation data not yet disclosed.

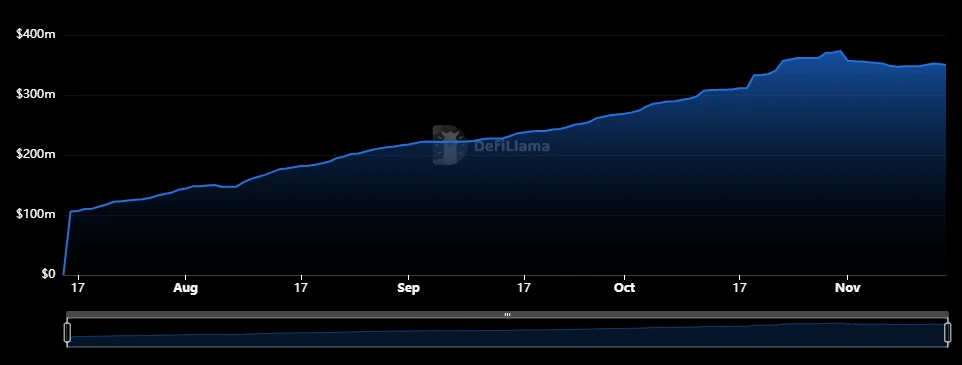

According to DefiLlama data, the current total TVL of the Usual platform is $350 million, close to its historical high.

Usual TVL Data

Token Economic Model

According to official information, the total supply of the fiat stablecoin issuer Usual's token USUAL is 4,000,000,000, of which the initial circulation accounts for 12.37% of the total supply, amounting to 494,600,000. The amount allocated to Binance Launchpool accounts for 7.5% of the total supply, which is 300,000,000. Therefore, the first round of airdrops may be 4.87%. Additionally, USUAL is an Ethereum native token, with the contract code: 0x430a2712cEFaaC8cb66E9cb29fF267CFcfA38a42.

The governance token USUAL of the fiat stablecoin issuer will have actual revenue from the platform protocol, future income, and infrastructure ownership. The official documentation emphasizes that 90% of the total token supply will be allocated to the community, and 10% will be allocated to insiders (team, advisors, investors), ensuring fair distribution and genuine participation for users.

Interactive Experience

Project official website: https://app.usual.money/

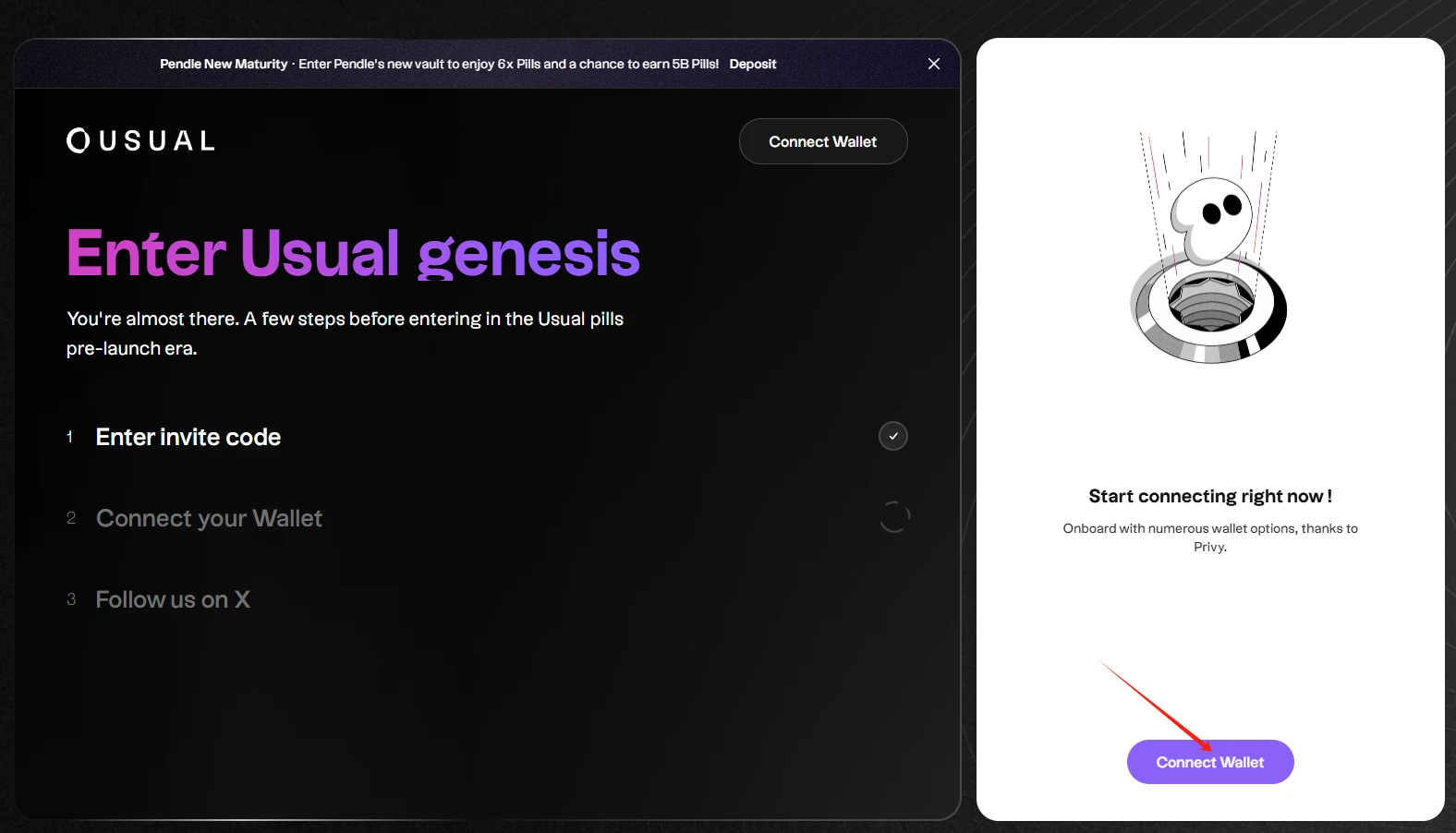

STEP1. Enter the interactive website and click "Connect Wallet."

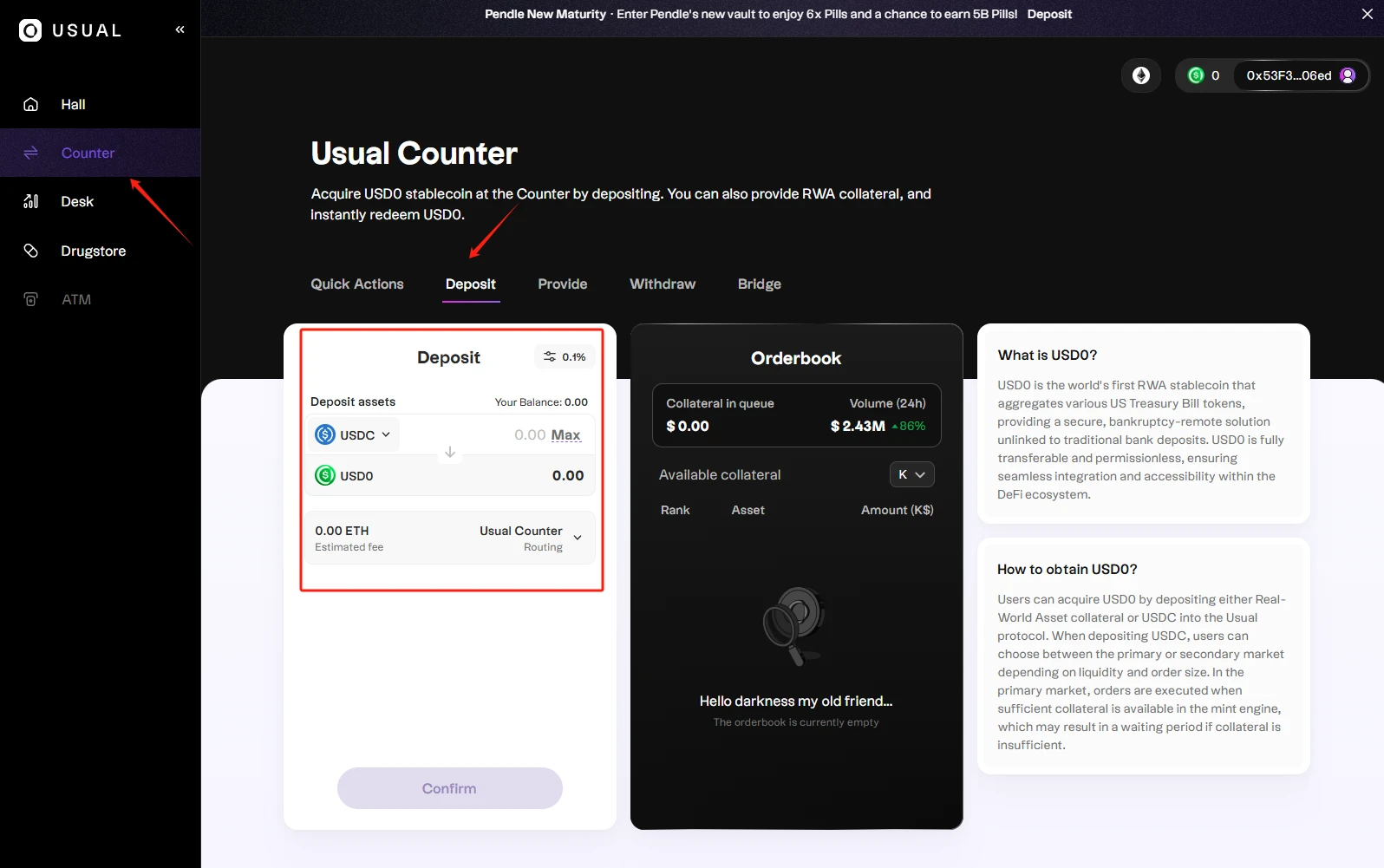

STEP2. Click "Counter" and then click "Deposit" to exchange USDC for USD0.

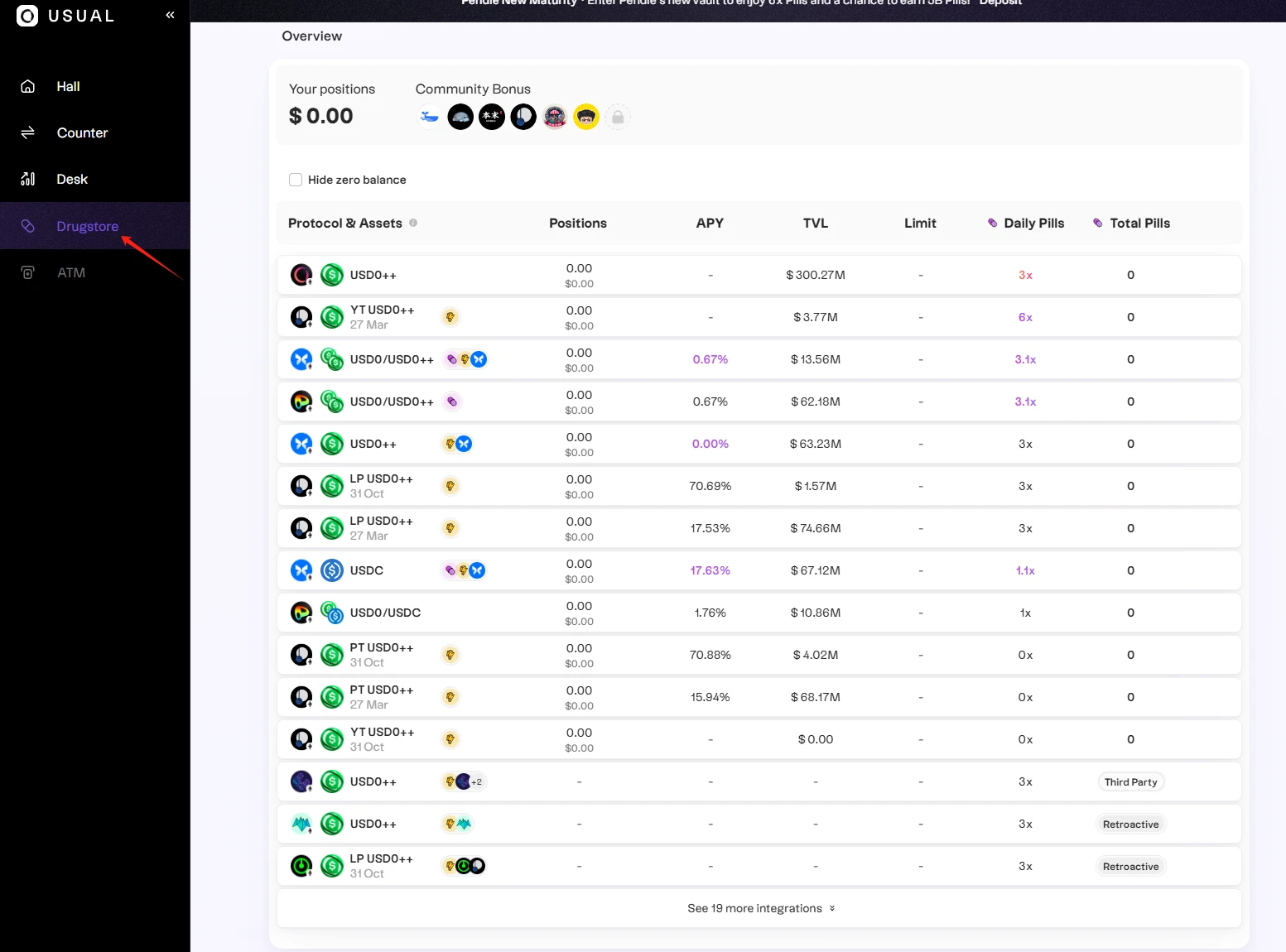

STEP3. Click "Drugstore" to create LP, with corresponding APY and Pills rewards for each row (Pills points are related to future token airdrops).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。