Analyst Chen Shu: 11.14 Afternoon Bitcoin and Ethereum Market Strategy *1, Short-term Long and Short Divergence Focus on 4-hour Moving Average Gains and Losses

On November 13, the afternoon analysis provided a strategy of short first and then long. During the afternoon, there was indeed a slight pullback, but it was followed by a slow rise, and during the US trading session, with the release of CPI data, a significant surge occurred, once again breaking through the historical high, with limited pullback strength. Currently, the short-term continues to maintain a high-level consolidation. For operational guidance, please see the analysis below.

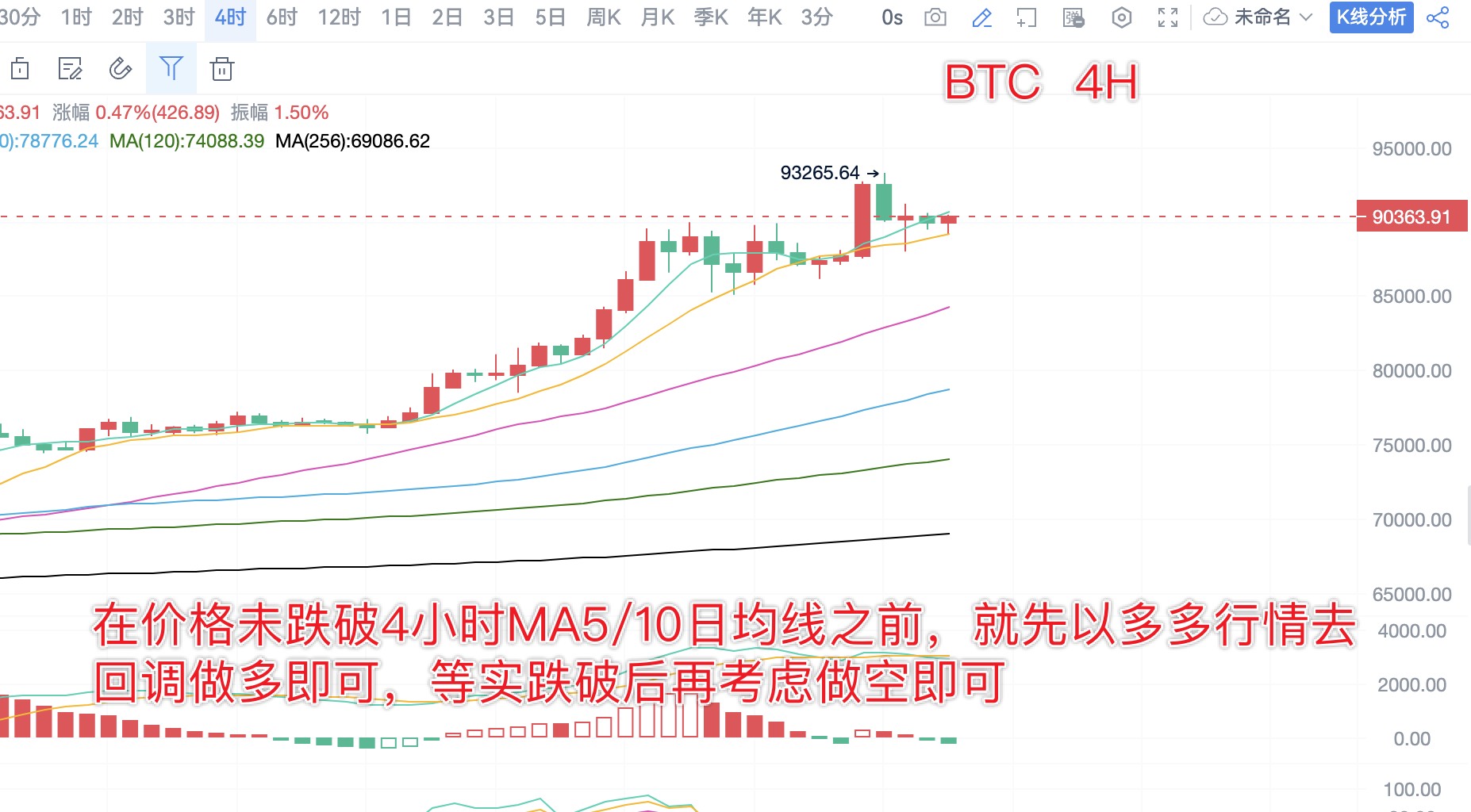

From the daily chart of Bitcoin, yesterday's daily candle closed with upper and lower shadows, and the pullback strength has not yet reached the support of the daily MA5 moving average. The overall trend still maintains a bullish market. Today, we focus on whether the 8.8 daily MA5 moving average support is effective. Looking at the 4-hour chart, the overall market is still fluctuating above the 4-hour MA5/10 moving averages. As long as the short-term does not completely lose this line, it will still be a bullish market. We also need to rule out false breakdown signals like yesterday's. The support will initially be set at 8.9/8.8 as the low point support for the bullish trend.

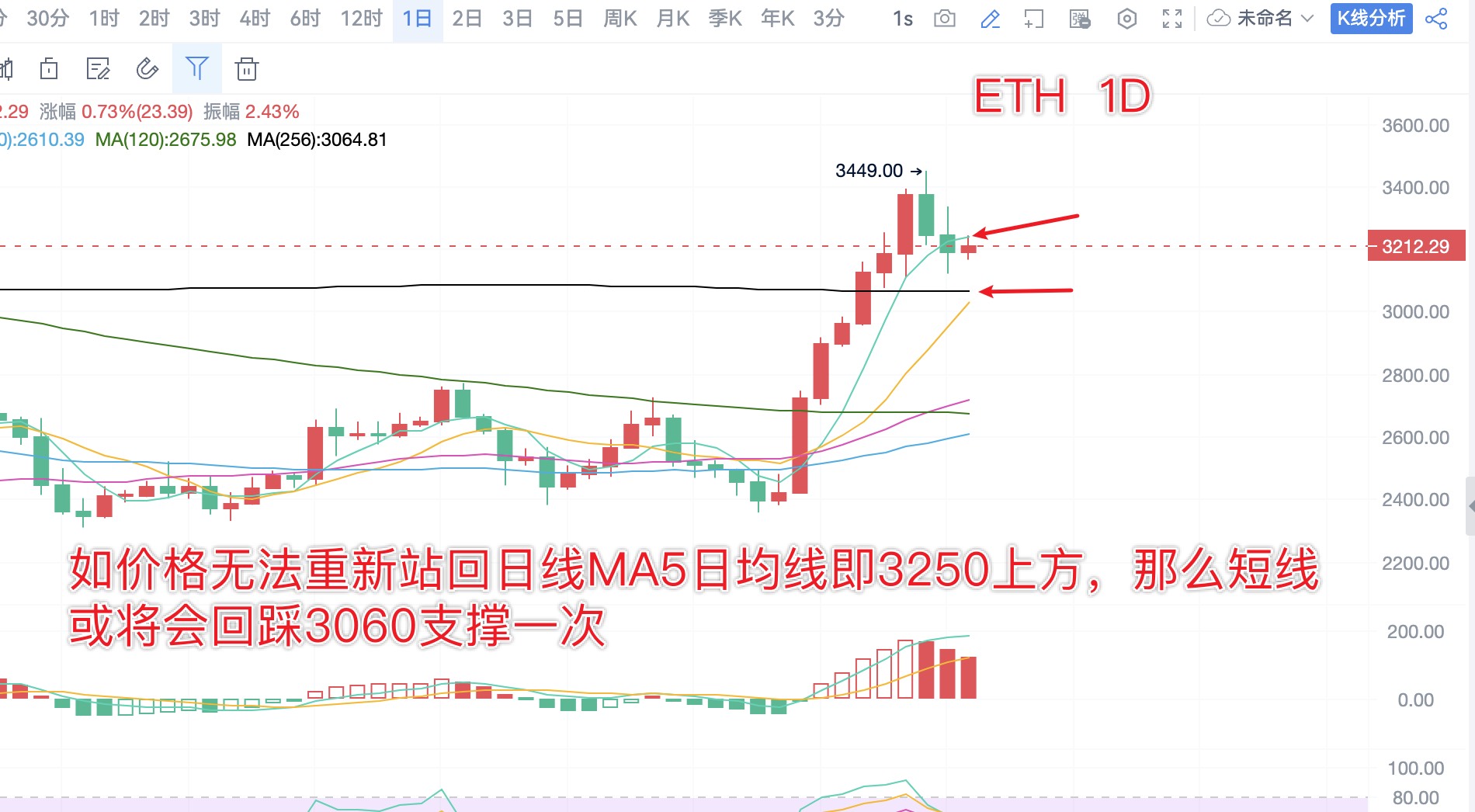

From the daily chart of Ethereum, yesterday closed with small upper and lower shadows and the price broke below the daily MA5 moving average support. If Ethereum continues to maintain a weak pullback today, it may test the MA256 moving average (3060) support. The resistance level will initially be the daily MA5 at 3250. If it breaks 3200 in the short term, it may pull back to 3060.

Afternoon Operational Thoughts (Written at: 16:00):

BTC: Light long positions in the 8.93-8.86 range, targeting around 2000 points; short positions should wait until breaking below the 4-hour MA5/10 moving averages before considering a pullback short.

ETH: Light short positions in the rebound range of 3250-3300, targeting 3100/3060. Long positions should follow Bitcoin, but the space looks small.

Note: The overall market maintains a wide range of fluctuations, and there is a possibility of a downward breakout pullback during high-level consolidation. However, we cannot predict whether or when it will happen. Just keep a close eye on the breakout situation of the 4-hour MA5/10 moving averages. Before a breakout occurs, treat pullbacks as opportunities to go long.

The daily analysis strategy has a very high win rate! Analysis is not easy, and I hope everyone can give a free follow, bookmark, like, and comment. Thank you all, and feel free to leave comments below for discussion; I will reply one by one!

For real-time market strategy exchanges and inquiries about market issues, you can follow me, the original (Coin World) ranked number one personal KOL main influencer, providing free guidance and answering trading questions. Welcome everyone to communicate and exchange!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。