With the rise of the Trump administration, the dawn of the crypto field seems to be gradually emerging.

Written by: Pzai, Foresight News

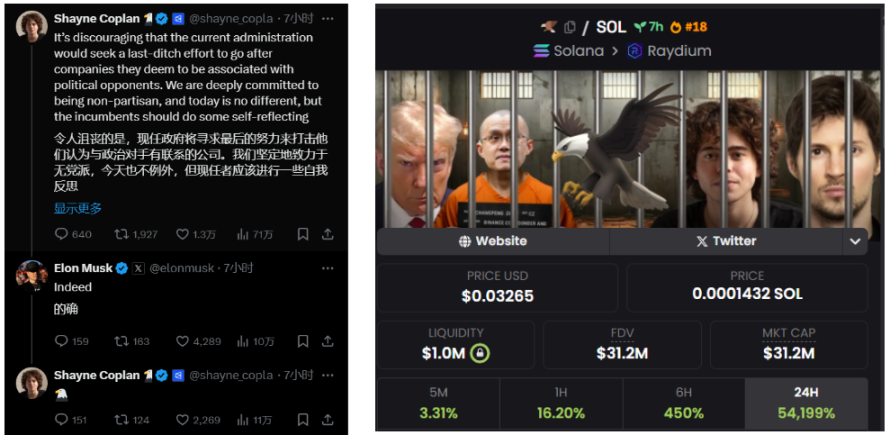

According to the New York Post, Polymarket CEO Shayne Coplan was investigated by the FBI yesterday, and his phone and other electronic devices were seized. He did not disclose the reason for the raid, but sources suspect it is political retaliation, as Polymarket accurately predicted that Trump would easily defeat Vice President Kamala Harris, contrary to traditional polls.

As Coplan accused the current government, Musk also agreed on Twitter, and a "hawk symbol" that Coplan replied with brought new speculative opportunities to the market, with the namesake meme also gaining popularity, reaching a market cap of up to $40 million.

Since Trump took office, expectations for regulation in the crypto field have significantly relaxed, but in the remaining months, the Biden administration seems intent on tightening its grip on crypto regulation one last time.

Polymarket Shines Bright

In the report, sources also speculated that the government might use liberal media reports to accuse Polymarket of manipulating the market and polling to support Trump.

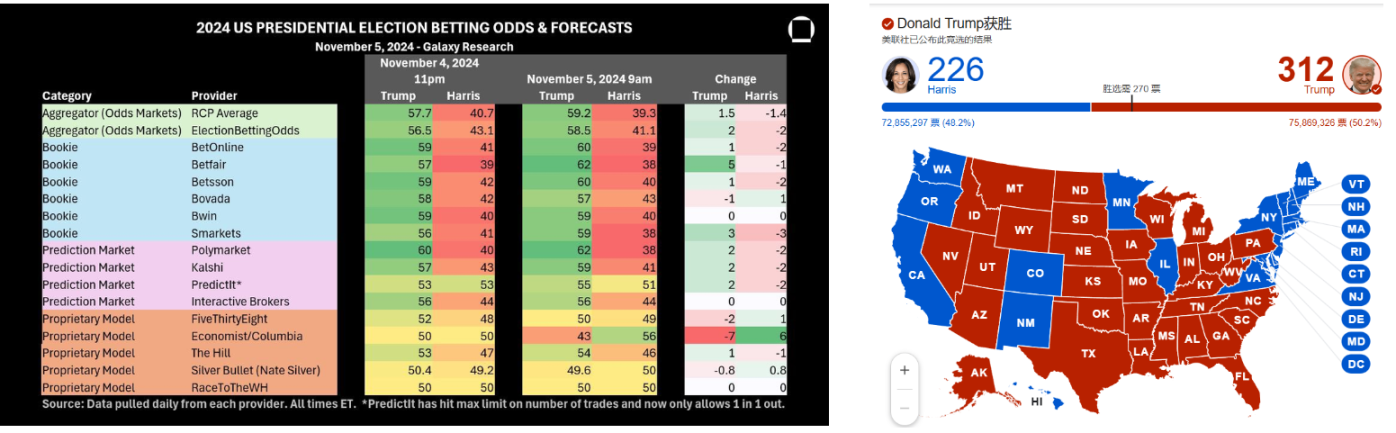

To understand the real situation, we can compare the gap between poll predictions and actual results. Galaxy Digital collected predictions from the election market a few days before voting, with the final result calculated by electoral votes being 58% to 42%. Overall, the prediction market's probability of Trump winning was above 55%, which is much closer to the actual situation compared to the average poll prediction of around 50%. As a polling media, centralized results inherently have ideological preferences, and the gap between the two proves this point.

Left: November 5 U.S. election market prediction distribution Source: Galaxy Digital Right: Actual results of the 2024 U.S. election

In this fully competitive market, some have reaped significant rewards. For example, French trader Théo made a large bet on Polymarket that Trump would win a second term, and according to the platform's data, he earned $85 million from this bet. The overall trading volume on Polymarket also reached $3.5 billion. However, its operations in the U.S. have not been smooth; in 2022, Polymarket was forced to suspend trading in the U.S. and pay a $1.4 million fine to settle allegations with the Commodity Futures Trading Commission (CFTC) for failing to register with the agency.

Regardless, Polymarket itself stated, "We have proven that prediction markets are wiser than polls, media, and experts."

The Struggle Now and in the Future

As a byproduct of political struggle, the donkey-elephant rivalry in the U.S. has naturally spilled over into the crypto field, with two distinct factions led by Musk and Trump representing the pro-crypto Republican side, while the "crypto strict regulation" camp is represented by the U.S. Securities and Exchange Commission (SEC), which communicates its stance through various lawsuits and fines, but the SEC is not always well-received.

After the SEC sued ConsenSys and Ripple, an appellate court ruled that the SEC's rejection of Grayscale's spot Bitcoin ETF application was "arbitrary and capricious." Following the dismissal of charges against Ripple's co-founder, the SEC also faced intense public scrutiny. In a previous interview with Foresight News, crypto-friendly SEC Commissioner Hester M. Peirce stated, "Good regulation allows innovators to focus on building under clear rules, rather than constantly trying to understand the rules they are following." (Further reading: Interview with the SEC's "Crypto Mom": Behind the $3 billion in fines over 10 years is the lack of regulatory progress in the U.S.)

Under the Biden administration, Gary Gensler has already issued Wells notices (notifications before formal charges) to crypto gaming projects like Immutable, NFT platform OpenSea, and stock and crypto trading platform Robinhood. With only a few months left, Gensler does not have enough time to initiate any new lawsuits or regulations, and the next SEC chair can choose to overturn these decisions.

In the future, after the election results are settled, under the banner of the Trump administration significantly elevating Bitcoin's status and "ensuring America's crypto position," a pro-crypto SEC chair appointed by the president is more likely to adopt a laissez-faire approach, legislating core functions of the crypto market to enhance regulatory transparency while allowing appropriate development of ecological projects and their use cases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。