The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

After discussing the recent trends, Lao Cui is a bit tired, so today I want to talk about the value of Bitcoin. Many friends are quite dismissive of the Bitcoin bull market, always making judgments based on their unclear understanding, which is indeed somewhat irrational. Lao Cui is also very aware that most users approach the cryptocurrency market with a speculative mindset, so the returns are often given in a speculative form, yielding very rich rewards, but the accompanying risks are also infinitely magnified. Today, Lao Cui will discuss in detail who is actually controlling Bitcoin. To find clues, we must start studying from the time Bitcoin was born. The year 2008 is very special; it experienced a financial crisis, gave birth to the Bitcoin ecosystem, and also announced that blockchain technology began to enter everyone's view.

For those interested, you can study Satoshi Nakamoto's paper, which is the beginning of the cryptocurrency world. Lao Cui has broken down this paper in detail and found it quite interesting. Lao Cui's conclusion is that this is definitely not something that can be accomplished by one person alone. This is also why Lao Cui mentioned earlier that what was born is the Bitcoin ecosystem, not just Bitcoin, because Satoshi Nakamoto's paper is detailed on how to build a channel and algorithm for Bitcoin. This paper does not merely tell how to mine Bitcoin; it is a real-world teaching. This is not Lao Cui's speculation; everyone should know that the emergence of this paper before Bitcoin's birth must have consumed a lot of effort, and the investment behind it must be enormous. This enormity is not just a matter of time; it is more about financial investment, and the conditions for this investment are not something ordinary financial institutions can support. The simple logic is that the birth of Bitcoin cannot estimate how many people can resonate with it and be willing to spend money to recognize this currency. In plain terms, the initial investment may not necessarily yield returns later. Under such circumstances, no one would invest. So who is Satoshi Nakamoto? This question has been something Lao Cui has been searching for an answer to since he got involved in the cryptocurrency world.

During this period, there were actually clues about Satoshi Nakamoto. After Satoshi Nakamoto published the paper, he did not start building the blockchain platform; he only provided direction. The construction of this ecosystem was a collaborative effort by engineers around the world. Therefore, when encountering problems that were not understood, there were indeed people who consulted Satoshi Nakamoto. At that time, as long as it involved technical issues related to Bitcoin, he would reply to every email in detail. So this person truly exists in the real world. What makes Lao Cui curious is that many people must have sought this answer, and they are more capable than Lao Cui. Subsequently, language experts and hackers have publicly sought Satoshi Nakamoto. They first looked for grammatical issues in the emails he replied to and found that he used both American and British English, and even Irish language. So this clue was completely evaded by him. It can also be seen that he was consciously trying not to let everyone know who he was. Secondly, hackers also attacked his IP address and found that he was also a highly elusive network engineer, making it impossible to trace his location. He even managed to reply to emails 24/7, making it impossible for anyone to determine which country he was from. Through his name, everyone assumed he was Japanese, but his language resembled that of a European, and his grammar was close to that of an American. Various clues have basically ended in failure.

At this point, you may wonder what the connection is between Satoshi Nakamoto and the value of Bitcoin. In fact, this is the core issue. Do you really think Satoshi Nakamoto's emergence was solely to disrupt the status of traditional currency? To profit in the cryptocurrency world, it is really necessary to understand its financial background and its connection to the real world. At the beginning of the article, Lao Cui already mentioned that the birth of Bitcoin coincided with the financial crisis in the U.S. in 2008. Lao Cui's speculation might be that at that time, he may have foreseen the current dollar crisis. The Federal Reserve's reckless over-issuance of currency would ultimately lead to the dissipation of dollar hegemony. Everyone can ponder this: once the economic structure of the dollar encounters problems, which currency will be the next to replace it? In traditional economics, it is likely to shift to the economy of the second-largest power, and they do not want to lose their hegemonic power, so they can only disrupt the structure of traditional currency. The emergence of Bitcoin just perfectly addresses the dollar crisis faced by the U.S., and the biggest beneficiaries in this entire structure are still the Americans. From this perspective, the biggest beneficiaries must have a close connection to the whole matter.

As mentioned earlier, Satoshi Nakamoto, you must have a fundamental logic in your mind. Satoshi Nakamoto is very likely a team, not an individual. And this team can only be operated by the Americans themselves because other organizations do not have much demand for the future attributes of currency. Moreover, Bitcoin's attributes are completely open source, which is why there is such a huge market in the market, with over 5,000 different cryptocurrencies. Discussing this logic is not to make everyone blindly believe in Bitcoin; blockchain technology does not represent Bitcoin. To put it bluntly, even if the future belongs to the coexistence of blockchain technology and the cryptocurrency world, Bitcoin will not become the status of the dollar in everyone's eyes; it is just that no one can shake the position of its ancestor. The value it embodies is a technological revolution, representing the future direction of currency. As the number of consensus participants increases, its value will continue to rise. Regardless of how brilliant the technological innovations of any future currency may be, or if everyone reaches a consensus to launch a currency representing fiat currency, the channel of Bitcoin will always exist. Its technology will continue to be passed down, and the cryptocurrencies of the current stage are all optimized based on Bitcoin's original code. As long as future currencies use blockchain technology, the value of Bitcoin will always exist. The two major economies behind it will never allow the cryptocurrency world to become a market with nothing. If the cryptocurrency market dissipates, based on the current holdings, the most affected will be China and the U.S. After saying all this, I just want to tell everyone one thing: the support behind Bitcoin has immense power, and the possibility of a collapse in the short term is not great. Technology is innocent; it depends on the mindset of those who use the technology in the cryptocurrency world.

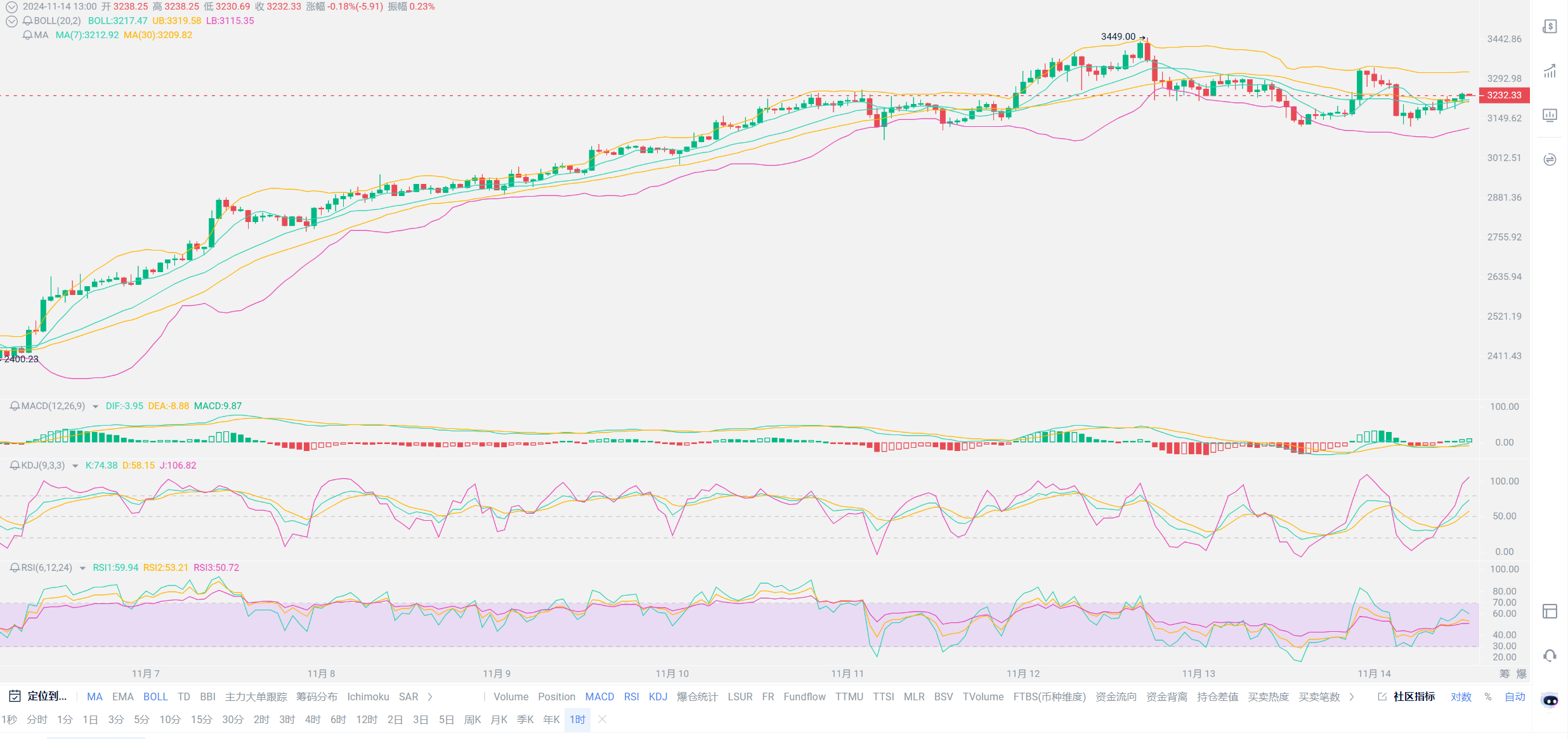

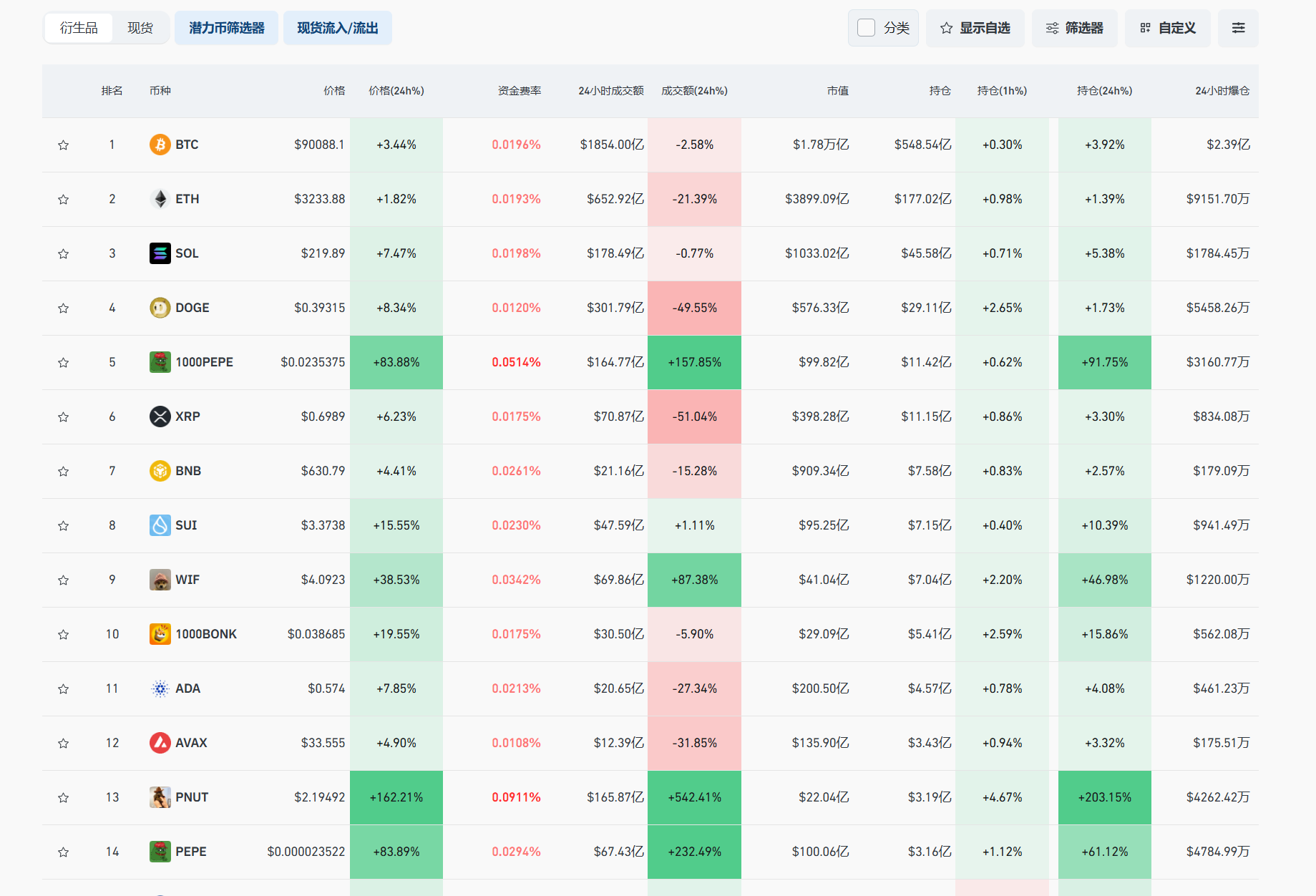

The most important point is that Tesla's holdings have reached 1 billion dollars, and its market value has once again broken the 3 trillion mark following a surge to the 90,000 mark last night. You should still remember that Lao Cui mentioned earlier that a market value of 3 trillion will be the first major test faced by the cryptocurrency world. The market, starting from 93,000, has directly welcomed the first major deep correction, dropping to around 86,000, with an overall correction depth reaching 7,000 points. The first test seems to have ended. The recovery strength of the market is far beyond our expectations. How high it can rise is subject to various opinions. Most predictions are around 12.5 billion for one Bitcoin, so for the second critical point, we can slightly lower our expectations; we definitely need to pay attention to risks around 100,000. There is nothing much to emphasize about the bullish trend; even the current spot entry may still be considered a low point when looking back next year. Speaking of risks, Lao Cui must remind everyone that the depth of future corrections will become increasingly high, so users chasing highs must be vigilant. Any historical high point will be met with frantic selling from other players, and ultimately, the capital volume in the cryptocurrency world is far from competing with other markets. Users who are bullish must ambush in advance; spot users can enter without much thought, while contract users must have stop-loss and take-profit points. Finally, I remind everyone that in a bull market, there is no saying of a top. Once a bull market starts, do not set limits for yourself. You can always buy the dip, especially in the current market. Once the depth of the correction is sufficient, you can prepare to enter at any time. Do not be blinded by so-called historical high points!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and ends up frequently trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。