Solana remains the most promising in the liquid staking token ecosystem, with a liquid staking rate of only about 7%.

Author: OurNetwork

Translation: ShenChao TechFlow

Liquid Staking

Jito | Rocket Pool | Dinero

Jito

Andrew Thurman | Website | Dashboard

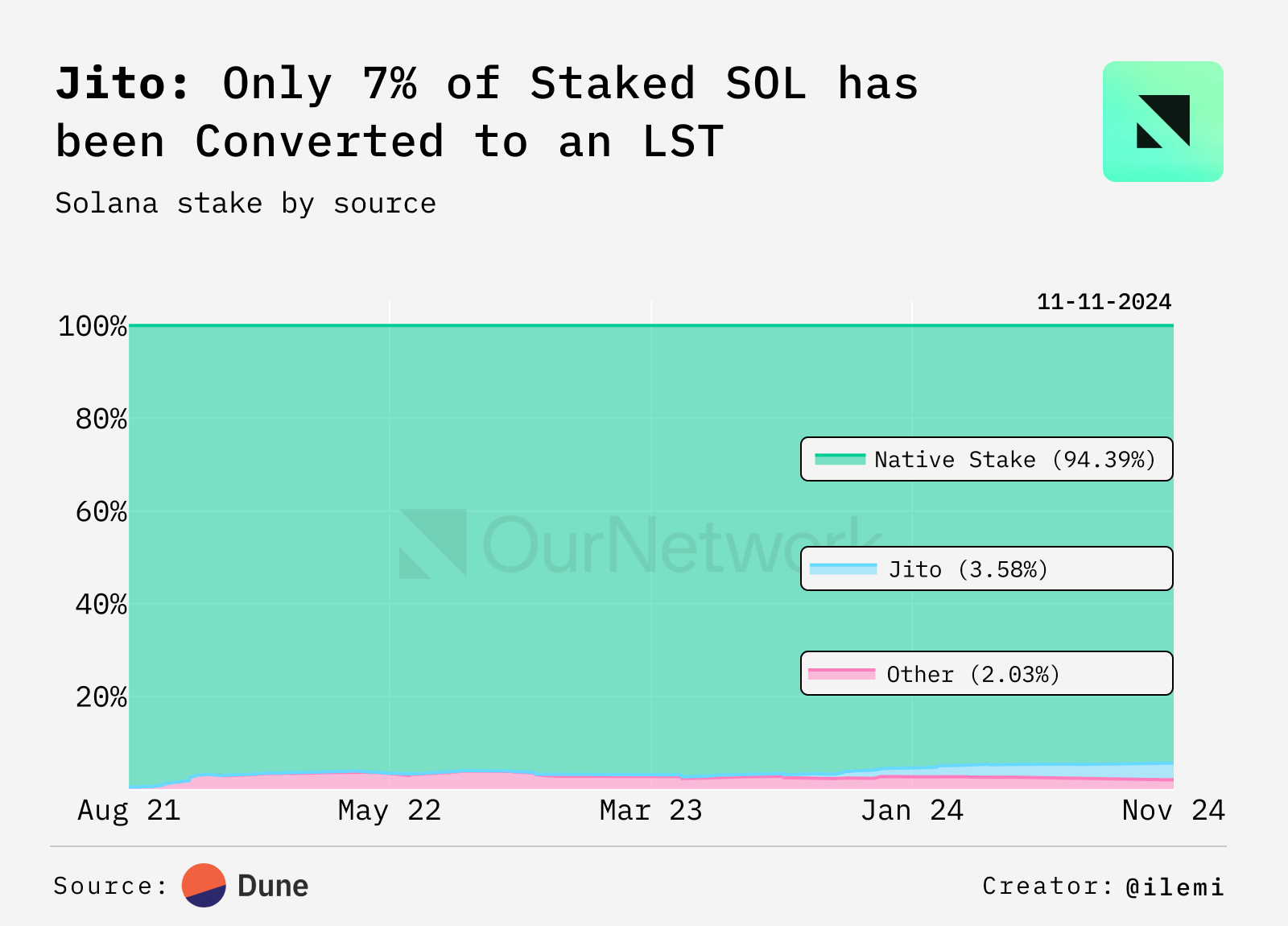

Solana remains the most promising in the liquid staking token ecosystem, with a liquid staking rate of only about 7%.

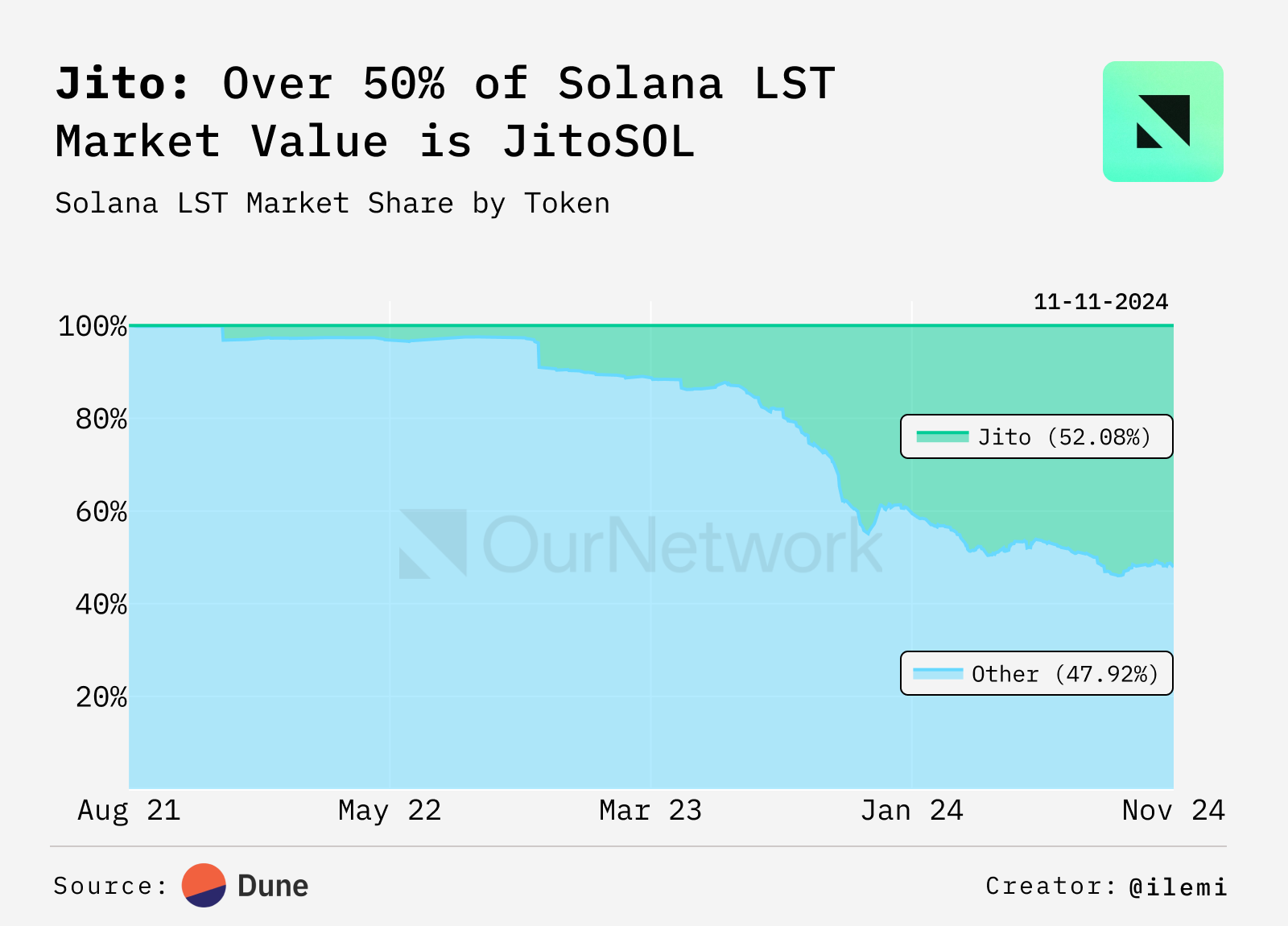

- The Jito network is a set of decentralized protocols based on Solana, primarily focusing on maximizing extractable value (MEV) and DeFi infrastructure. The liquid staking token (LST) JitoSOL of the Jito network is the largest DeFi protocol on Solana, with deposits of 14 million SOL, making it the largest LST in the network's history, accounting for over 50% of the Solana LST market. JitoSOL plays a key role in Solana's DeFi ecosystem, with 25% of its total value locked (TVL) used as collateral for various protocols. JitoSOL-SOL is the most liquid trading pair on Solana, with liquidity reaching 72 million dollars.

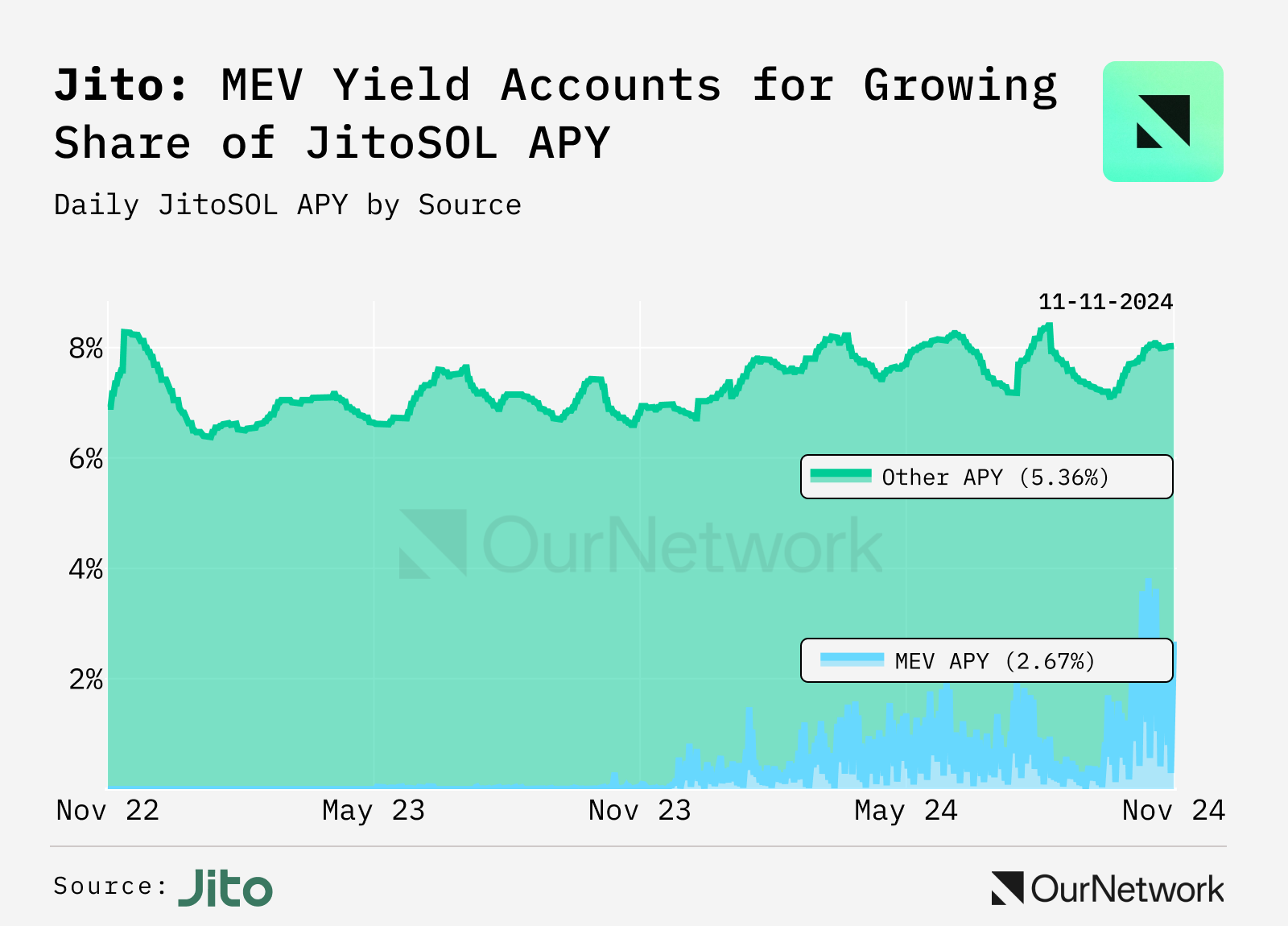

- With the support of the Jito-Solana client, MEV tip income is gradually increasing as a proportion of validator income, allowing the annual percentage yield (APY) for LST delegated to validators through the Jito block engine to exceed 8%. As memecoin trading and other activities increase on Solana, MEV trading volume will also rise, further enhancing returns.

- Currently, the LST market penetration rate for Ethereum is about 35%, while Solana is around 7%, which has nearly doubled year-on-year. Despite the low barriers to user interface and experience for native staking on Solana, there are no strong reasons to suggest that the percentage gap in LST between these two ecosystems will not eventually narrow.

- Trading Focus: Want to predict the future? Check out this wallet: six-figure meme tokens, six-figure JitoSOL, and six-figure stablecoins. A perfect balance, just as it should be.

Rocket Pool

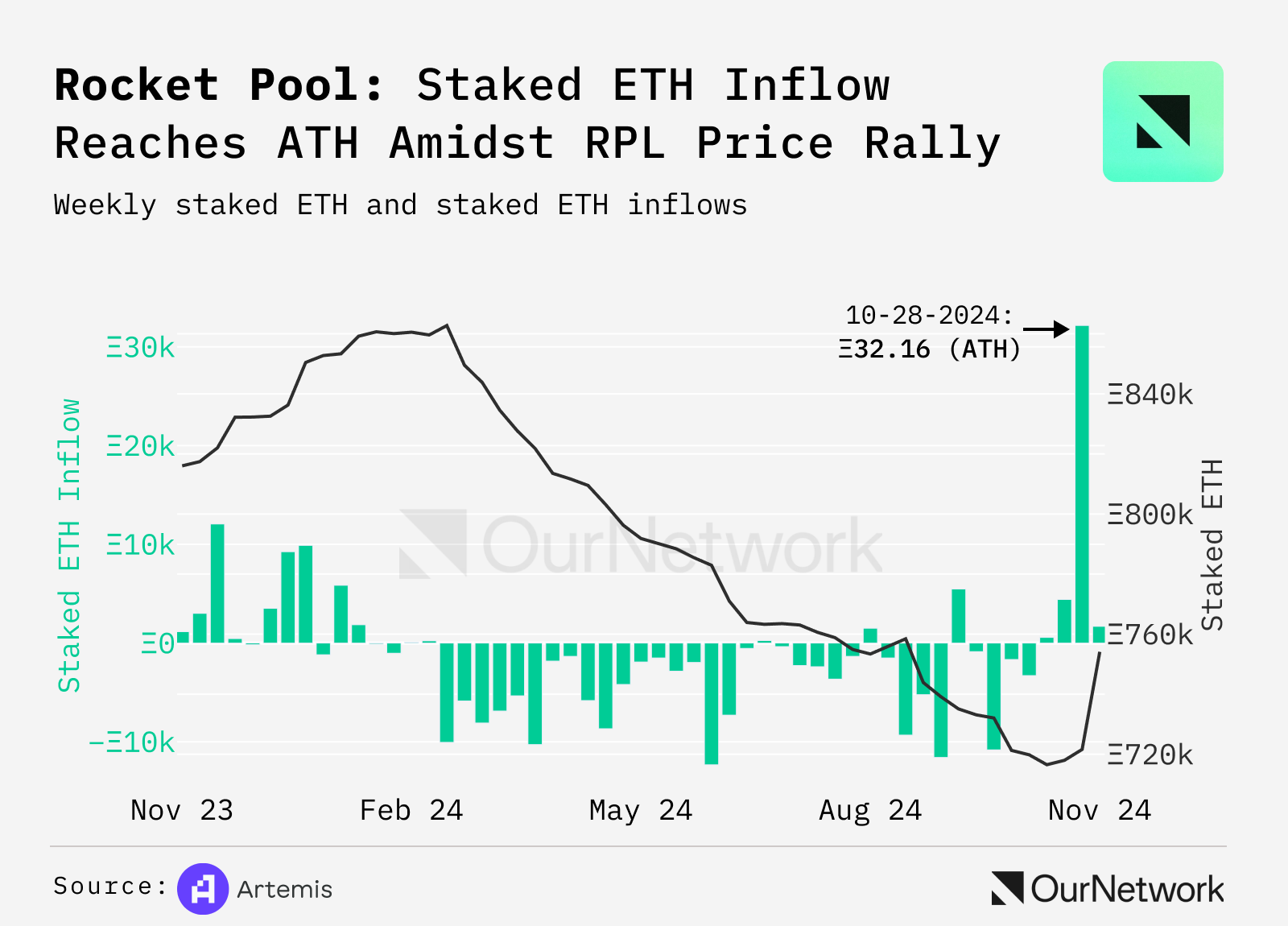

Rocket Pool's ETH staking inflow peaked at 12,500 daily, double the highest value so far this year.

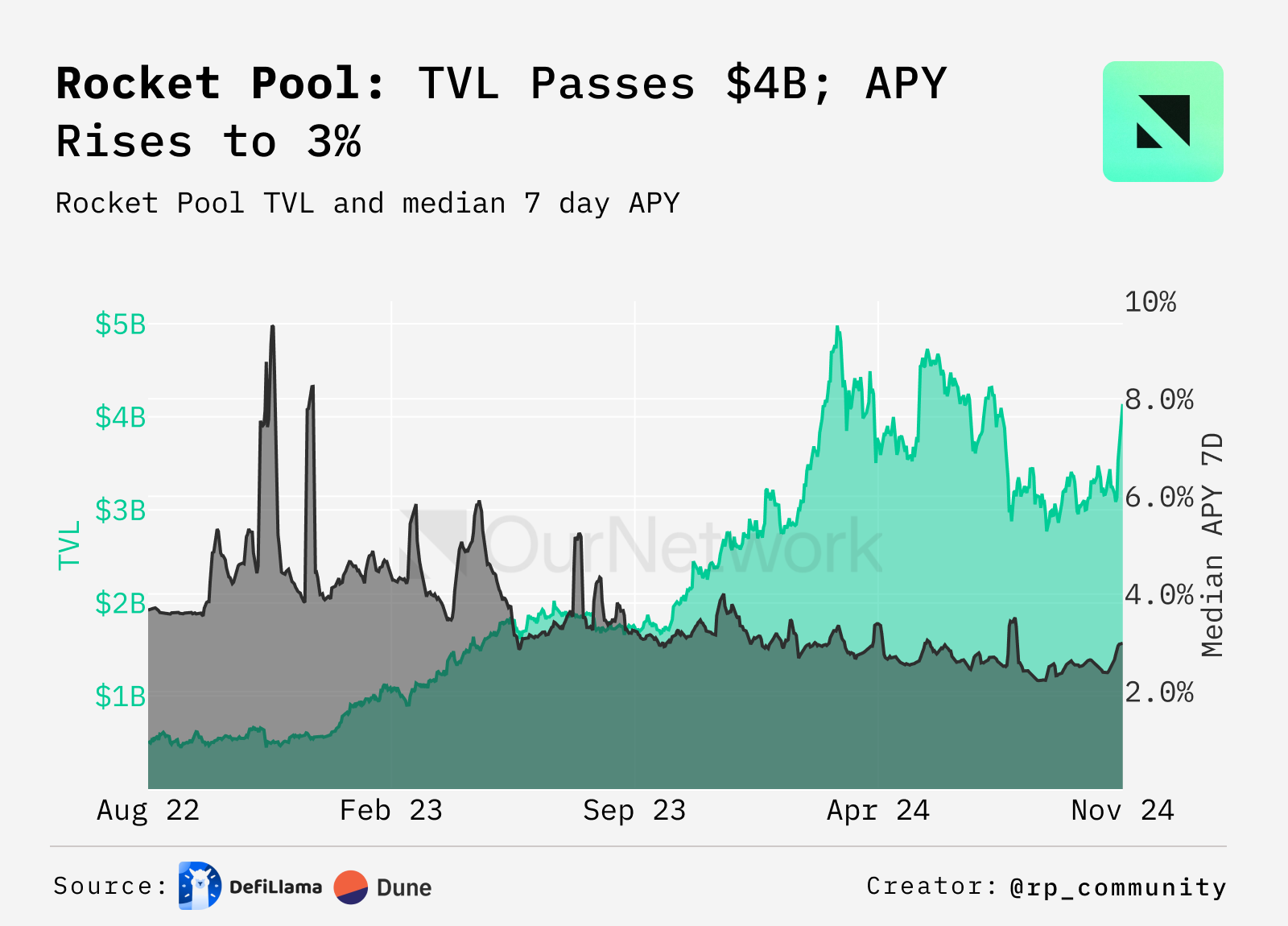

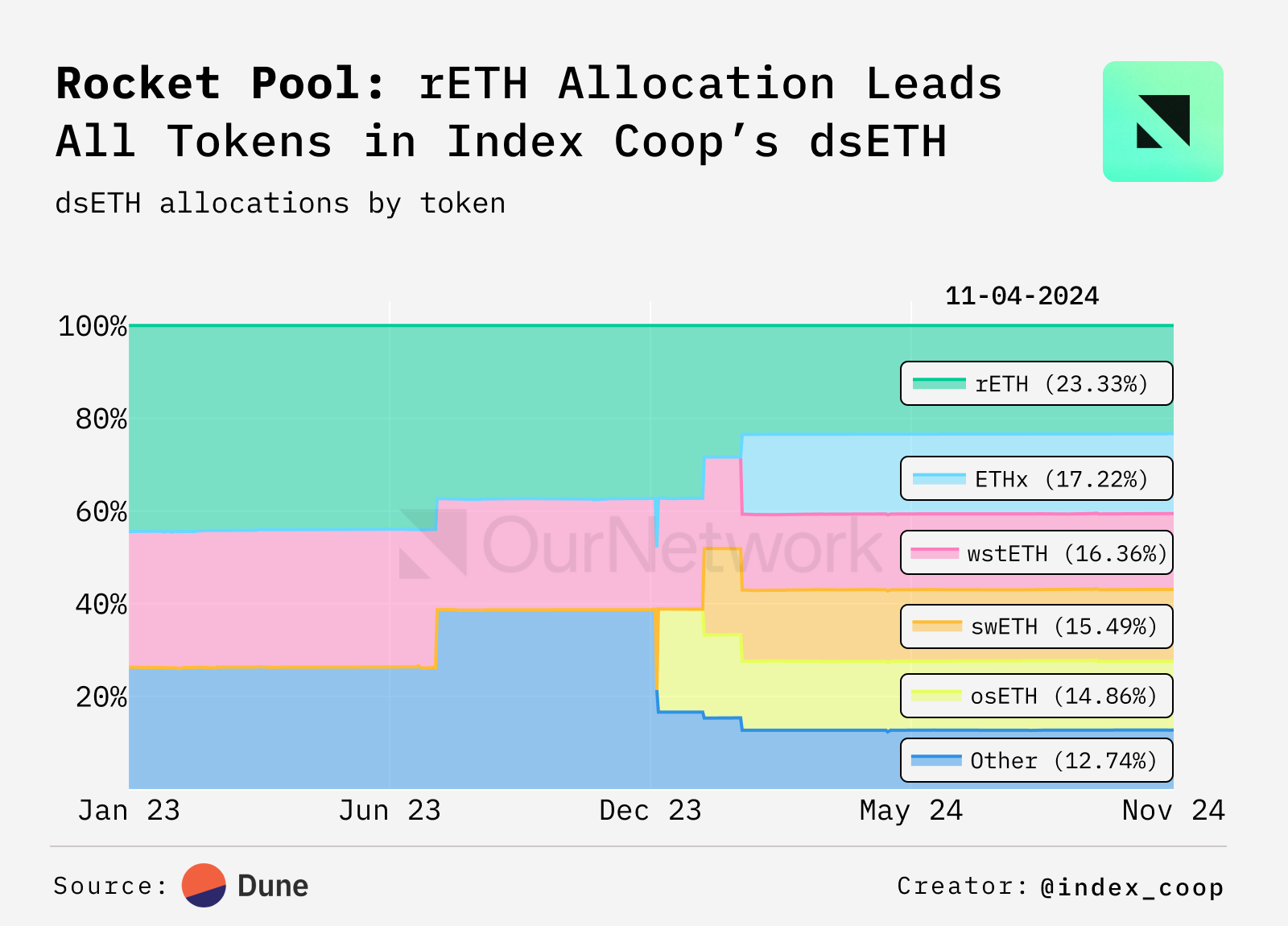

- Rocket Pool is currently the second-largest liquid staking participant, with a market share of about 7%. Over the past week, the total value locked (TVL) grew from 3.2 billion dollars to 4 billion dollars, an increase of over 30%. This coincides with a rise in APY, which had been declining for a long time but has now rebounded to 3%. The average node staking rate is 33%, with an average staking amount of 4,400 for Rocket Pool's native token RPL and an average ETH staking amount of 94. Among the liquid staking tokens (LST) that make up dsETH, rETH has the largest allocation at 23%, and dsETH is an ETH LST basket developed by Index Coop.

DeFiLlama & Dune - @rp_community

- Over the past week, the price of RPL has increased by 20%, reaching 11.80 dollars, which corresponds with the surge in ETH staking inflows. Notably, this inflow is nearly three times the last surge in inflows at the end of November 2023. Additionally, there were no weeks with net inflows from January 24 to September 24.

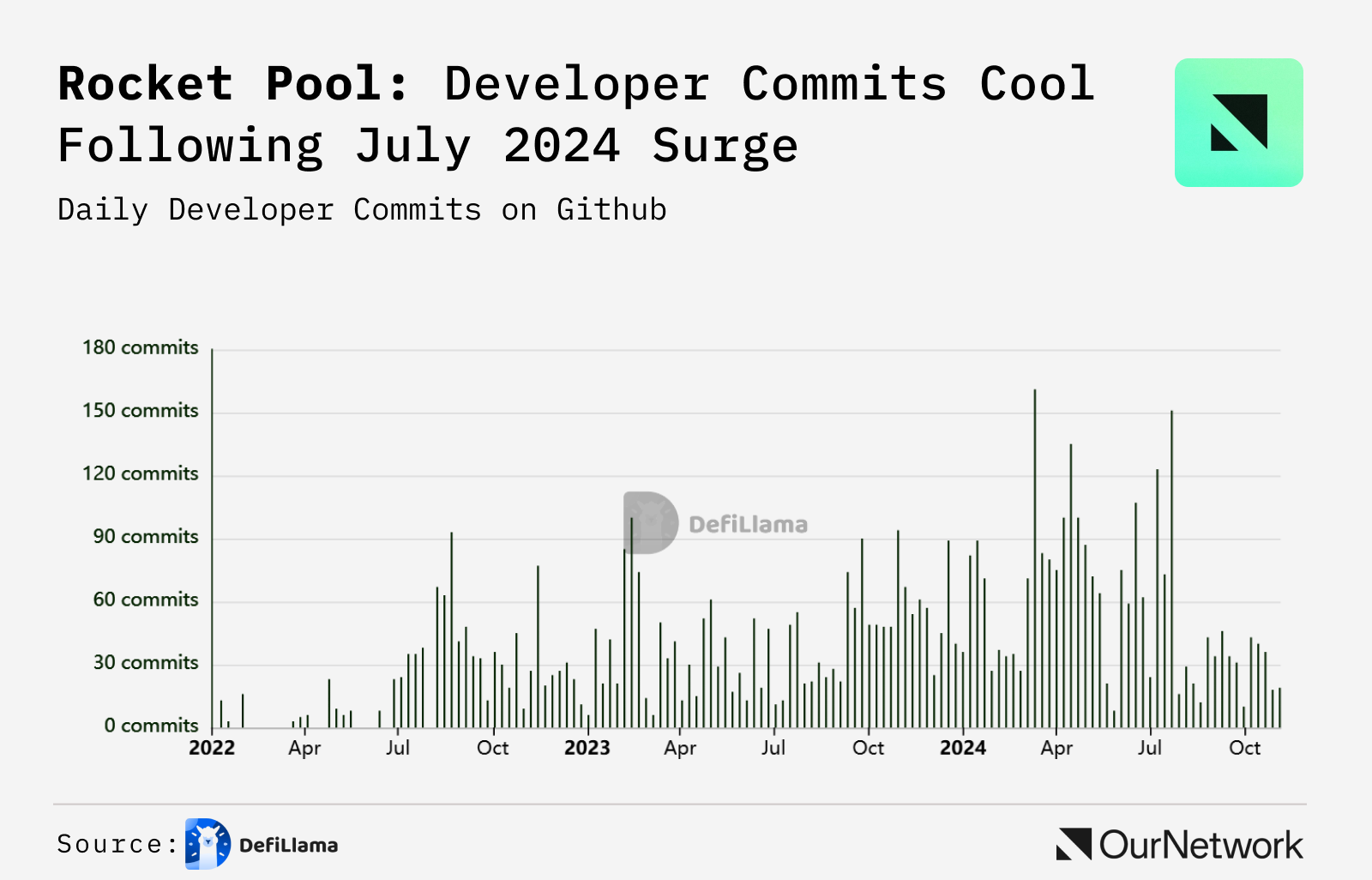

- Rocket Pool has seen a significant increase in developer activity in 2024, peaking in July with over 150 daily submissions, but has since dropped to about 30 daily submissions.

Dinero

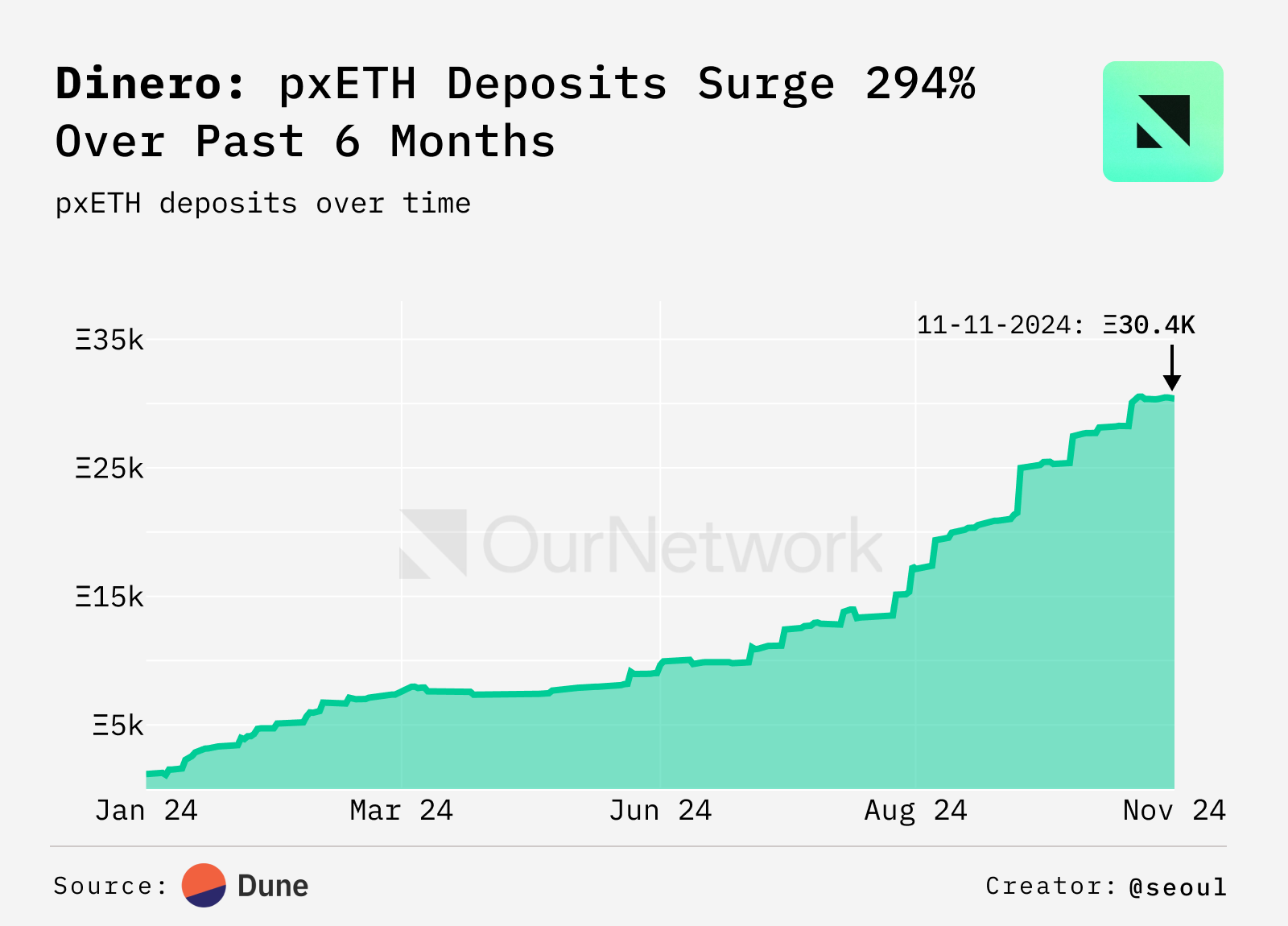

pxETH Staking Volume Surpasses 30,000 ETH

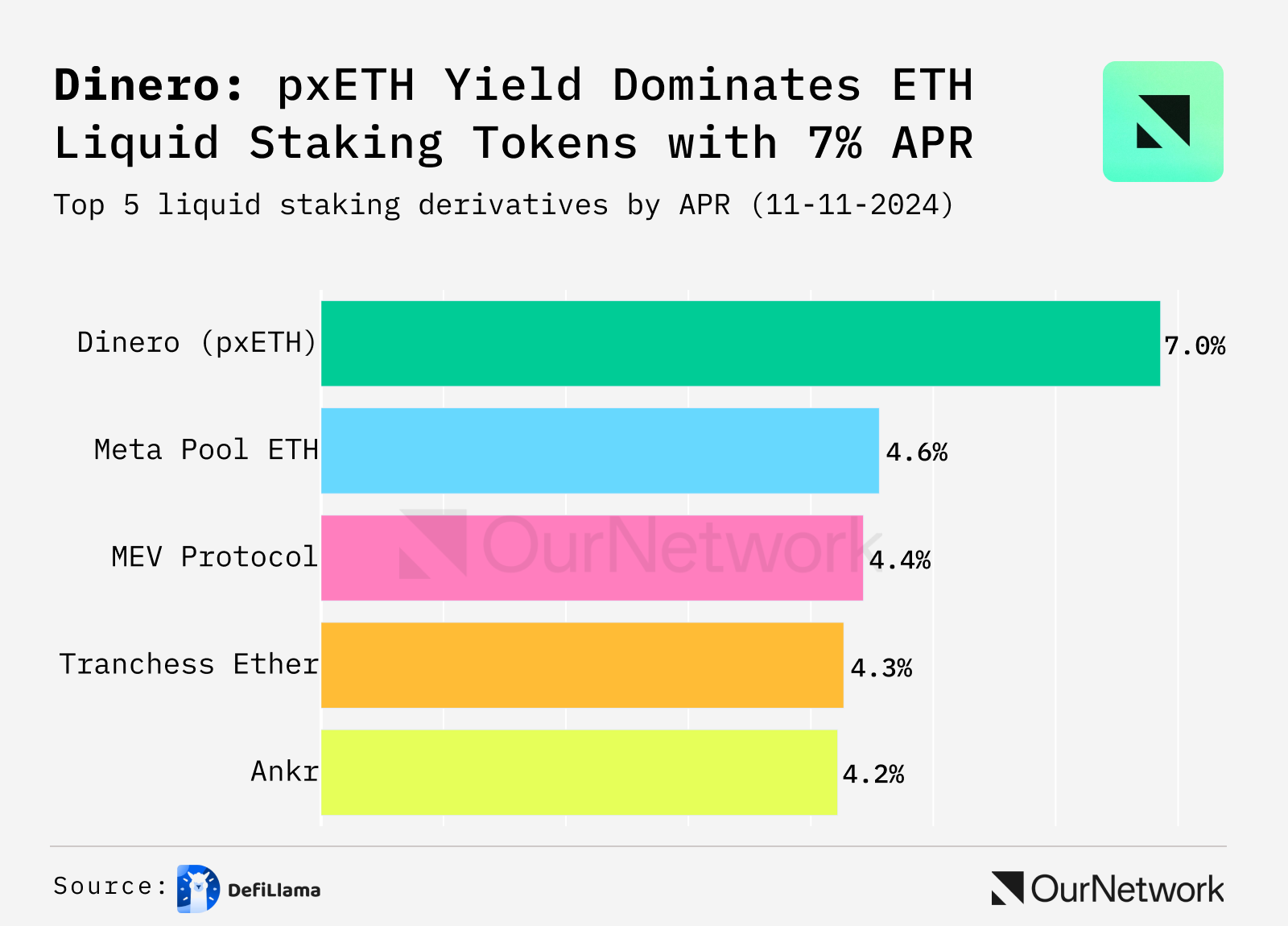

- Over the past six months, the deposits of Dinero's liquid staking product pxETH have increased from 7,706 ETH to 30,393 ETH, a growth of 294%, reflecting strong market demand for higher ETH yields. Due to the design of pxETH, it offers an annual percentage rate (APR) of approximately 7% for ETH staking, which is double the industry average.

- The system's yields are particularly outstanding compared to other liquid staking options. The dual token design of pxETH allows Dinero to expand yields at both ends of the risk curve (DeFi and staking), rather than compressing the yields for both types of users.

- To expand Dinero's LST yields across different blockchains, branded LSTs have been launched. This is a liquid staking solution that allows L1 and L2 networks to launch native LSTs supported by staked pxETH. Early partners include Arbitrum (orbETH), Sei (seiyanETH), and Flare (flrETH), with Sei and Flare already live.

- Trading Focus: Branded LSTs leverage LayerZero's cross-chain messaging protocol. Users can choose to deposit from the Ethereum mainnet and use LayerZero to mint "partnerETH" on partner networks, or they can directly deposit on partner networks. In either case, the branded LST solution handles all cross-chain activities and staking operations, allowing users to start earning staking rewards simply by making a deposit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。